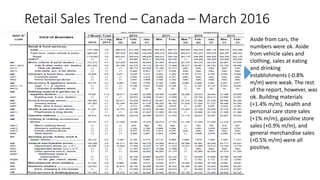

- Retail sales in the US were mixed in March, with vehicle, clothing, and restaurant sales down but building materials, health/personal care, gas, and general merchandise up.

- Hudson's Bay will invest $750-850 million in renovations, technology, and expanding Saks Off 5th stores, opening 7 new Saks stores and 32 Off 5th stores.

- Sears will close 68 Kmart stores and 10 Sears stores in July and September to generate cash as it deals with over $1.2 billion in debt.