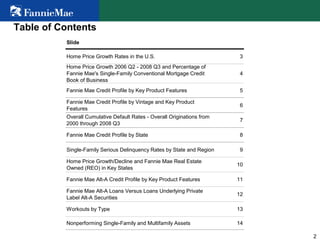

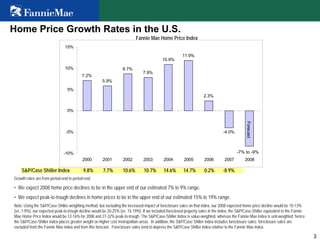

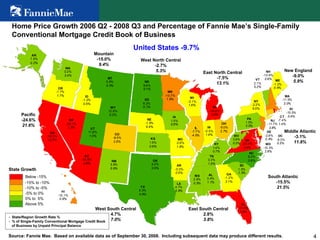

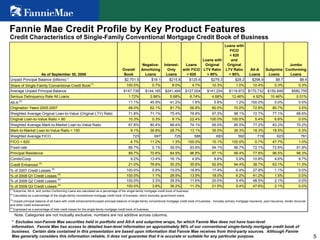

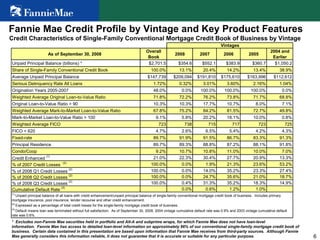

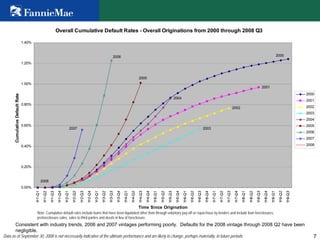

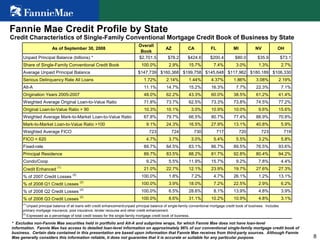

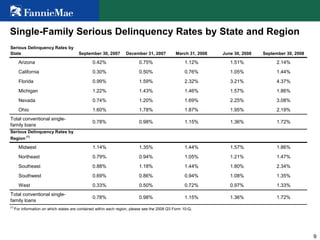

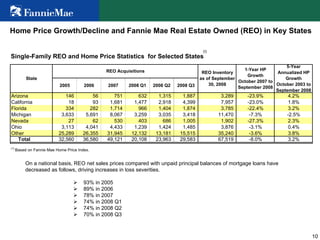

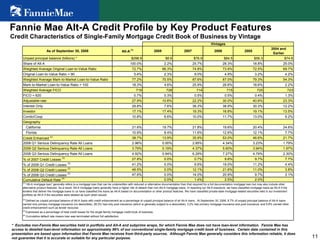

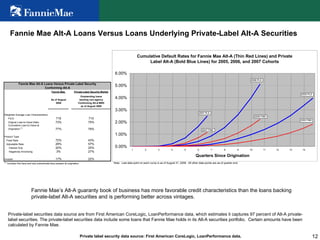

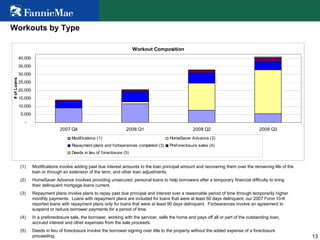

This document provides information from Fannie Mae's 2008 Q3 10-Q Credit Supplement. It includes tables and analysis on Fannie Mae's single-family mortgage credit book of business, including details by key product features, state, vintage, and delinquency rates. It also provides forecasts for future home price declines in 2008 and from peak to trough, expected to be in the upper end of estimated ranges of 7-9% and 15-19%, respectively.