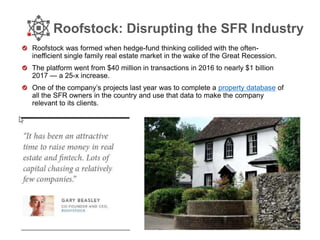

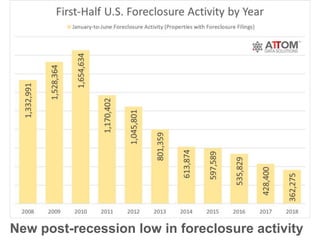

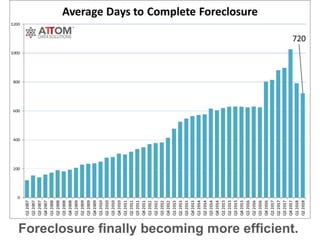

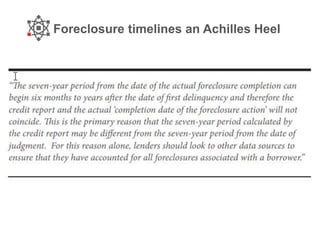

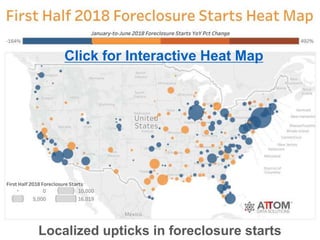

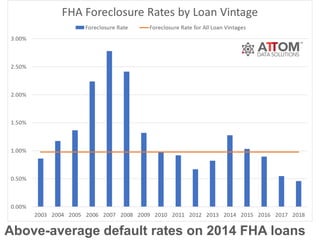

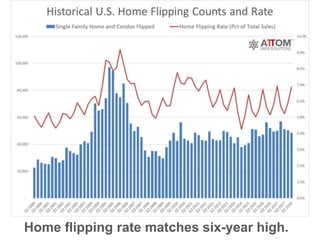

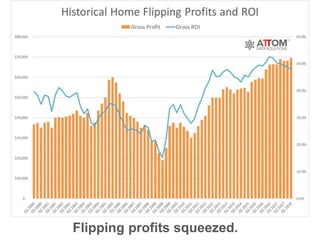

The document discusses various trends and applications in the real estate market, including home prices, loan origination, foreclosure rates, and investor behaviors. It highlights the increasing role of technology in real estate, specifically through data solutions that enhance property valuation and mortgage processes. The report outlines insights from industry leaders and the impact of macroeconomic factors on homeownership and market dynamics.

![Real Estate Data: Trends & Applications

1Copyright © 2016 ATTOM Data Solutions. All rights reserved. [ CONFIDENTIAL ]](https://image.slidesharecdn.com/attomfayservicingpresentationaugust2018v3-180828232947/75/Real-Estate-Data-Trends-Applications-1-2048.jpg)

![What we’ll cover

• Macro housing trends

• Homeownership

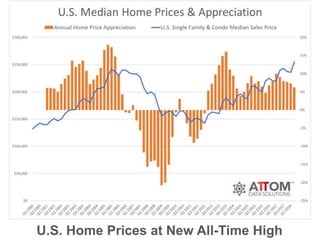

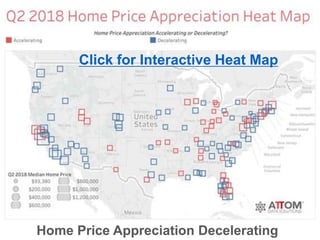

• Home prices

• Affordability

• Loan origination

• Investor-focused housing trends

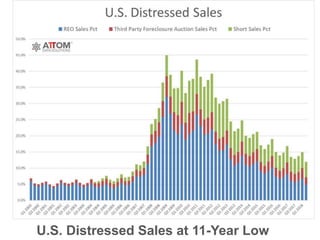

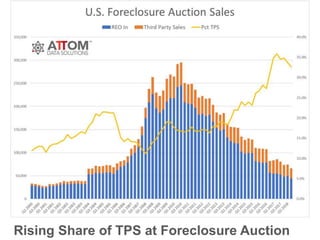

• Foreclosure

• Home Flipping

• Single Family Rental

• Neighborhood rankings

• Real-Life Applications of Real Estate Data

• Peppered in

2Copyright © 2016 ATTOM Data Solutions. All rights reserved. [ CONFIDENTIAL ]](https://image.slidesharecdn.com/attomfayservicingpresentationaugust2018v3-180828232947/85/Real-Estate-Data-Trends-Applications-2-320.jpg)

![Clear Capital: Property Valuation

7Copyright © 2018 ATTOM Data Solutions. All rights reserved. [ CONFIDENTIAL ]

Fueling Property Valuation

and Analytics

“ATTOM’s property data solutions are key

to Clear Capital providing accurate and

innovative property valuation products to

the mortgage industry. Whether fueling

our automated analytics like ClearAVM, or

assisting our staff with quality review,

ATTOM’s datasets allow us to set the bar

as a property valuation leader."

Kenon Chen

Clear Capital EVP ProductData Solution

Bulk tax assessor,

recorder deed/mortgage

and pre-foreclosure

Use Case No.1

Integrates public record

property data into various

lender valuation products

Provides tech-driven real estate valuation solutions

to mortgage originators, servicers, GSEs and

capital markets participants](https://image.slidesharecdn.com/attomfayservicingpresentationaugust2018v3-180828232947/85/Real-Estate-Data-Trends-Applications-7-320.jpg)

![15Copyright © 2018 ATTOM Data Solutions. All rights reserved. [ CONFIDENTIAL ]

Designing the Digital Mortgage

Digital mortgage origination for investment

properties (fix-and-flip)

Data Solution

Bulk tax assessor,

recorder deed,

foreclosure

Use Case No.1

Automation of online mortgage

application process and

borrower pre-qualification

Matt Humphrey

LendingHome CEO

“Online lenders like us exist because banks

and large lenders don’t play in this space,

and they aren’t using technology to be

efficient, nimble and fast. Now that

investors have digital-native lenders

catering to them, financing becomes an

attractive alternative to cash. We predict

this trend will continue because 2018 is

already off to an incredible start for us.”

Designing a Digital Mortgage](https://image.slidesharecdn.com/attomfayservicingpresentationaugust2018v3-180828232947/85/Real-Estate-Data-Trends-Applications-15-320.jpg)

![Powering an Online Mortgage Marketplace

16Copyright © 2018 ATTOM Data Solutions. All rights reserved. [ CONFIDENTIAL ]

A leading online loan marketplace helping consumers connect with

multiple lenders for various financial borrowing needs

Data Solution

Bulk tax assessor, recorder

deed/mortgage, AVM

Use Case No.1

Online mortgage application pre-fill and validation with

property characteristics, ownership details, transaction

history and automated valuation model

Powering an Online Mortgage Marketplace](https://image.slidesharecdn.com/attomfayservicingpresentationaugust2018v3-180828232947/85/Real-Estate-Data-Trends-Applications-16-320.jpg)

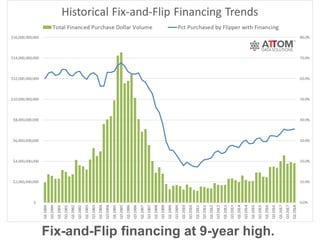

![LendingHome: Fix-and-Flip Lending

34Copyright © 2018 ATTOM Data Solutions. All rights reserved. [ CONFIDENTIAL ]

Defining a New Industry

Use Case No.2

Market analytics and marketing for the fix-and-flip

lending space

Digital mortgage origination for investment

properties (fix-and-flip)

“Wall Street has become more comfortable

with the fix-and-flip space because they now

have access to four years of performance

data, and they’ve actively watched the

development of this asset class. Large-

scale, low-cost financing coupled with

efficient tech-driven operations — like ours

at LendingHome — means lower fees to

borrowers with terms that work for them.”

Matt Humphrey

LendingHome CEO](https://image.slidesharecdn.com/attomfayservicingpresentationaugust2018v3-180828232947/85/Real-Estate-Data-Trends-Applications-34-320.jpg)