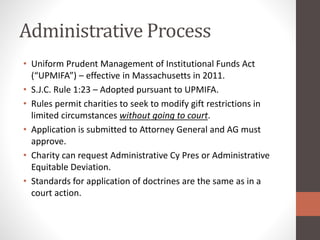

This document summarizes the legal doctrines of cy pres and equitable deviation, which allow courts to modify restrictions on charitable gifts when circumstances change. Cy pres applies when a gift becomes impossible, impractical, or illegal, and was made with a general charitable intent. Equitable deviation applies to administrative restrictions. The document provides examples and discusses Massachusetts' codification of equitable deviation. It also outlines an administrative process under UPMIFA to modify small, older restricted gifts without court approval.

![Sample Strategies

1. Lapse

$ to charity to establish [______] Foundation, “provided,

however, if in the Trustees’ conclusive judgment such

organization is then no longer in existence in its present name or

form or for its present purposes, the Trustees shall pay over the

amount designated for such organization to the organization or

organizations which in the Trustees’ conclusive judgment is the

successor to the work and purposes of such organization, or, if in

the Trustees’ conclusive judgment there is no such successor,

such gift shall lapse.”](https://image.slidesharecdn.com/rez-cyprespresentationpublic-150323081505-conversion-gate01/85/Doctrines-of-Cy-Pres-and-Equitable-Deviation-15-320.jpg)

![Sample Strategies

2. Trustee Discretion

$ to charity to establish [______] Foundation “provided,

however, if in the Trustees’ conclusive judgment such

organization is then no longer in existence in its present name or

form or for its present purposes, the Trustees shall pay over the

amount designated for such organization to the organization or

organizations which in the Trustees’ conclusive judgment is the

successor to the work and purposes of such organization, or, if in

the Trustees’ conclusive judgment there is no such successor, to

another charitable organization or organizations with a similar

mission or purpose contributions to which are deductible under

Section 2055 of the Code to be selected by the Trustees in their

sole discretion.”](https://image.slidesharecdn.com/rez-cyprespresentationpublic-150323081505-conversion-gate01/85/Doctrines-of-Cy-Pres-and-Equitable-Deviation-16-320.jpg)

![Sample Strategies

3. Contingent Remainder Charity

$ to “St. Mary’s Church in Randolph, Massachusetts, provided

that [______] is the pastor at the time of my death, otherwise if

[______] is not the pastor of St. Mary’s Church, in his honor or

memory, as the case may be, to St. Patrick’s Seminary and

University, located in Menlo Park, California….”

*Consider tax implications if there is non-charitable remainder.](https://image.slidesharecdn.com/rez-cyprespresentationpublic-150323081505-conversion-gate01/85/Doctrines-of-Cy-Pres-and-Equitable-Deviation-17-320.jpg)

![Sample Strategies

4. Broaden Restriction

$ to “the Dana Farber Cancer Institute located in Boston,

Massachusetts, in memory of my Husband and me, to fund

lymphoma and leukemia research and to be used at the

direction of [_____], M.D., or if he is no longer working at Dana

Farber Cancer Institute, to be used at the direction of a

successor physician who oversees lymphoma and leukemia

research.”](https://image.slidesharecdn.com/rez-cyprespresentationpublic-150323081505-conversion-gate01/85/Doctrines-of-Cy-Pres-and-Equitable-Deviation-18-320.jpg)