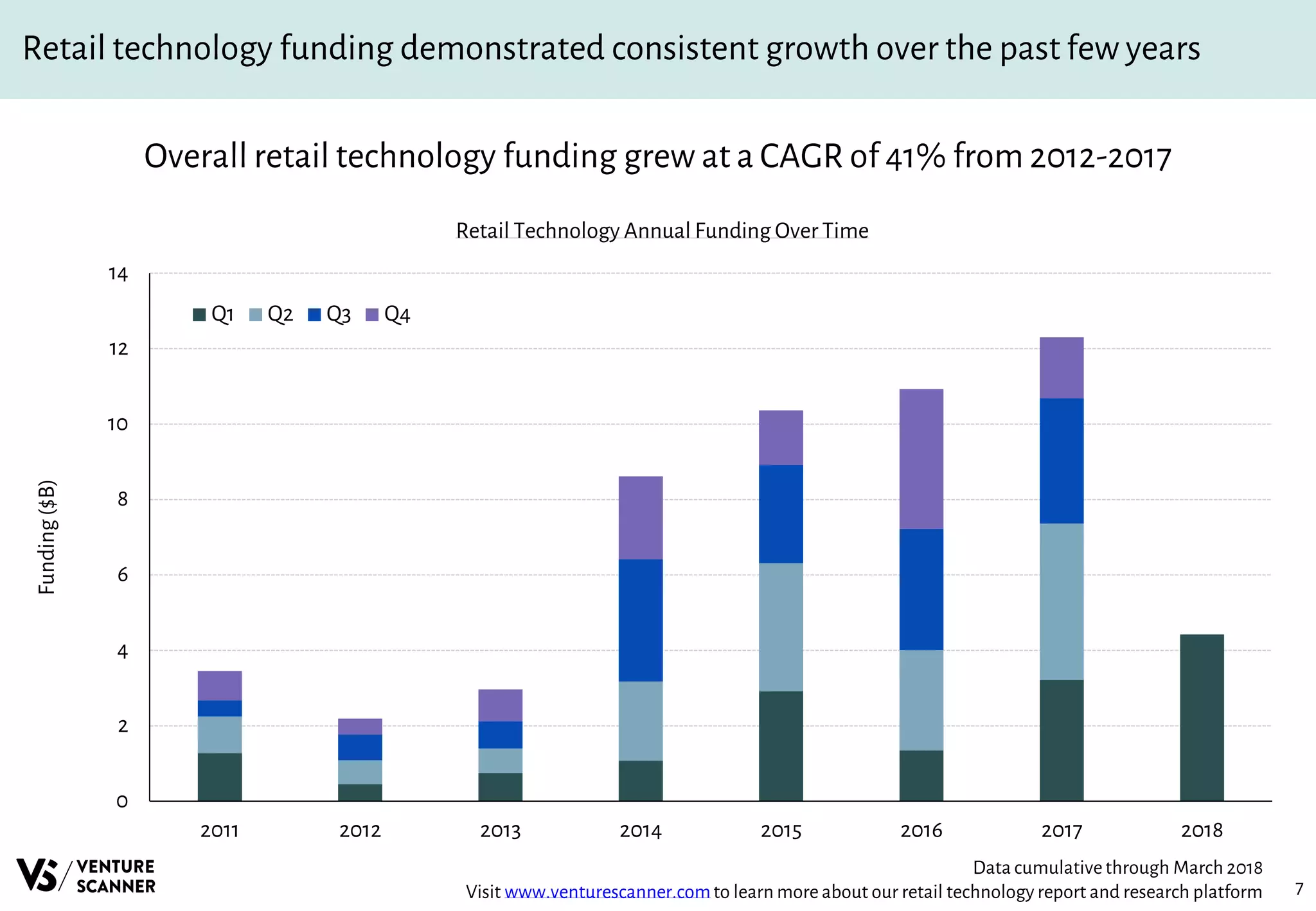

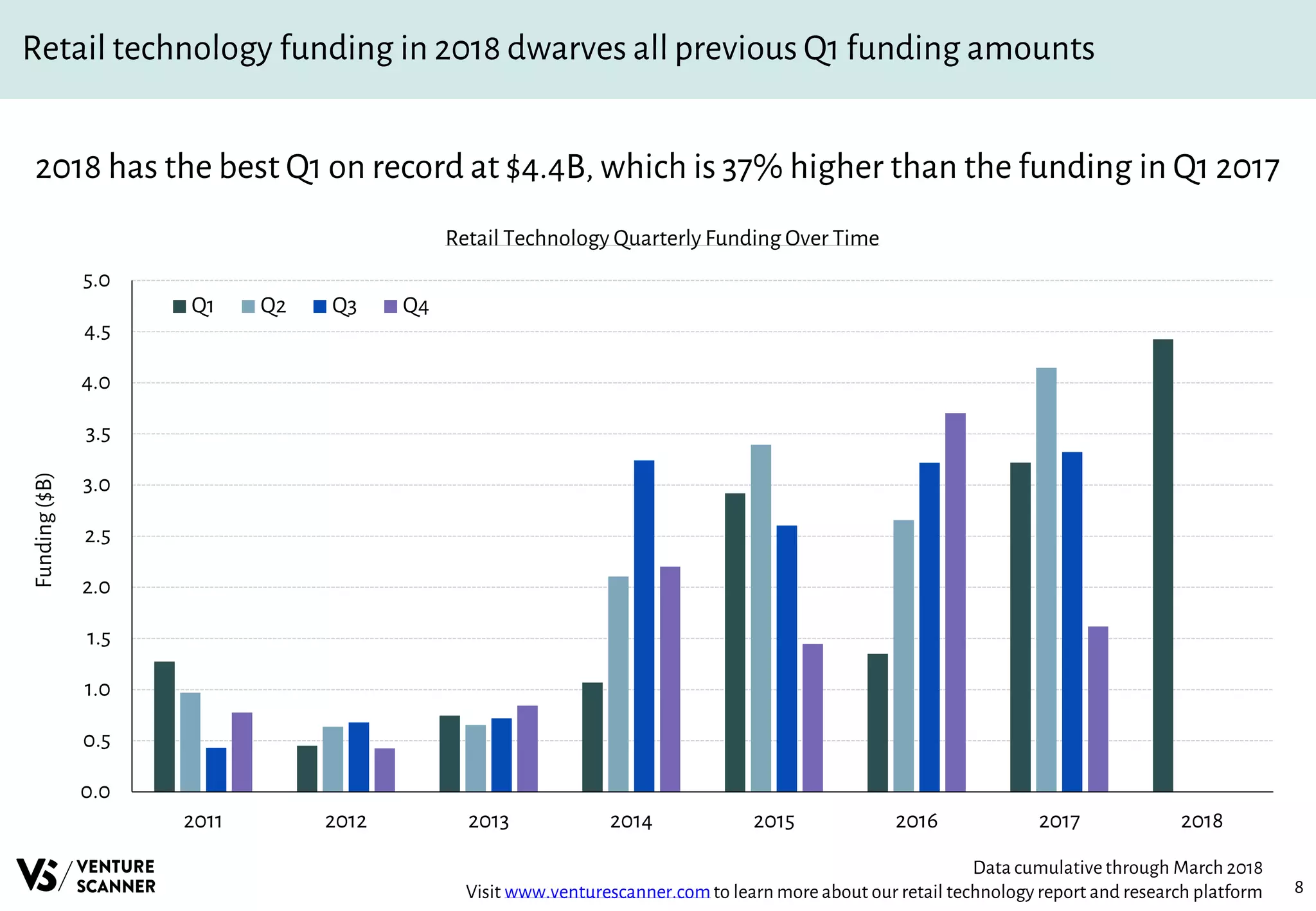

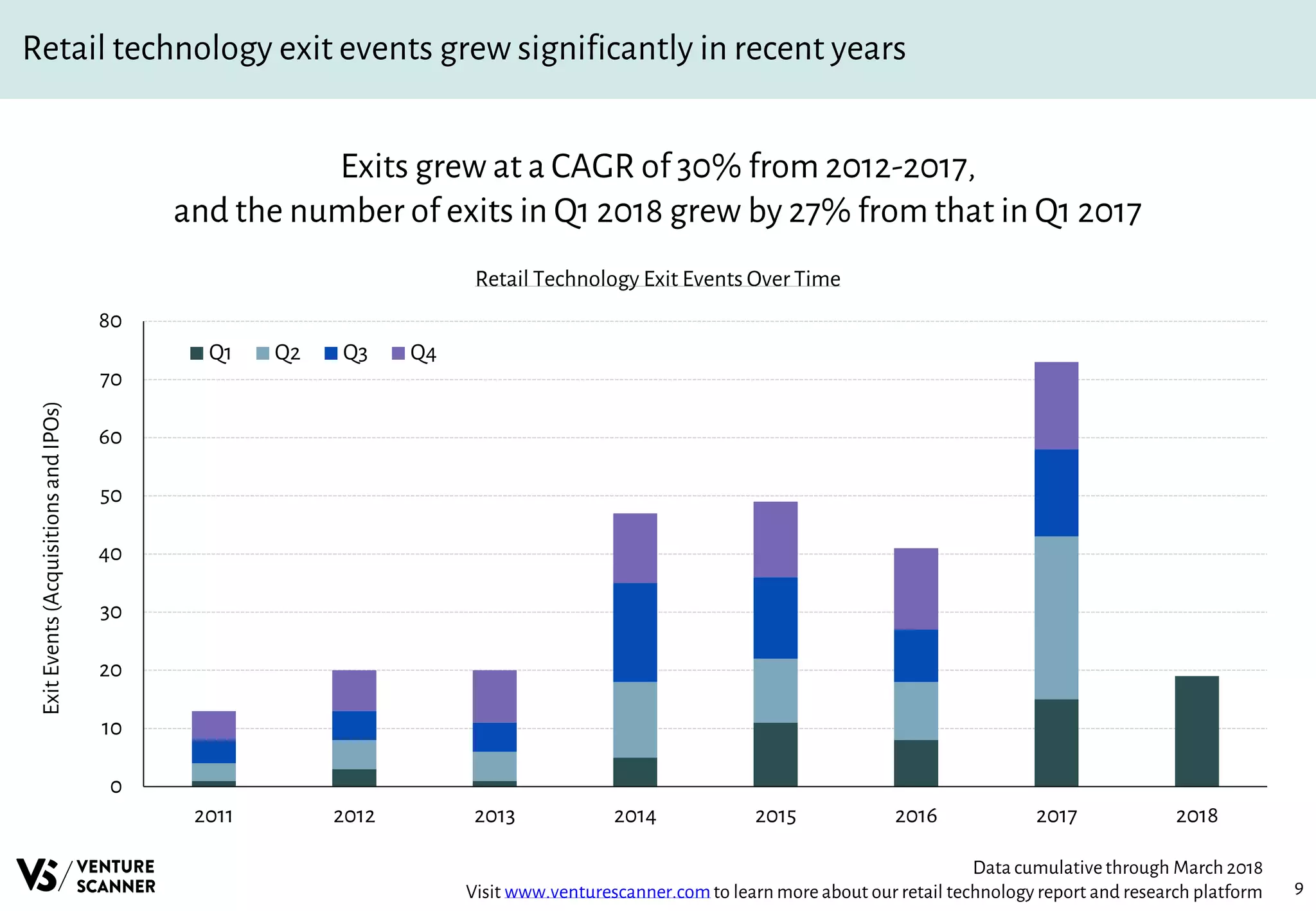

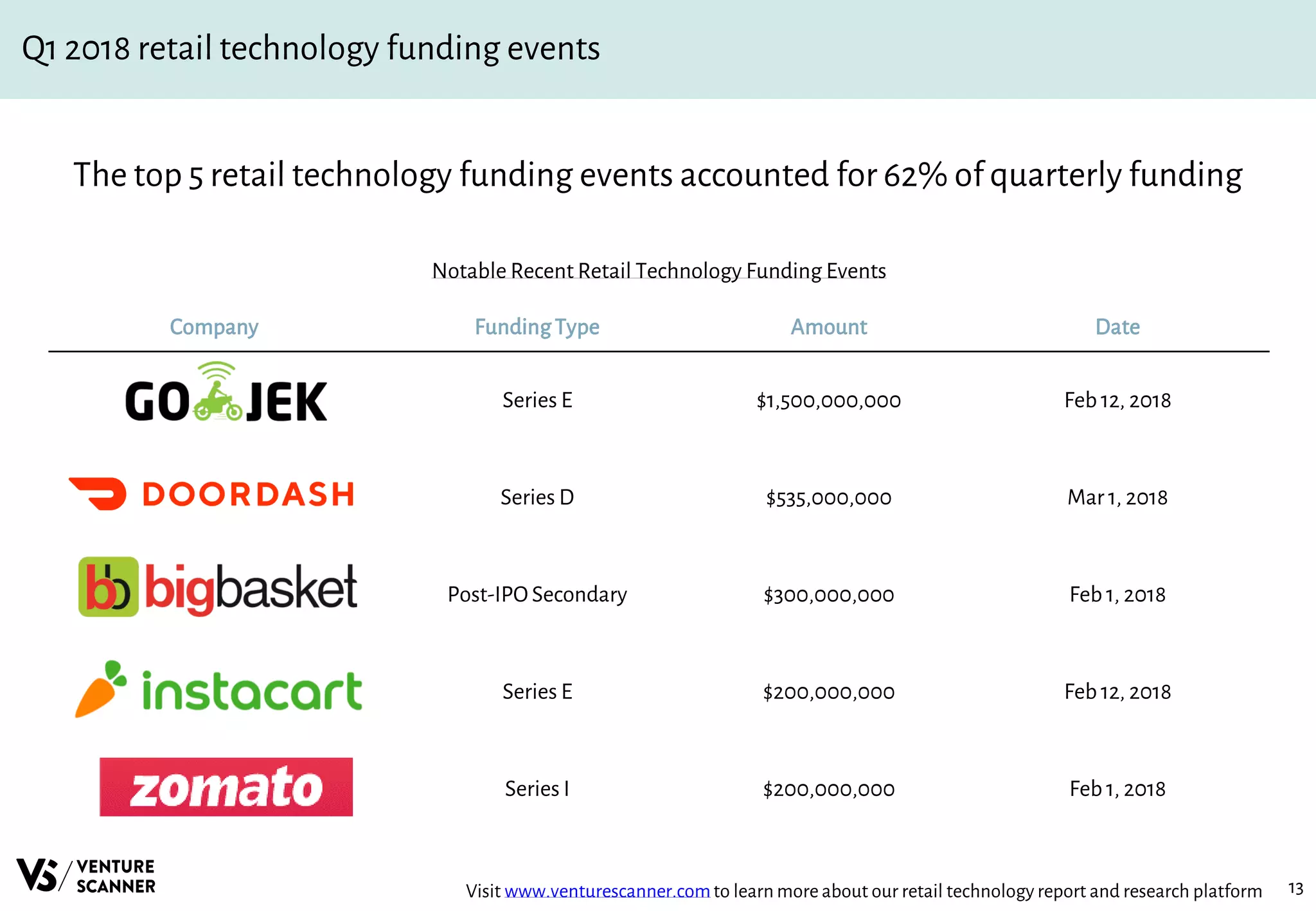

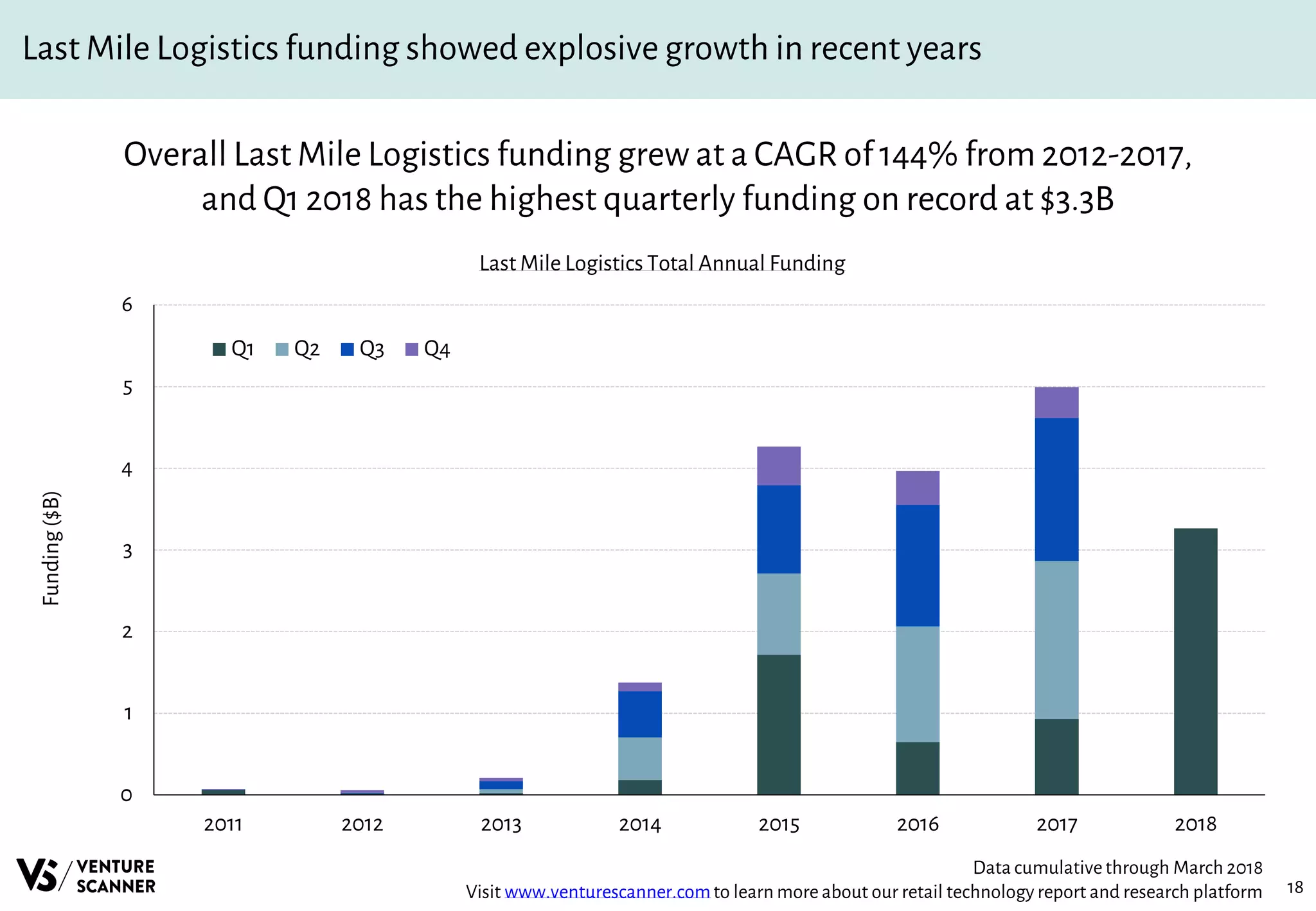

The May 2018 quarterly report on retail technology highlights a sector with 1,738 startups and $60 billion in funding, showcasing significant growth trends in funding and exit events over recent years. In Q1 2018 alone, retail technology funding reached $4.4 billion, with last mile logistics receiving the highest share at $3.3 billion. The report also discusses category-specific insights, particularly the dominance and funding concentration within the last mile logistics category.