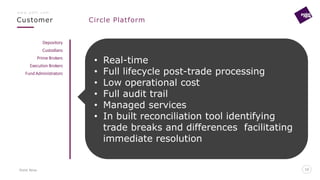

Point Nine is a leading provider of post-trade execution, processing, and reporting services. Founded in 2002, it offers the Circle platform which provides real-time, end-to-end automation of post-trade workflows across multiple asset classes. Circle integrates with exchanges, custodians, brokers and other financial firms to streamline settlements, matching, affirmations, corporate actions and reporting for clients. Point Nine aims to help clients reduce costs, operational risk, and processing times through its centralized and scalable proprietary technology solution.