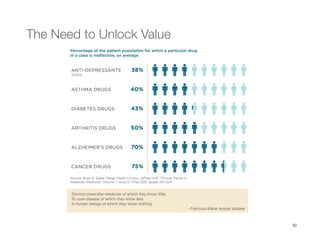

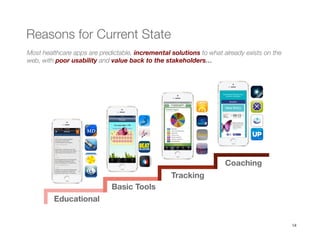

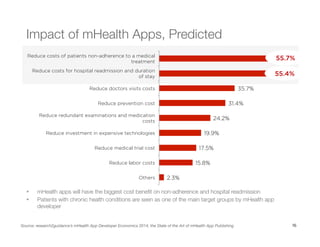

1) The document discusses mHealth apps and innovations. It highlights that apps targeting diabetics have the biggest market potential.

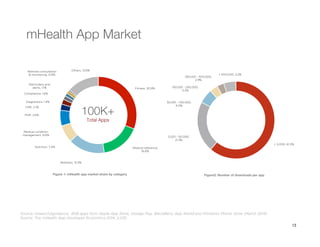

2) It summarizes two reports on the diabetes app market and the mHealth app developer economy. The reports analyze market trends, top publishers, and forecasts.

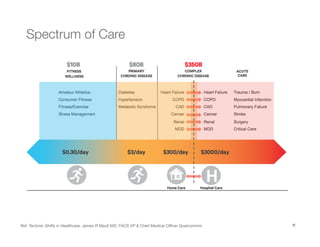

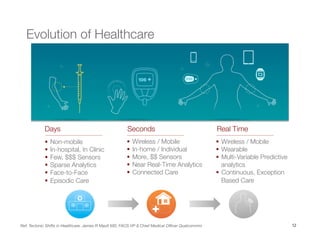

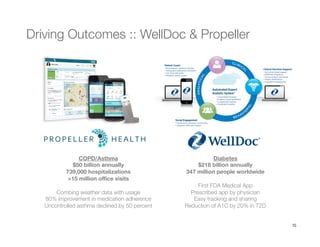

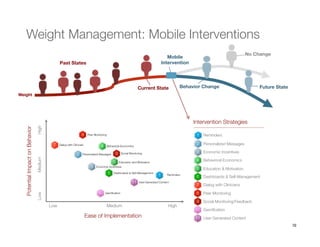

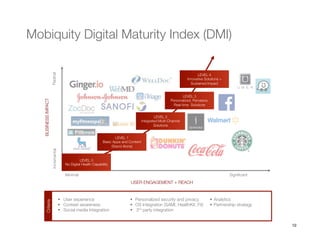

3) The presentation discusses how mHealth can move beyond adherence tracking to deliver true value across the spectrum of care from patients to clinicians. It provides examples of apps that have successfully driven health outcomes.