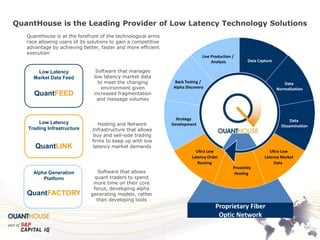

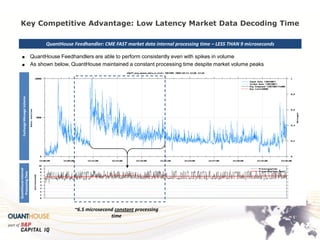

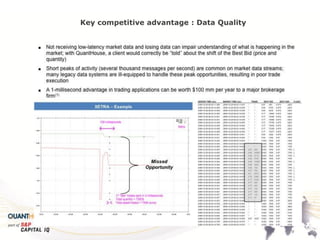

Quanthouse, a part of S&P Capital IQ, specializes in low-latency trading infrastructure and services that cater to a diverse clientele including buy-side firms and exchanges. The company offers advanced solutions for electronic traders, such as market data feeds and trading infrastructure, leveraging proprietary technology for high-performance execution. With a strong focus on managing data quality and operational efficiency, Quanthouse positions itself as a leader in the evolving landscape of automated trading.