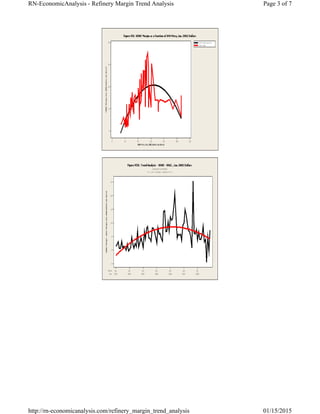

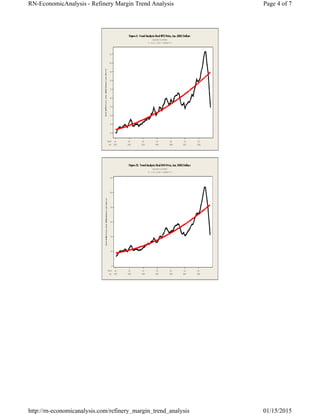

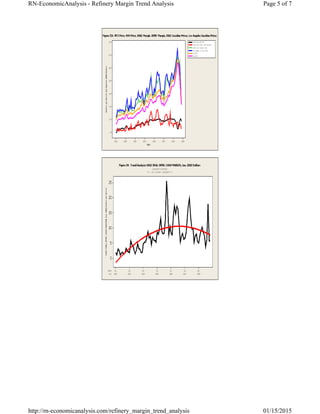

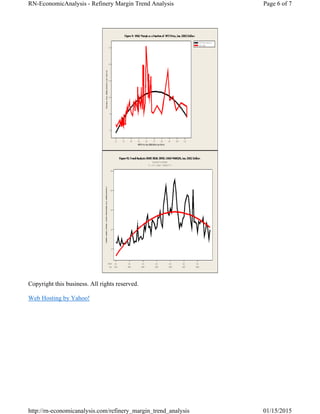

The document analyzes trends in refinery margins from 2002 to 2008. It finds that margins peaked in 2006 and have been declining since, correlating with rises in crude oil prices above $70/barrel on the Gulf Coast and $60/barrel on the West Coast. Charts show margins declining as crude prices continued rising until late 2008 when prices fell rapidly due to reduced demand during the recession. While useful, the margin index analyzed makes assumptions of fixed variables that do not reflect real-world changes to costs and prices over time.