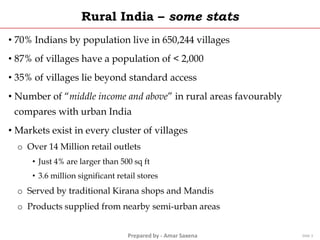

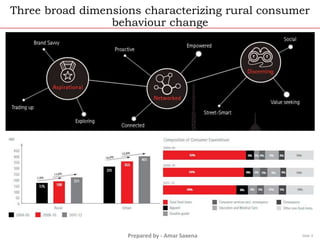

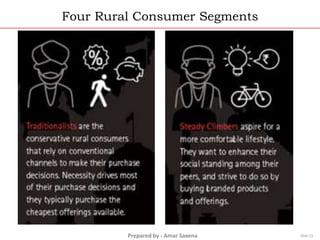

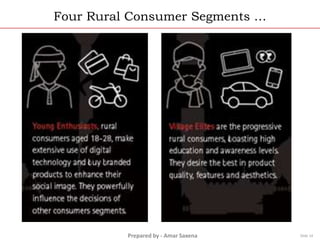

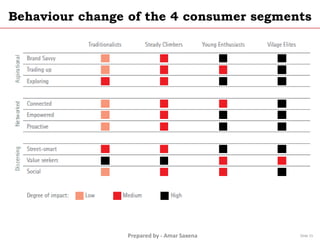

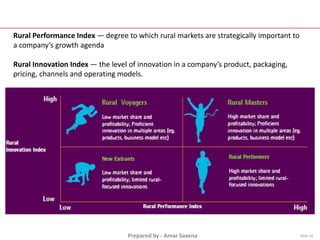

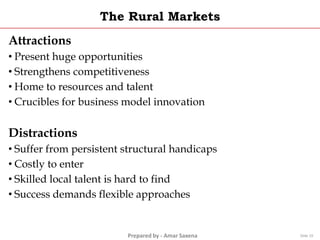

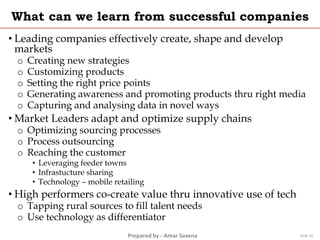

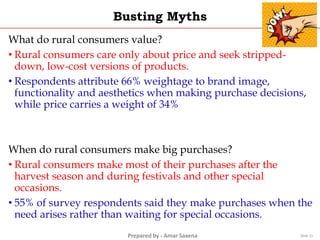

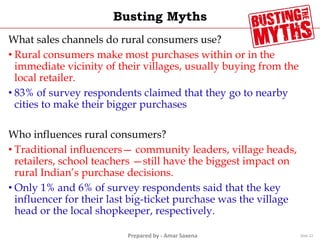

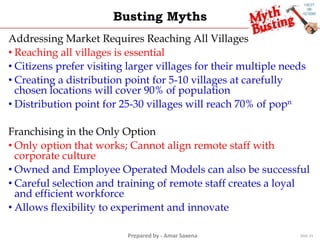

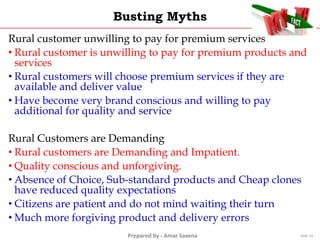

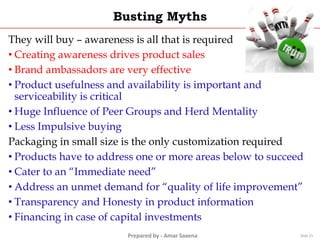

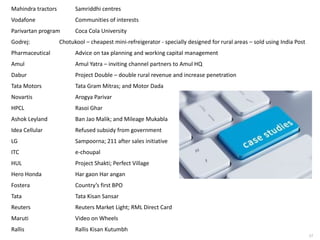

The presentation discusses the potential of rural markets in India, highlighting key statistics such as 70% of the population living in villages and significant growth in rural GDP and spending. It emphasizes the importance of understanding rural consumer behavior, challenges faced by businesses, and strategies for effective market engagement. Notable examples of successful rural marketing initiatives by various companies illustrate the opportunities and innovative approaches in this sector.