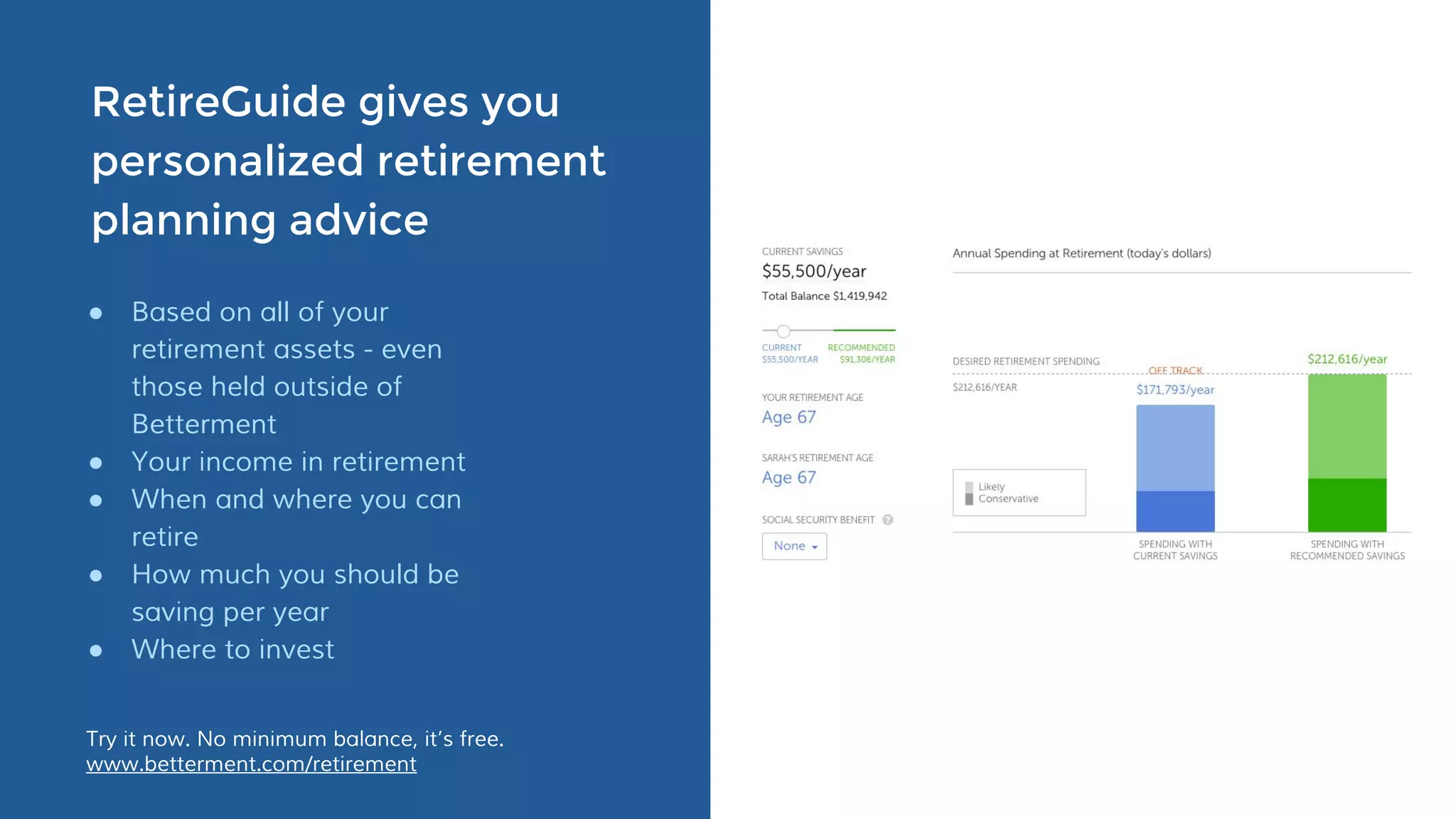

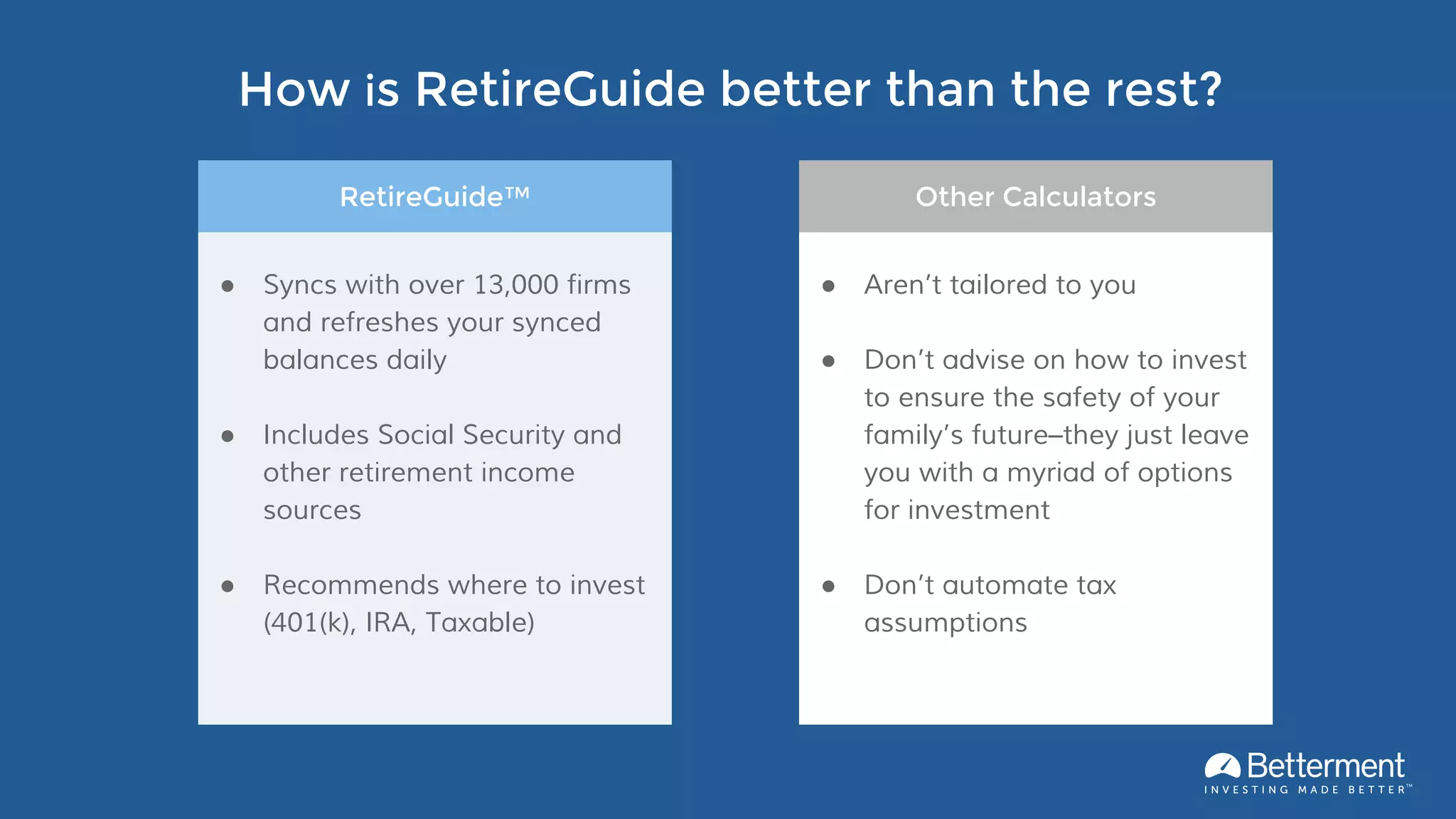

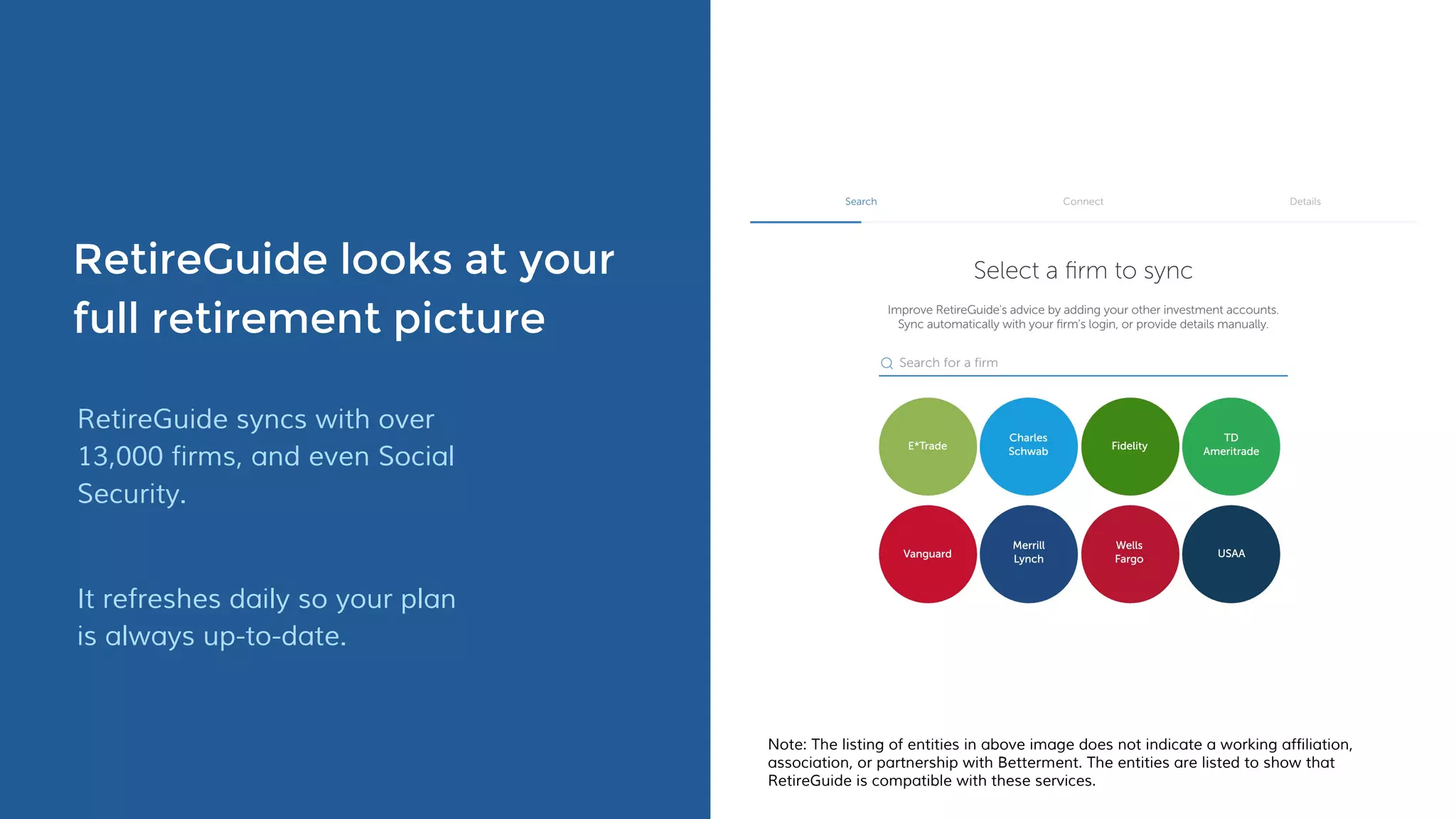

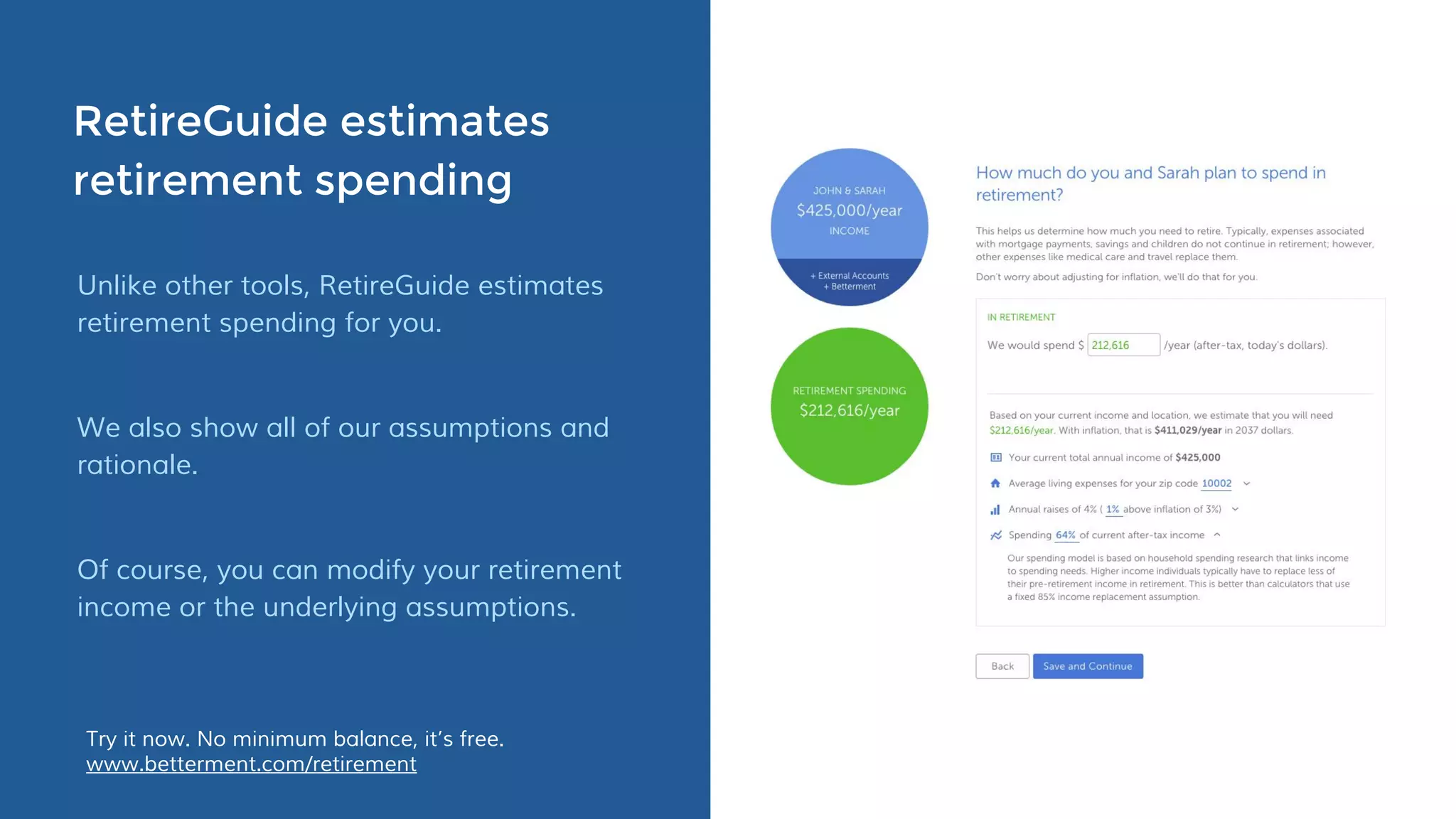

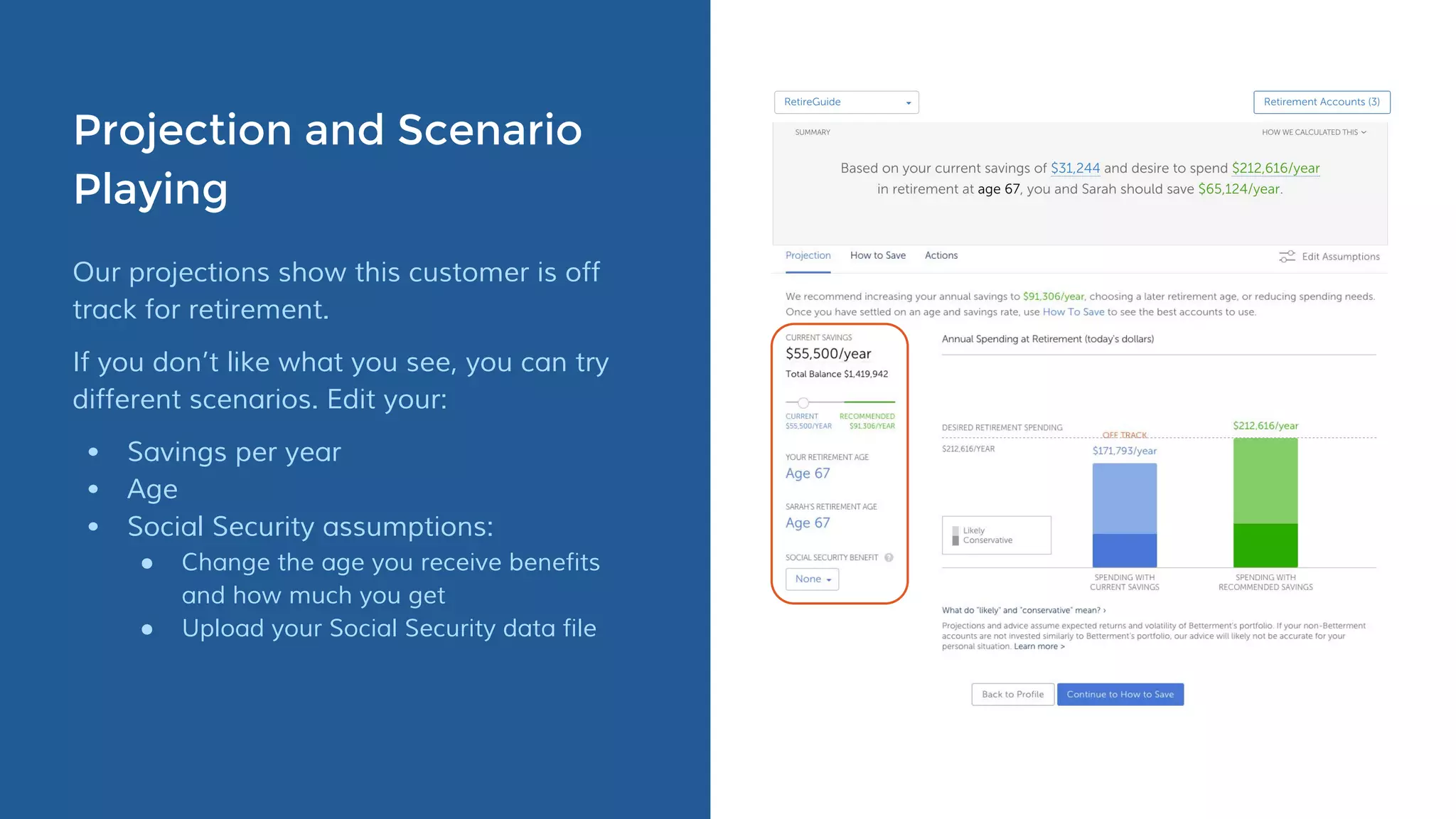

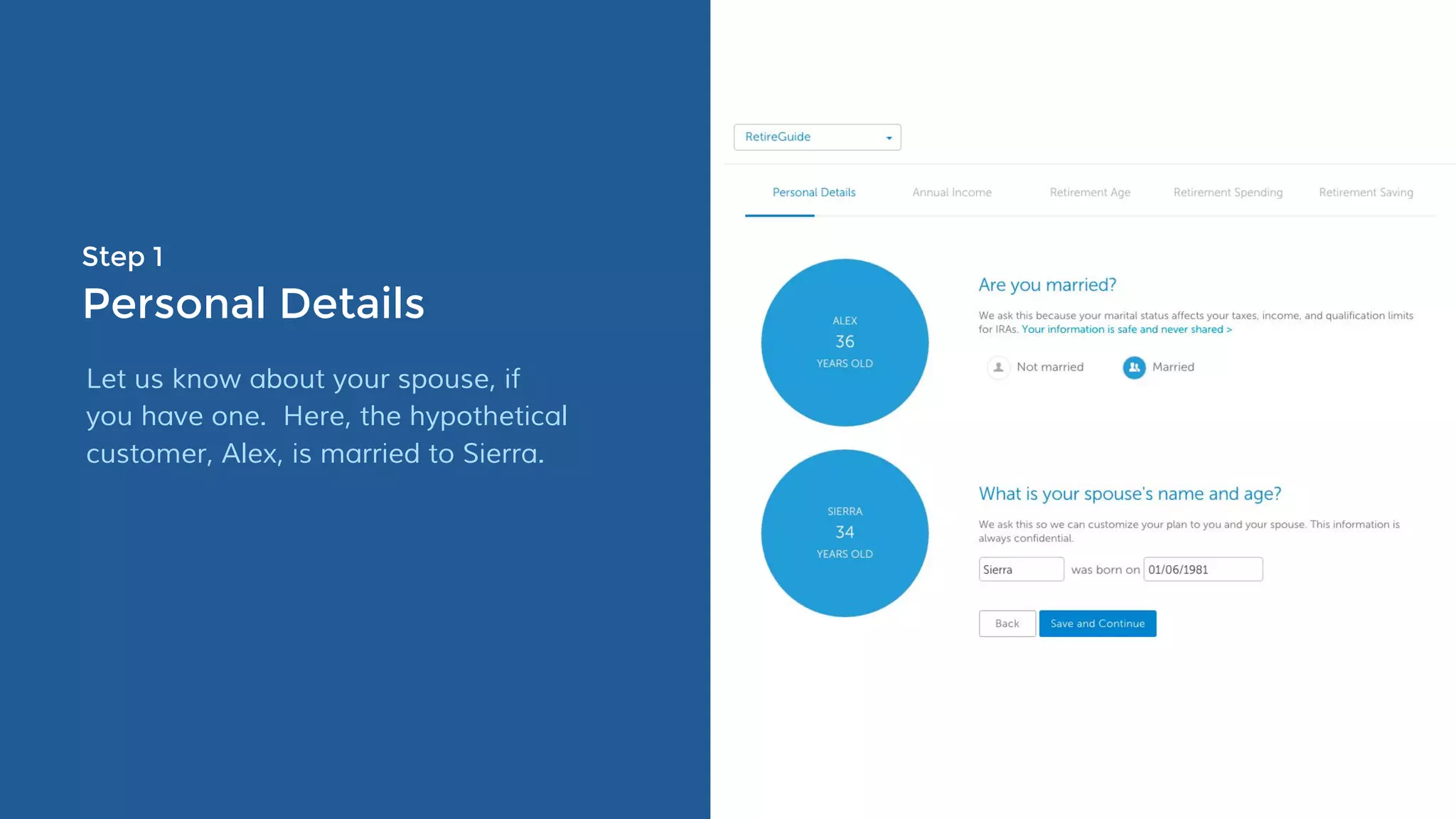

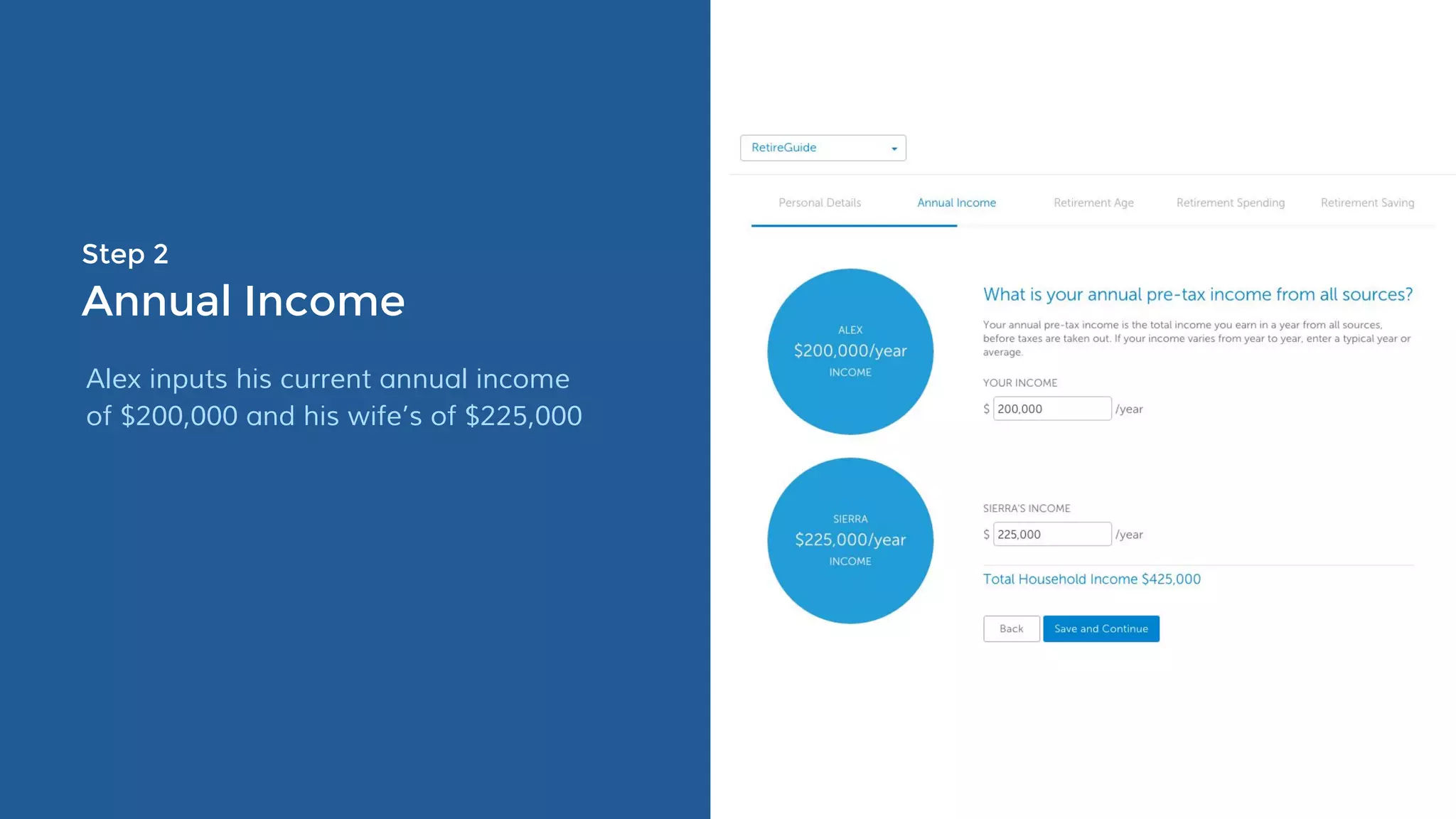

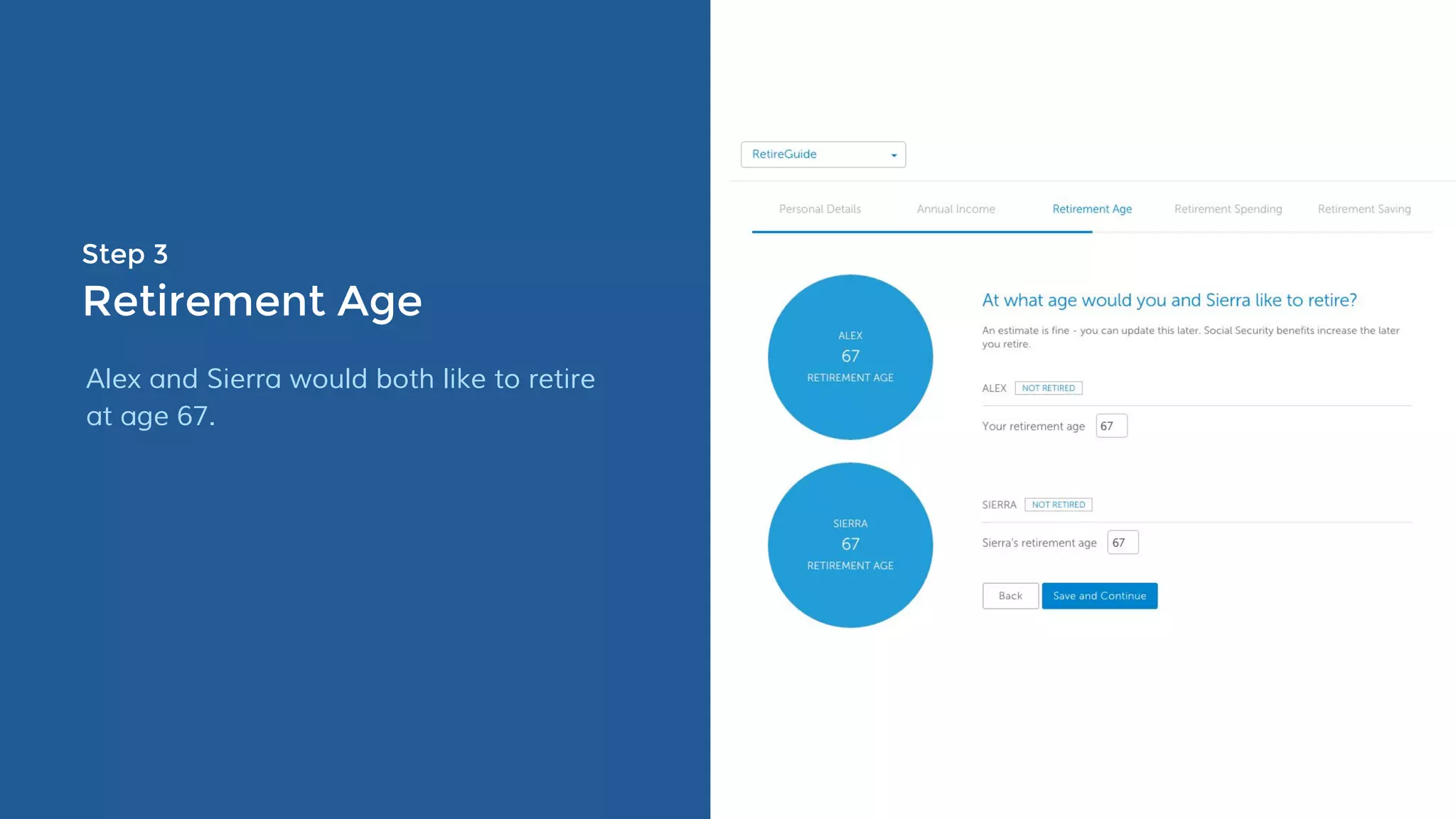

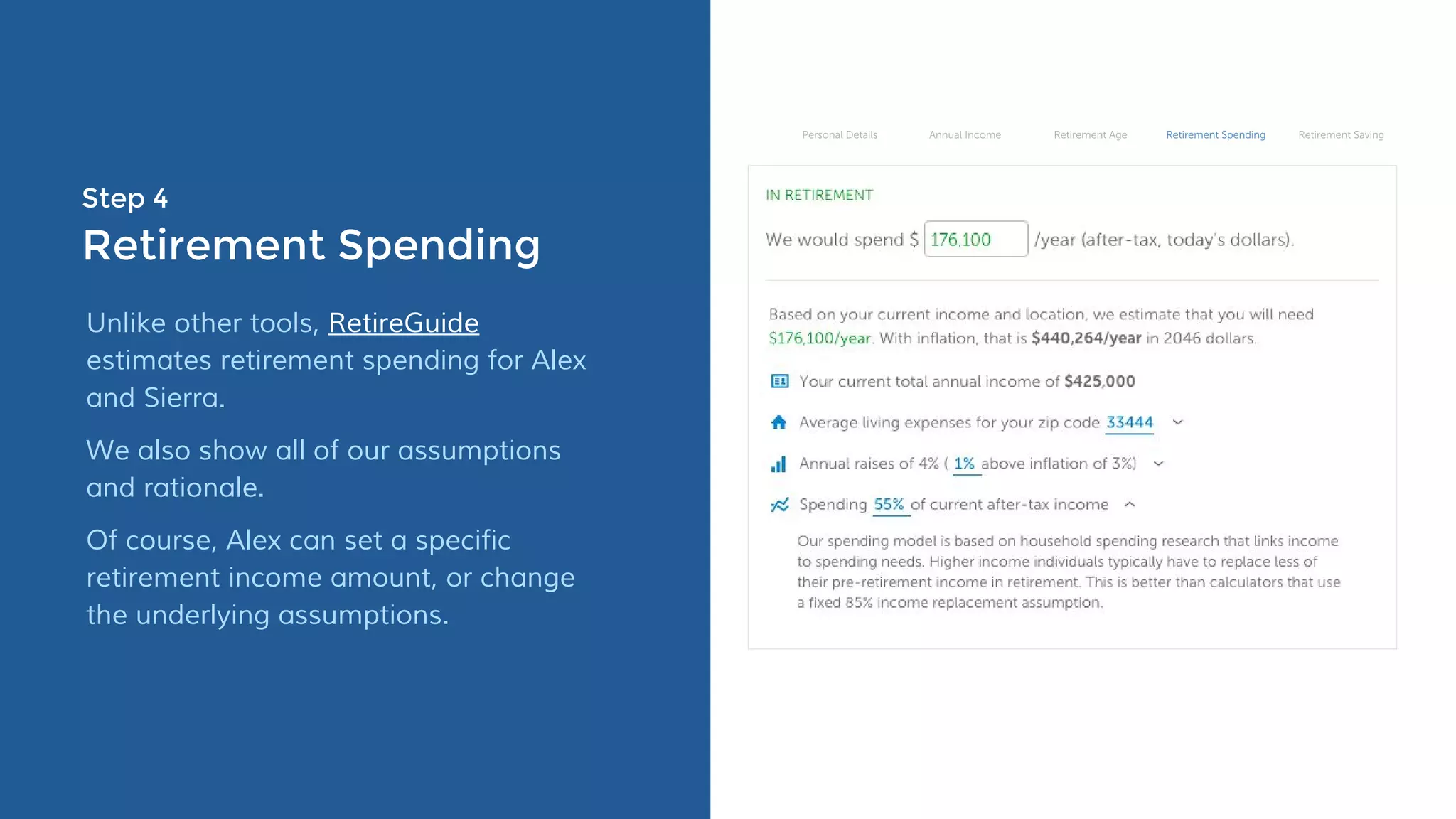

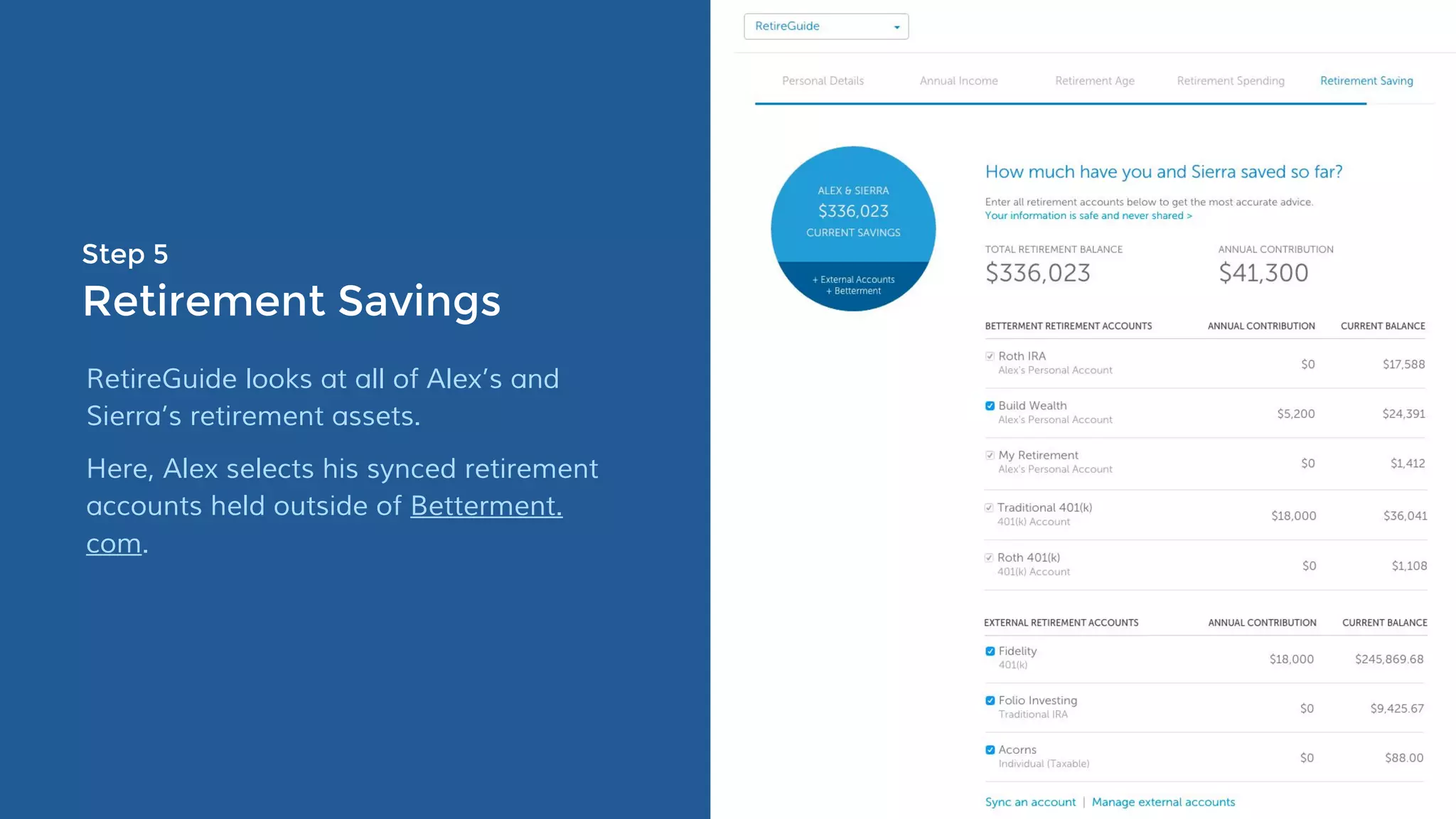

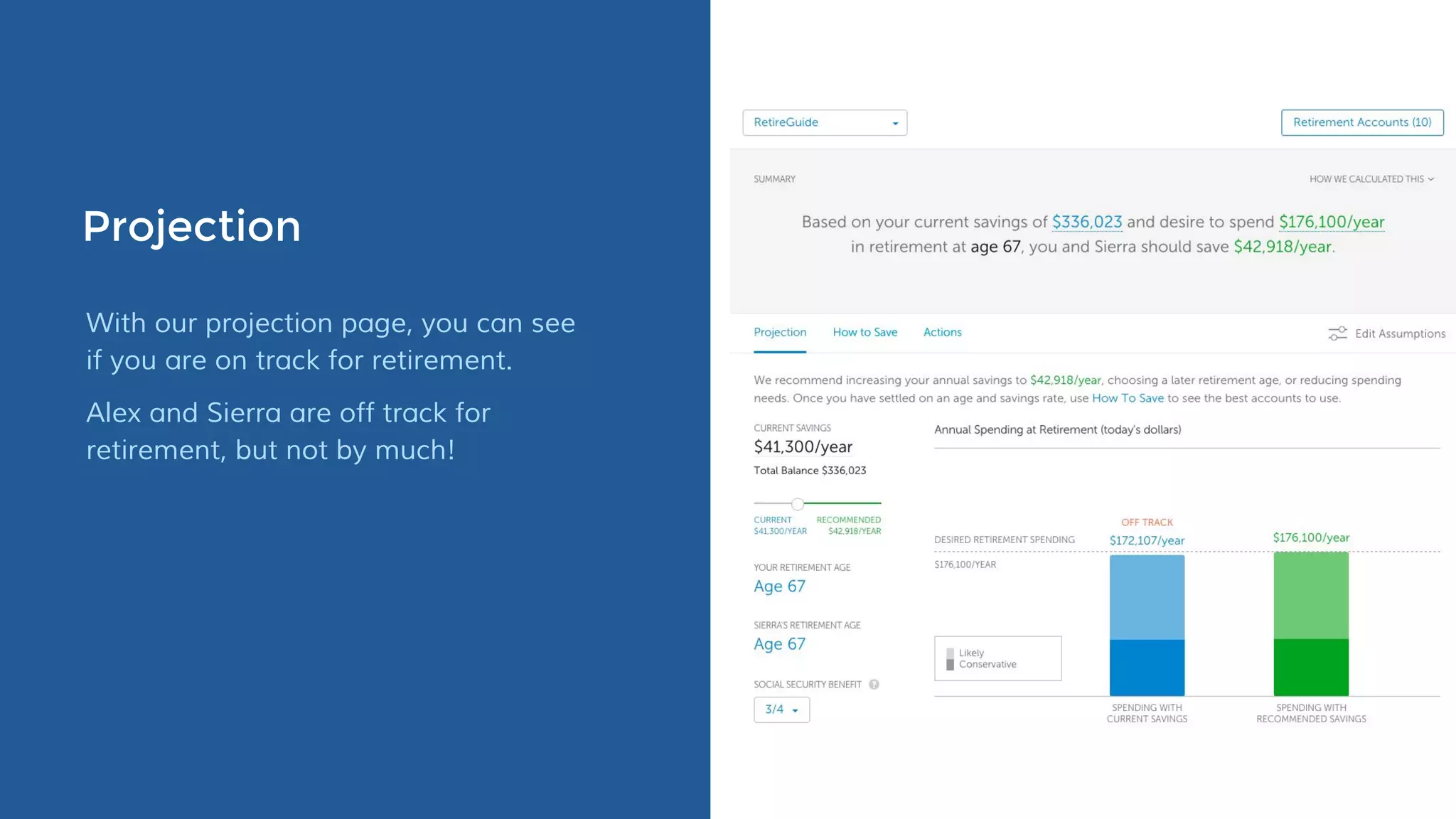

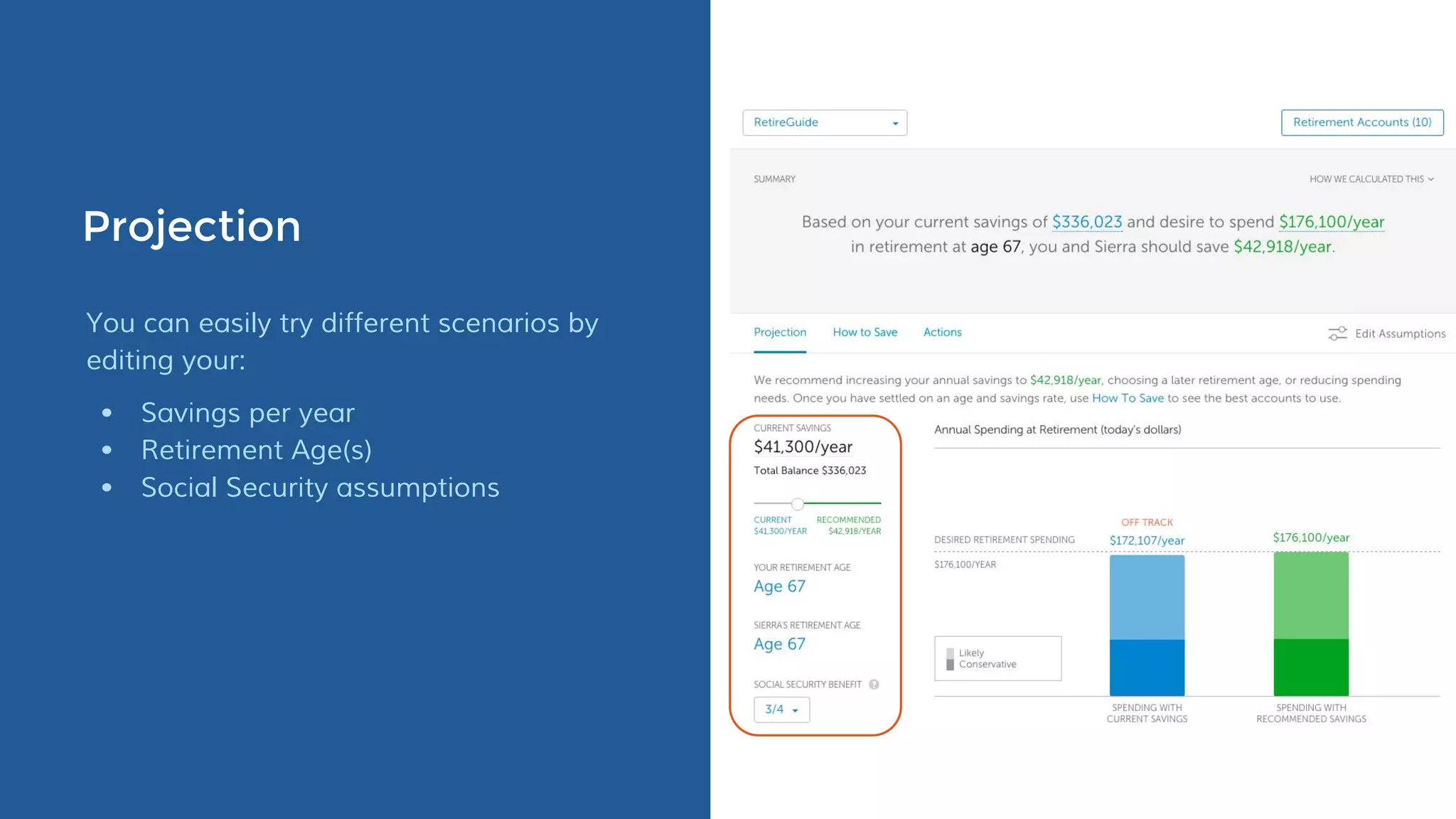

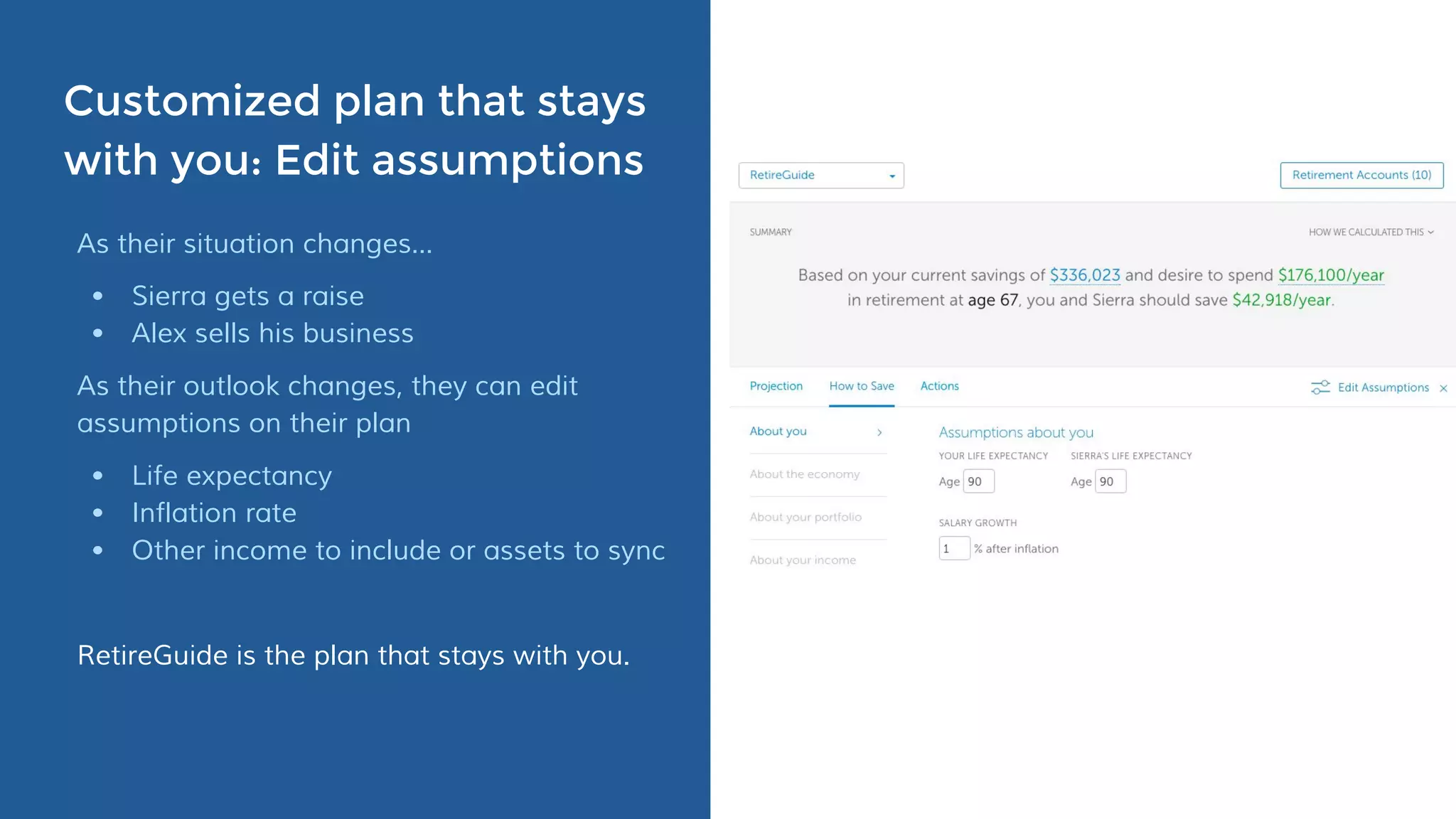

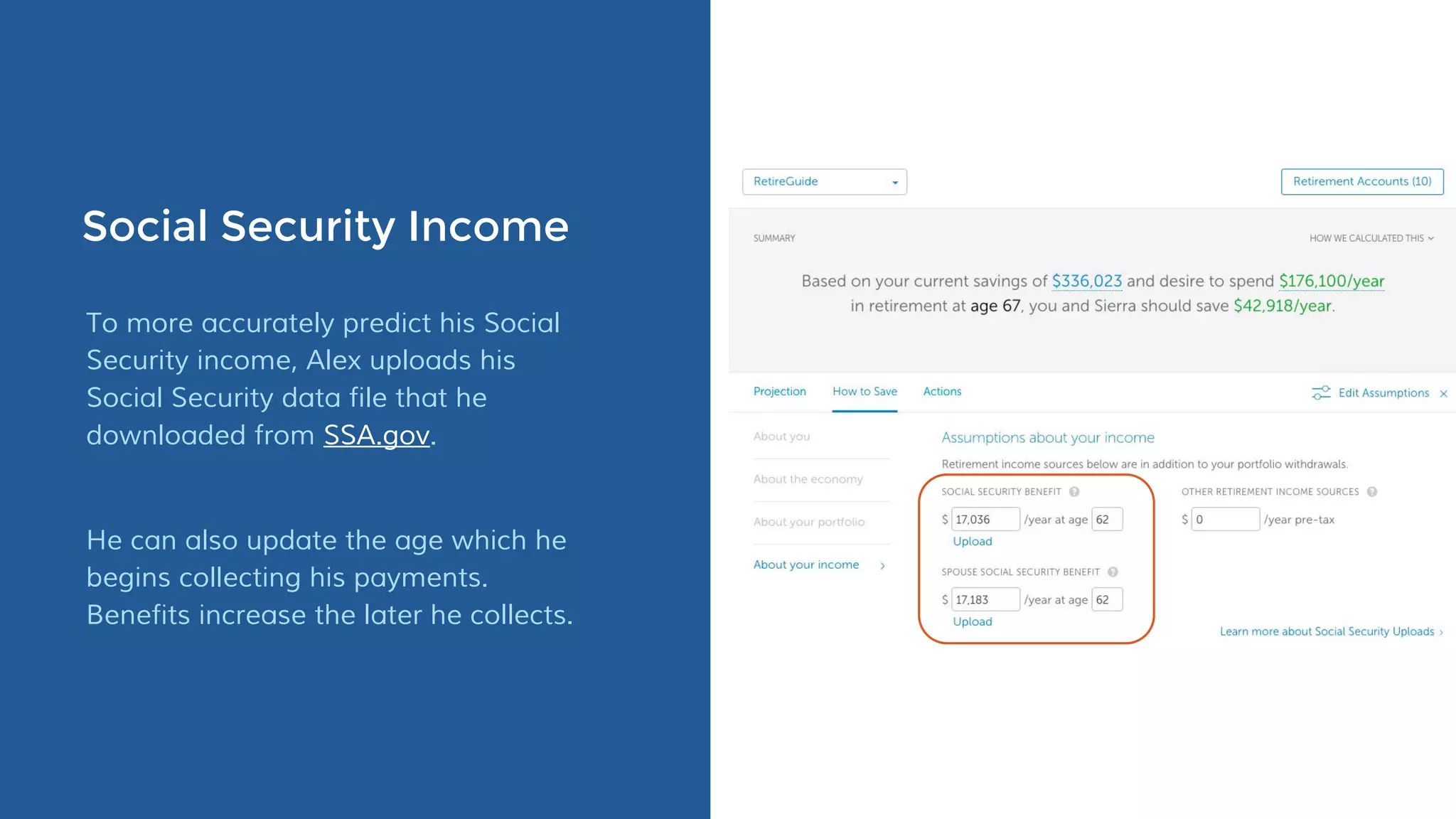

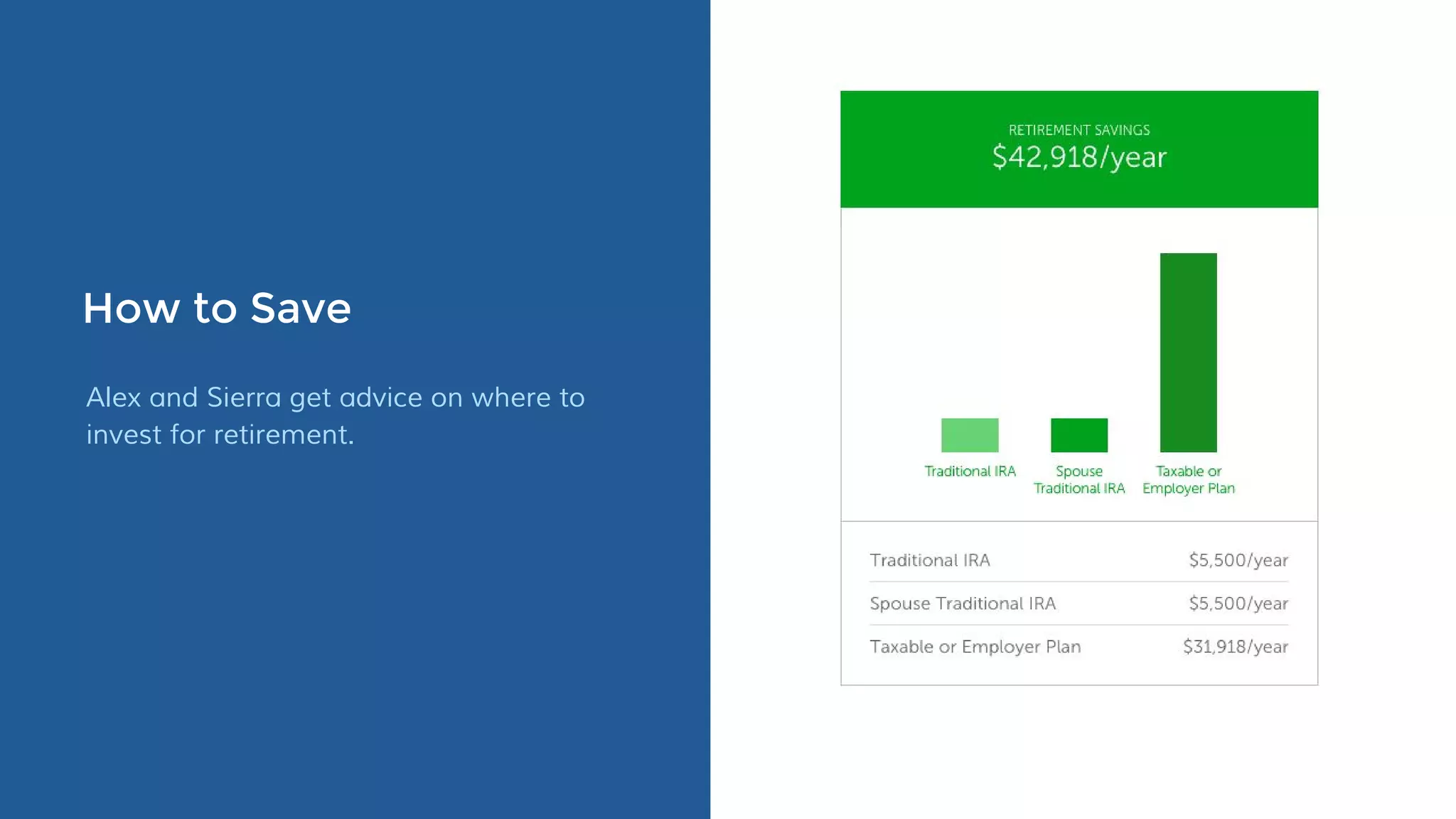

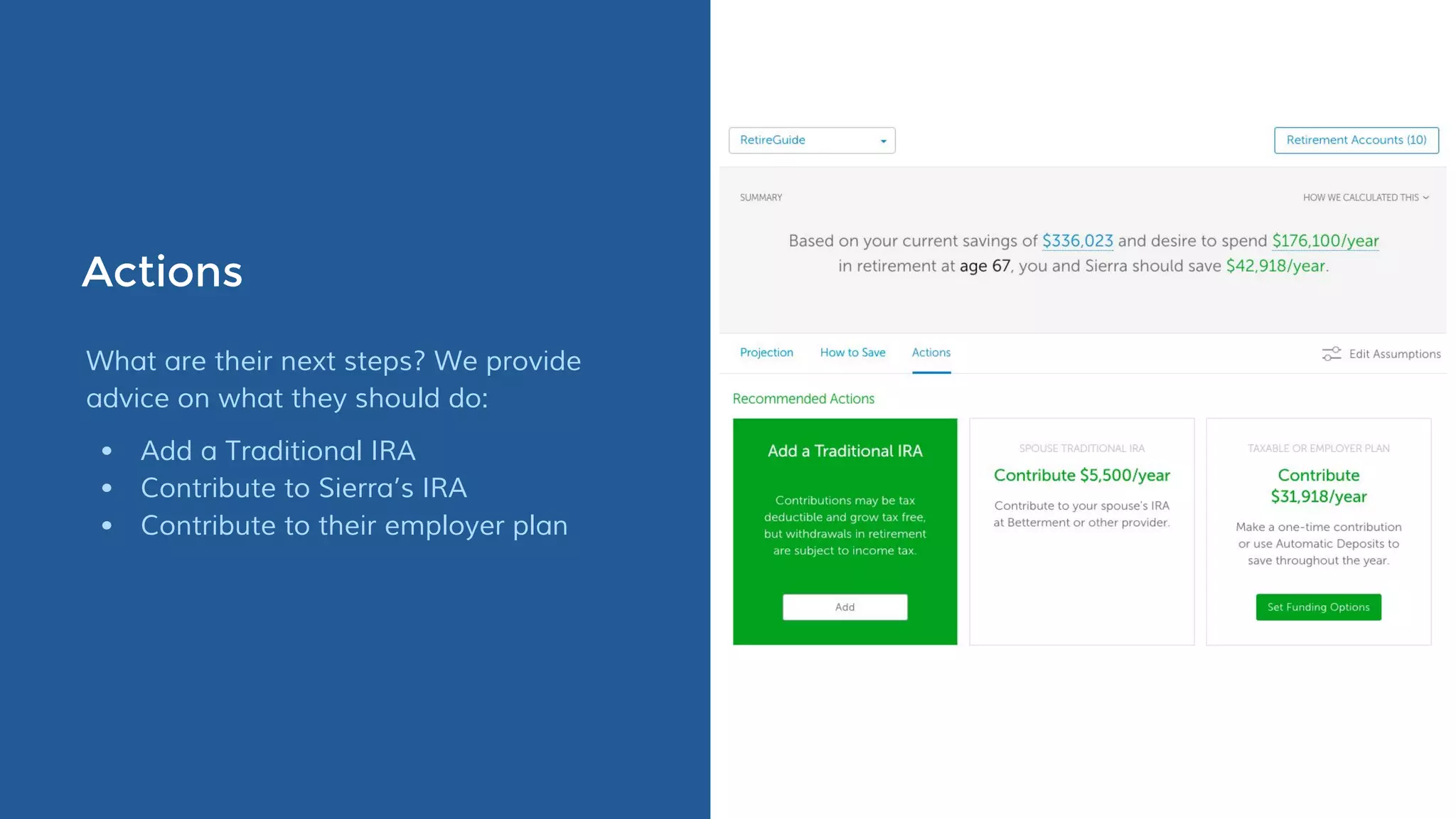

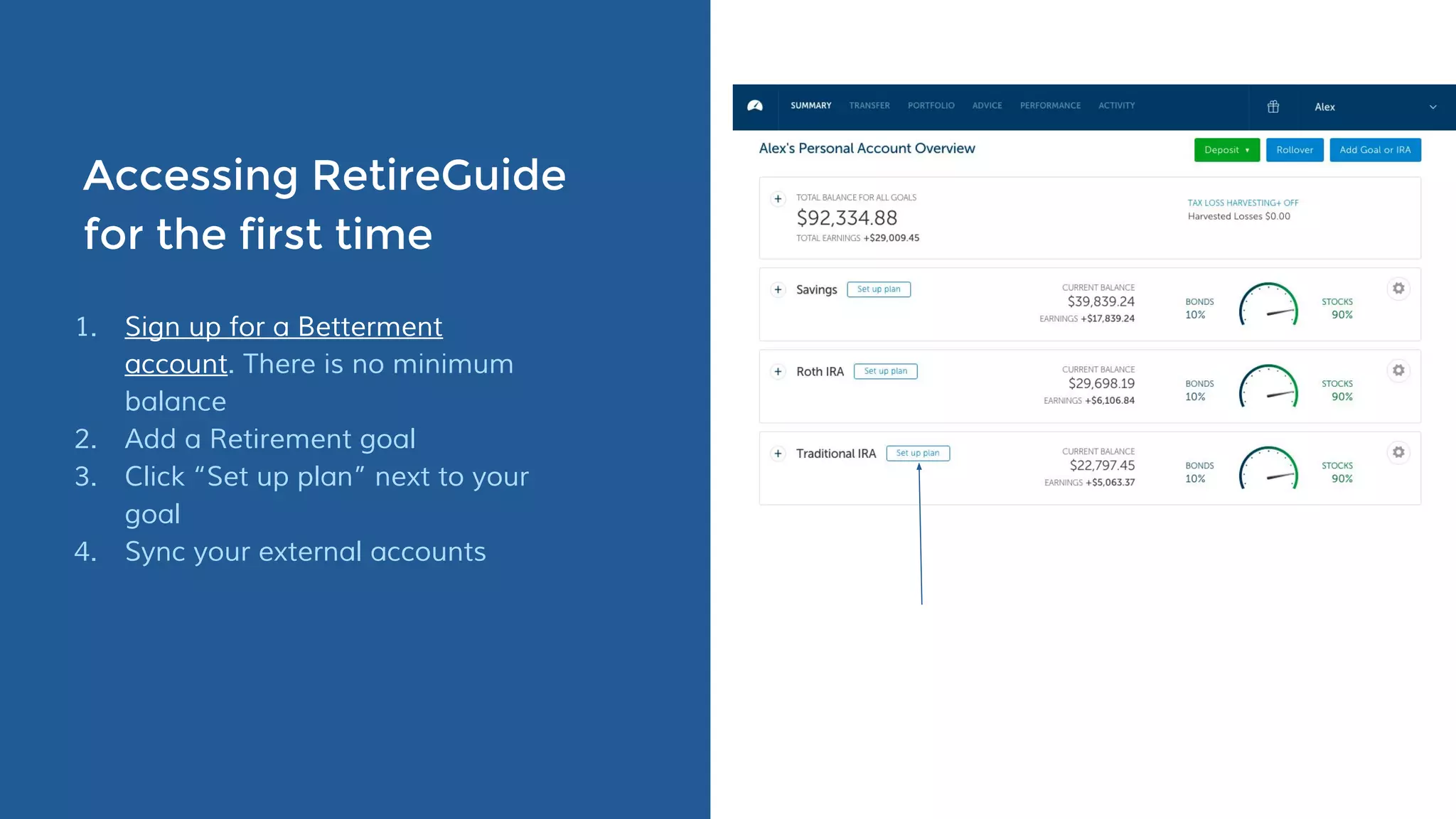

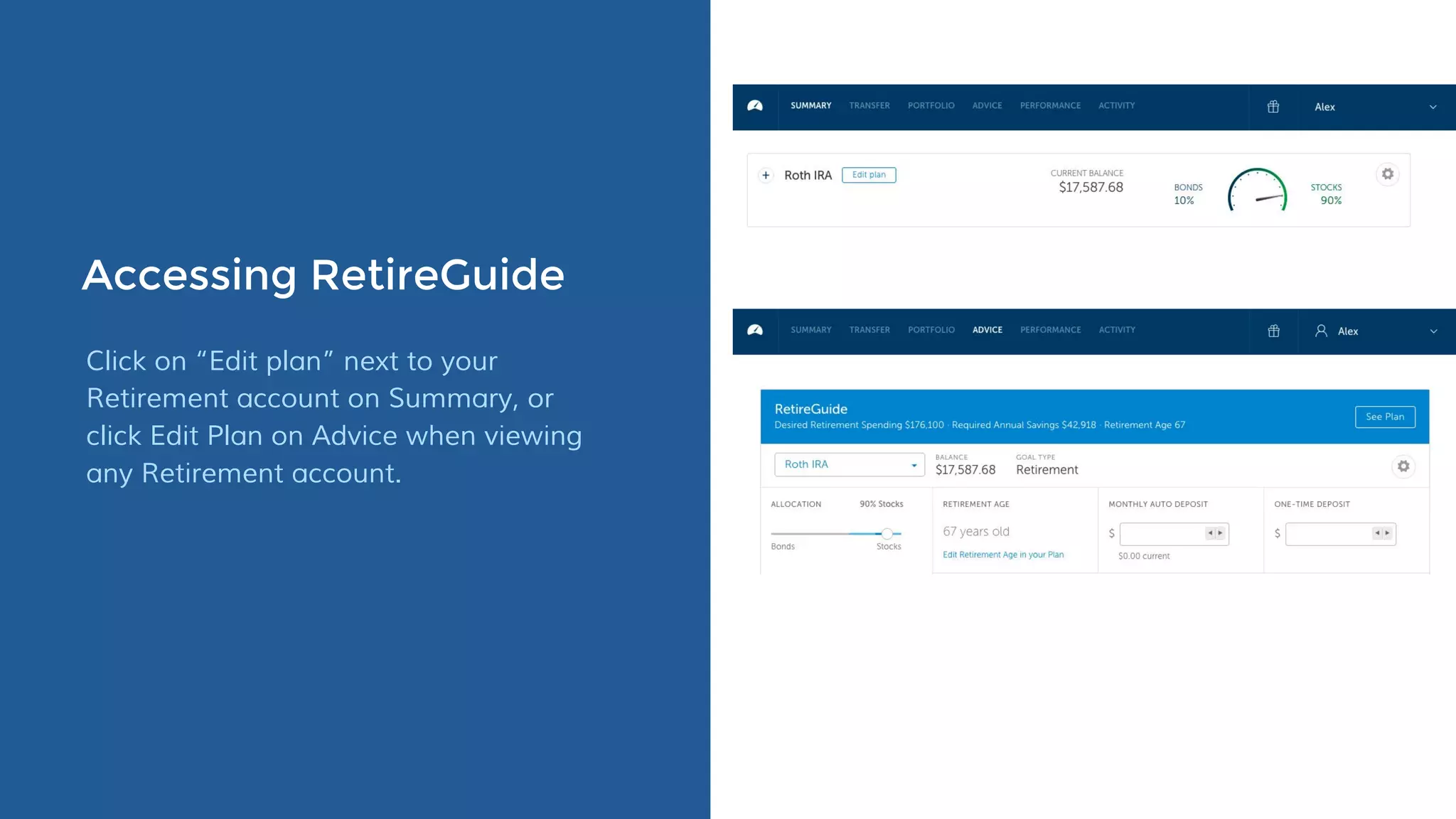

Betterment's RetireGuide offers personalized retirement planning tools that integrate all retirement assets and income sources, including social security, to provide up-to-date projections and customized advice. Users can simulate different retirement scenarios, adjust assumptions, and receive specific investment recommendations to help achieve their retirement goals. The service is free with no minimum balance requirement and aims to help users stay on track for a comfortable retirement.