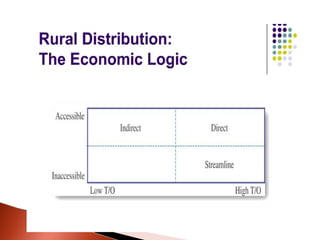

Rural markets in India represent a large opportunity for consumer goods companies as rural populations and incomes grow. However, rural distribution is challenging due to factors like scattered populations and lack of infrastructure. Companies are experimenting with innovative distribution models like ITC's e-Choupal, HUL's Project Shakti, and rural retail formats to better reach rural consumers. Successful rural marketing requires adapting the four P's, especially developing new distribution channels suited to rural contexts.

![ Rural India The Changing Face The “culture of

non-indulgence” and abstinence in consumption is

well and truly over Rural India buys 46% of all soft

drinks sold [Coca-Cola is growing at 37% in rural

markets with only 25% penetration, compared with

24% in urban areas] 49% of motorcycles and 59%

of cigarettes Source: MART

](https://image.slidesharecdn.com/ruralmkt-130128223035-phpapp02/85/Rural-mkt-3-320.jpg)

![ They have tried tinkering with all the four 'P's of the

marketing mix i.e. Product, Pricing, Promotion and

Place [ E.g. HUL has been a pioneer in reaching out to

the smallest of villages with innovative products such

as single-use packets of shampoo] To sell in villages,

products must be priced low, profit margins must be

kept to the minimum and the marketing message must

be kept simple.](https://image.slidesharecdn.com/ruralmkt-130128223035-phpapp02/85/Rural-mkt-12-320.jpg)

![The Distribution

Challenge Large and Scattered Markets

Dispersed population and trade Low density of

shops/village and high variation in their concentration

Inadequate Transport Facilities Lack of Retail

Infrastructure Poor visibility and display of product on

rural shop shelves Highly credit driven market and low

investment capacity of retailers Inadequate bank and

credit facilities for rural retailers Lack of proper

warehousing facility Multiple Tiers (large no. of

intermediaries) leading to higher costs *[ Though it

depends on Cost/Benefit ratio of the individual

organization] Poor Communication of due to Poor Reach

of Media](https://image.slidesharecdn.com/ruralmkt-130128223035-phpapp02/85/Rural-mkt-16-320.jpg)

![Response to the

Issues Large and Scattered Markets

Inadequate Transport Facilities

Marico and HLL have started using delivery vans to

cater to rural markets. Coca Cola has opted for a ‘hub

and spoke’ distribution system. [Coke bottles were

transported from the bottling plants to the hubs (large

distributors) and from hubs to spokes (smaller

distributors) situated in small towns. Further

distribution is done from there.]](https://image.slidesharecdn.com/ruralmkt-130128223035-phpapp02/85/Rural-mkt-17-320.jpg)