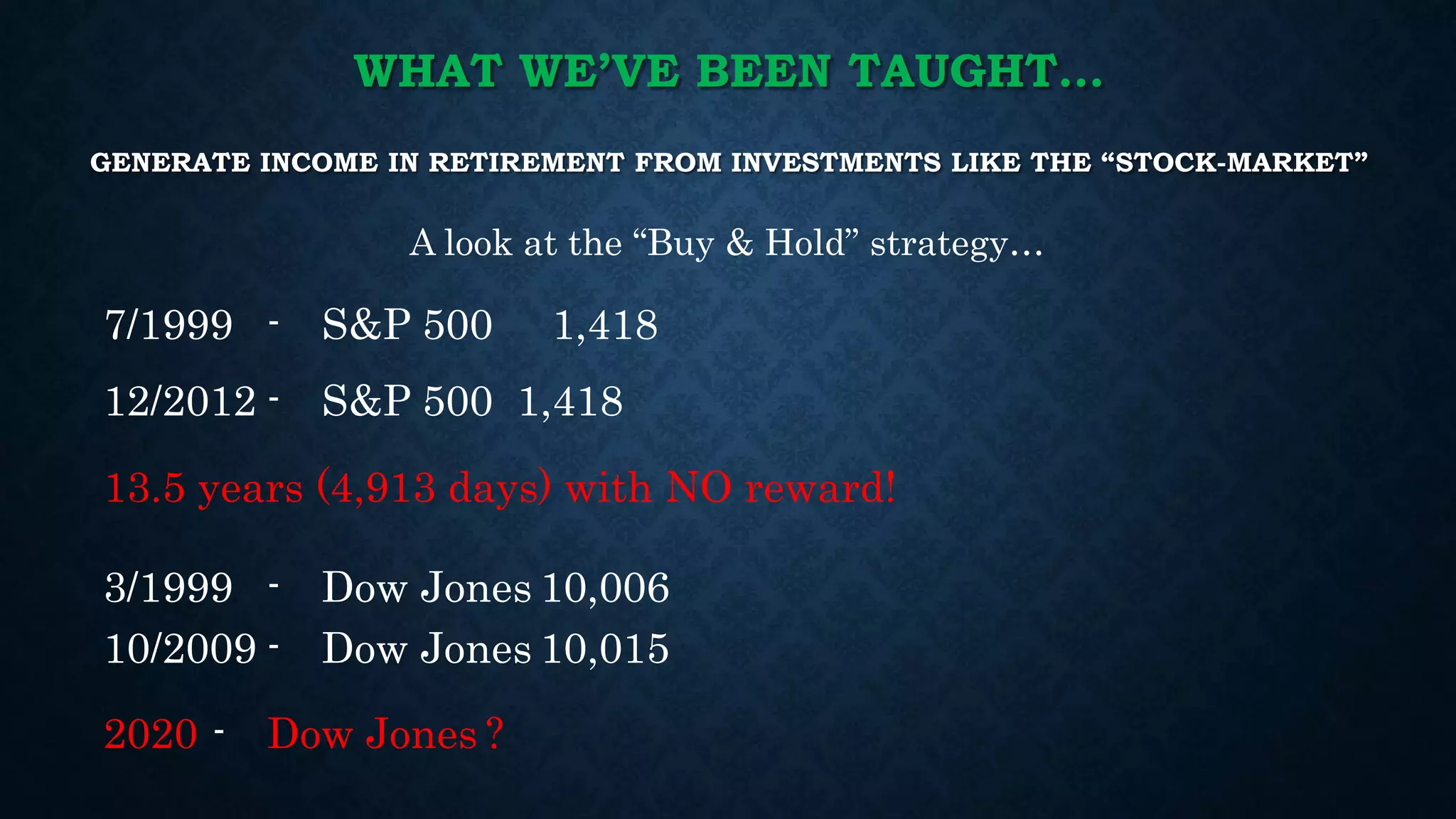

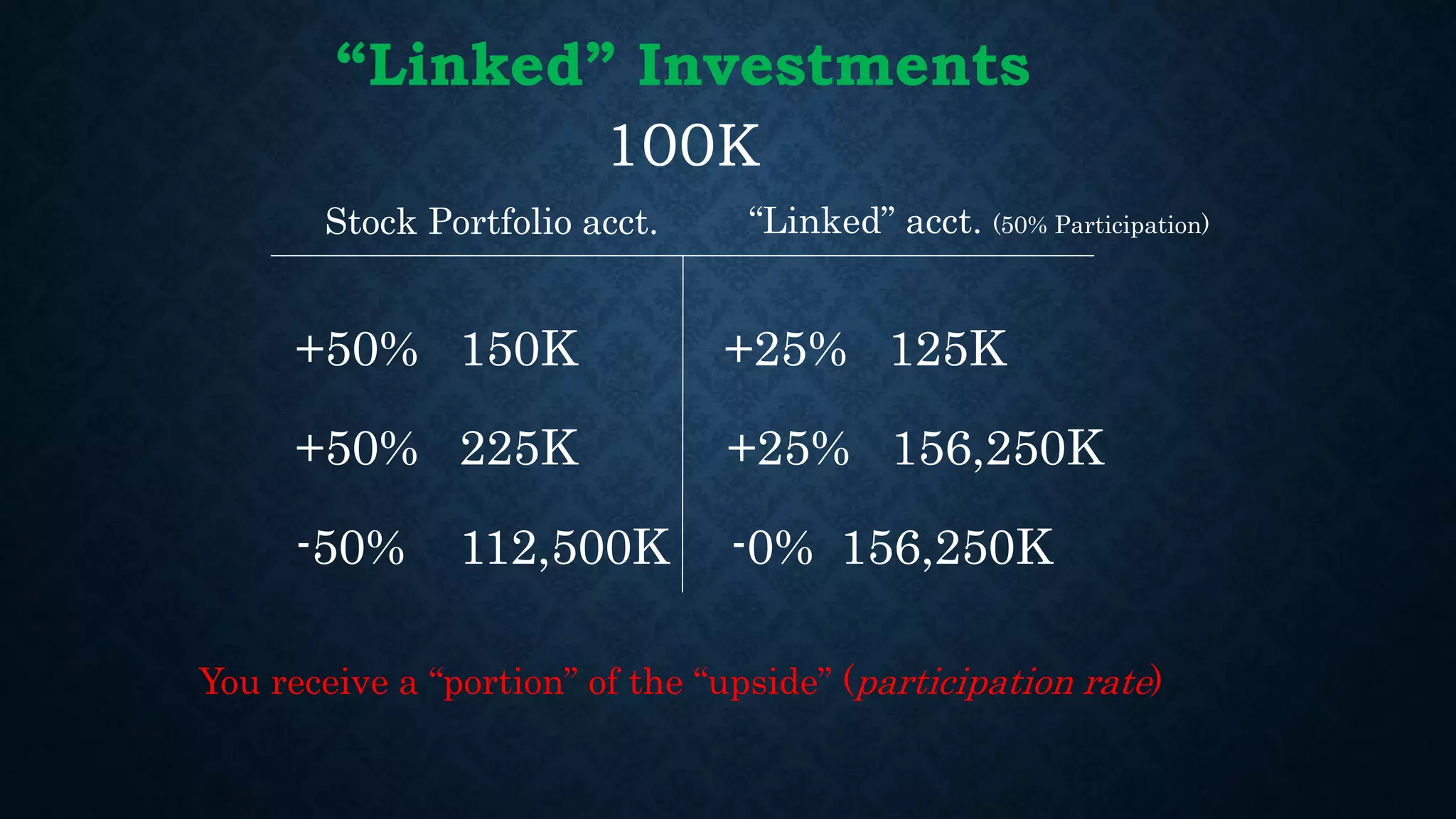

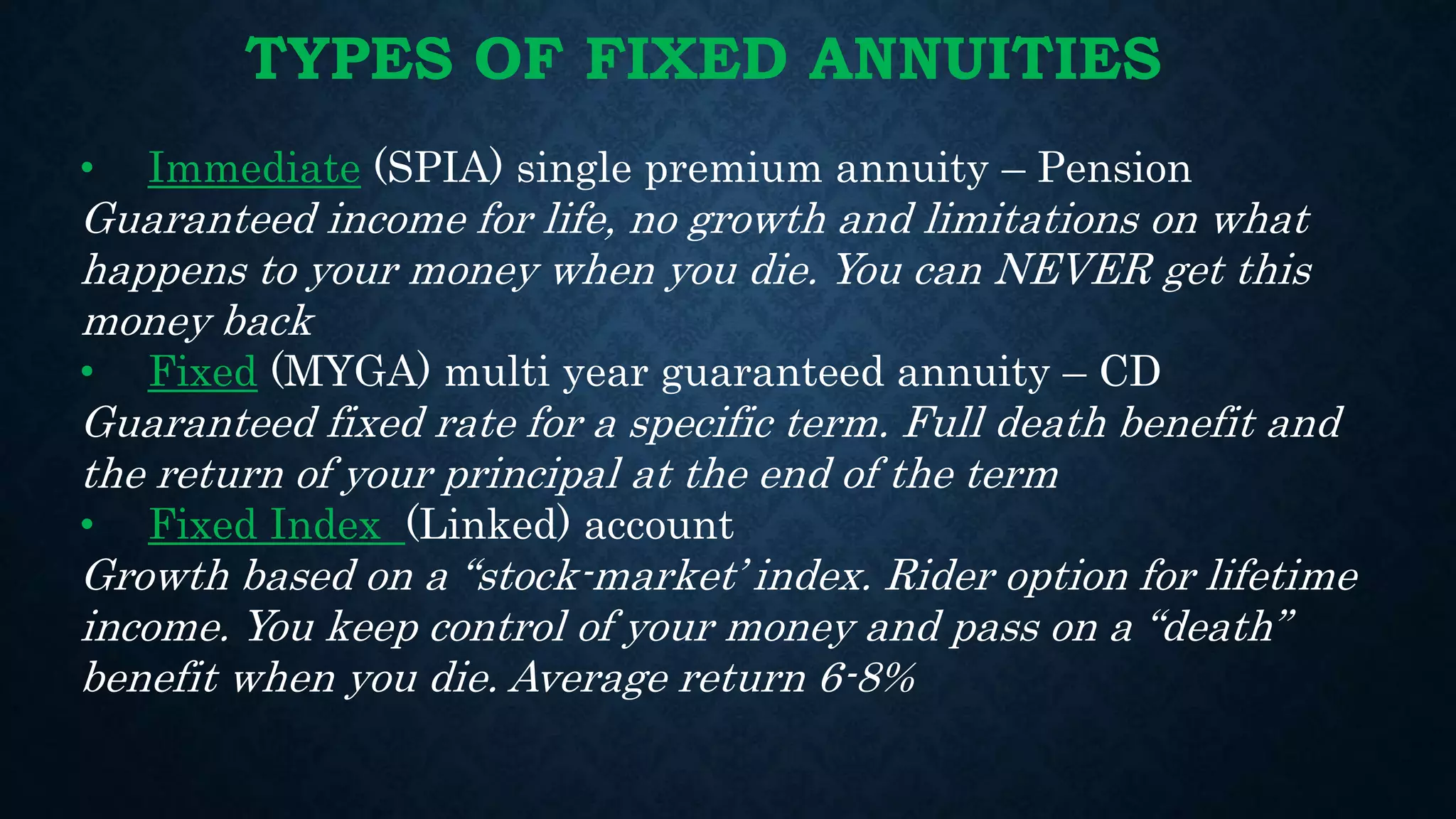

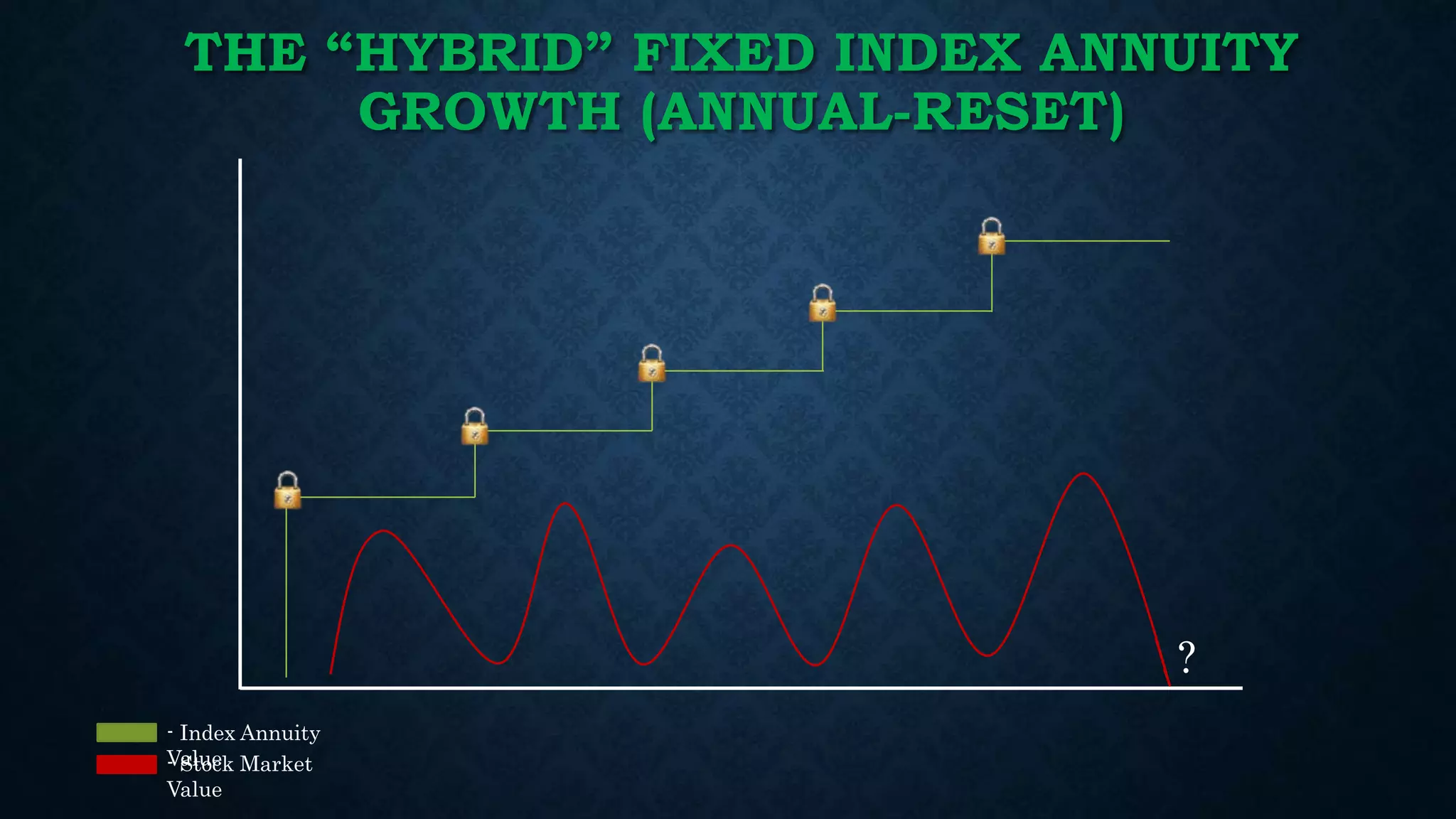

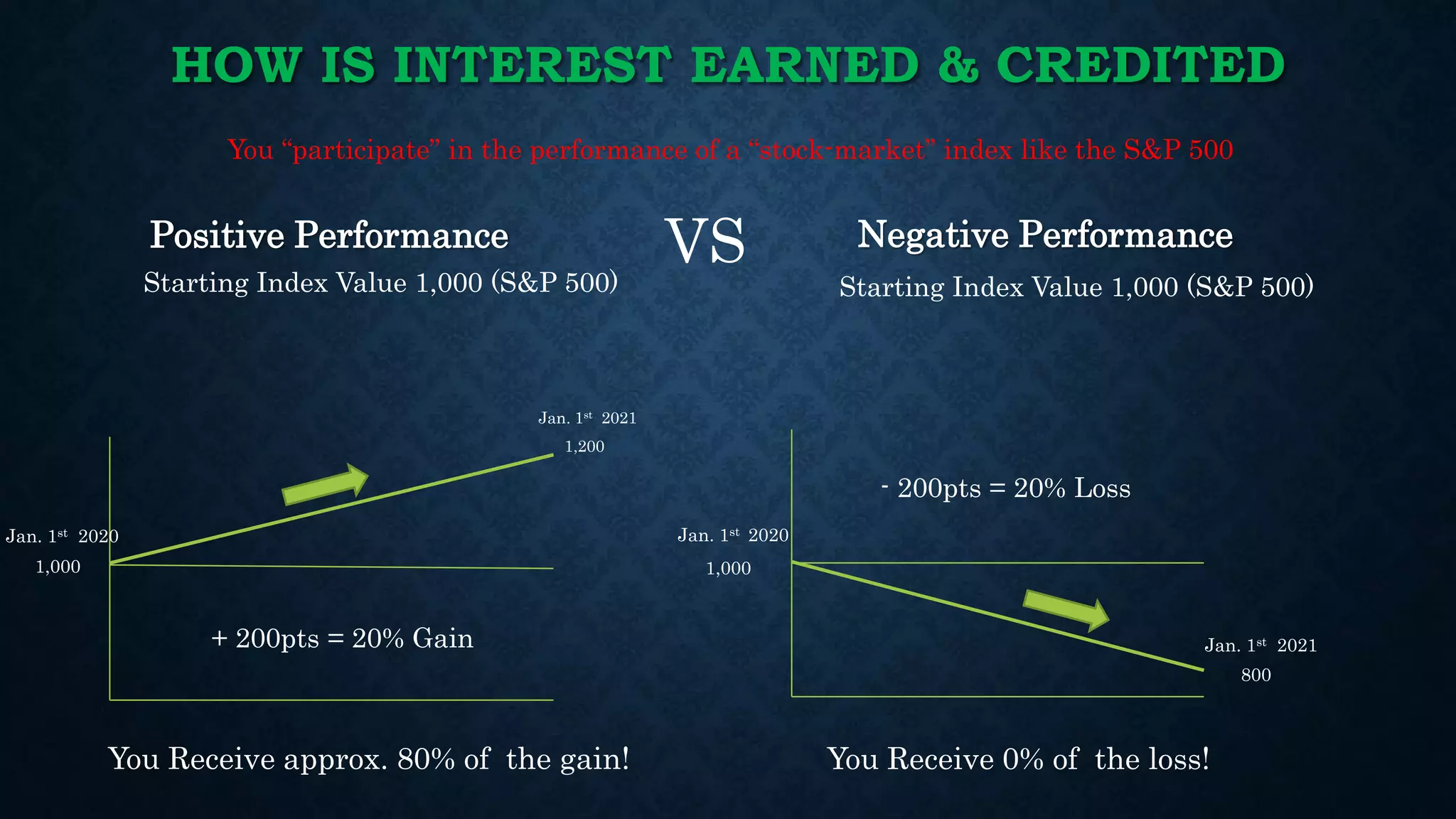

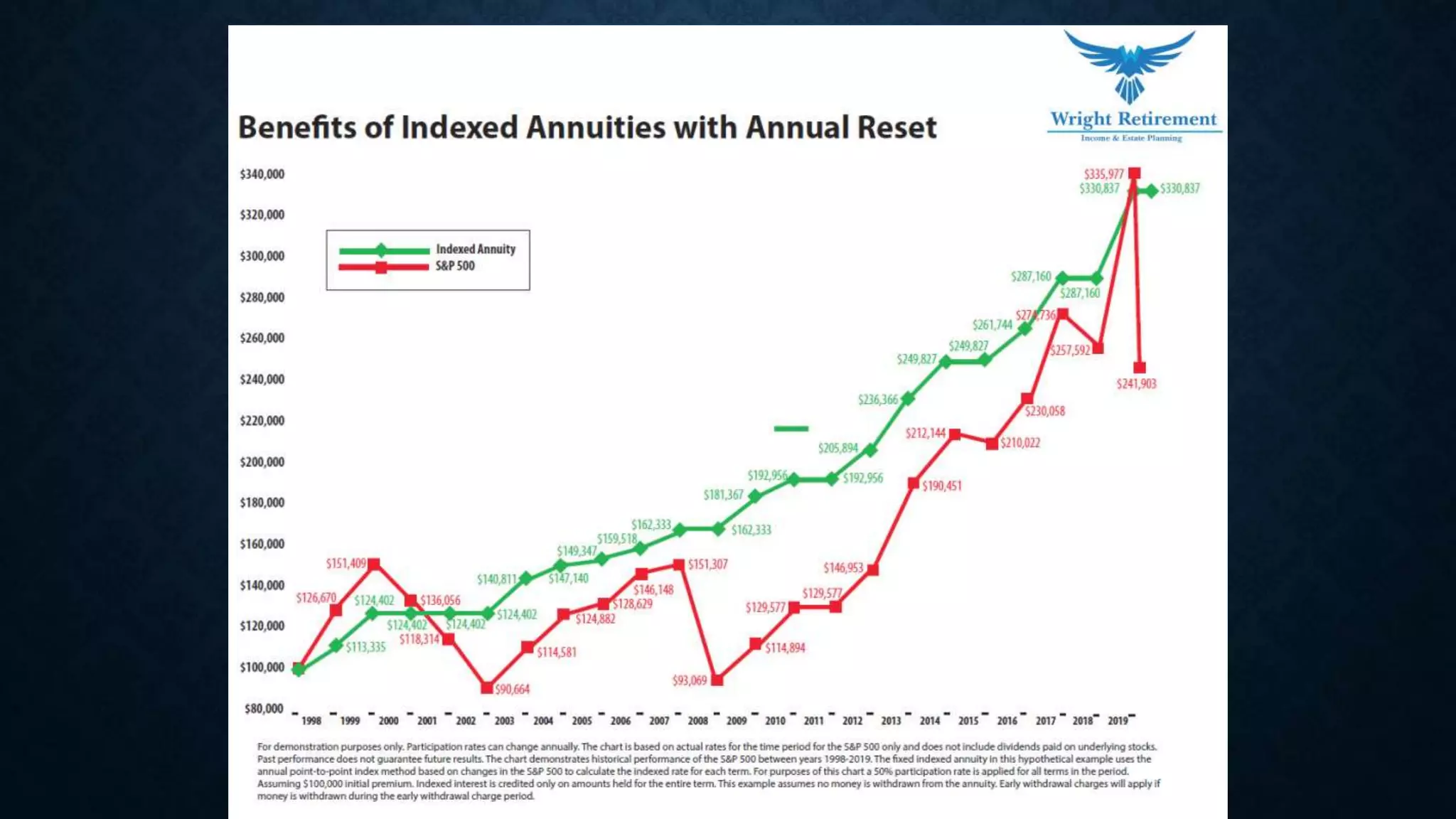

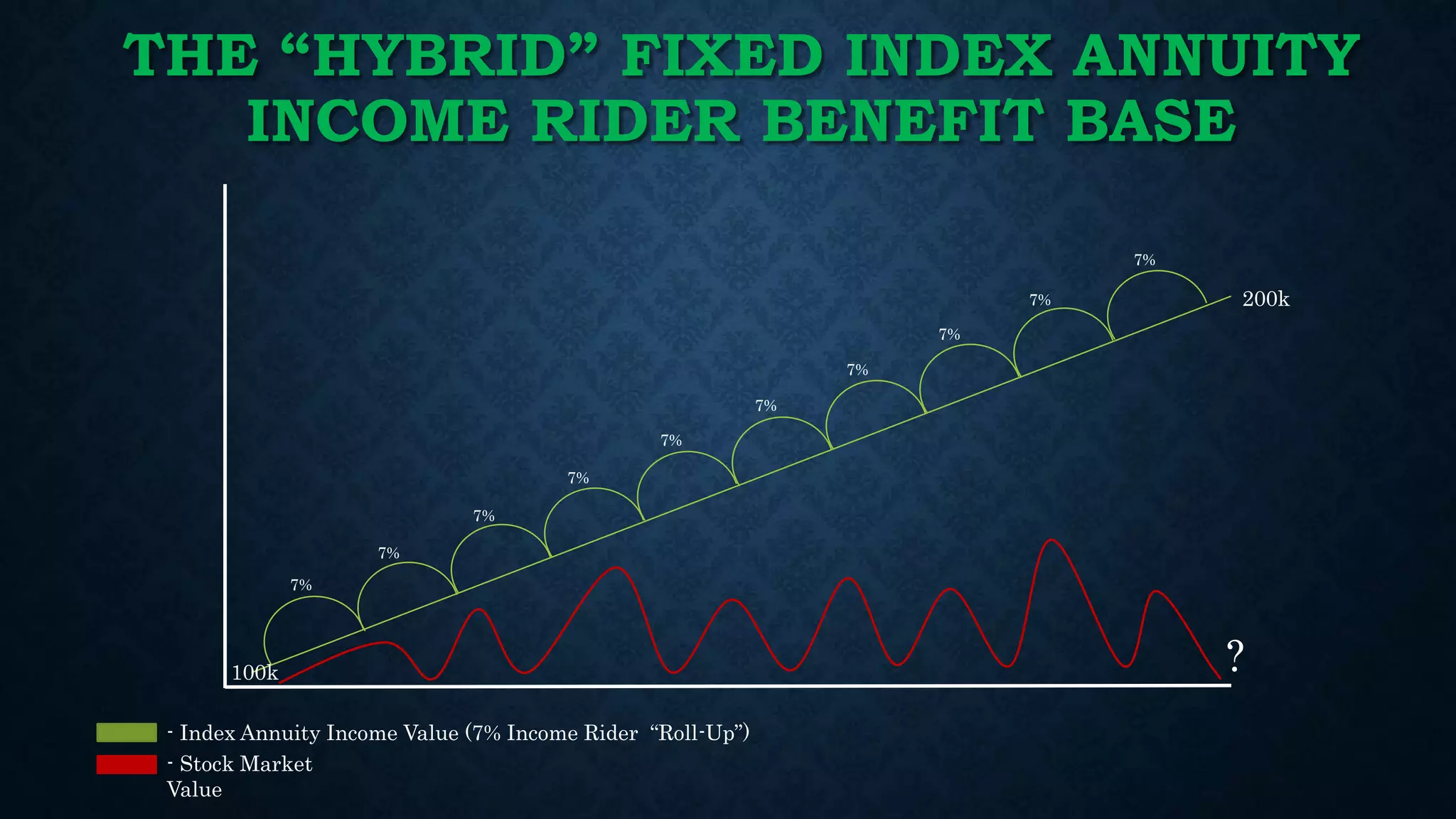

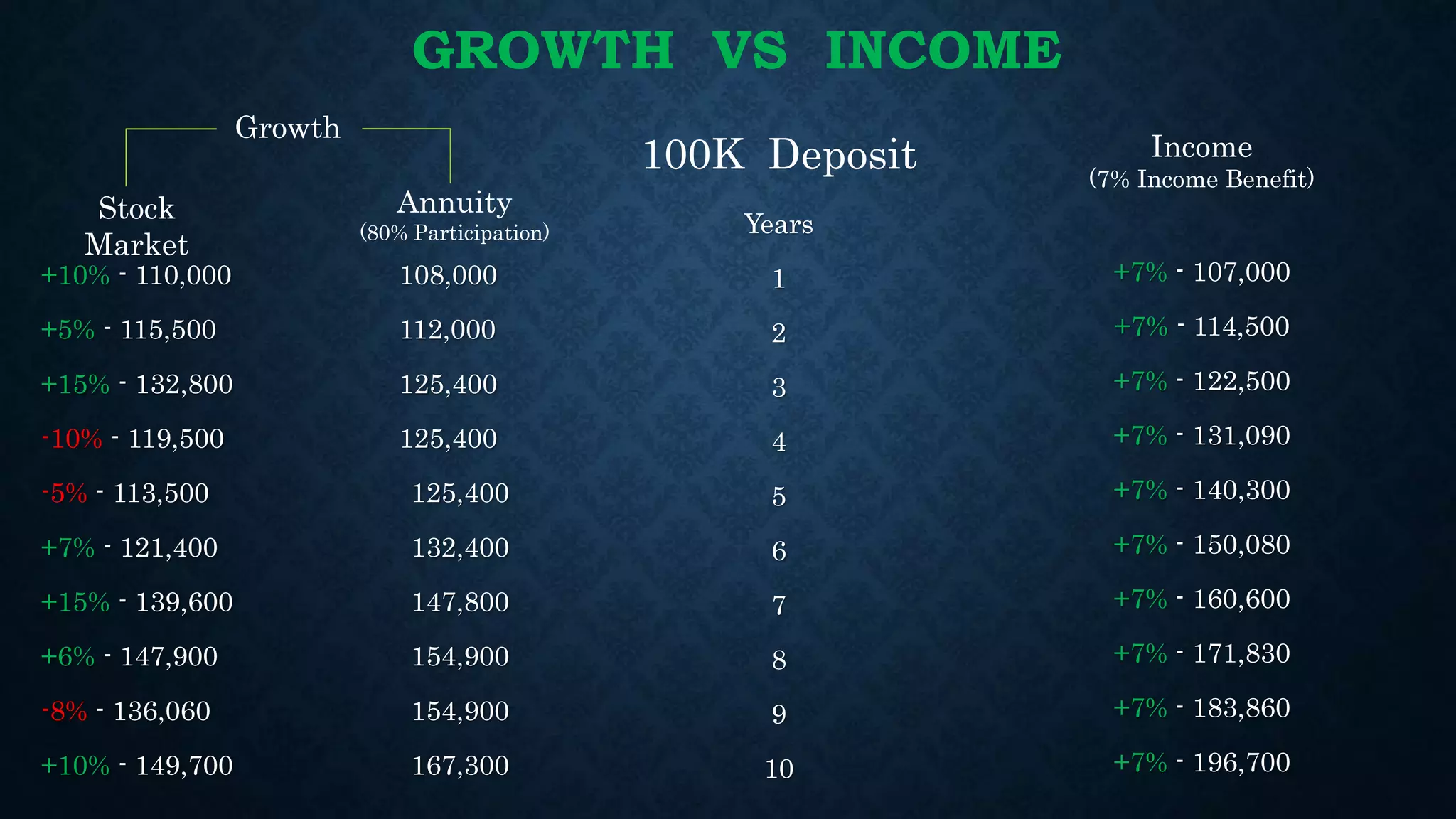

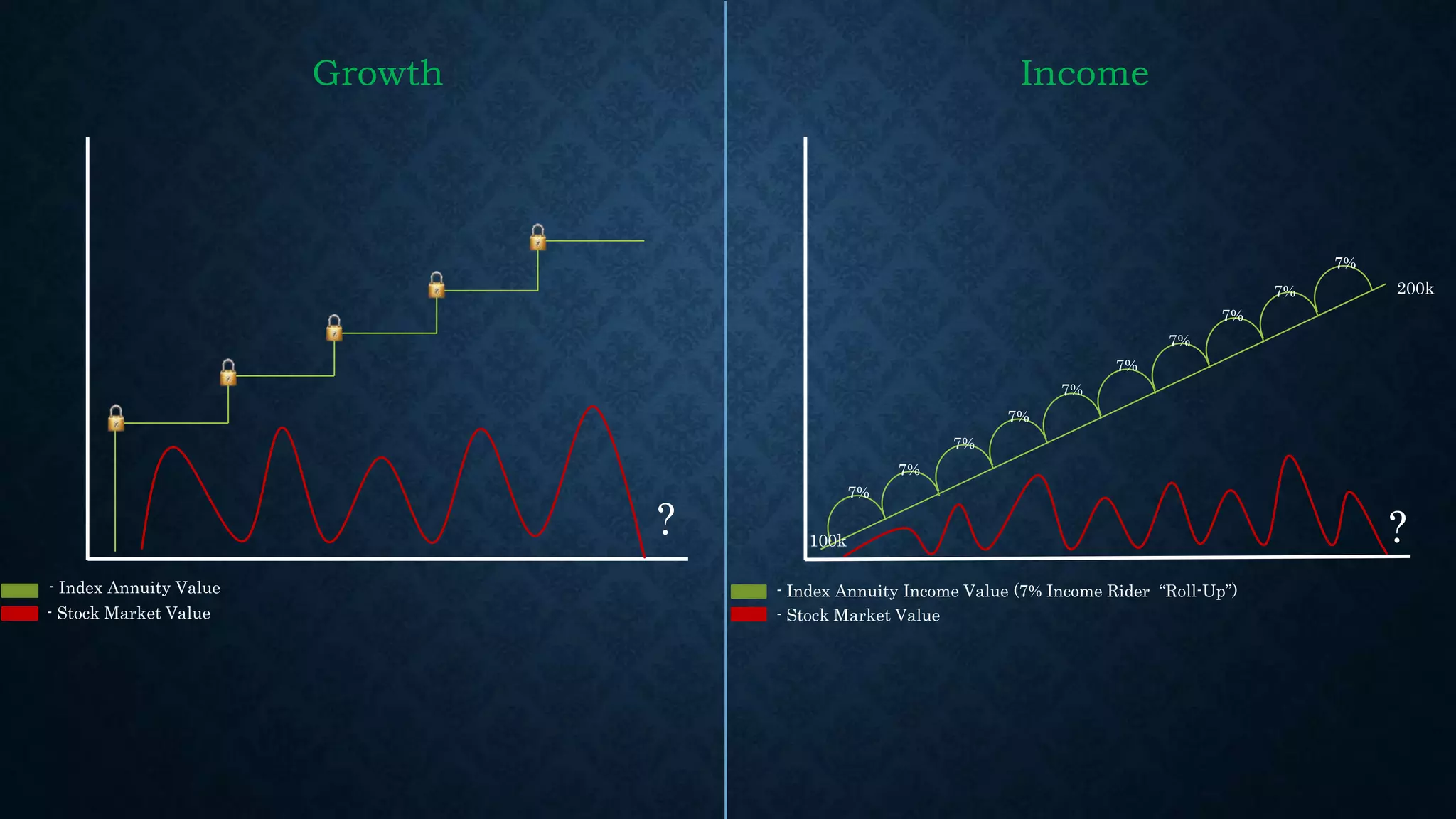

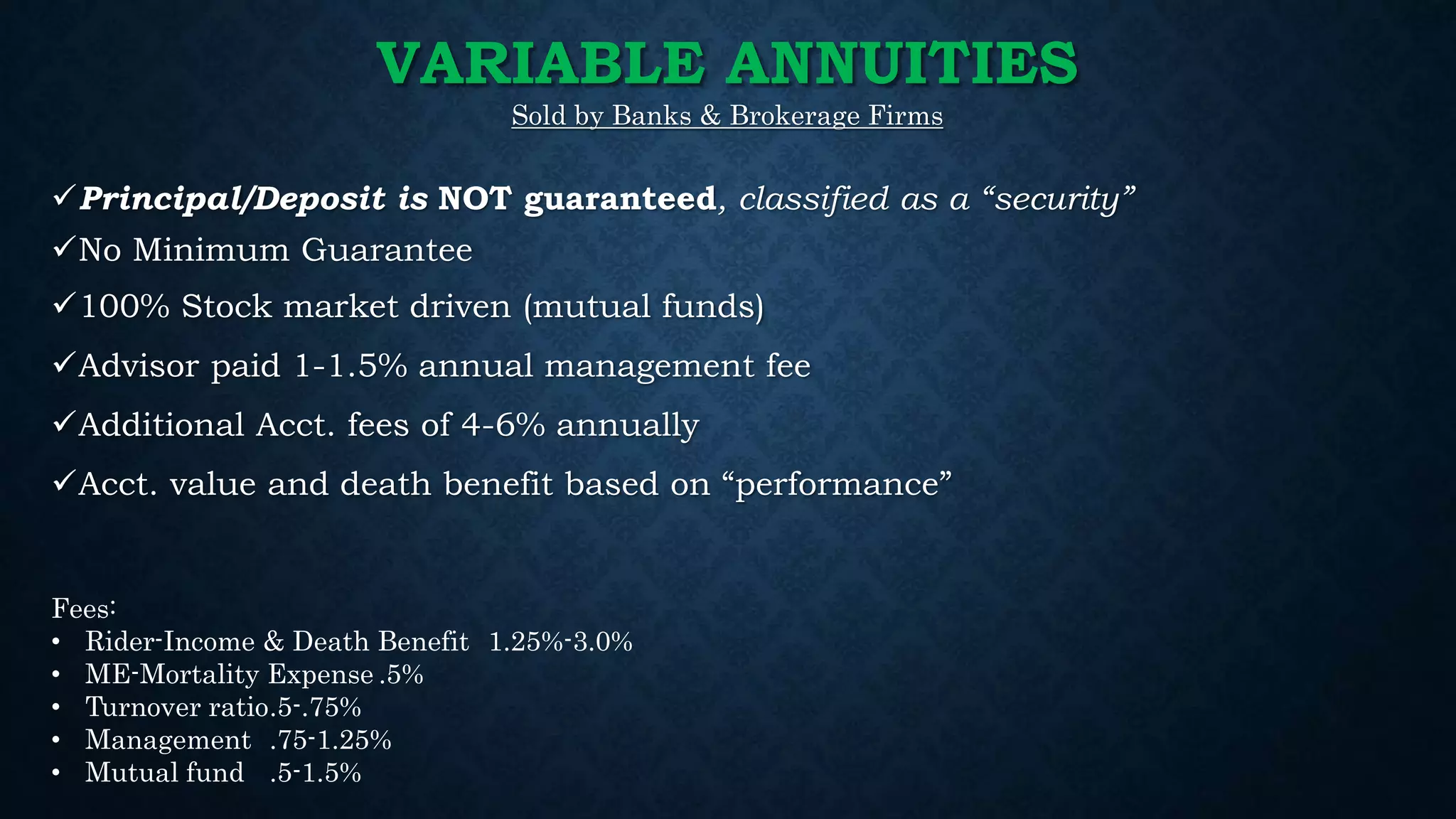

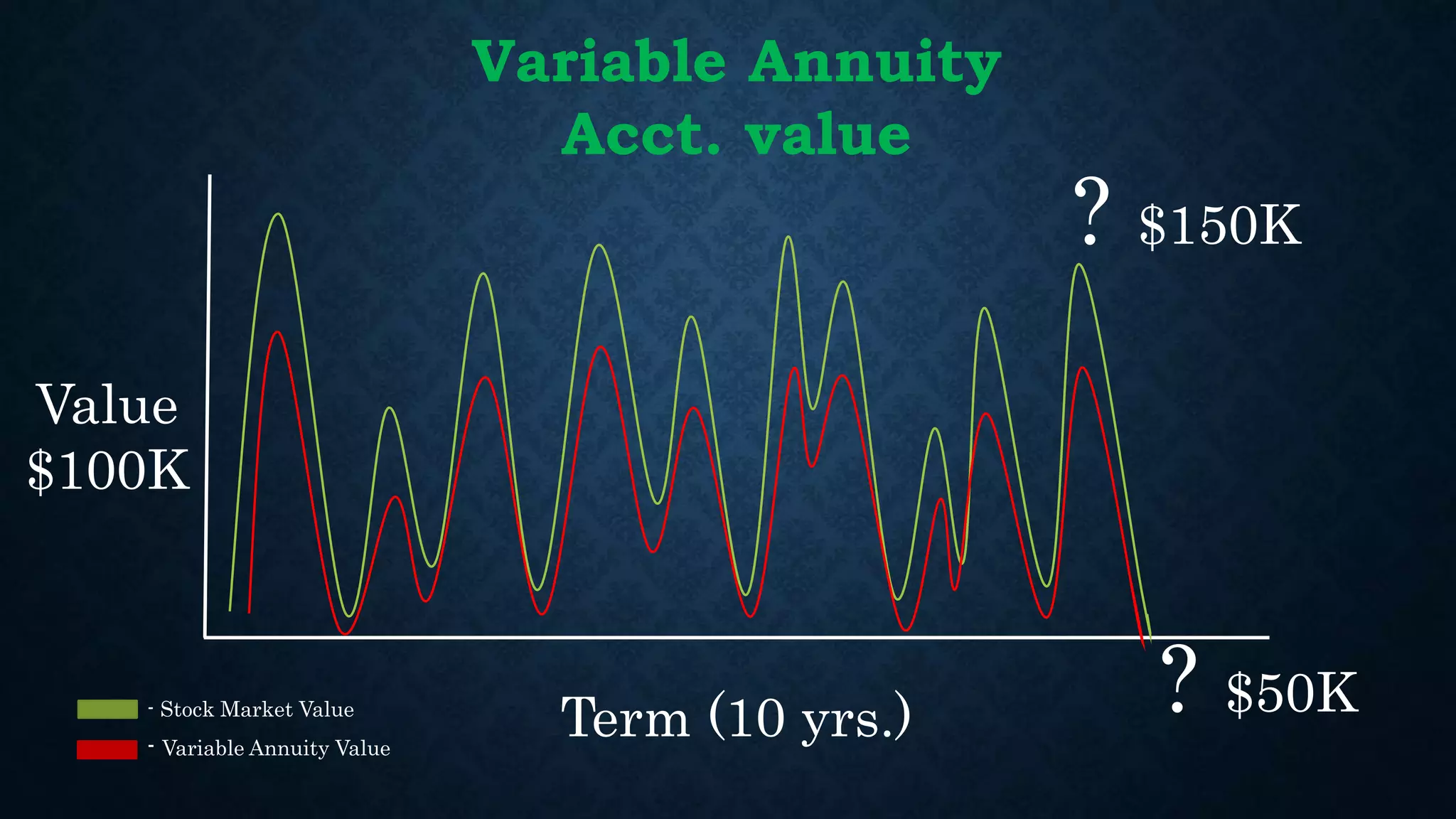

The presentation discusses retirement income planning and different investment options for generating retirement income. It notes that monthly income is most important in retirement, not how much is earned, but how much is kept. It then reviews different types of fixed and variable annuities that can provide guaranteed lifetime income through options like income riders, as well as growth potential while protecting against market downturns. This is compared to traditional stock market investment strategies that provide no guarantees and have potential for losses.