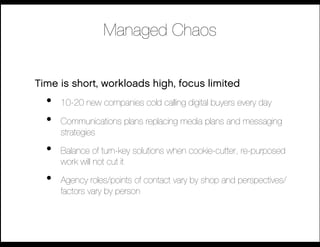

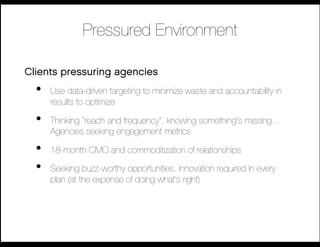

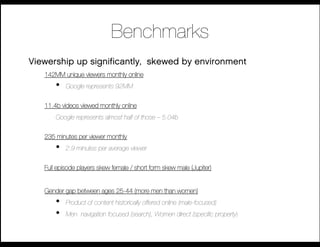

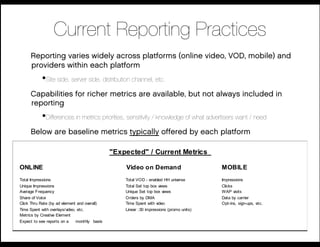

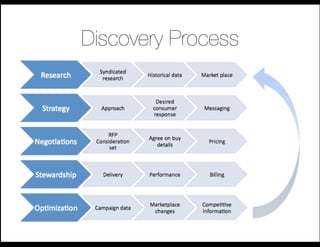

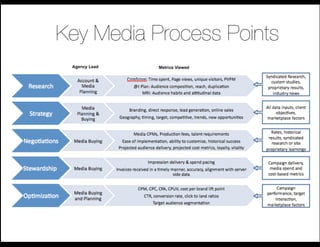

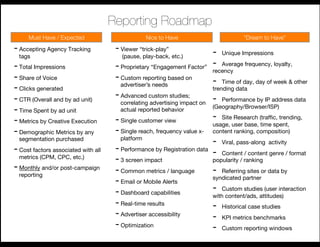

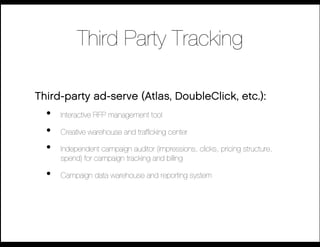

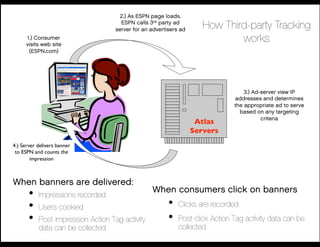

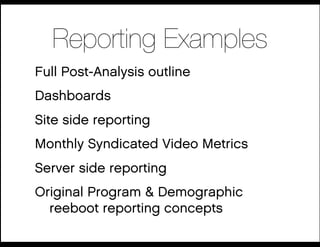

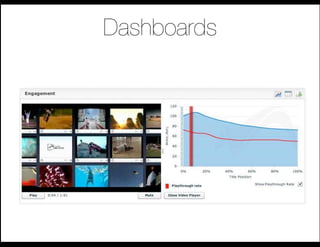

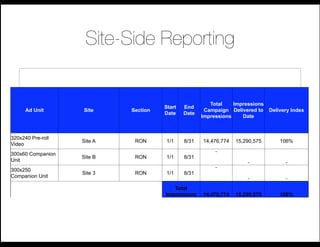

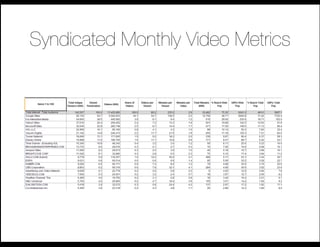

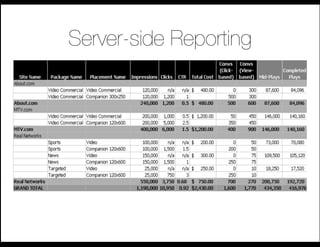

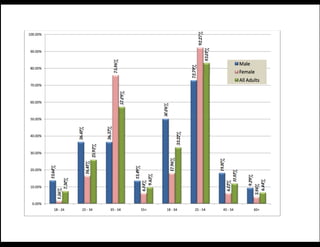

This document discusses the need for improved online video measurement and analytics. It outlines current reporting practices that vary widely across platforms and providers. The document proposes a "roadmap" for standardizing key metrics that should be reported, as well as "nice to have" and "dream to have" additional metrics. Examples are provided of best-in-class reporting deliverables, including dashboards, site-side reporting, and syndicated monthly video metrics. The goal is to provide consistent and comprehensive analytics to help digital media buyers.