1. The document contains questions regarding mergers and acquisitions, valuation of companies, and cash flow analysis.

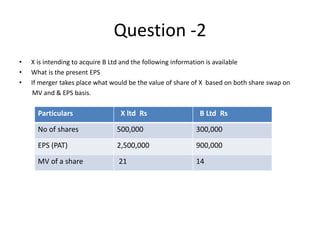

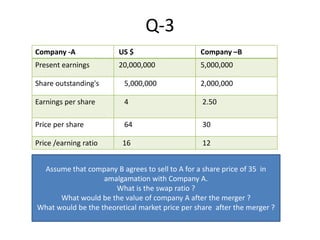

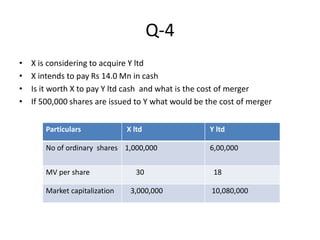

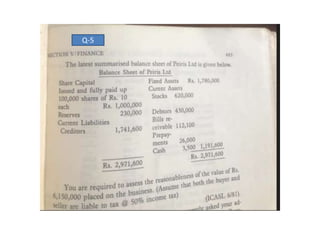

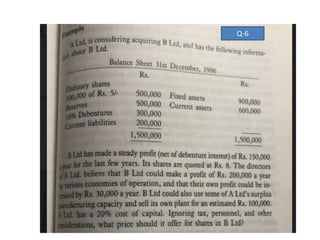

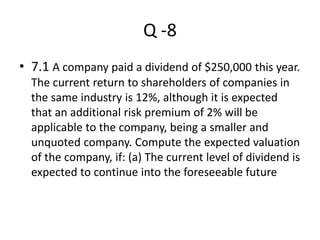

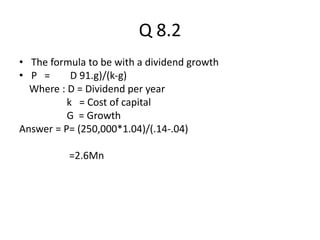

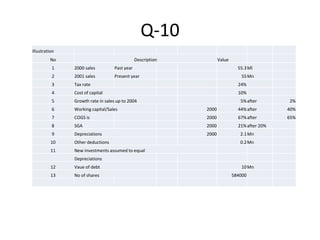

2. Specific questions ask about EPS and share value of companies pre- and post-merger, swap ratios in an acquisition, maximum price to pay for a target, and dividend growth models.

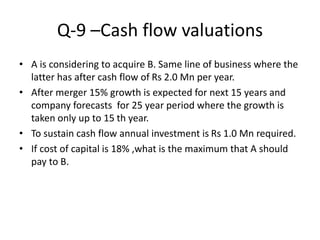

3. One question provides details on a company's financials and asks to calculate valuation using a discounted cash flow approach factoring in costs of capital, growth rates, and cash flow projections over multiple years.