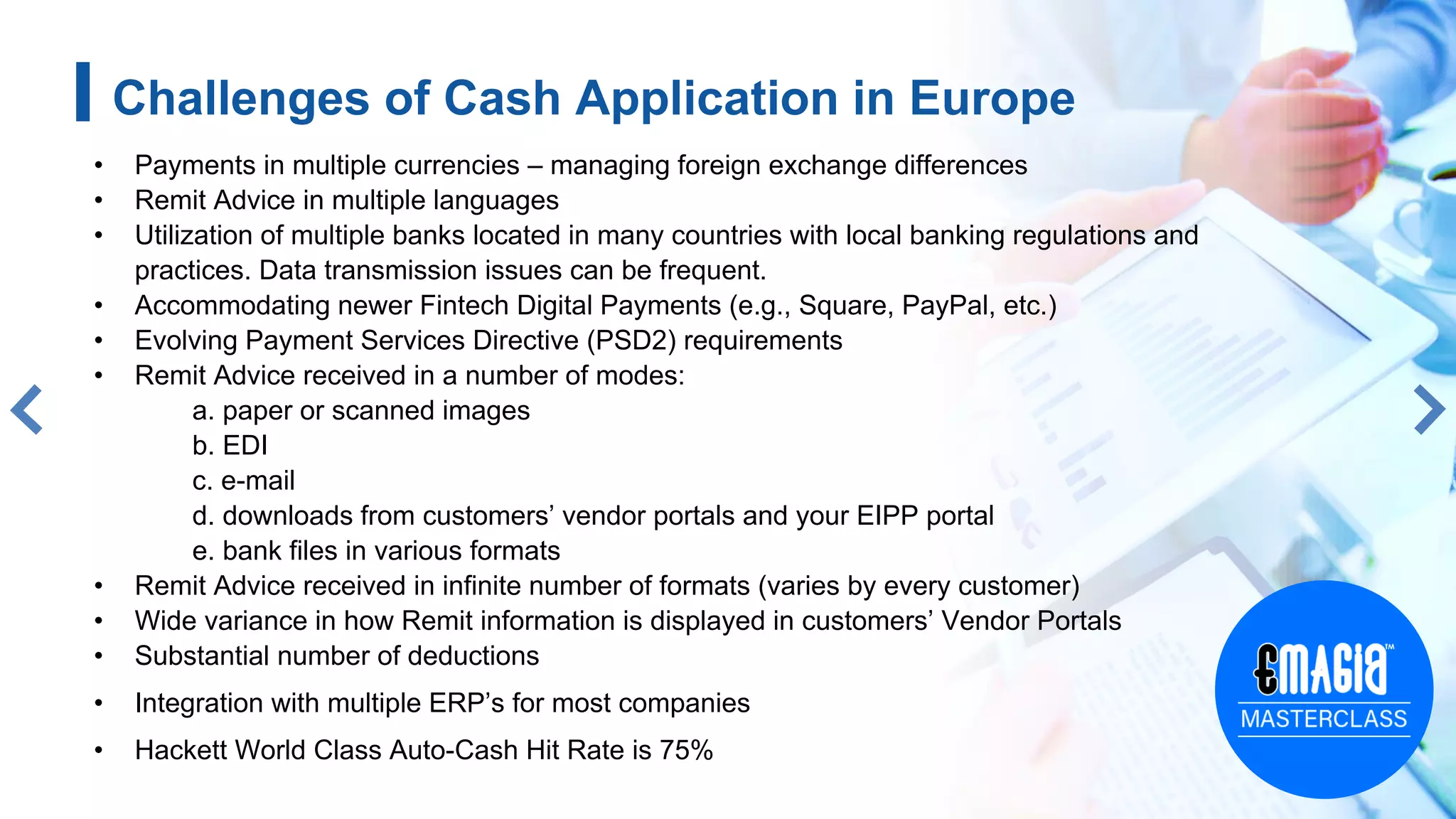

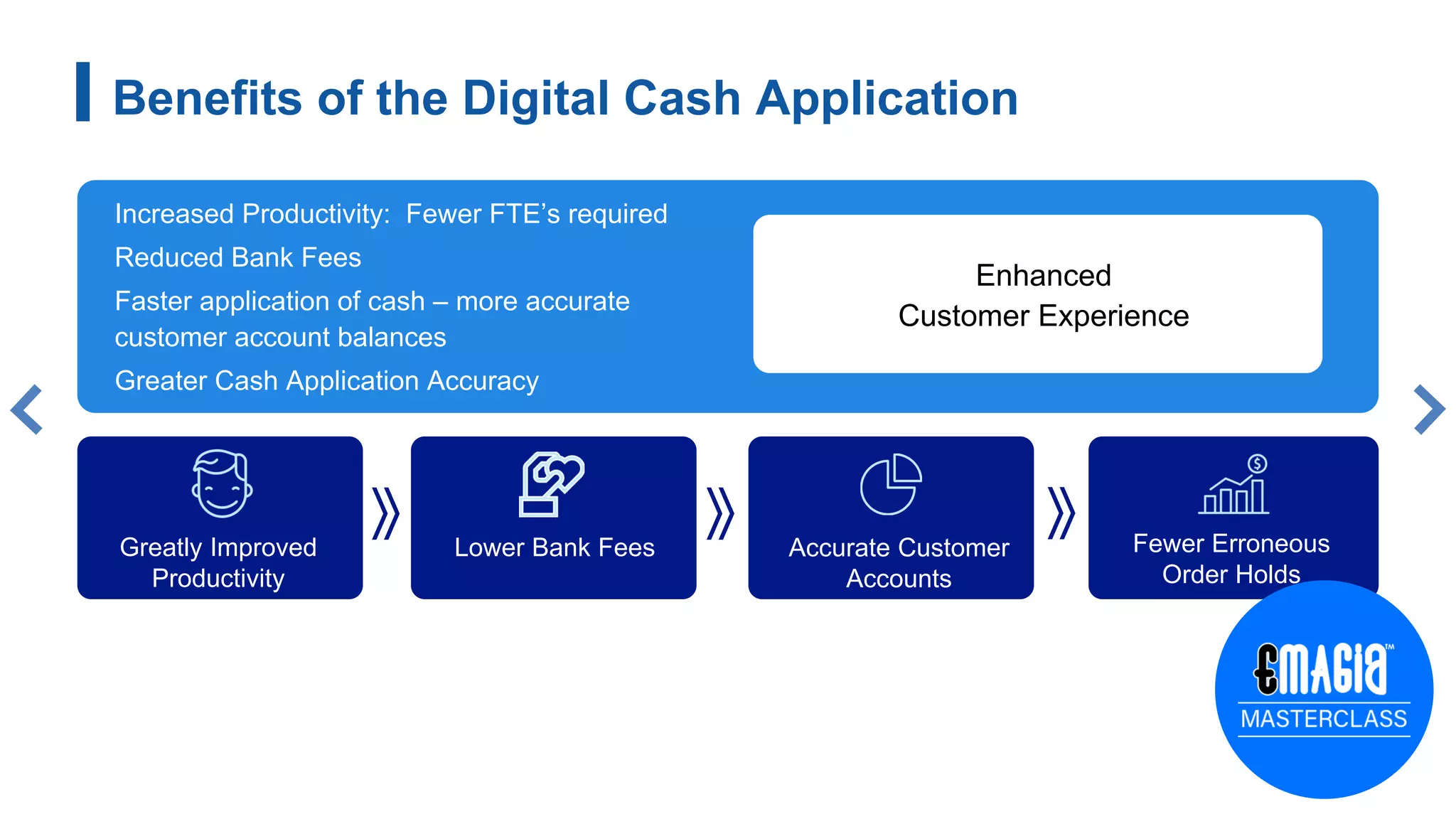

The document discusses using AI to improve cash application processes in Europe. It notes that cash application in Europe faces unique challenges compared to North America due to factors like multiple currencies and languages. The document proposes using AI-enhanced intelligent document processing and AI digital assistants to automate tasks like extracting remittance data from various sources and automatically applying payments to invoices. This could increase cash application hit rates from 45% to 85-90% while reducing costs. A customer success story is provided of a company that achieved these benefits through an AI-powered digital receivables platform.