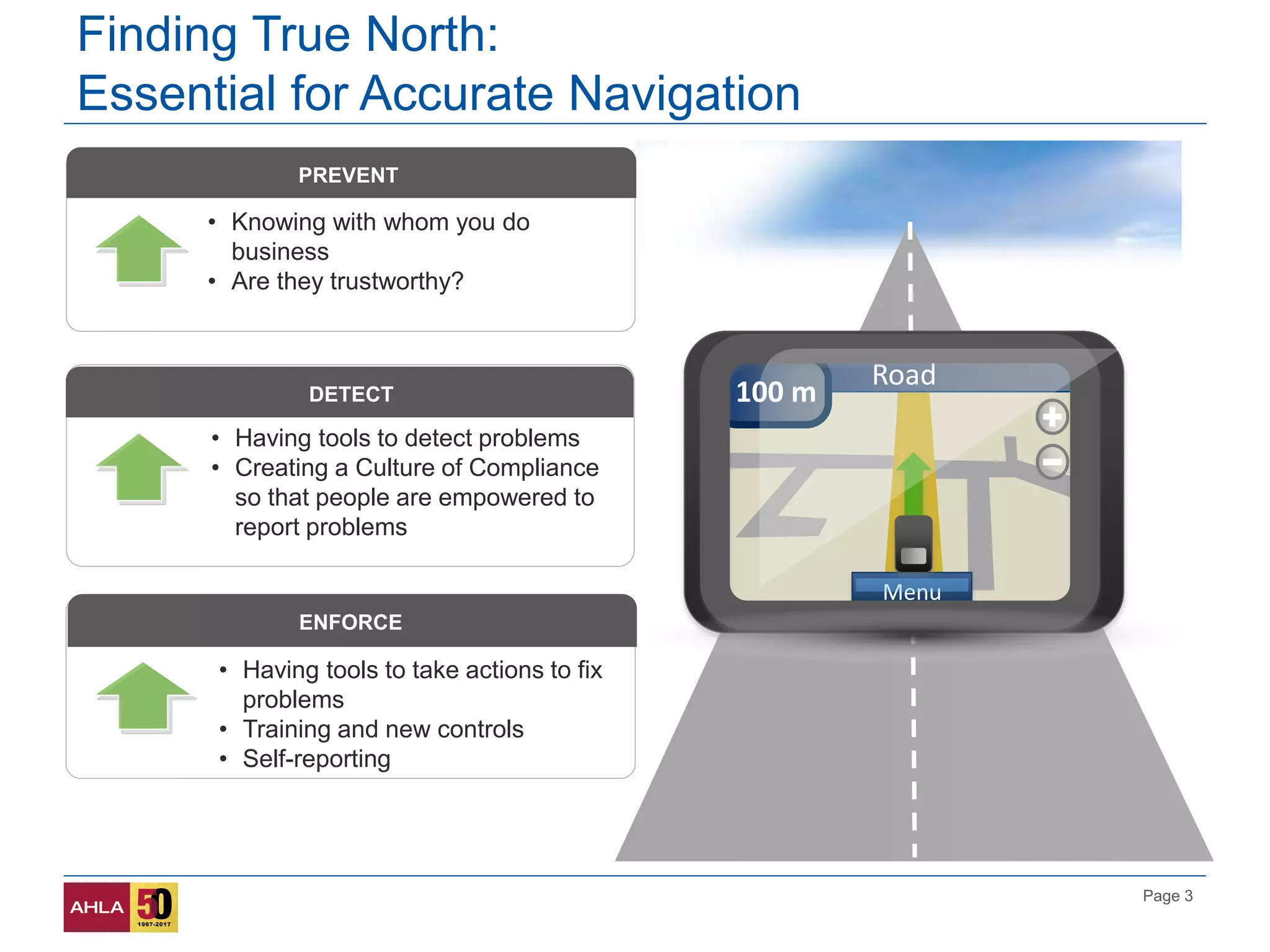

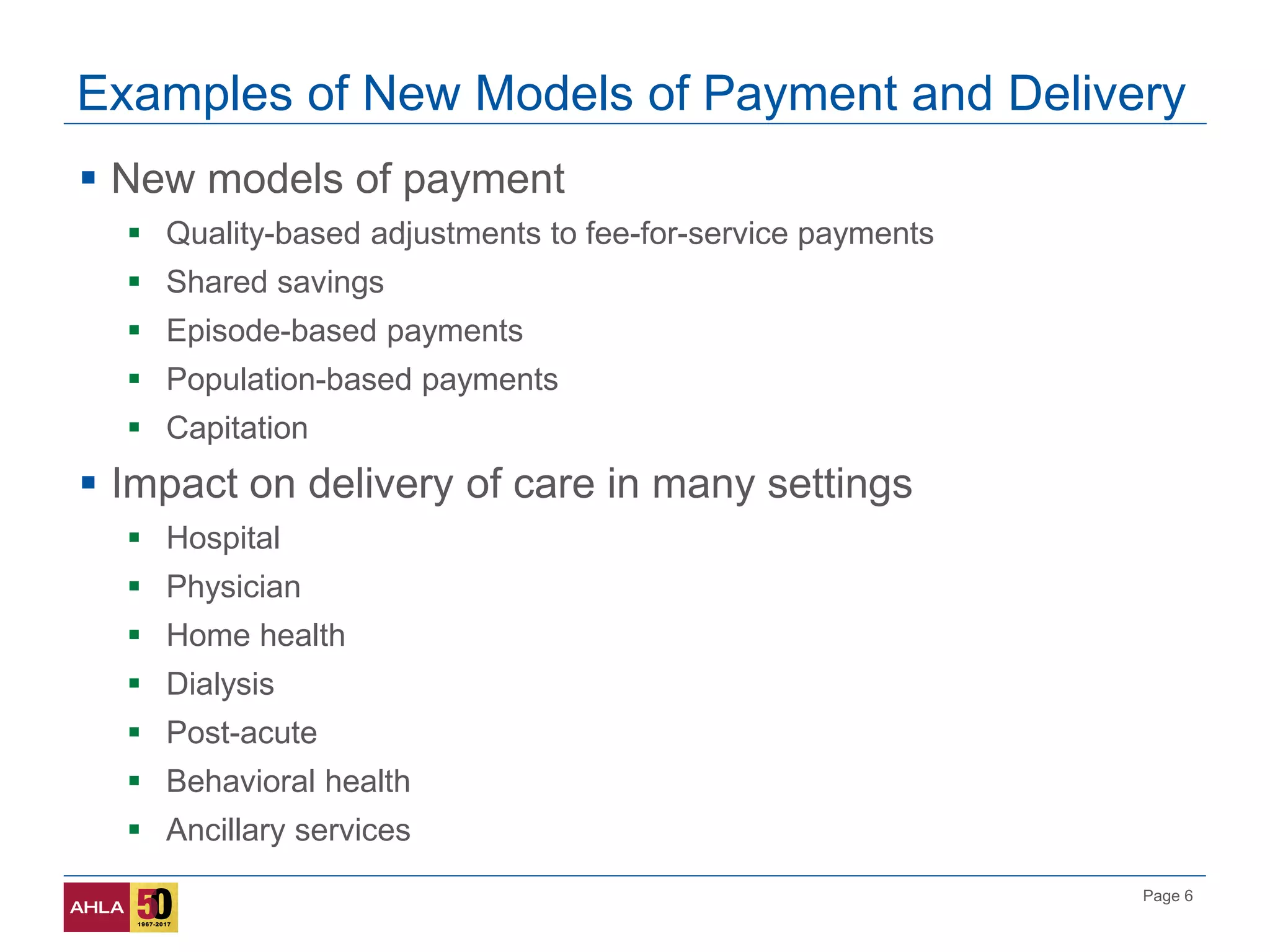

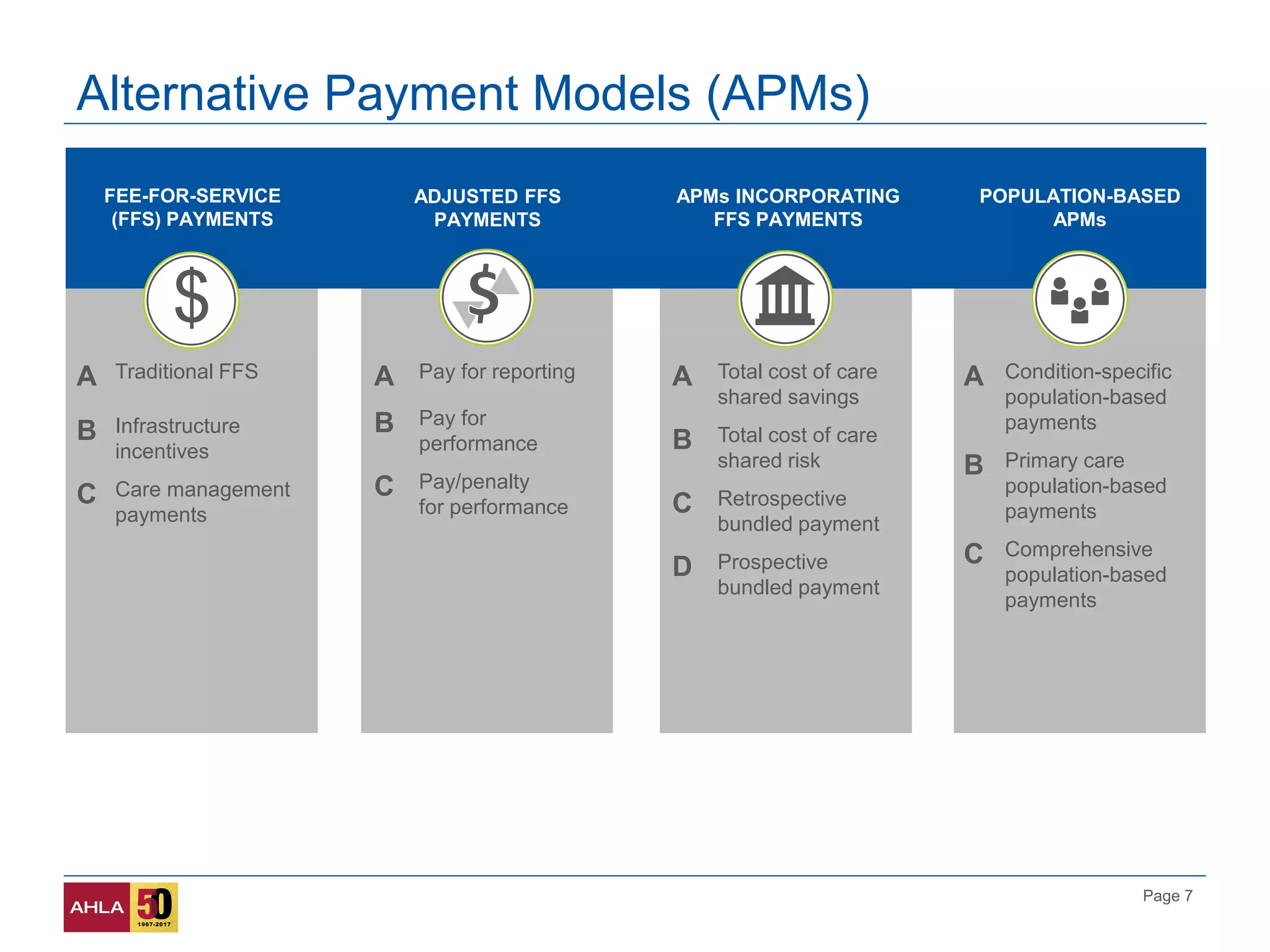

The presentation discusses compliance challenges and opportunities in the healthcare industry amidst evolving payment and delivery models. It emphasizes the importance of program integrity principles, quality data analytics, and the role of human resources in fostering a compliance culture. Additionally, it highlights new regulatory flexibilities designed to improve access to care and reduce costs.