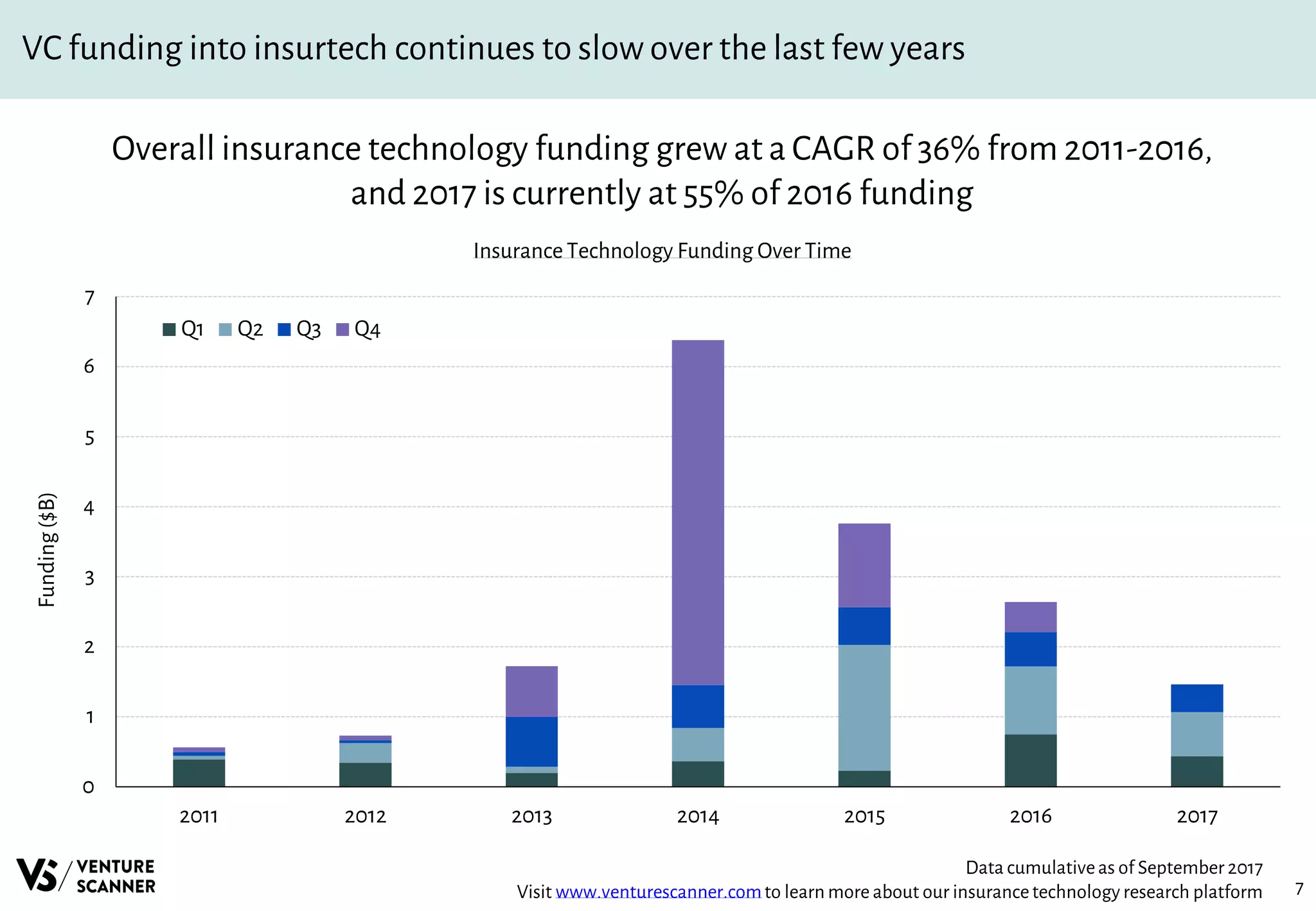

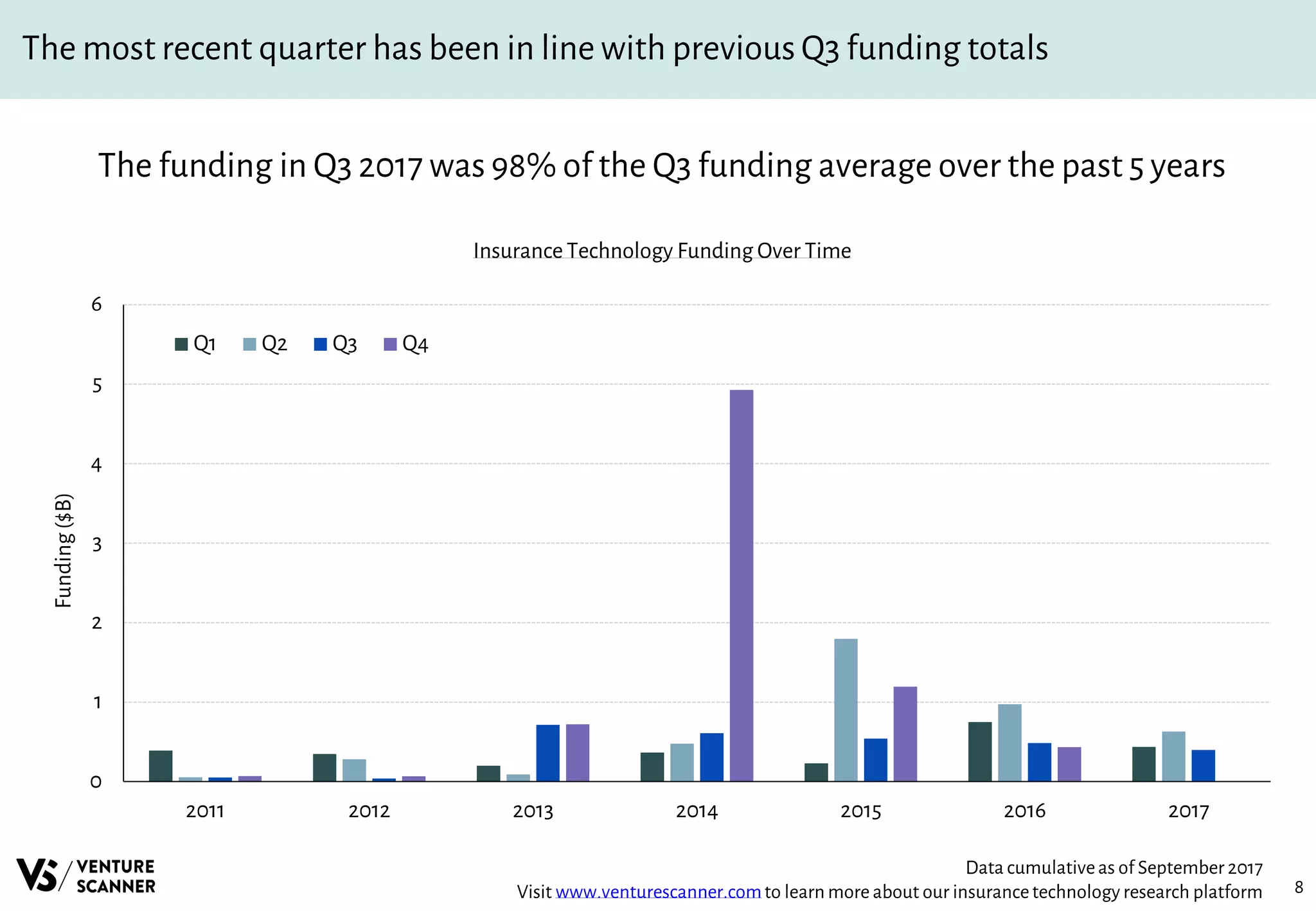

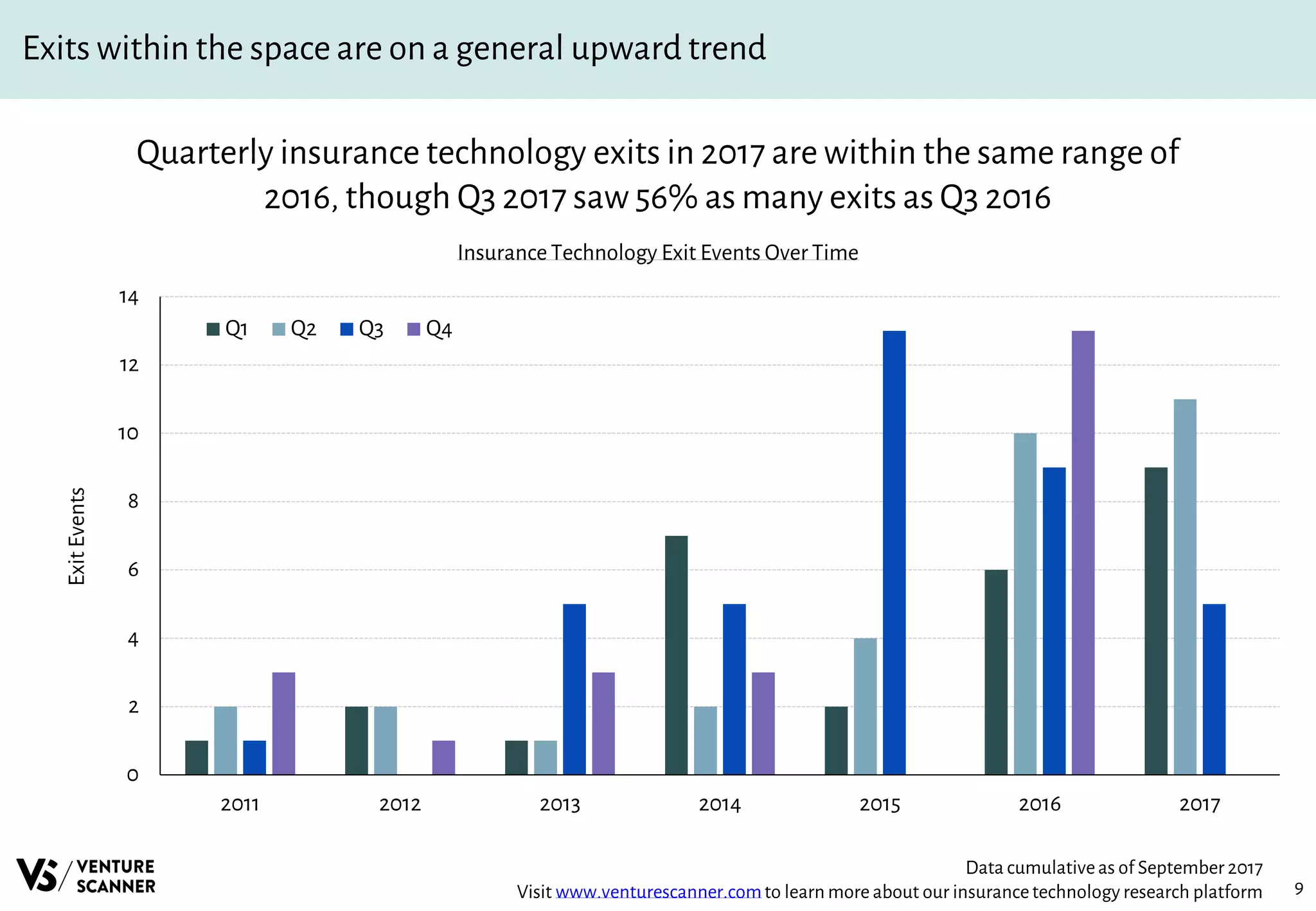

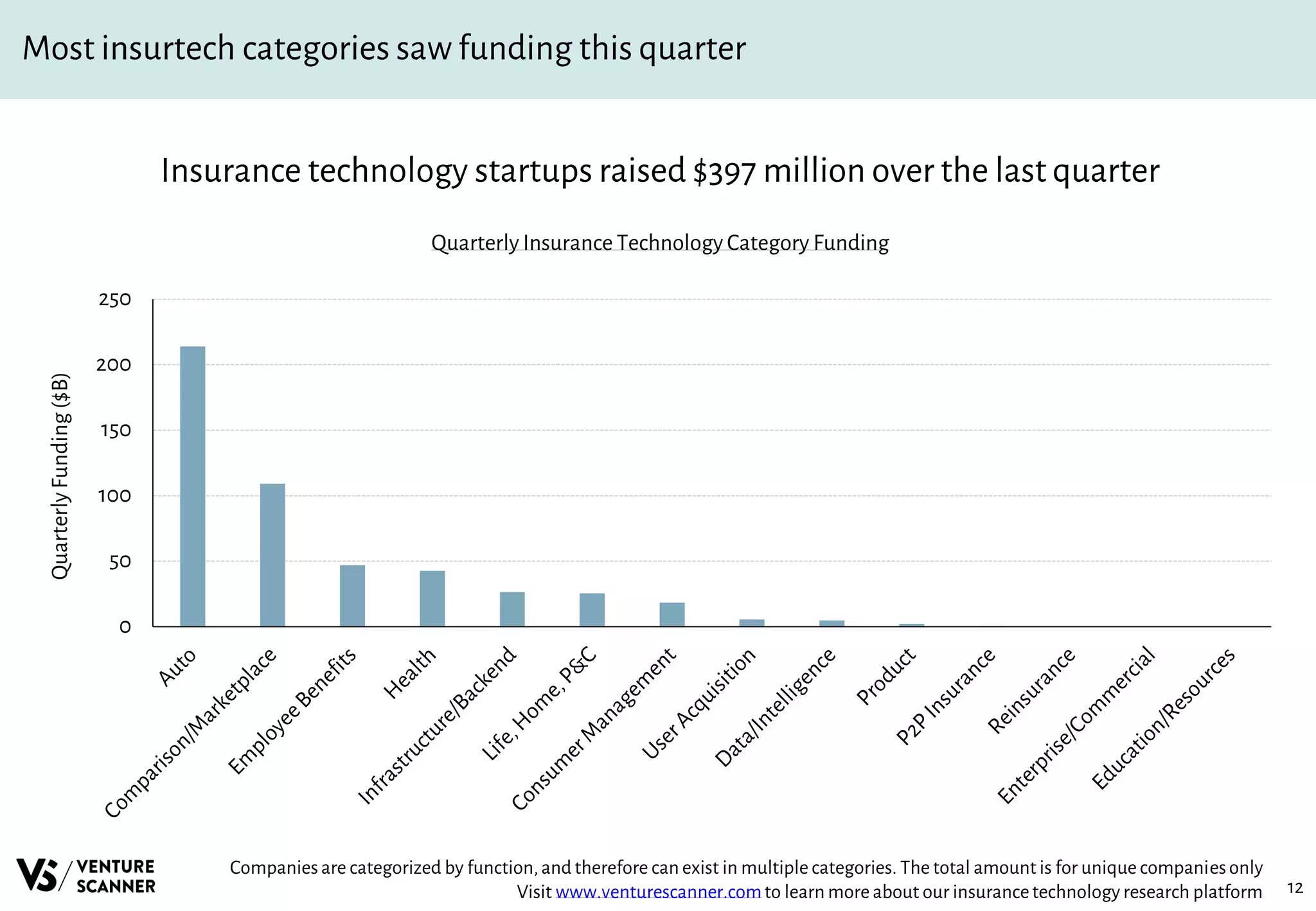

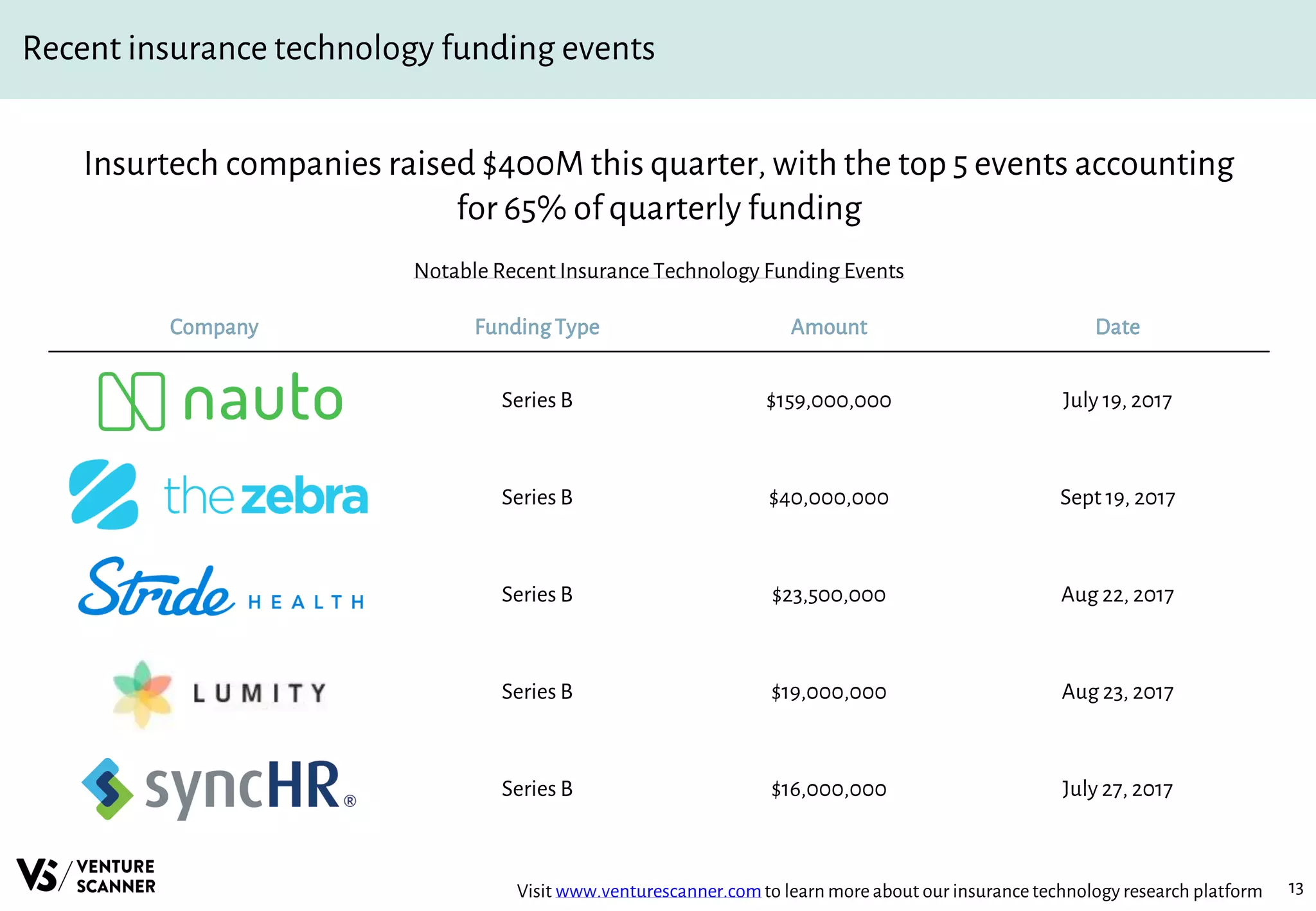

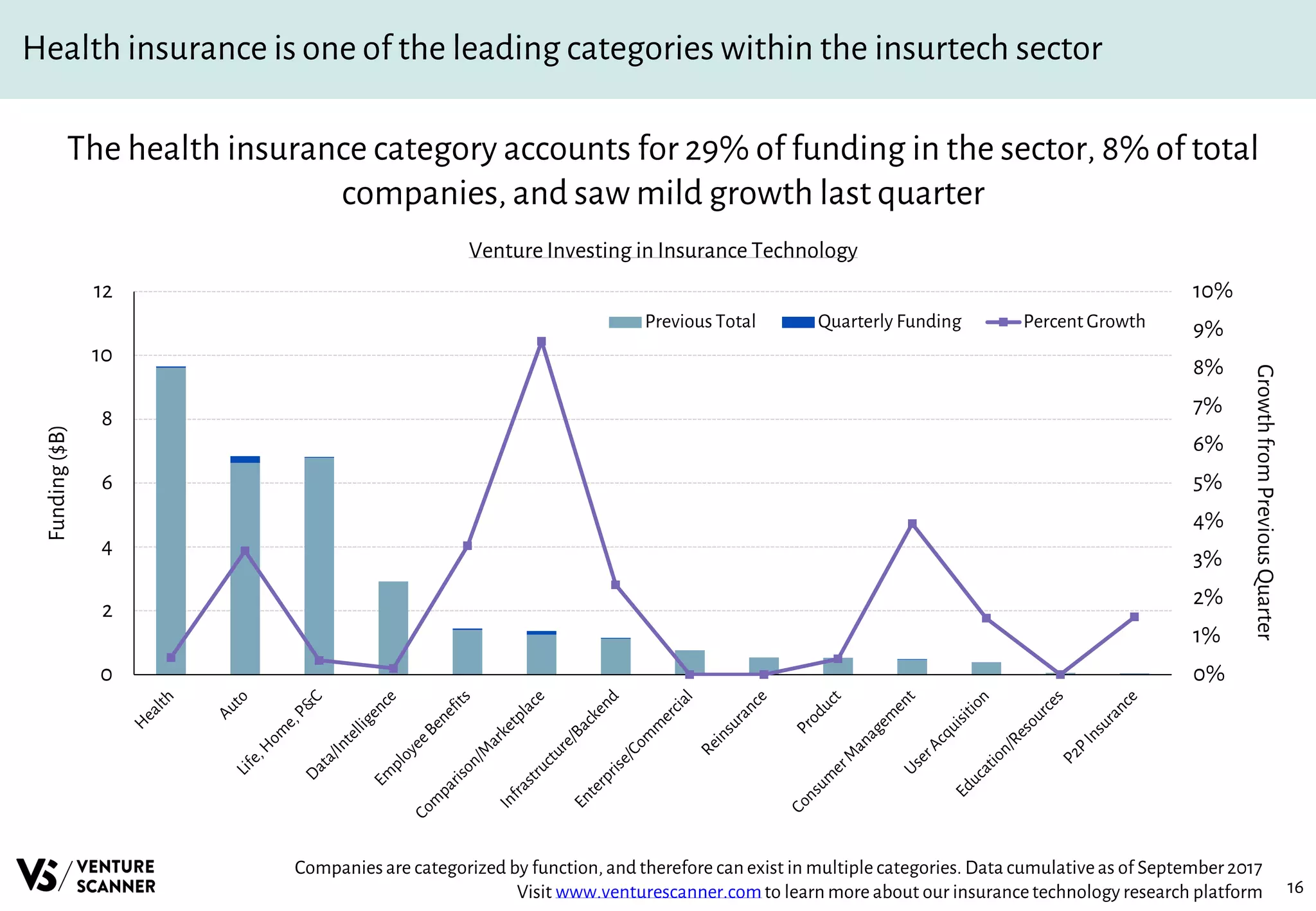

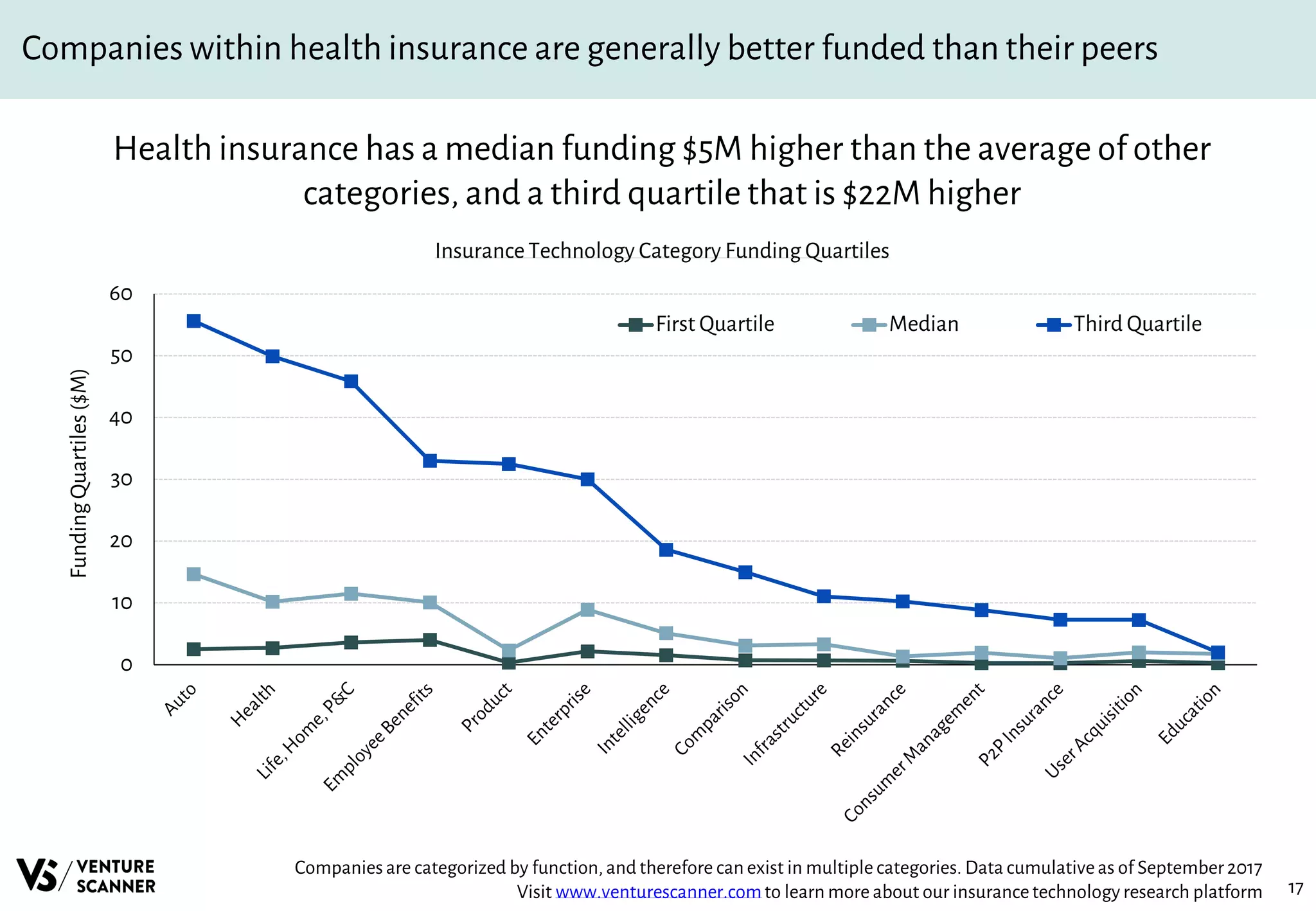

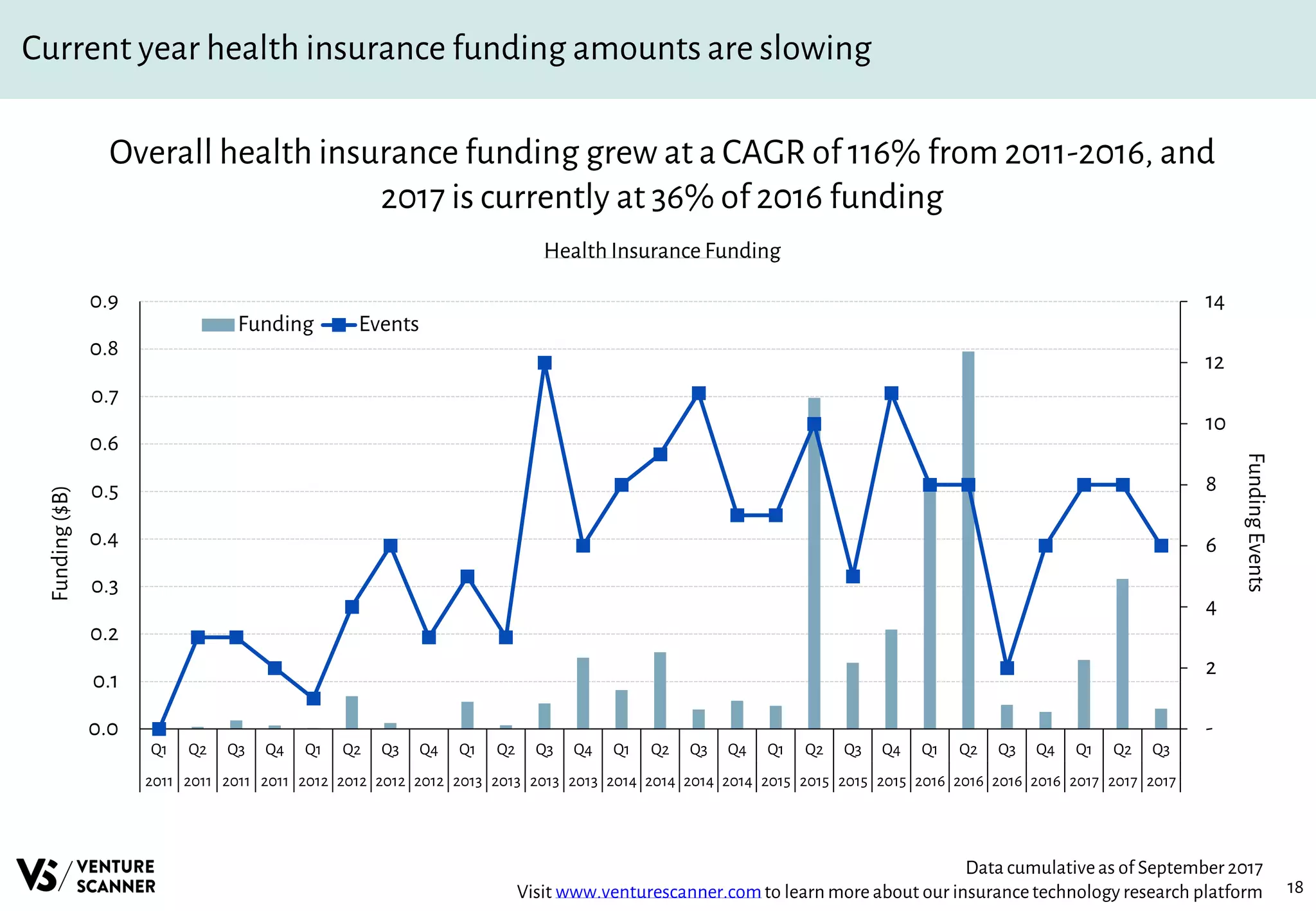

The document provides a quarterly overview of the insurance technology sector from November 2017. It summarizes funding trends, notable funding events, and exit events from Q3 2017. It also features an in-depth look at the health insurance category, analyzing its funding levels and composition compared to other categories in the insurtech sector.