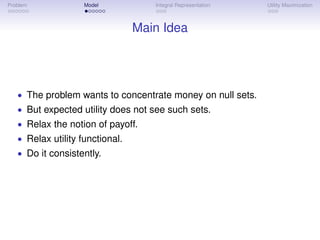

This document provides an outline and summary of a presentation on relaxing the assumptions of utility maximization in complete markets. It discusses relaxing preferences to allow risk aversion to decline to zero as wealth increases, and relaxing payoffs to include more than just random variables. The presentation introduces a model that uses measures instead of densities to represent payoffs, and relaxes the utility functional. It presents results on an expected utility representation involving both absolutely continuous and singular components, and characterizes optimal solutions. The document provides context and motivation for considering cases where the asymptotic elasticity of the utility function approaches one.

![Problem Model Integral Representation Utility Maximization

The Usual Argument

• Utility Maximization from terminal wealth:

max{EP [U(X )] : EQ [X ] ≤ x}

• Use first-order condition to look for solution:

ˆ dQ

U (X ) = y

dP

• Pick the Lagrange multiplier y which saturates constraint:

ˆ

EQ X (y ) = x

• If there is any.

• Assumptions on U?](https://image.slidesharecdn.com/relaxvienna-110421150757-phpapp02/85/Relaxed-Utility-Maximization-in-Complete-Markets-3-320.jpg)

![Problem Model Integral Representation Utility Maximization

Singular Investment

• Kramkov and Schachermayer (1999) show what goes wrong.

• Countable space Ω = (ωn )n≥1 . dP/dQ(ωn ) = pn /qn ↑ ∞ as n ↑ ∞.

• Finite space ΩN . ωn = ωn for n < N. (ωn )n≥N lumped into ωN .

N N

• Solution exists in each ΩN . Satisfies first order condition:

N N

U (Xn ) = y qn /pn 1≤n<N U (XN ) = y qN /pN

N N−1 N N−1

where pN = 1 − n=1 pn and qN = 1 − n=1 qn .

• What happens to N

(Xn )1≤n≤N as N ↑ ∞?

N

• Xn → Xn , which solves U (Xn ) = yqn /pn for n ≥ 1.

• For large initial wealth x, EQ [X ] < x. Where has x − EQ [X ] gone?

N N N

• qN XN converges to x − EQ [X ]. But qN decreases to 0.

• Invest x − EQ [X ] in a “payoff” equal to ∞ with 0 probability.](https://image.slidesharecdn.com/relaxvienna-110421150757-phpapp02/85/Relaxed-Utility-Maximization-in-Complete-Markets-7-320.jpg)

![Problem Model Integral Representation Utility Maximization

Setting

• (Ω, T ) Polish space.

• P, Q Borel-regular probabilities on Borel σ-field F.

• Q∼P

• Payoffs available with initial capital x: C(x) := {X ∈ L0 |EQ [X ] ≤ x}

+

• Market complete.

• U : (0, +∞) → (−∞, +∞)

strictly increasing, strictly concave, continuously differentiable.

• Inada conditions U (0+ ) = +∞ and U (+∞) = 0.

• supX ∈C(x) EP [U(X )] < U(∞)

• P (and hence Q) has full support, i.e. P(G) > 0 for any open set G.

• If not, replace Ω with support of P.](https://image.slidesharecdn.com/relaxvienna-110421150757-phpapp02/85/Relaxed-Utility-Maximization-in-Complete-Markets-9-320.jpg)

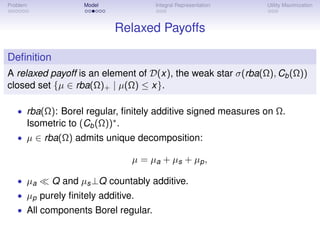

![Problem Model Integral Representation Utility Maximization

Integral Representation

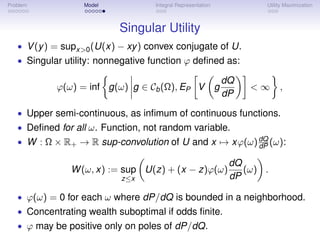

Theorem

Let µ ∈ rba(Ω)+ , and Q ∼ P fully supported probabilities.

i) In general:

dµa

IU (µ) = EP W ·, + ϕdµs + inf µp (f ).

dQ f ∈Cb (Ω),EP [V (f dQ )]<∞

dP

ii) If ϕ = 0 P-a.s., then:

dµa

IU (µ) = EP U + ϕdµs + inf µp (f ).

dQ f ∈Cb (Ω),EP [V (f dQ )]<∞

dP

xU (x)

iii) If lim supx↑∞ U(x) < 1, then {ϕ = 0} = Ω and

dµa

IU (µ) = EP U .

dQ](https://image.slidesharecdn.com/relaxvienna-110421150757-phpapp02/85/Relaxed-Utility-Maximization-in-Complete-Markets-14-320.jpg)

![Problem Model Integral Representation Utility Maximization

Three Parts

• First formula holds for any µ ∈ rba(Ω)+ .

• But has finitely additive part...

• ...and has sup-convolution W instead of U.

• Second formula replaces W with U under additional assumption.

• Then utility is sum of three pieces.

• Usual expected utility E[U(X )] with X = dµa .

dQ

• Finitely additive part.

• Singular utility ϕdµs .

• Accounts for utility from concentration of wealth on P-null sets.

• ϕ(ω) represents maximal utility from Dirac delta on ω

• Only usual utility remains for AE(U) < 1.](https://image.slidesharecdn.com/relaxvienna-110421150757-phpapp02/85/Relaxed-Utility-Maximization-in-Complete-Markets-15-320.jpg)

![Problem Model Integral Representation Utility Maximization

Relaxed utility Maximization

Theorem

Under coercivity assumption, and if ϕ = 0 a.s.:

i) u(x) = maxµ∈D(x) IU (µ);

dµ∗

ii) u(x) = E[U(X ∗ (x))] + ϕdµ∗ , where X ∗ (x) =

s dQ .

a

iii) Budget constraint binding: µ∗ (Ω) = EQ [X ∗ (x)] + µ∗ (Ω)

s = x.

iv) µ∗ unique. Support of any µ∗ satisfies:

a s

supp(µ∗ ) ⊆ argmax(ϕ).

s

v) If x > x0 , any solution has the form µ∗ = µ∗ + µ∗ , where

a s

µ∗ (Ω) = x − x0 .

s

vi) u(x) = u(x0 ) + (x − x0 ) maxω ϕ(ω) = u(x0 ) + (x − x0 )y0 .](https://image.slidesharecdn.com/relaxvienna-110421150757-phpapp02/85/Relaxed-Utility-Maximization-in-Complete-Markets-18-320.jpg)