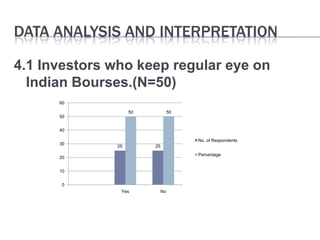

This document summarizes a study on investors in Bathinda city regarding Indian stock exchanges. It outlines the objectives, methodology, scope and limitations of the study. Key findings from data analysis include that investors do not closely follow stock exchange activities, most are short-term investors, and they perceive speculation in the exchanges. Investors give most importance to RBI policies and world economy when investing. They are satisfied with exchange administration and feel SEBI's role has strengthened the exchanges. However, investors face problems with company information.