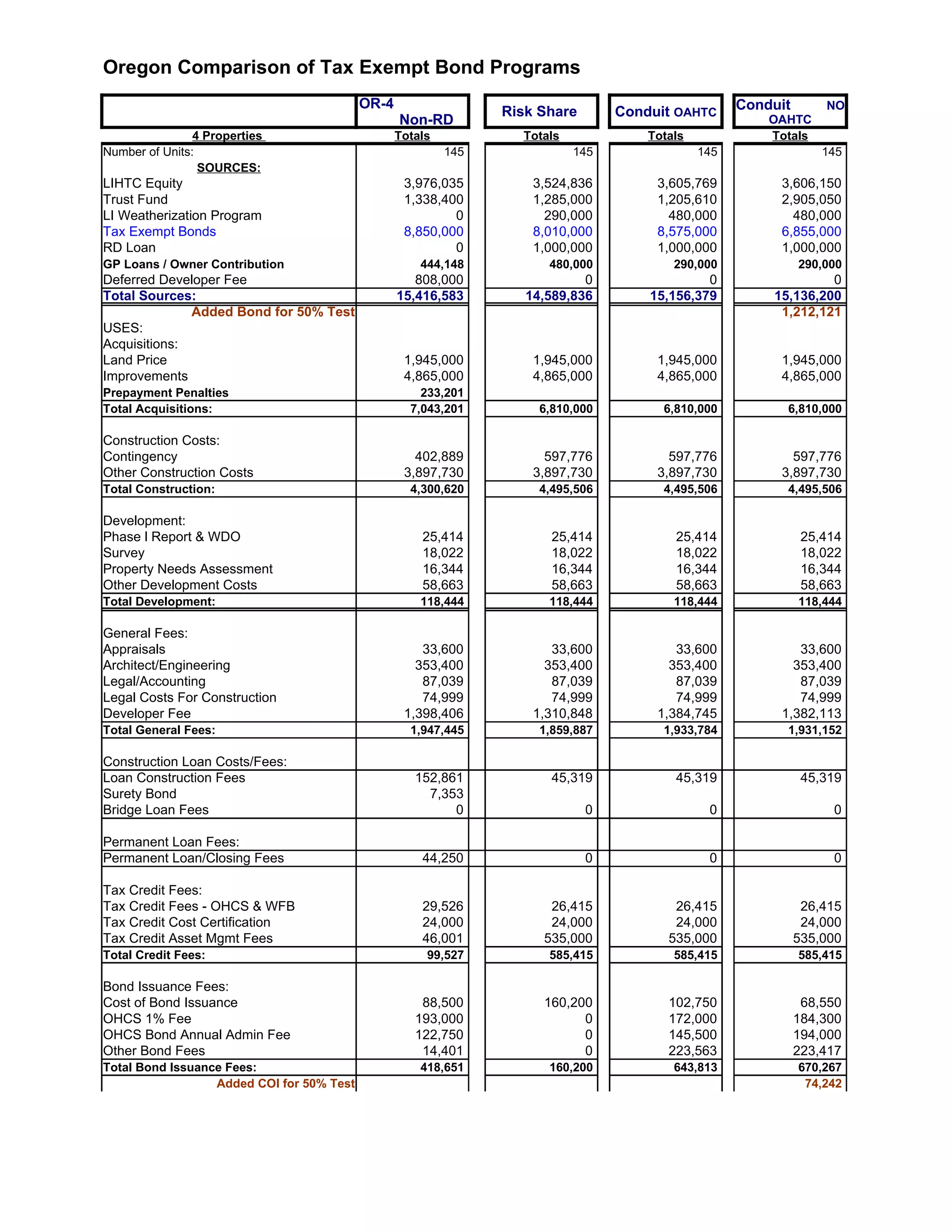

This document compares the sources and uses of funds for four different tax-exempt bond programs that could finance 145 units across four properties in Oregon. It finds that a conduit bond program would result in total sources of $14.6 million and uses of $14.6 million, breaking even exactly. A risk share bond program would require $15.2 million in sources and uses, while a conduit OAHTC program would need $15.1 million in both sources and uses. A non-RD program using only OAHTC would need $15.1 million in sources and uses as well.