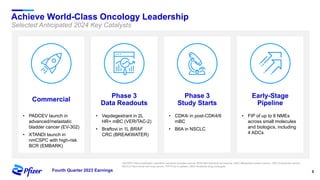

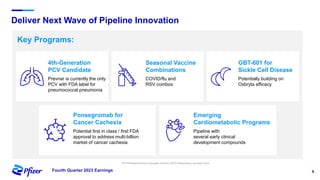

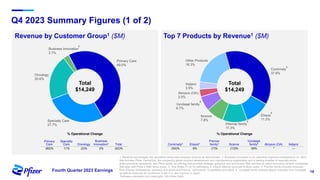

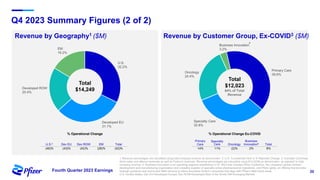

Pfizer's fourth quarter 2023 earnings teleconference discusses forward-looking statements related to its operating performance, product pipeline, and strategic goals, including the impact of recent acquisitions and ongoing responses to COVID-19. Key priorities for 2024 include oncology leadership, pipeline innovation, and maximizing the performance of new products amidst a challenging financial landscape. The firm projects revenues between $58.5 billion and $61.5 billion for 2024, alongside adjusted EPS within the range of $2.05 to $2.25.