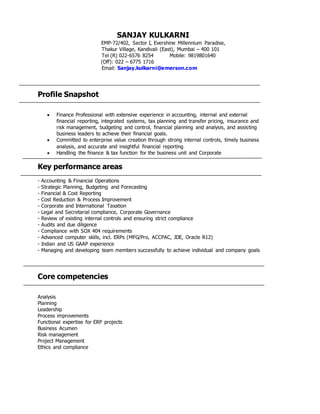

This document provides a summary of Sanjay Kulkarni's experience and qualifications. It outlines his current role as Director of Finance and Tax at Emerson Electric Co India Pvt Ltd since 2013, where he oversees corporate finance, budgeting, treasury management, statutory compliance, and taxation. Prior to this role, he held finance leadership positions at Emerson Process Management India and Sigma Marine and Protective Coatings India, where he was responsible for accounting, reporting, audits, systems implementation, and process improvements. He has over 20 years of experience in finance, accounting, taxation, and business partnering.