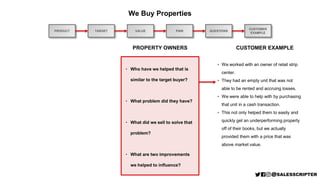

The document describes a real estate company called "We Buy Properties" that purchases distressed or underperforming properties from owners. Key points:

- They pay the typical market value for properties that are distressed or difficult to sell, taking ownership and any associated debt.

- Benefits to property owners include getting a higher price than selling on the open market, avoiding broker fees, and faster closing without going through a bank.

- The company targets property owners looking to unload distressed assets that may be losing money or difficult to sell traditionally.