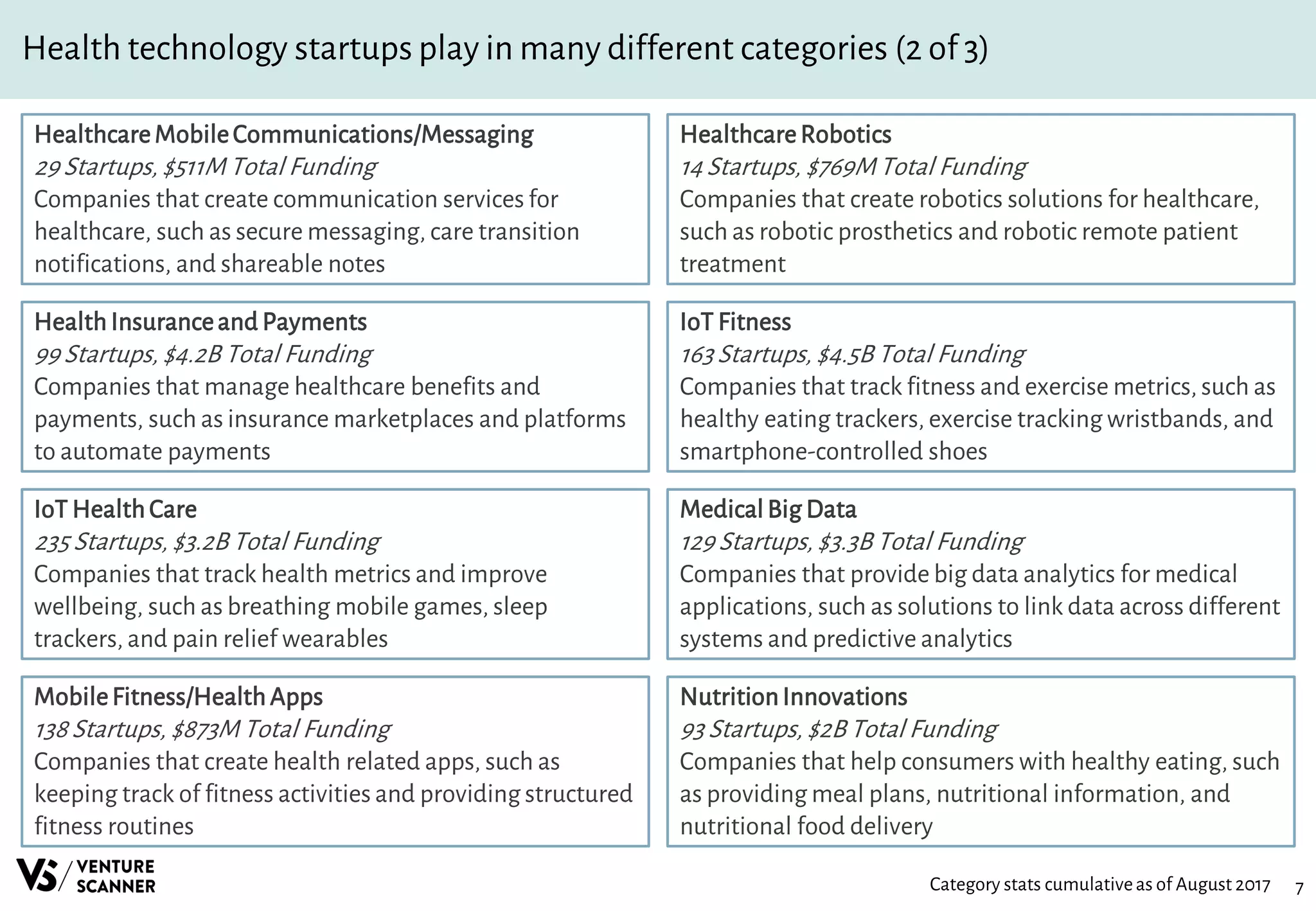

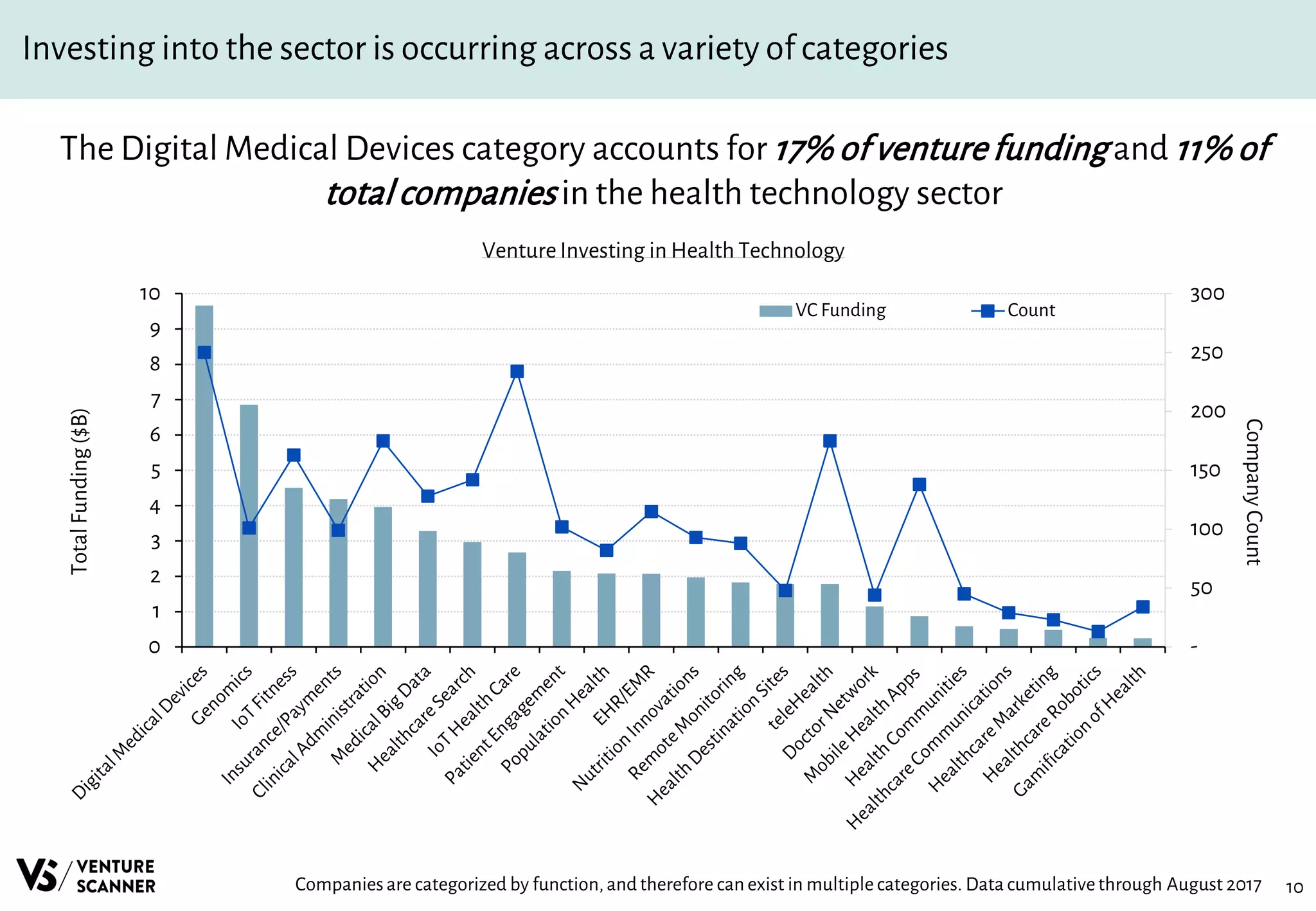

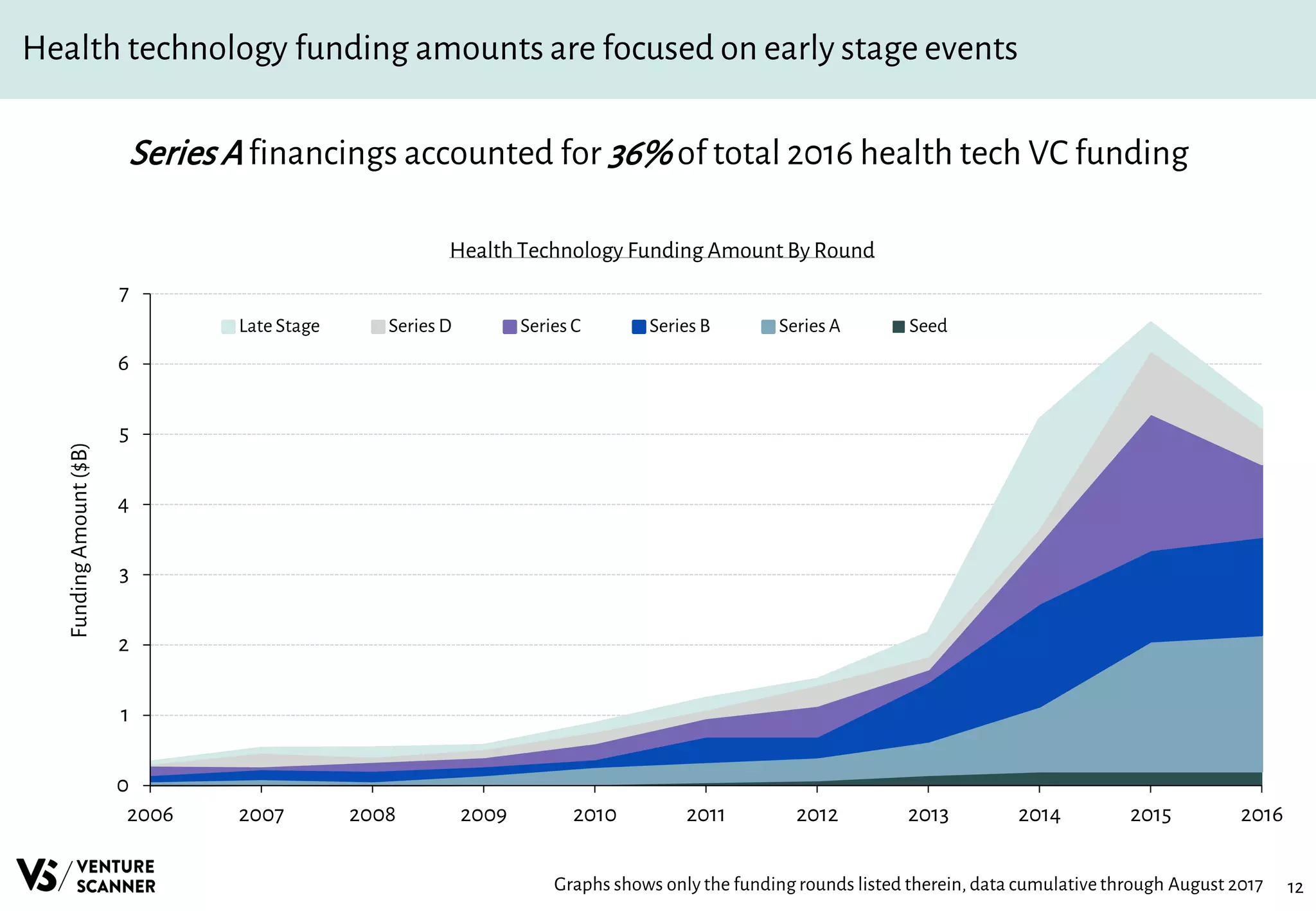

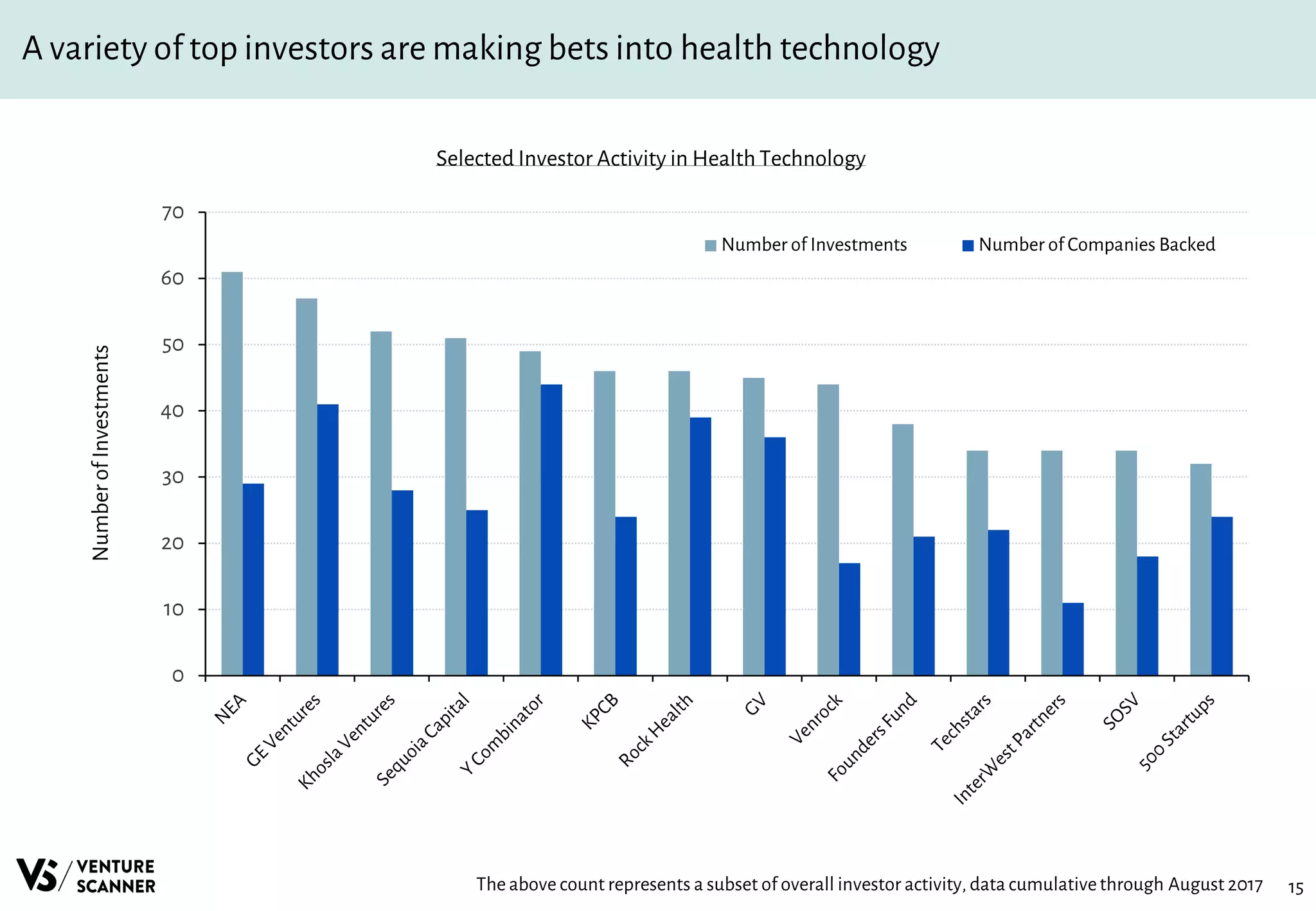

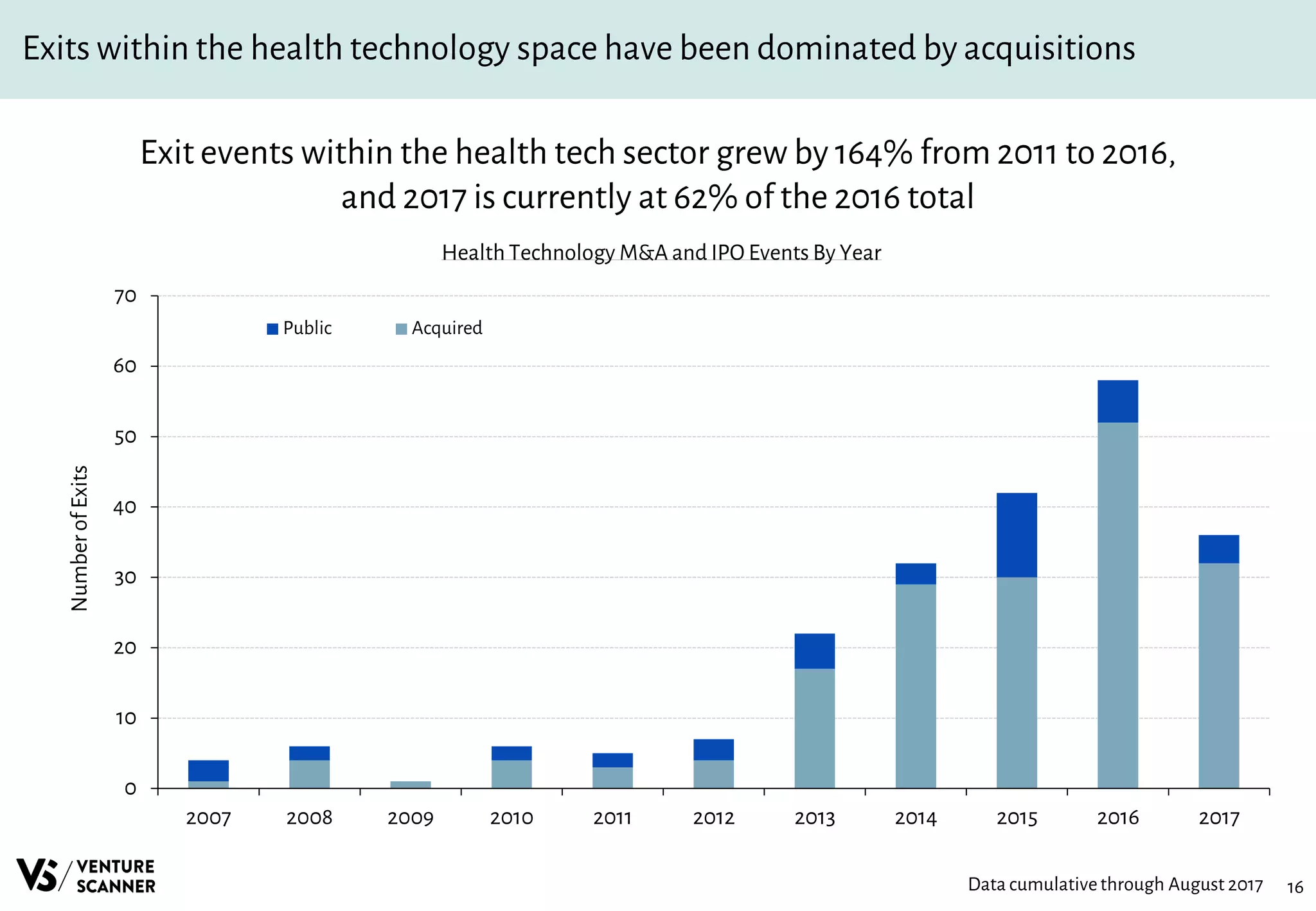

The August 2017 Health Technology Report outlines the health technology sector, highlighting 1,977 startups with $48 billion in funding across various categories, including telehealth and genomics. It details significant trends such as a 31% CAGR in VC funding from 2011-2016 and provides insights on major funding events and exits within the industry. The report further emphasizes that startups founded in 2013 account for a notable portion of sector funding and that healthcare startup activity is a global phenomenon.