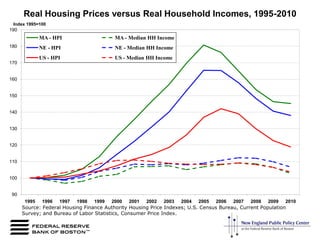

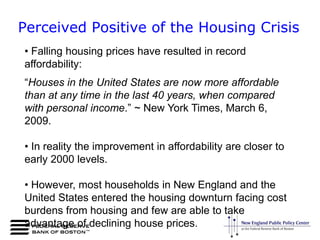

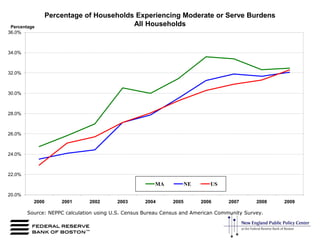

The document discusses housing affordability in the context of the recent housing crisis. It makes three key points:

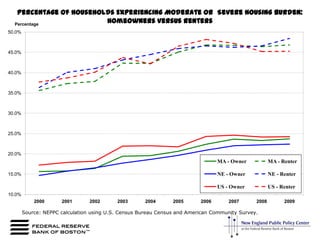

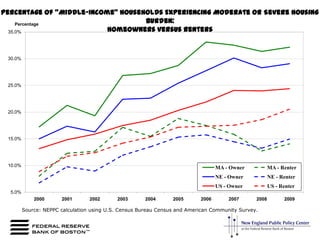

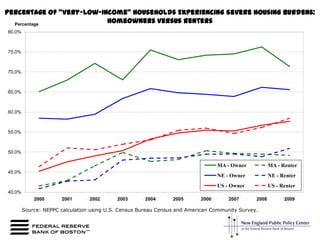

1) While falling home prices have led to record housing affordability levels, most households entered the downturn already facing high housing costs and few can take advantage of lower prices.

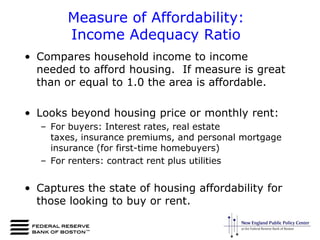

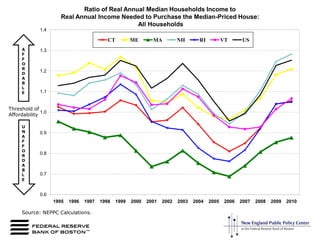

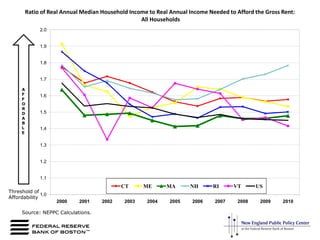

2) Measures of housing affordability and burden show that affordability has only improved to early 2000 levels and many households, especially low- and moderate-income, still face high housing costs.

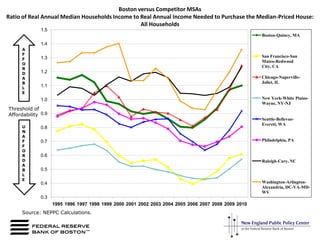

3) The housing affordability problem is particularly acute in Massachusetts compared to other markets. Most households cannot benefit from lower home prices due to existing high housing cost burdens.