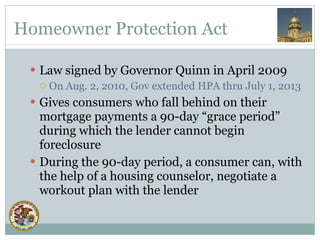

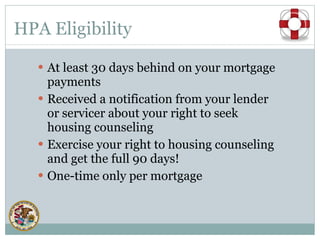

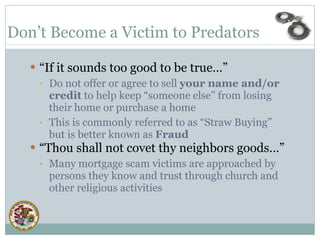

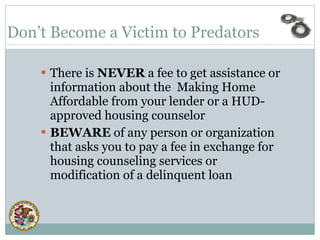

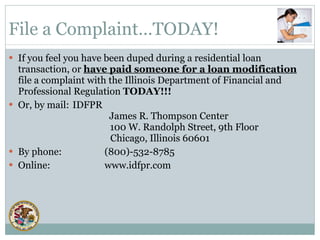

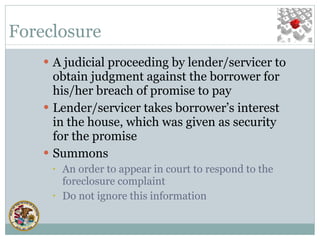

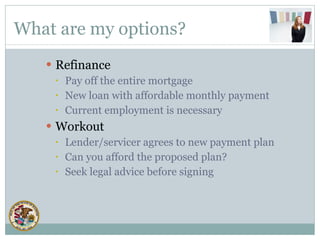

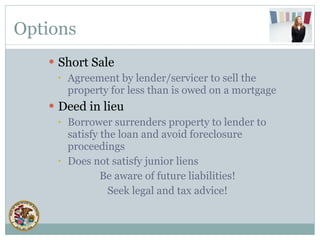

The document discusses resources for homeowners who are behind on their mortgage payments or facing foreclosure in Illinois. It outlines the state's Homeowner Protection Act, which provides a 90-day grace period during which foreclosure cannot begin. It warns homeowners about foreclosure rescue scams and advises homeowners to contact their lender or a HUD-certified counselor for assistance to avoid being victimized. The document also reviews options for homeowners such as loan modifications, short sales, and outlines the foreclosure process and rights of homeowners in Illinois.