Roll no. 20

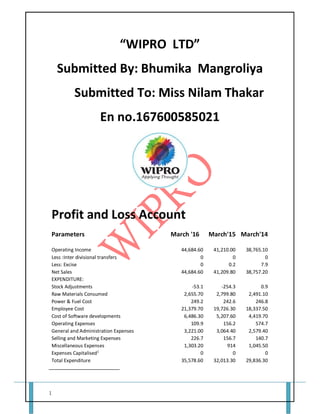

- 1. 1 “WIPRO LTD” Submitted By: Bhumika Mangroliya Submitted To: Miss Nilam Thakar En no.167600585021 Profit and Loss Account Parameters March '16 March'15 March'14 Operating Income 44,684.60 41,210.00 38,765.10 Less :Inter divisional transfers 0 0 0 Less: Excise 0 0.2 7.9 Net Sales 44,684.60 41,209.80 38,757.20 EXPENDITURE: Stock Adjustments -53.1 -254.3 0.9 Raw Materials Consumed 2,655.70 2,799.80 2,491.10 Power & Fuel Cost 249.2 242.6 246.8 Employee Cost 21,379.70 19,726.30 18,337.50 Cost of Software developments 6,486.30 5,207.60 4,419.70 Operating Expenses 109.9 156.2 574.7 General and Administration Expenses 3,221.00 3,064.40 2,579.40 Selling and Marketing Expenses 226.7 156.7 140.7 Miscellaneous Expenses 1,303.20 914 1,045.50 Expenses Capitalised1 0 0 0 Total Expenditure 35,578.60 32,013.30 29,836.30

- 2. 2 PBIDT (Excl OI) 9,106.00 9,196.50 8,920.90 Other Income 2,772.70 2,501.80 1,798.70 Operating Profit 11,878.70 11,698.30 10,719.60 Interest 527.8 362.9 374.7 PBDT 11,350.90 11,335.40 10,344.90 Depreciation 868.8 778.4 736.7 Profit Before Taxation & Exceptional Items 10,482.10 10,557.00 9,608.20 Exceptional Income / Expenses 0 0 0 Profit Before Tax 10,482.10 10,557.00 9,608.20 Provision for Tax 2,383.10 2,363.90 2,220.80 PAT 8,099.00 8,193.10 7,387.40 Extraordinary Items 0 0 0 Adj to Profit After Tax 134.2 0 0 Profit Balance B/F 15,994.70 12,176.90 7,837.10 Appropriations 24,227.90 20,370.00 15,224.50 Equity Dividend (%) 300 600 400 Earnings Per Share (in ₹) 32.78 33.19 29.96 Book Value (in ₹) 164.81 139.92 118.92 Comment: Opening Income 35,000.00 36,000.00 37,000.00 38,000.00 39,000.00 40,000.00 41,000.00 42,000.00 43,000.00 44,000.00 45,000.00 46,000.00 2016 2015 2014

- 3. 3 Net Sales Stock Adjustments Raw Materials Consumed 35,000.00 36,000.00 37,000.00 38,000.00 39,000.00 40,000.00 41,000.00 42,000.00 43,000.00 44,000.00 45,000.00 46,000.00 2016 2015 2016 -300 -250 -200 -150 -100 -50 0 50 2016 2015 2014

- 4. 4 Power & Fuel Cost Employee Cost 2,300.00 2,350.00 2,400.00 2,450.00 2,500.00 2,550.00 2,600.00 2,650.00 2,700.00 2,750.00 2,800.00 2,850.00 2016 2015 2014 238 240 242 244 246 248 250 2016 2015 2016

- 5. 5 Cost of Software developments Operating expenses 0 1000 2000 3000 4000 5000 6000 7000 2016 2015 2014 16500 17000 17500 18000 18500 19000 19500 20000 20500 21000 21500 22000 2016 2015 2014

- 6. 6 General and Administration Expenses Miscellaneous Expenses 0 100 200 300 400 500 600 700 2016 2015 2014 0 500 1000 1500 2000 2500 3000 3500 2016 2015 2014

- 7. 7 PBIDT (Excl OI) Other Income 0 200 400 600 800 1000 1200 1400 2016 2015 2014 8750 8800 8850 8900 8950 9000 9050 9100 9150 9200 9250 2016 2015

- 8. 8 Interest 0 500 1000 1500 2000 2500 3000 2016 2015 2014 0 100 200 300 400 500 600 2016 2015 2014

- 9. 9 Depreciation Profit Before Taxation & Exceptional Items PAT 650 700 750 800 850 900 2016 2015 2014 9000 9200 9400 9600 9800 10000 10200 10400 10600 10800 2016 2015 2014

- 10. 10 Profit Balance B/F Appropriations 6800 7000 7200 7400 7600 7800 8000 8200 8400 2014 2015 2016 0 2000 4000 6000 8000 10000 12000 14000 16000 18000 2016 2015 2014

- 11. 11 Equity Dividend Earnings Per Share 0 5000 10000 15000 20000 25000 30000 2016 2015 2014 0 100 200 300 400 500 600 700 2016 2015 2014

- 12. 12 Balance Sheet Parameters MAR'16 MAR'15 MAR'14 EQUITY AND LIABILITIES Share Capital 494.10 493.70 493.20 Share Warrants & Out standings Shareholder's Funds 40,905.20 34,621.60 29,355.9 Long-Term Borrowings 0.00 0.00 0.00 Secured Loans 120.10 114.30 106.00 Unsecured Loans 1,026.40 948.90 900.10 Deferred Tax Assets / Liabilities -218.20 -109.20 -10.80 Other Long Term Liabilities 46.40 28.10 62.90 Long Term Trade Payables 0.00 0.00 0.00 Long Term Provisions 399.10 273.60 288.90 Total Non-Current Liabilities 1,373.80 1,255.70 1,347.10 Trade Payables 5,993.10 5,728.80 5,356.60 Current Liabilities Other Current Liabilities 2,665.20 2,551.10 2,404.80 Short Term Borrowings 5,549.50 4,970.40 3,504.20 Short Term Provisions 2,399.30 4,115.00 3,619.60 Total Current Liabilities 16,607.10 17,365.30 14,885.2 28 29 30 31 32 33 34 2016 2015 2014

- 13. 13 Total Liabilities 58,886.10 53,242.60 45,588.2 Non-Current Assets 0.00 0.00 0.00 ASSETS Gross Block 10,304.90 9,453.80 9,043.40 Less: Accumulated Depreciation 6,116.20 5,415.40 5,068.40 Less: Impairment of Assets 0.00 0.00 0.00 Net Block 4,188.70 4,038.40 3,975.00 Lease Adjustment A/c 0.00 0.00 0.00 Capital Work in Progress 325.10 361.20 275.10 Intangible assets under development 0.00 0.00 0.00 Pre-operative Expenses pending 0.00 0.00 0.00 Assets in transit 0.00 0.00 0.00 Non Current Investments 5,732.80 5,579.70 5,196.80 Long Term Loans & Advances 2,936.50 2,810.80 2,896.20 Other Non Current Assets 674.30 597.00 640.90 Total Non-Current Assets 13,857.40 13,387.10 12,984.0 Total Reserves 40,220.90 34,046.40 28,831.8 Current Assets Loans & Advances Currents Investments 12,730.20 5,188.80 5,839.20 Inventories 526.20 479.40 228.30 Cash and Bank 12,007.80 15,667.50 10,554.9 Other Current Assets 6,571.20 6,044.70 4,963.90 Short Term Loans and Advances 4,488.50 4,330.90 2,467.00 Total Current Assets 45,028.70 39,855.50 32,604.2 Net Current Assets (Including Current Investments) 28,421.60 22,490.20 17,719.0 Total Current Assets Excluding Current Investments 32,298.50 34,666.70 26,765.0 Miscellaneous Expenses not written off 0.00 0.00 0.00 Total Assets 58,886.10 53,242.60 45,588.2 Contingent Liabilities 3,374.20 2,935.90 2,732.00 Total Debt 6,812.90 6,102.60 4,583.00 Book Value (in ₹) 164.80 0.00 118.92 Adjusted Book Value (in ₹) 164.80 0.00 118.92 Comment: Share capital

- 14. 14 Shareholder's Funds Secured Loans 492.6 492.8 493 493.2 493.4 493.6 493.8 494 494.2 2016 2015 2014 0 5000 10000 15000 20000 25000 30000 35000 40000 45000 2016 2015 2014

- 15. 15 Unsecured Loans Deferred Tax Assets 95 100 105 110 115 120 125 2016 2015 2014 820 840 860 880 900 920 940 960 980 1000 1020 1040 2016 2015 2014

- 16. 16 Other Long Term Liabilities Long Term Provisions -250 -200 -150 -100 -50 0 2016 2015 2014 0 10 20 30 40 50 60 70 2016 2015 2014

- 17. 17 Total Non-Current Liabilities Trade Payables 0 50 100 150 200 250 300 350 400 450 2016 2015 2014 1180 1200 1220 1240 1260 1280 1300 1320 1340 1360 1380 1400 2016 2015 2014

- 18. 18 Other Current Liabilities Short Term Borrowings 5000 5200 5400 5600 5800 6000 6200 2016 2015 2014 2250 2300 2350 2400 2450 2500 2550 2600 2650 2700 2016 2015 2014

- 19. 19 Short Term Provisions Total Current Liabilities 0 1000 2000 3000 4000 5000 6000 2016 2015 2014 0 500 1000 1500 2000 2500 3000 3500 4000 4500 2016 2015 2014

- 20. 20 Total Liabilities Gross Block 13500 14000 14500 15000 15500 16000 16500 17000 17500 18000 2016 2015 2014 0 10000 20000 30000 40000 50000 60000 70000 2016 2015 2014

- 21. 21 Capital Work in Progress Other Non Current Assets 8400 8600 8800 9000 9200 9400 9600 9800 10000 10200 10400 2016 2015 2014 0 50 100 150 200 250 300 350 400 2016 2015 2014

- 22. 22 Total Reserves Currents Investments 540 560 580 600 620 640 660 680 700 2016 2014 2014 0 5000 10000 15000 20000 25000 30000 35000 40000 45000 2016 2015 2014

- 23. 23 Inventories Cash and Bank 0.00 2,000.00 4,000.00 6,000.00 8,000.00 10,000.00 12,000.00 14,000.00 2016 2015 2014 0 100 200 300 400 500 600 2016 2015 2014

- 24. 24 Other Current Assets Short Term Loans and Advances 0 2000 4000 6000 8000 10000 12000 14000 16000 18000 2016 2015 2014 0.00 1,000.00 2,000.00 3,000.00 4,000.00 5,000.00 6,000.00 7,000.00 2016 2015 2014

- 25. 25 Net Current Assets (Including Current Investments) Total Current Assets Excluding Current Investments 0.00 500.00 1,000.00 1,500.00 2,000.00 2,500.00 3,000.00 3,500.00 4,000.00 4,500.00 5,000.00 2016 2015 2014 0.00 5,000.00 10,000.00 15,000.00 20,000.00 25,000.00 30,000.00 2016 2015 2014

- 26. 26 Total Assets Contingent Liabilities 0.00 5,000.00 10,000.00 15,000.00 20,000.00 25,000.00 30,000.00 35,000.00 40,000.00 2016 2015 2014 0.00 10,000.00 20,000.00 30,000.00 40,000.00 50,000.00 60,000.00 70,000.00 2016 2015 2014

- 27. 27 Total Debt 2 2 www.moneycontrol.com › MARKETS › Computers - Software 0.00 500.00 1,000.00 1,500.00 2,000.00 2,500.00 3,000.00 3,500.00 4,000.00 2016 2015 2014 0.00 1,000.00 2,000.00 3,000.00 4,000.00 5,000.00 6,000.00 7,000.00 8,000.00 2016 2015 2014