Embed presentation

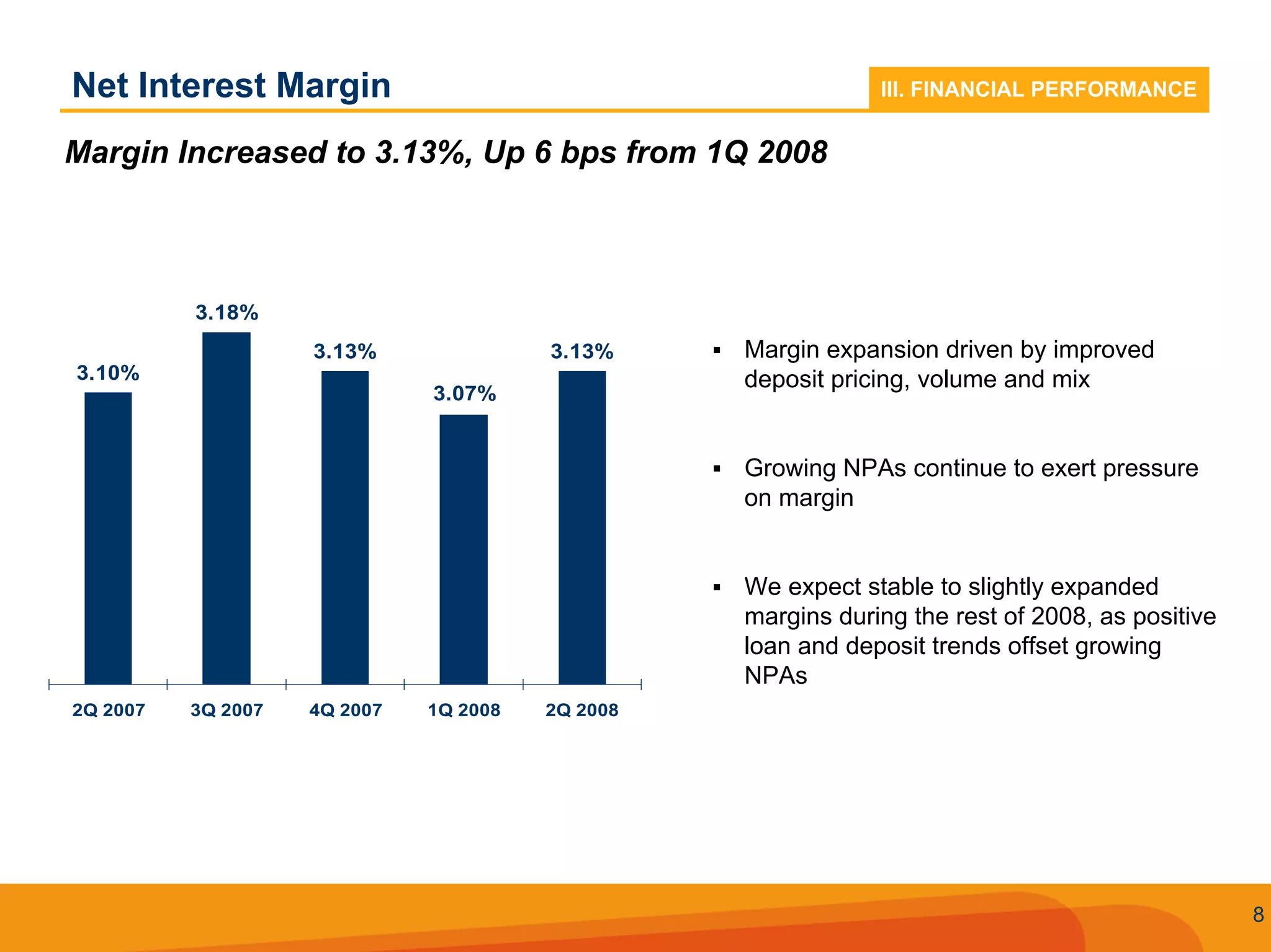

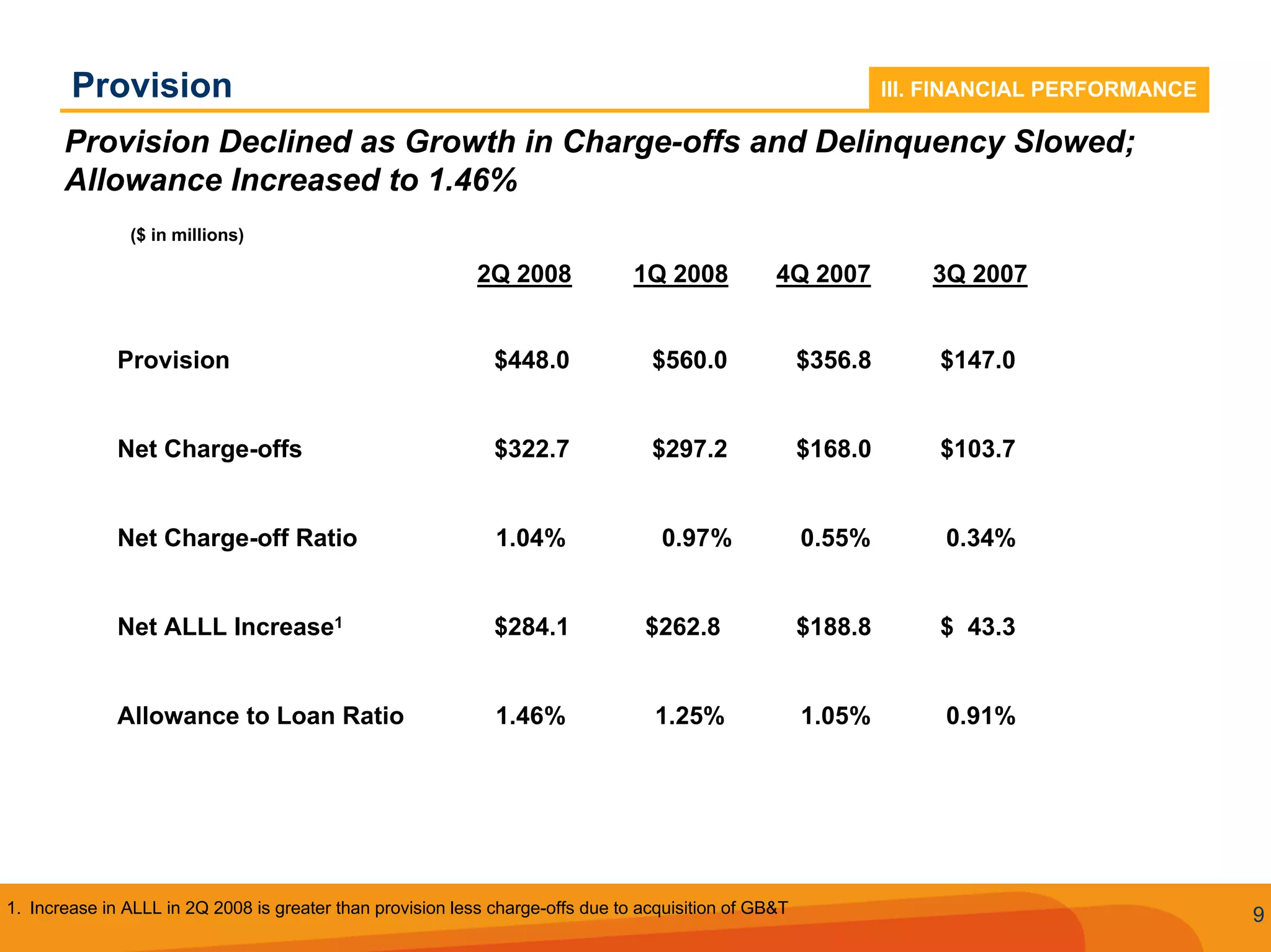

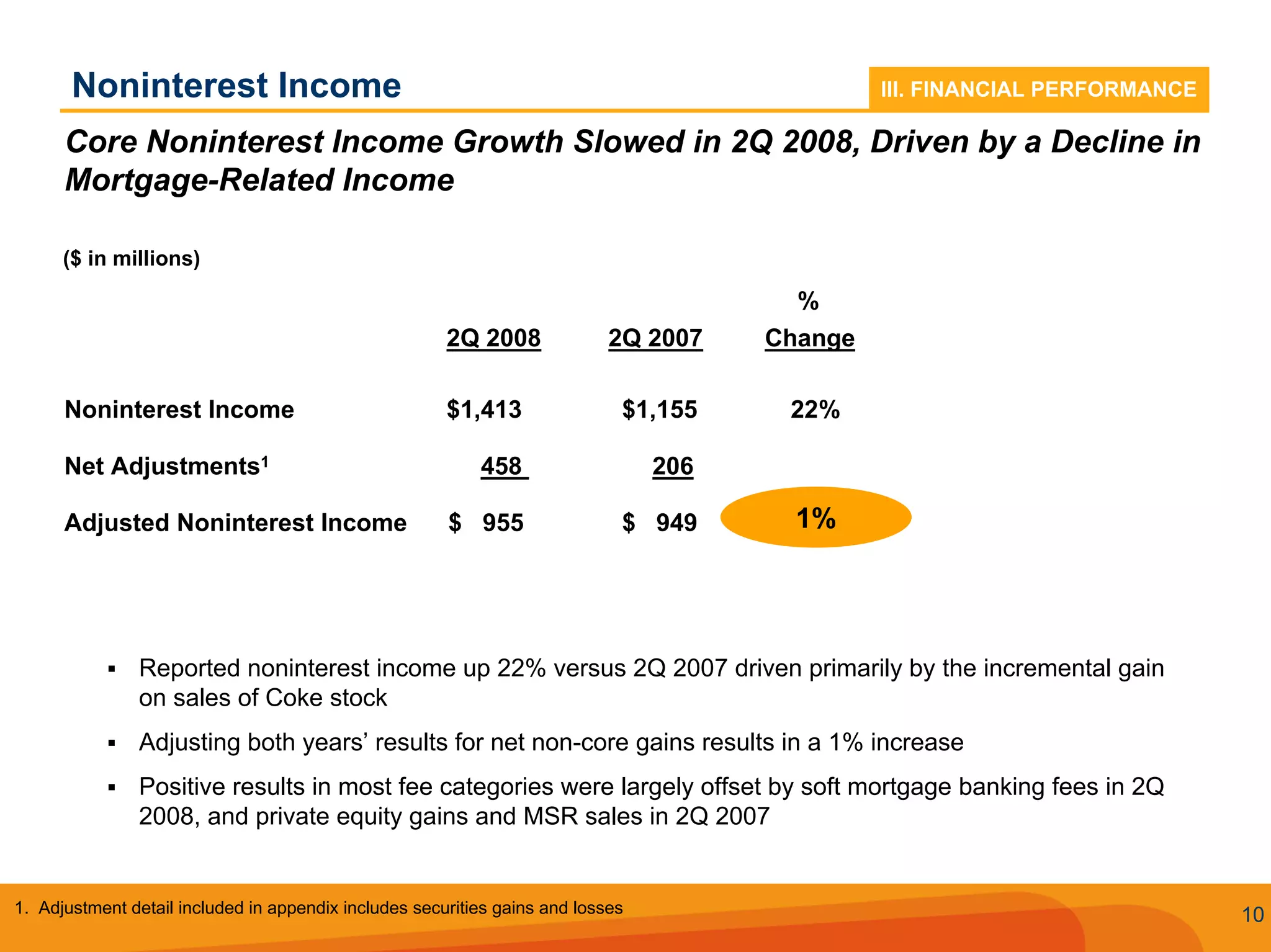

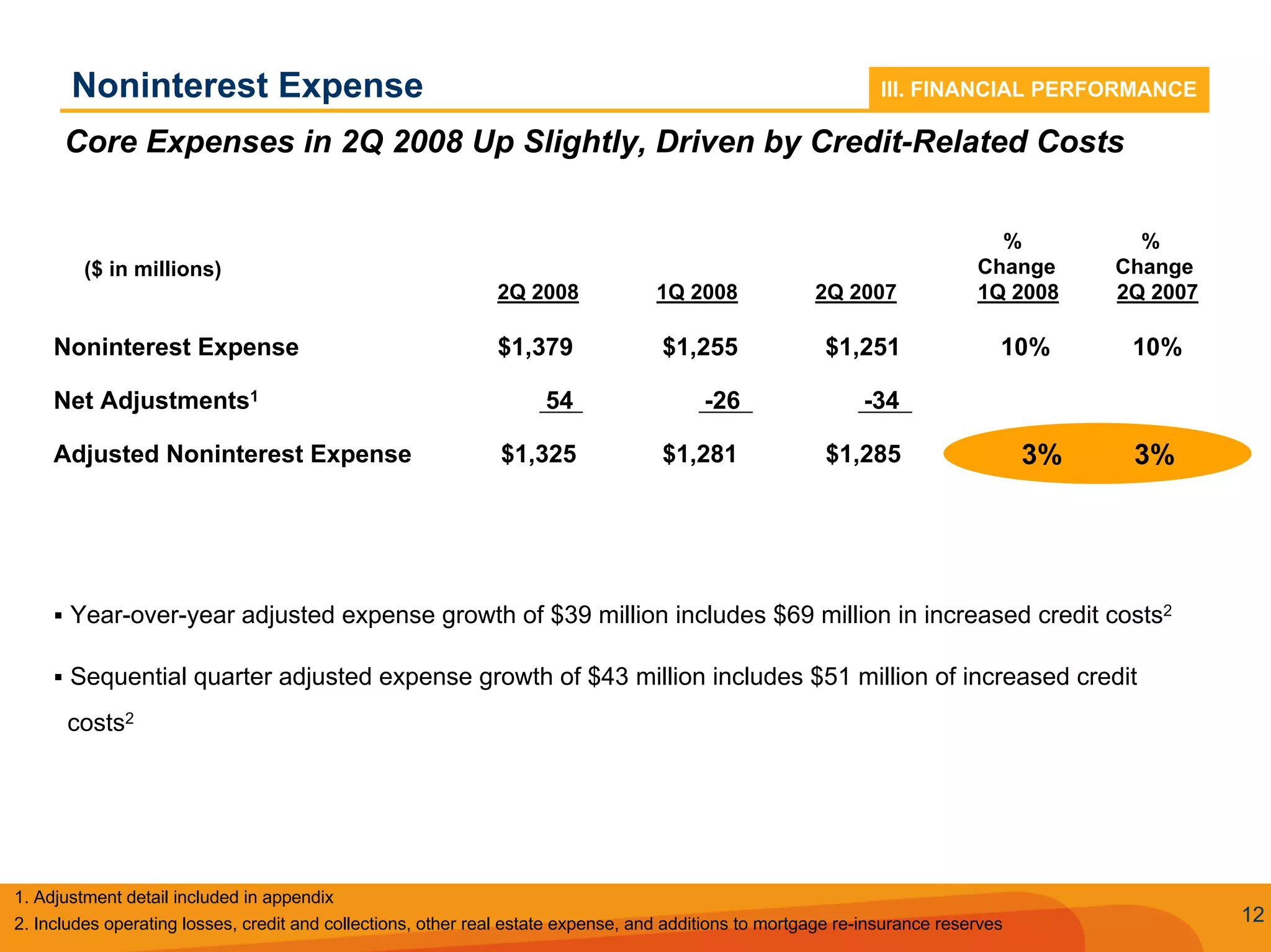

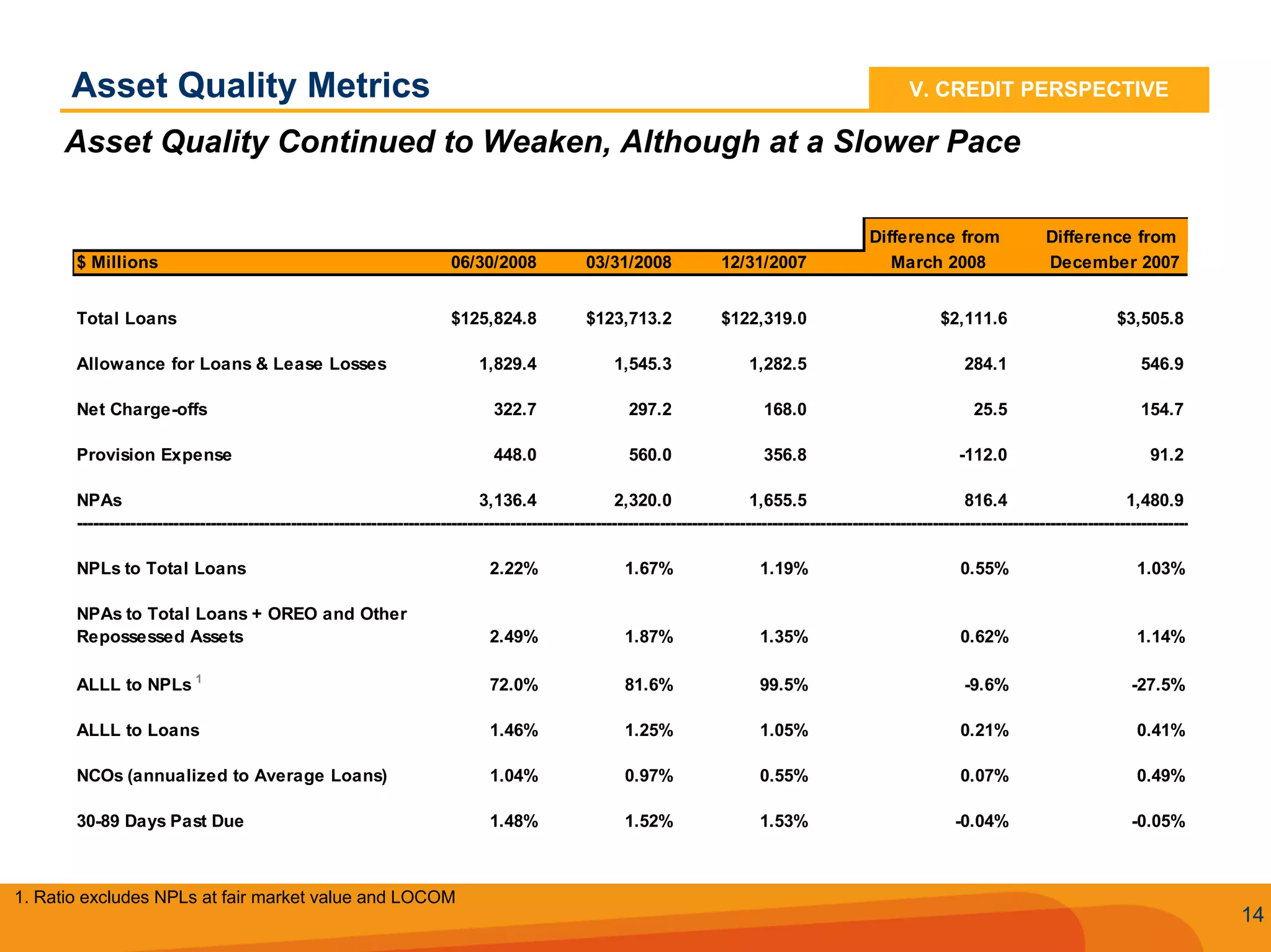

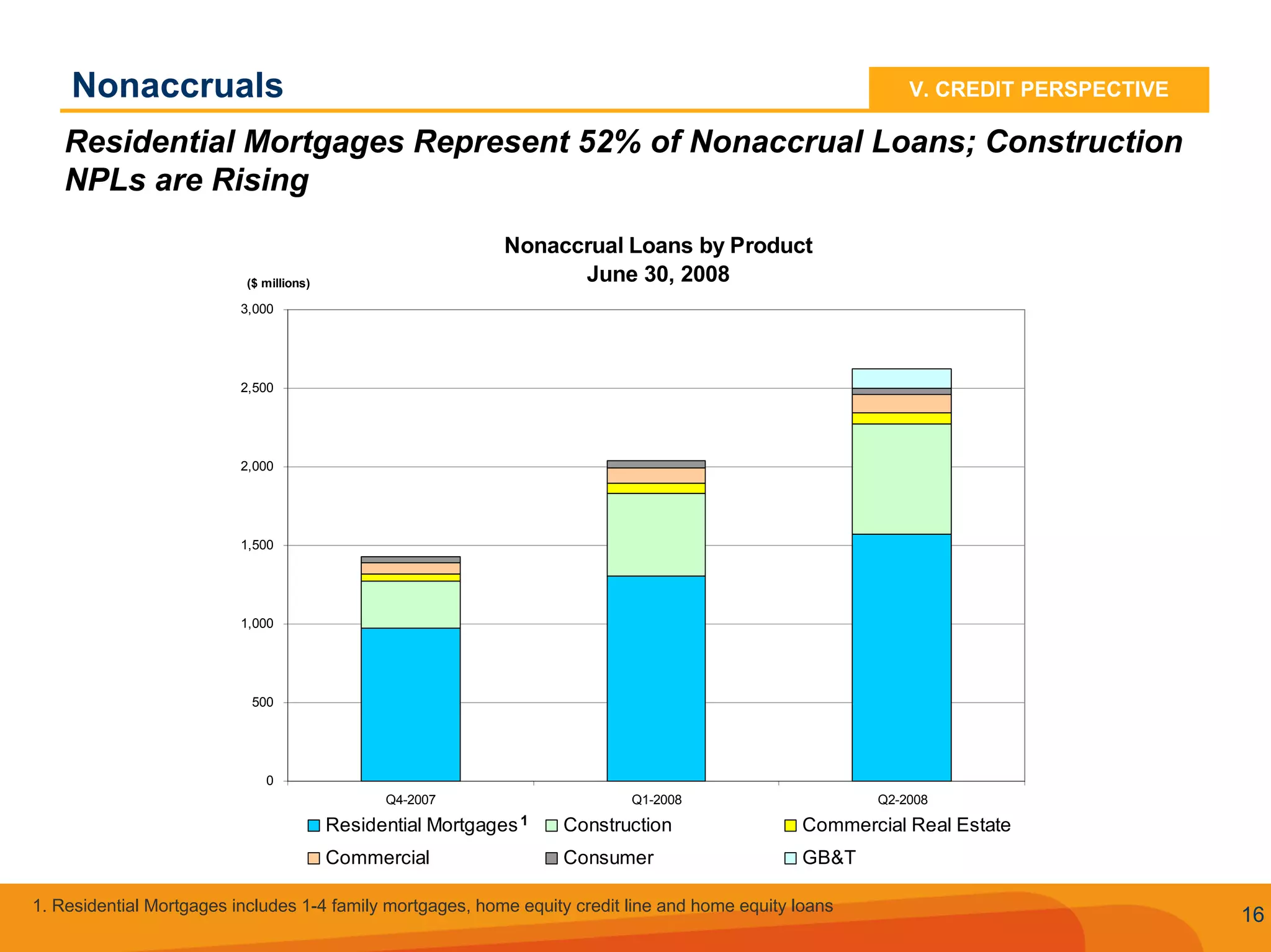

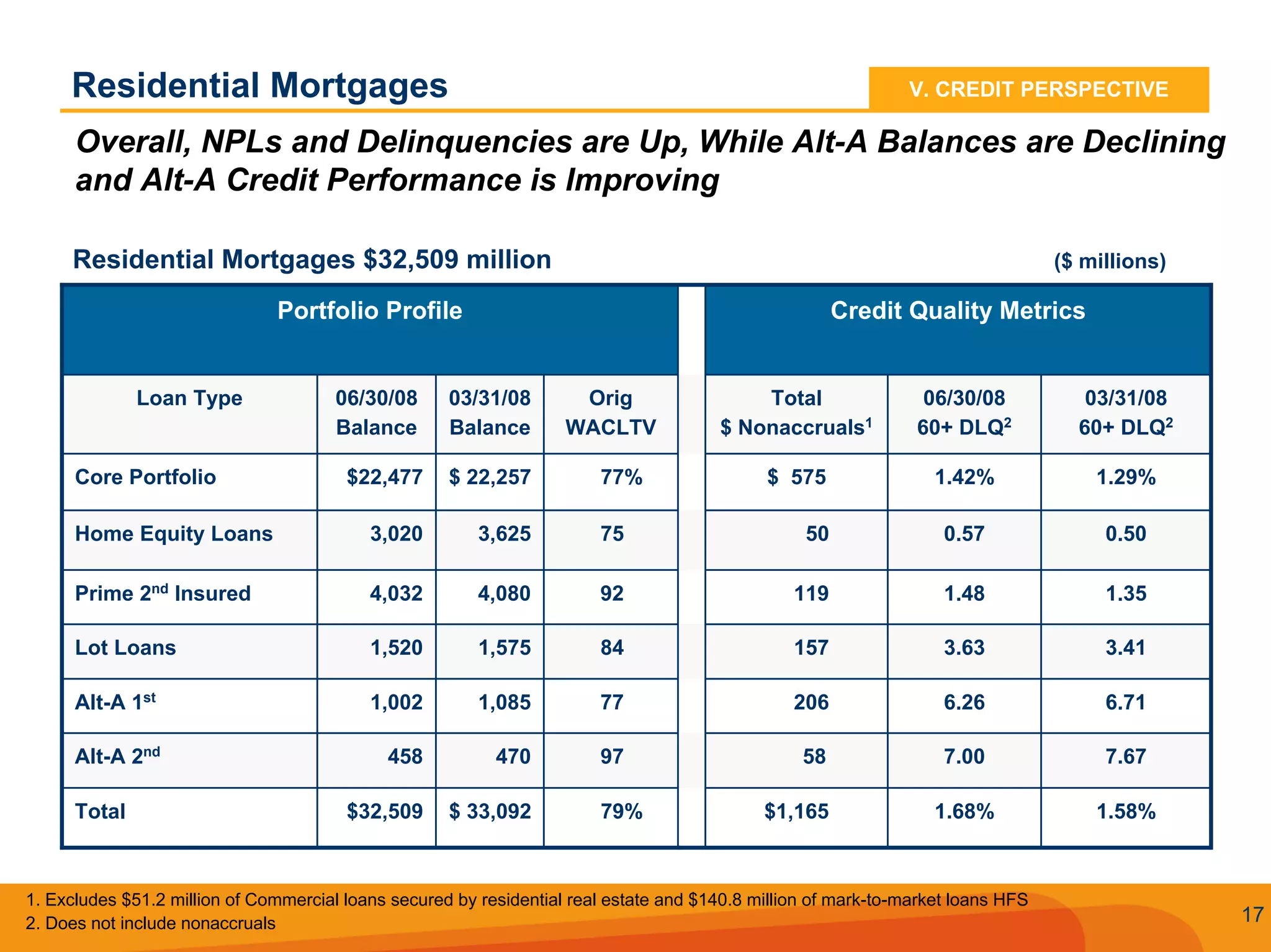

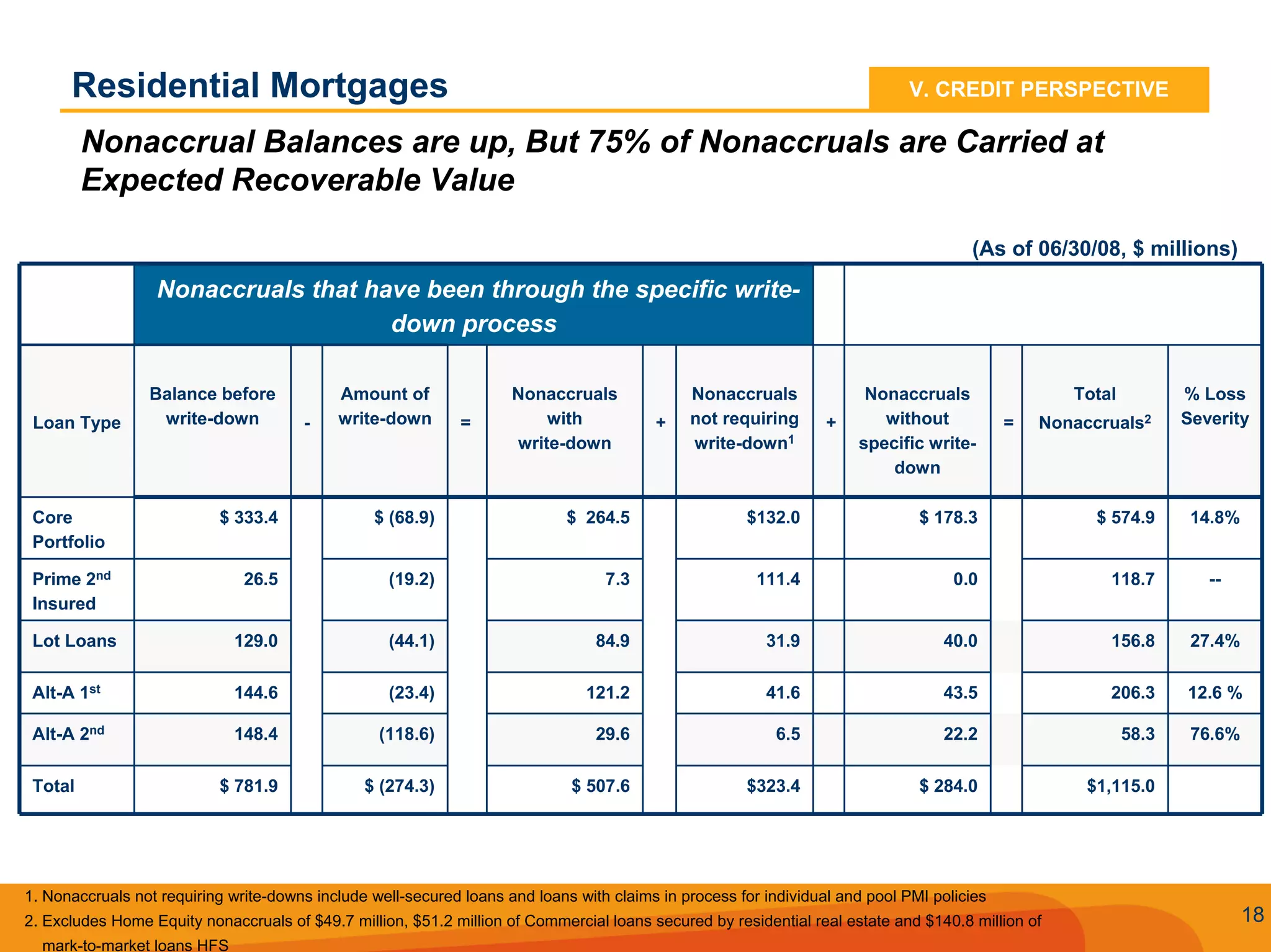

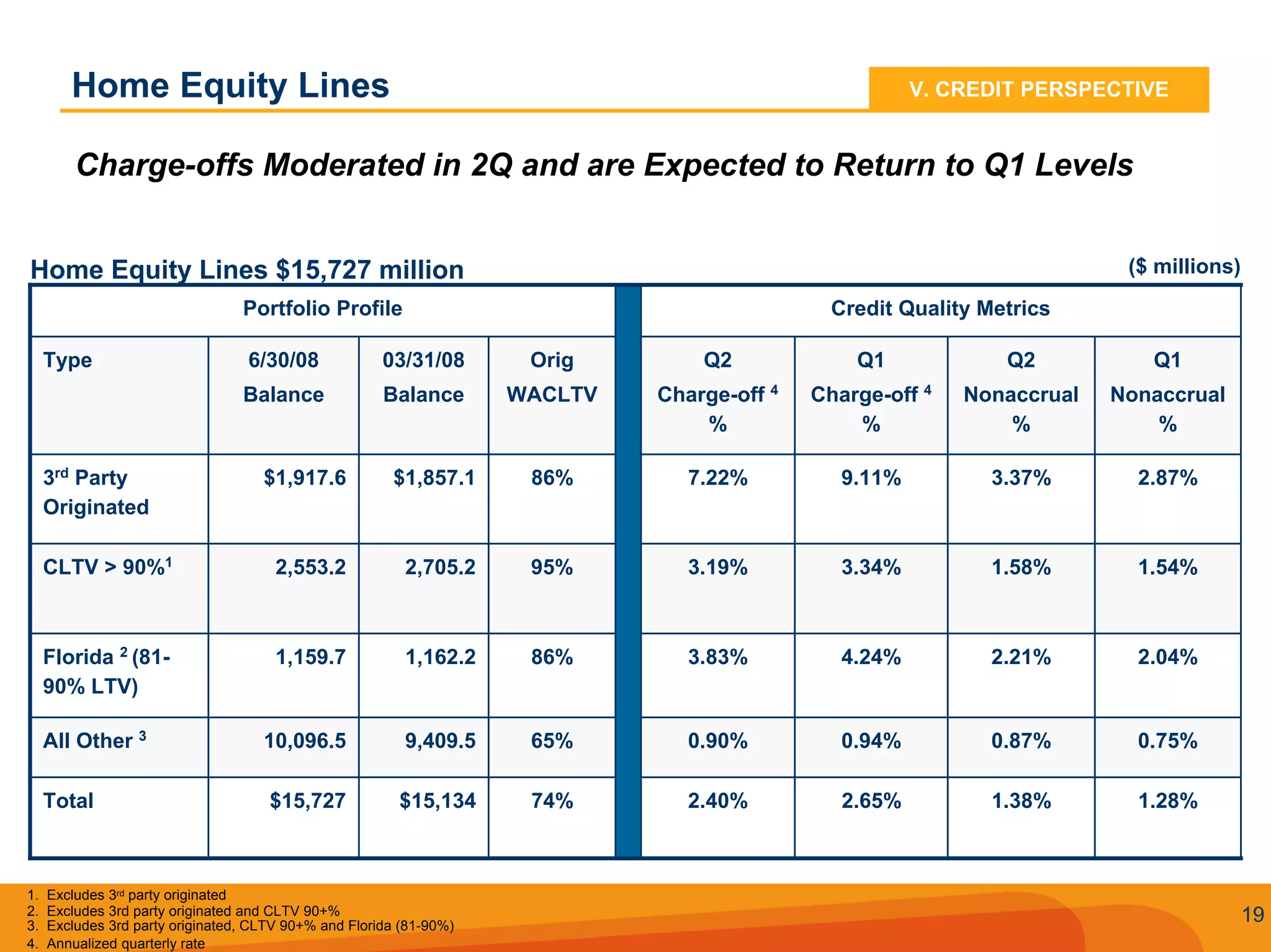

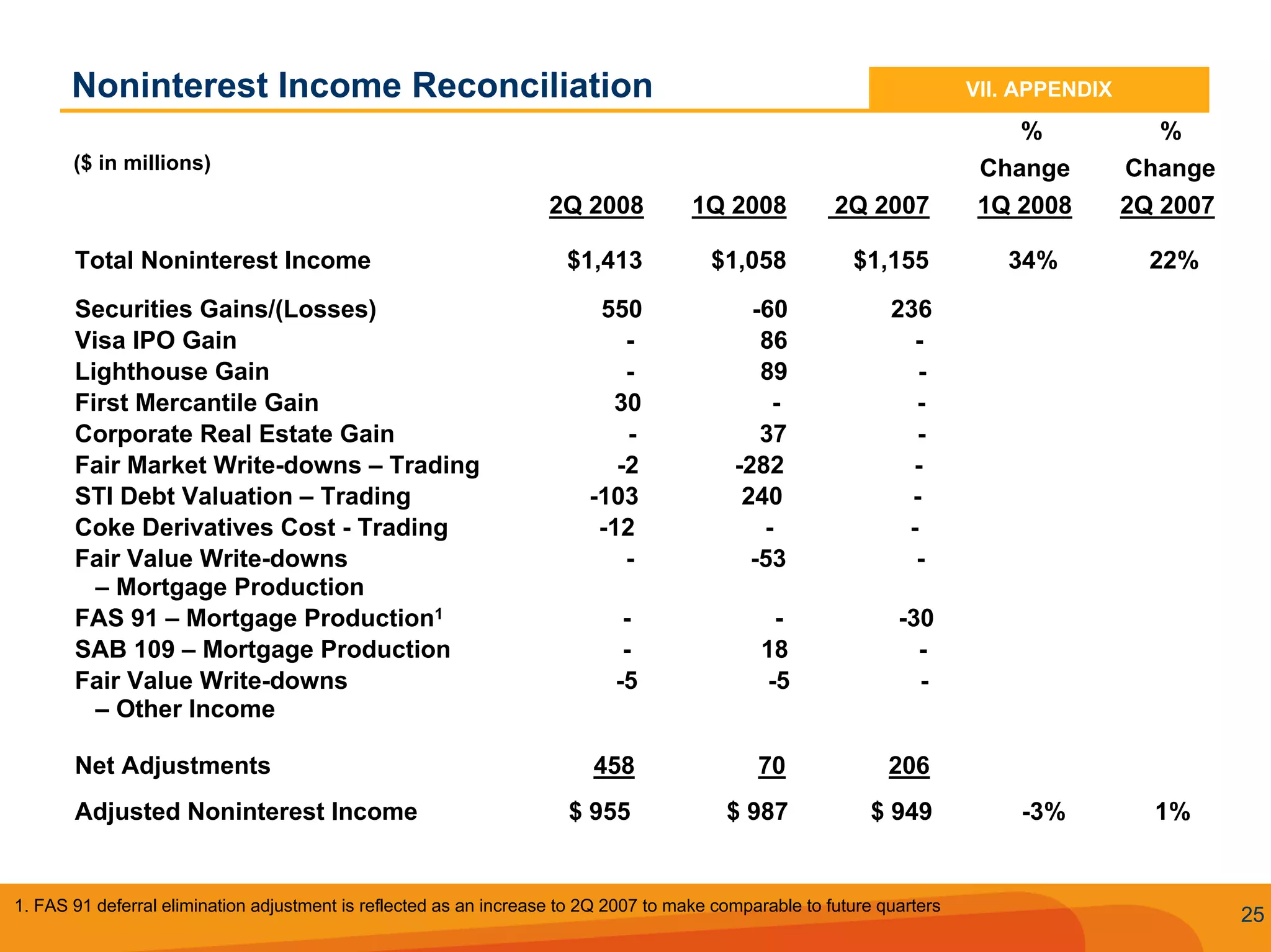

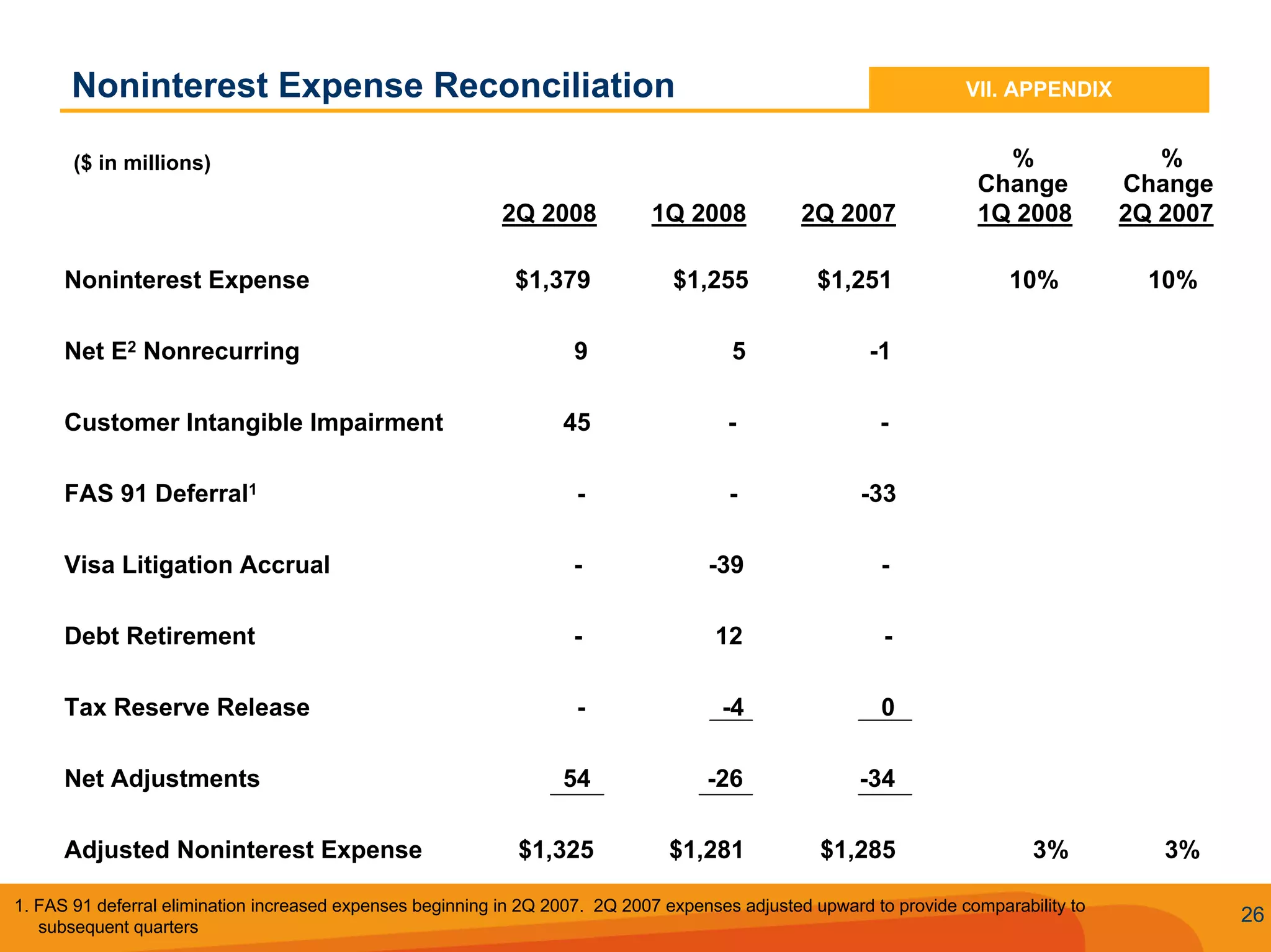

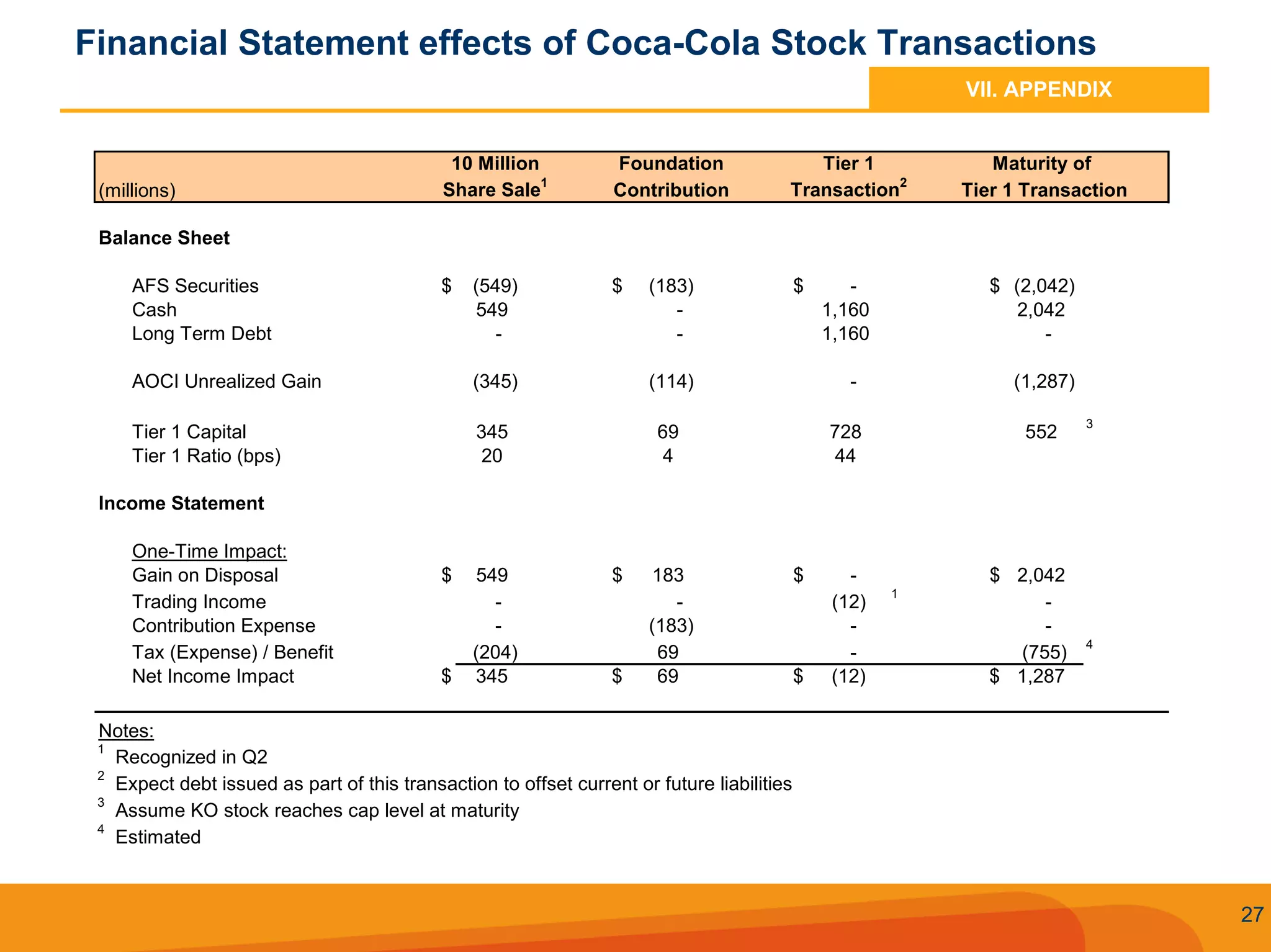

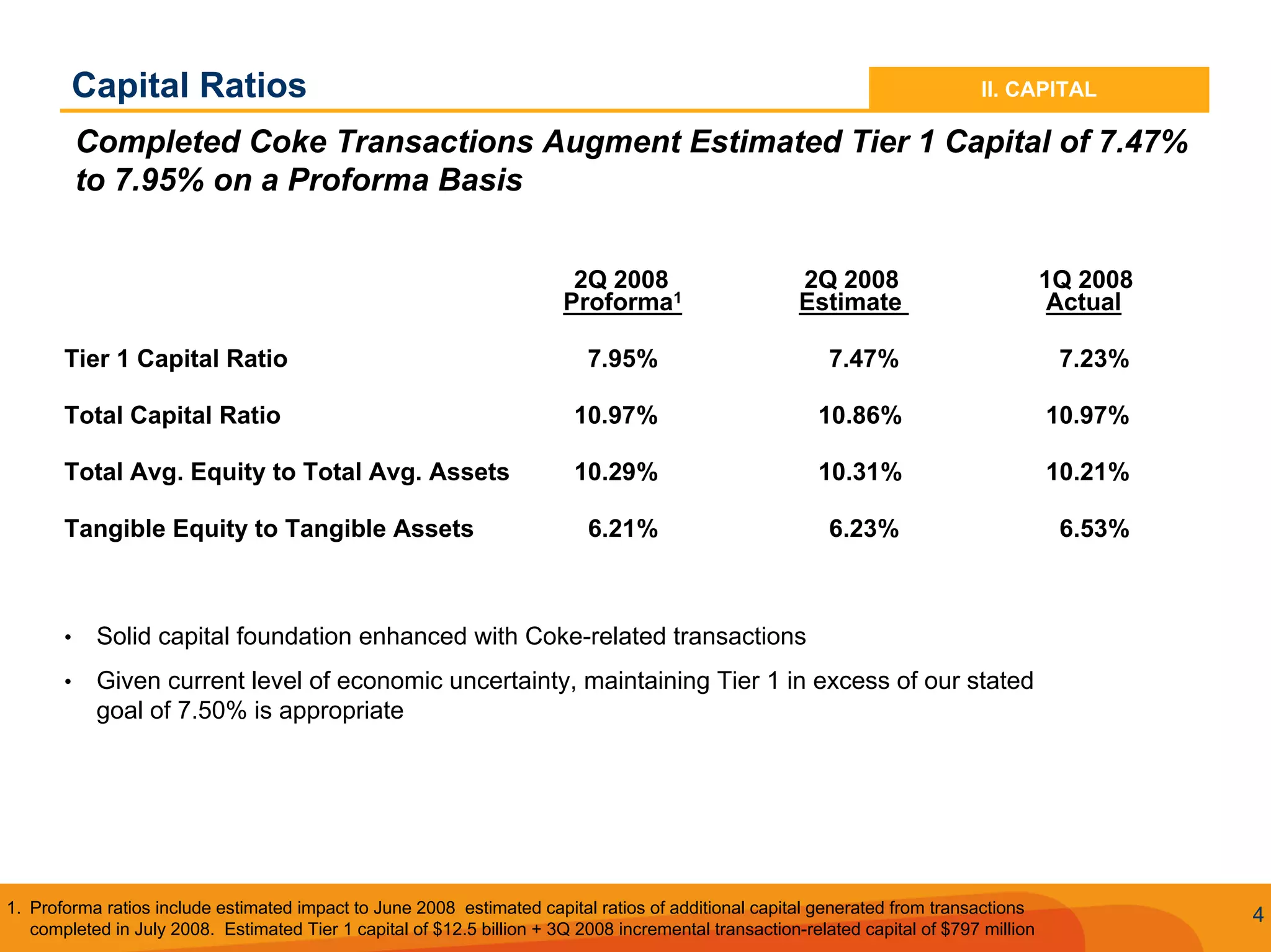

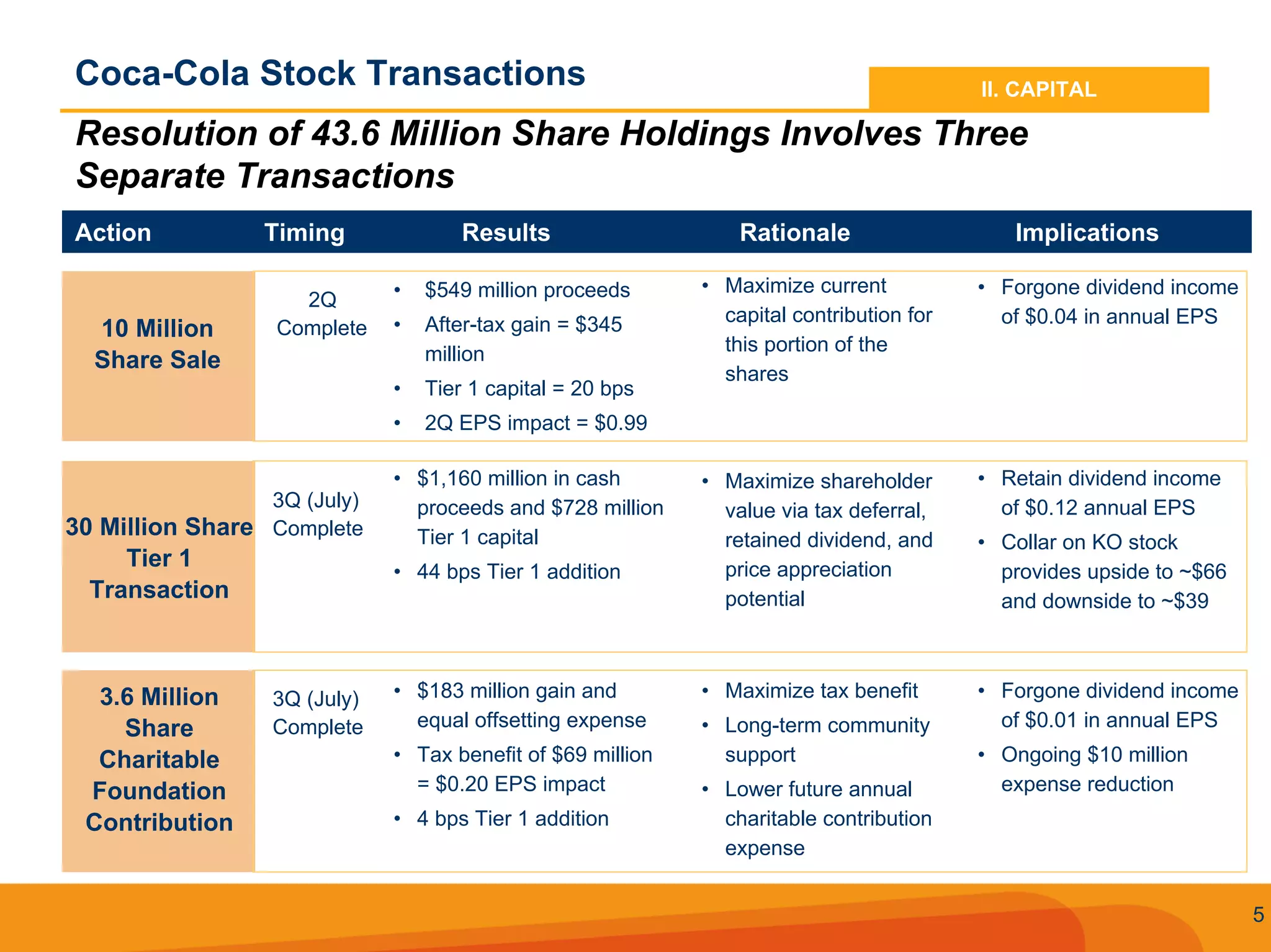

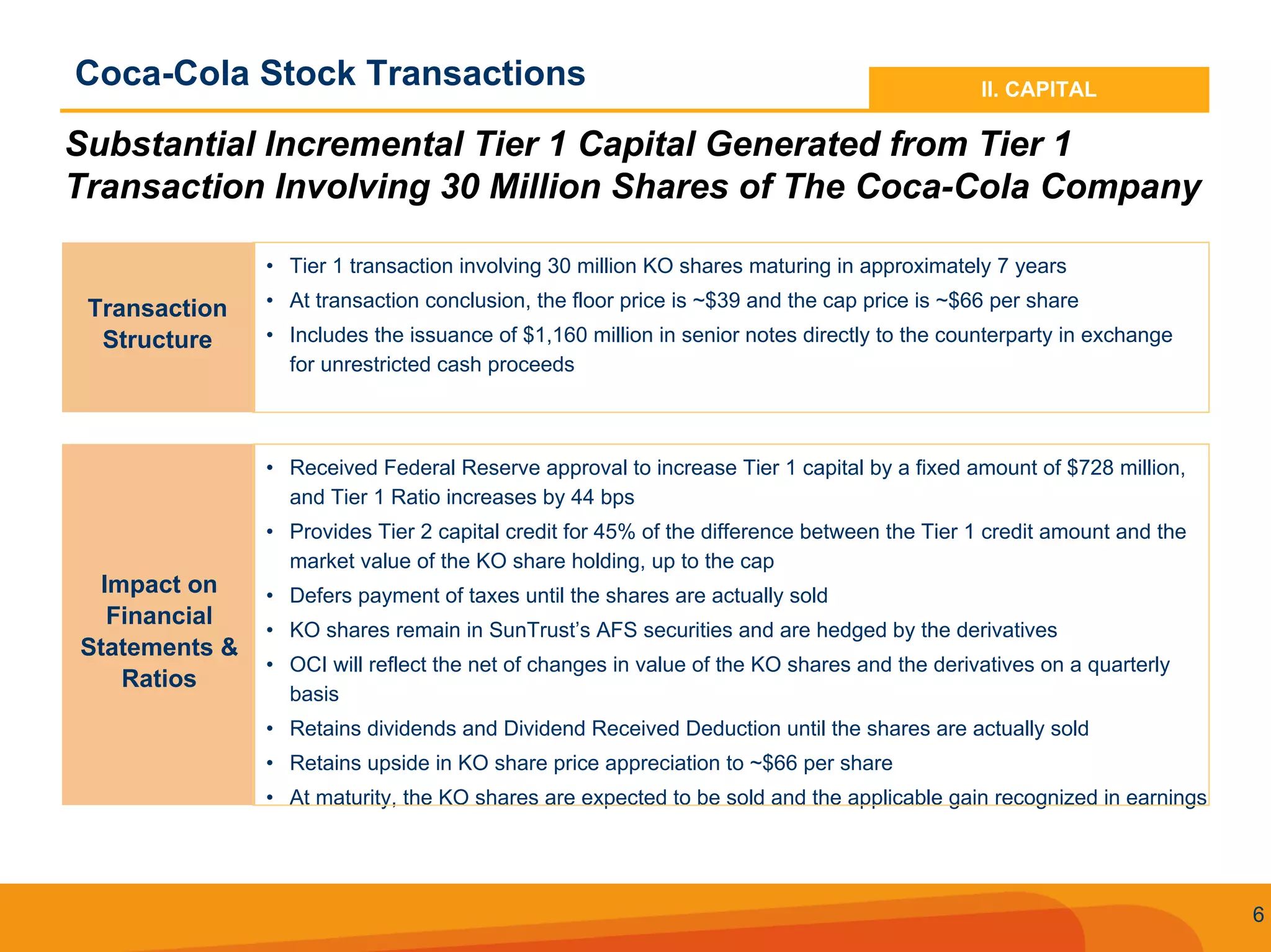

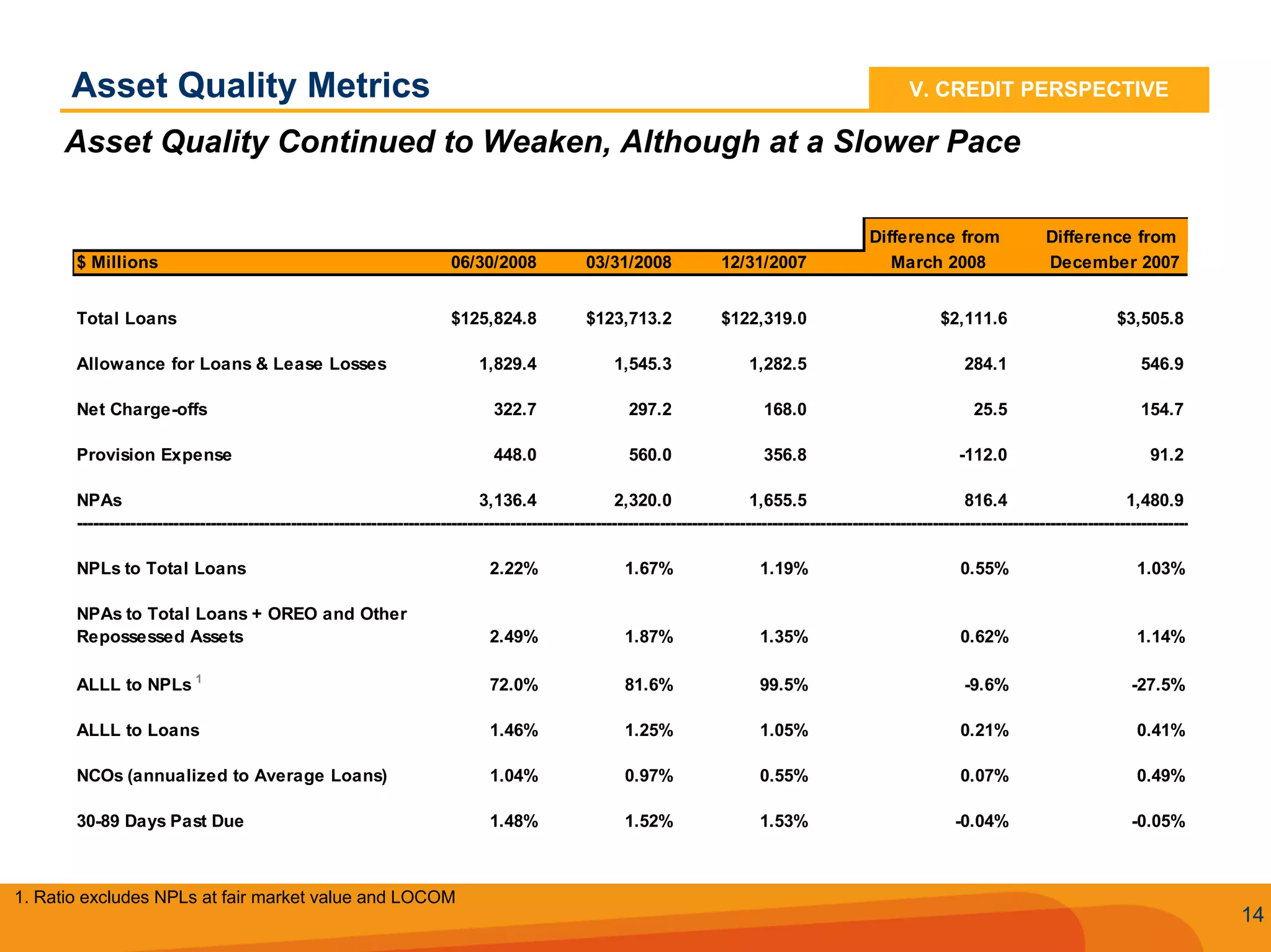

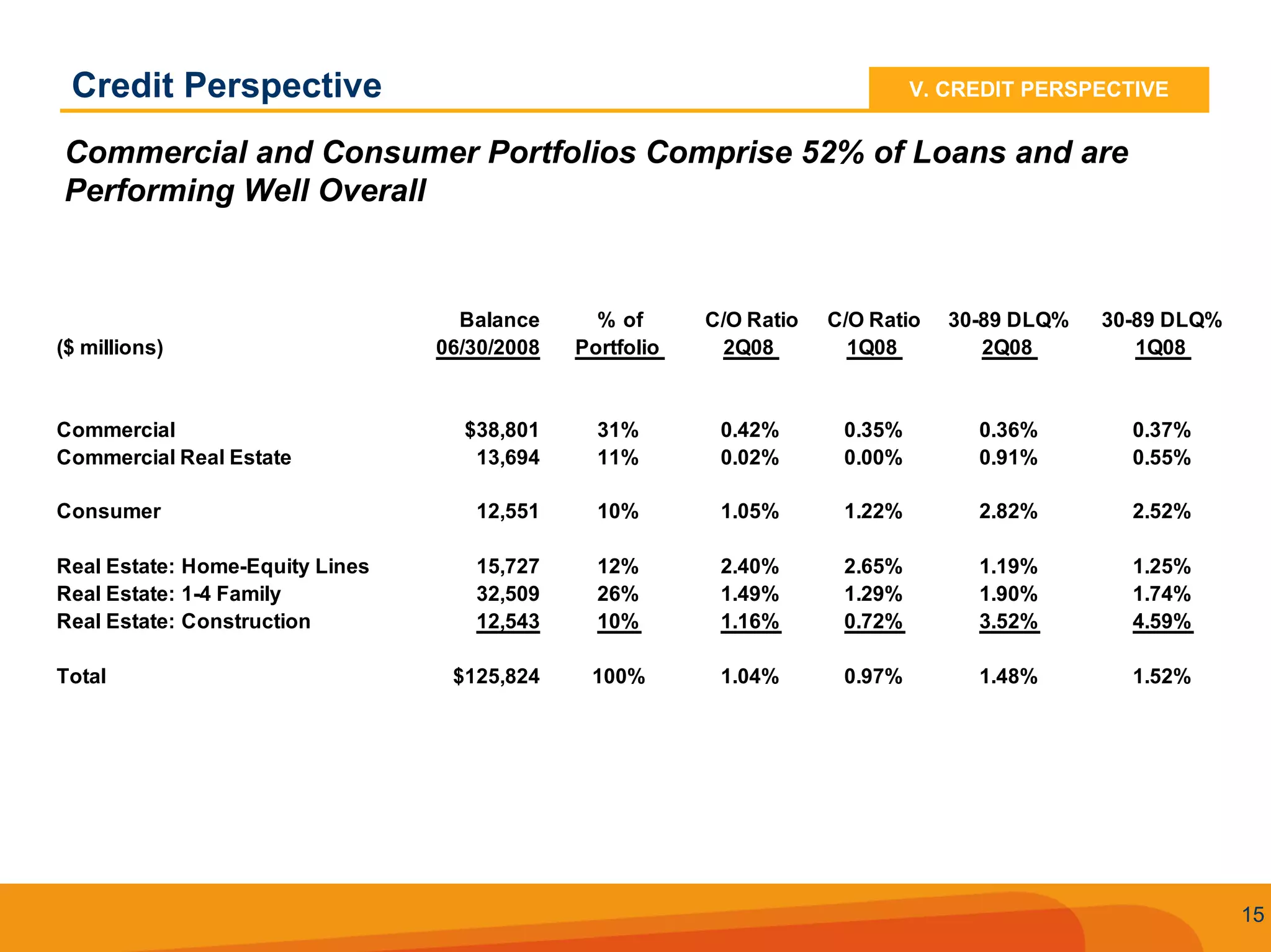

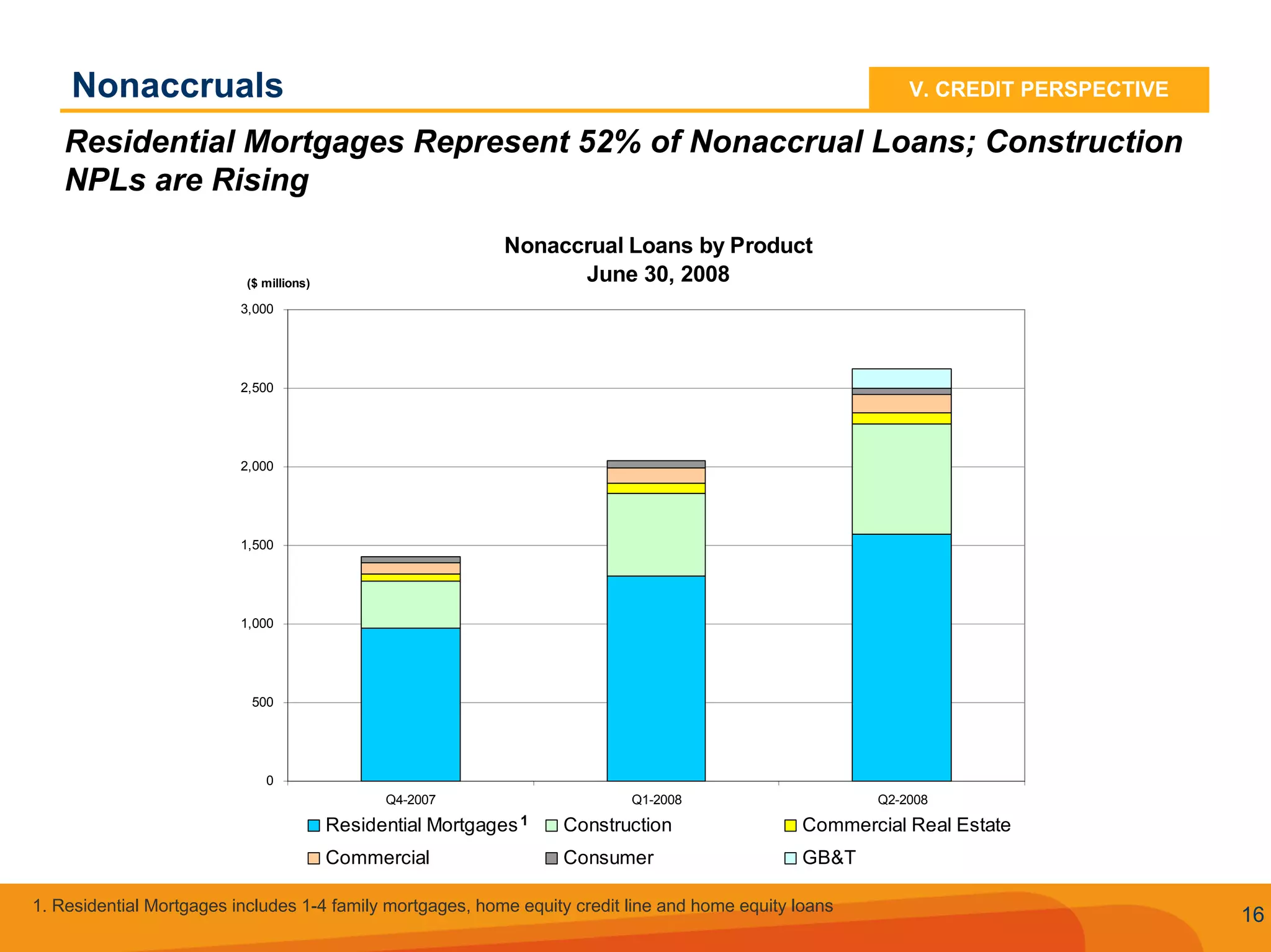

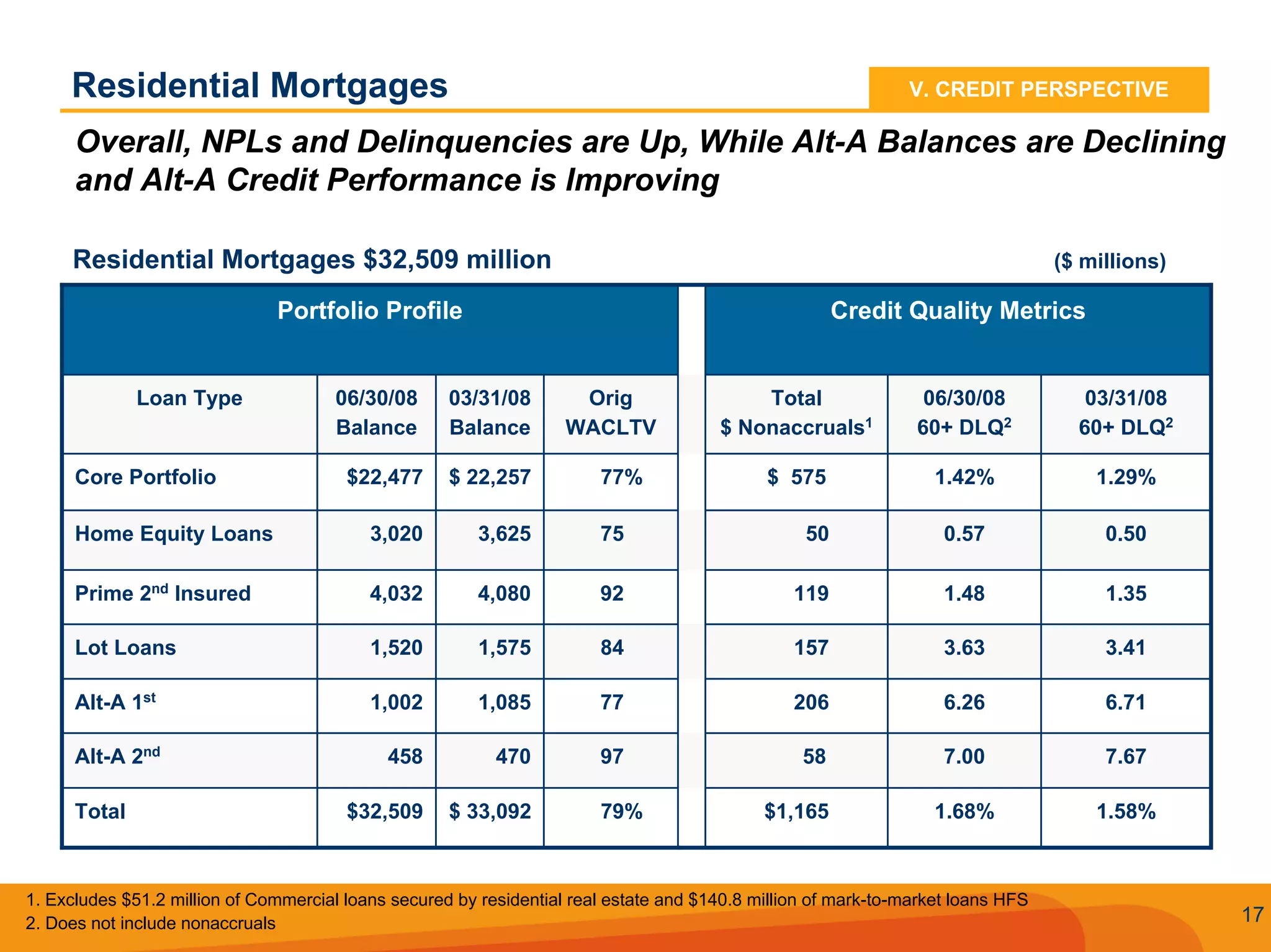

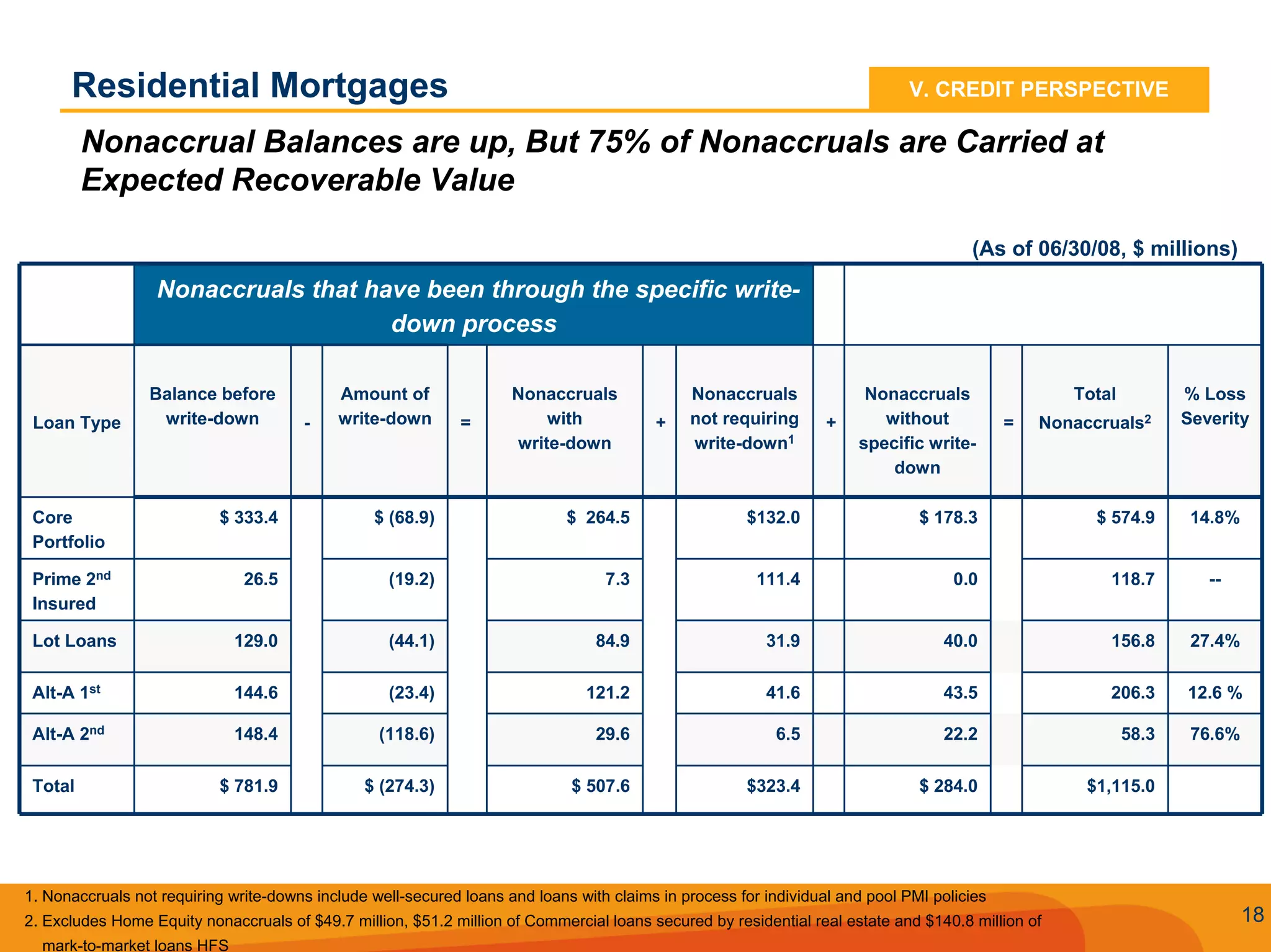

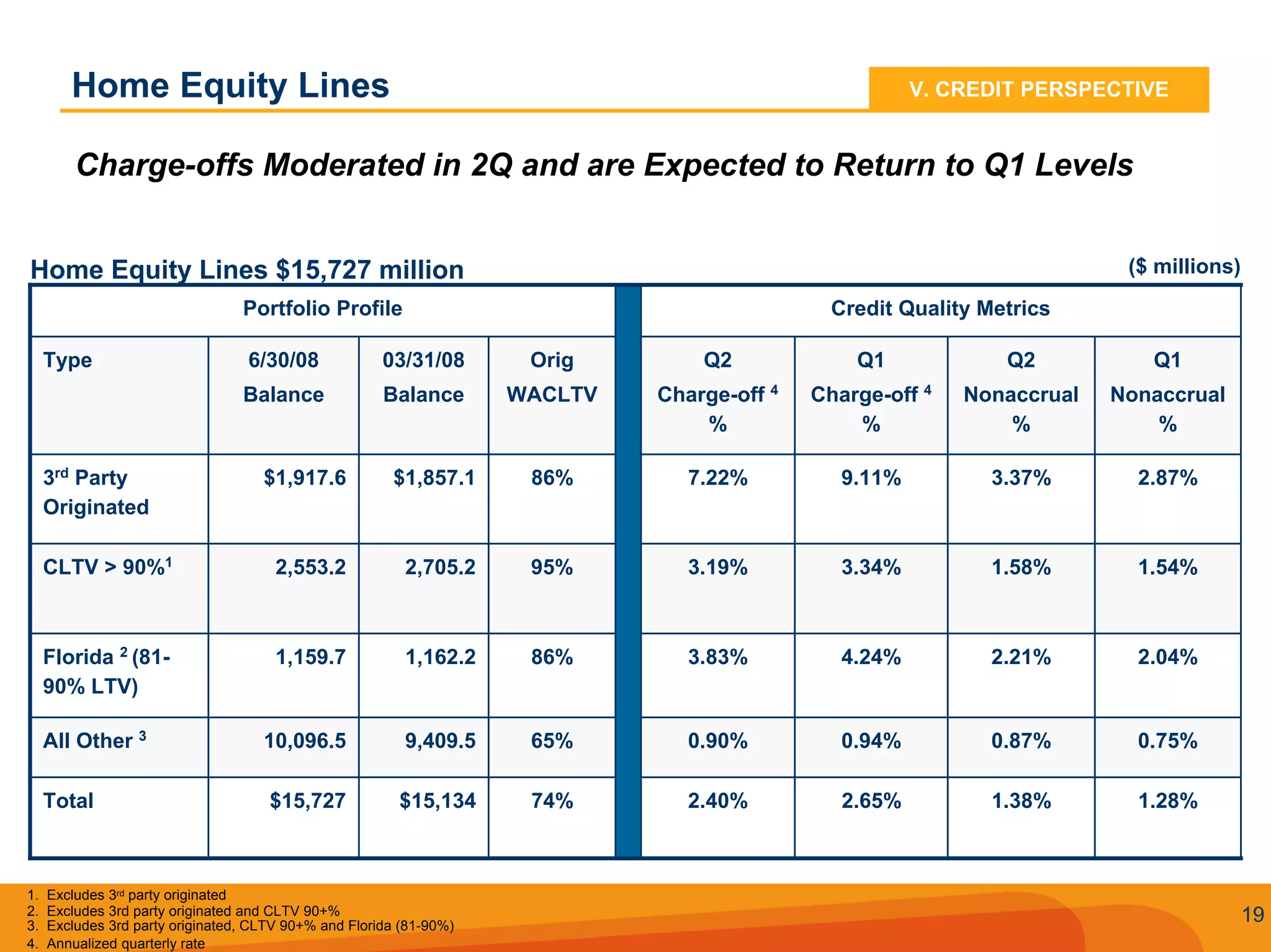

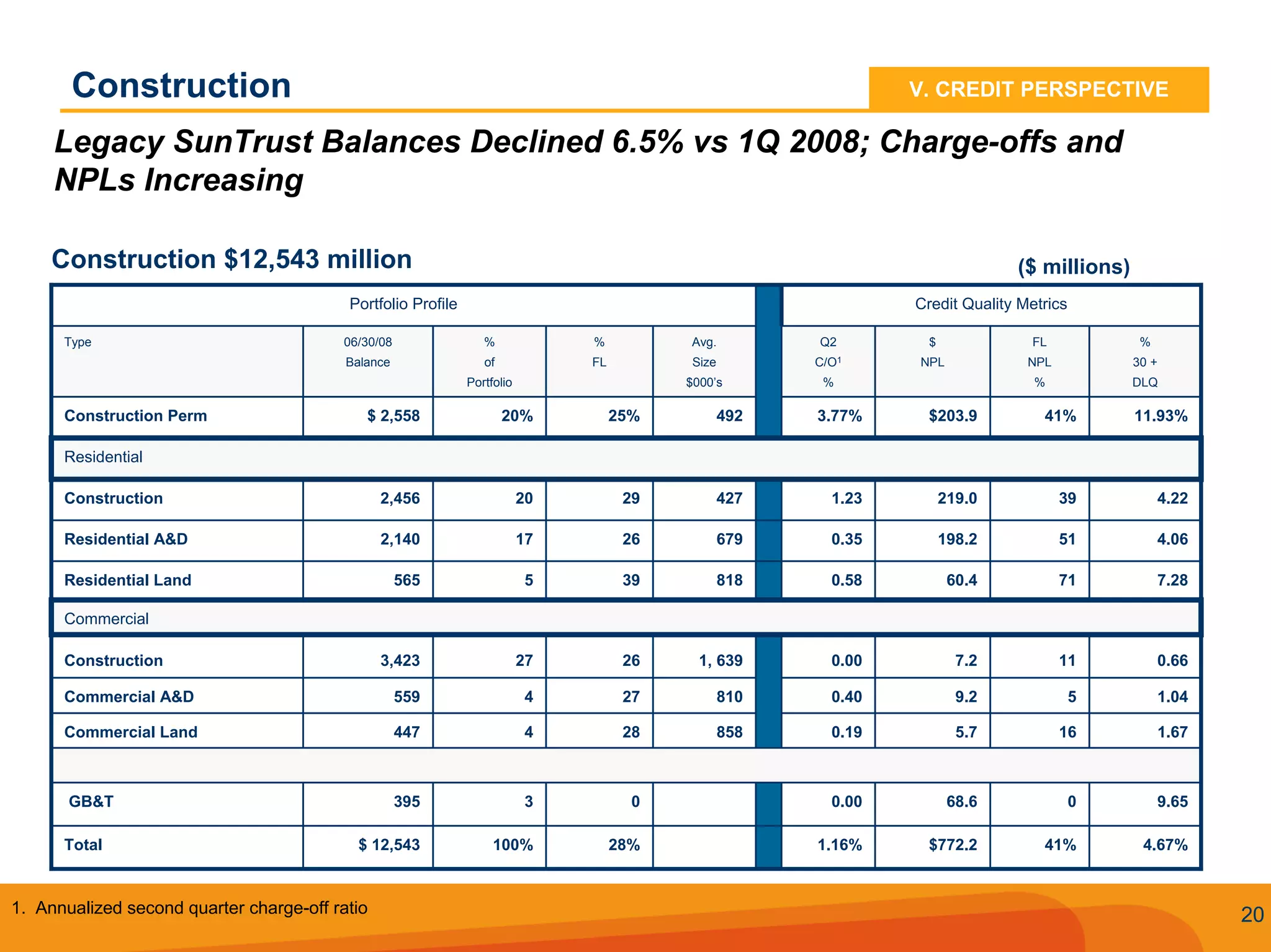

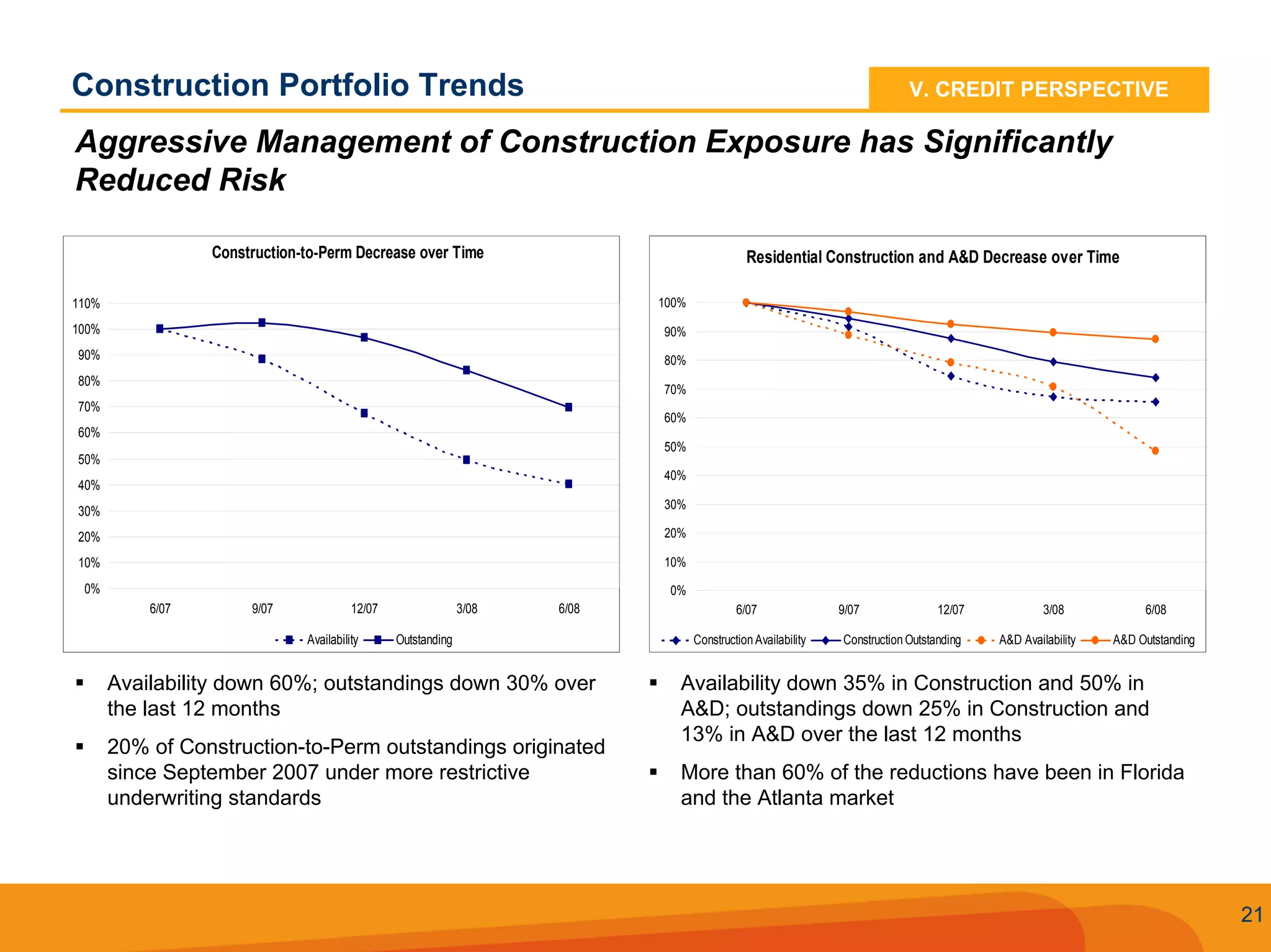

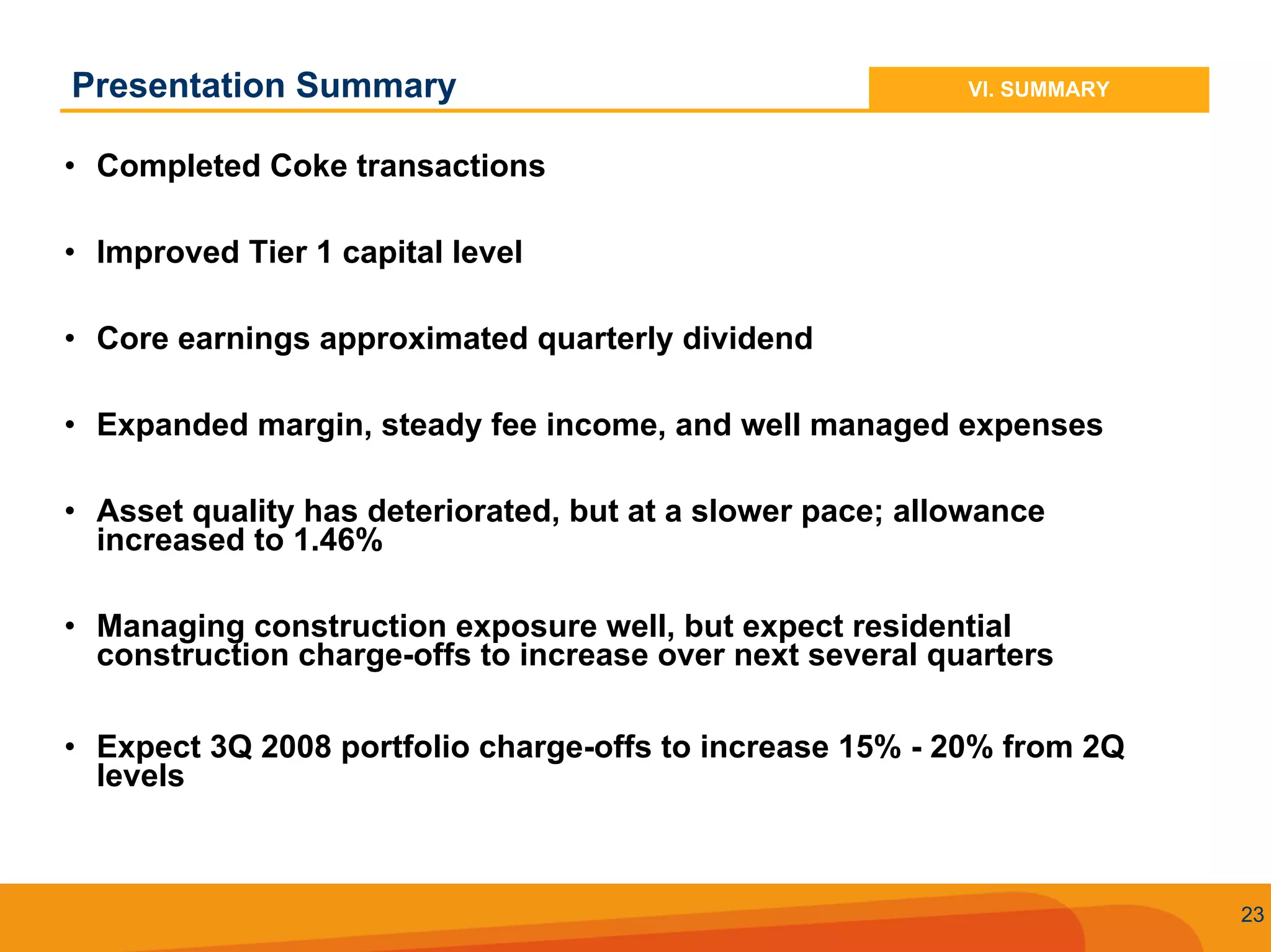

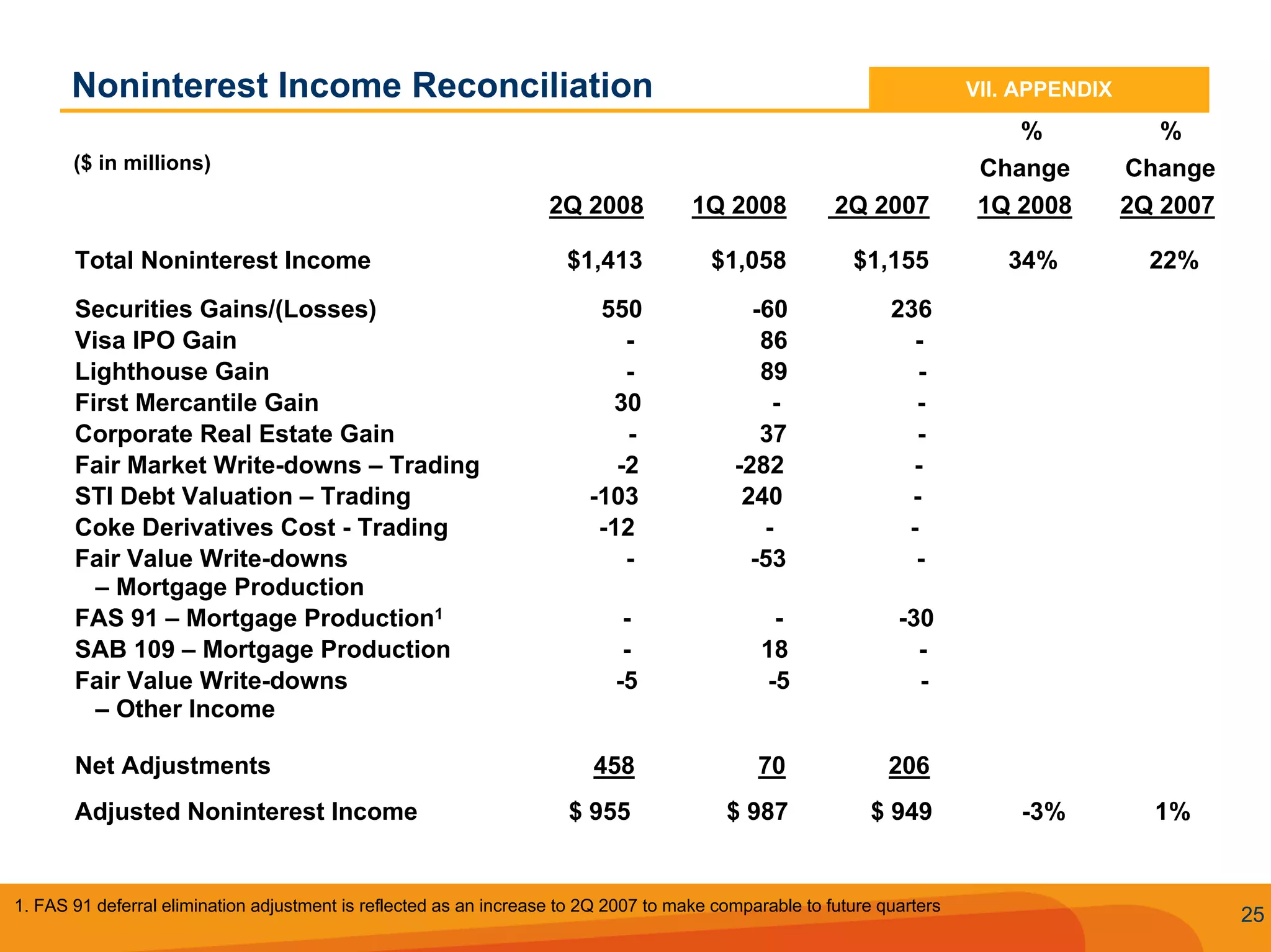

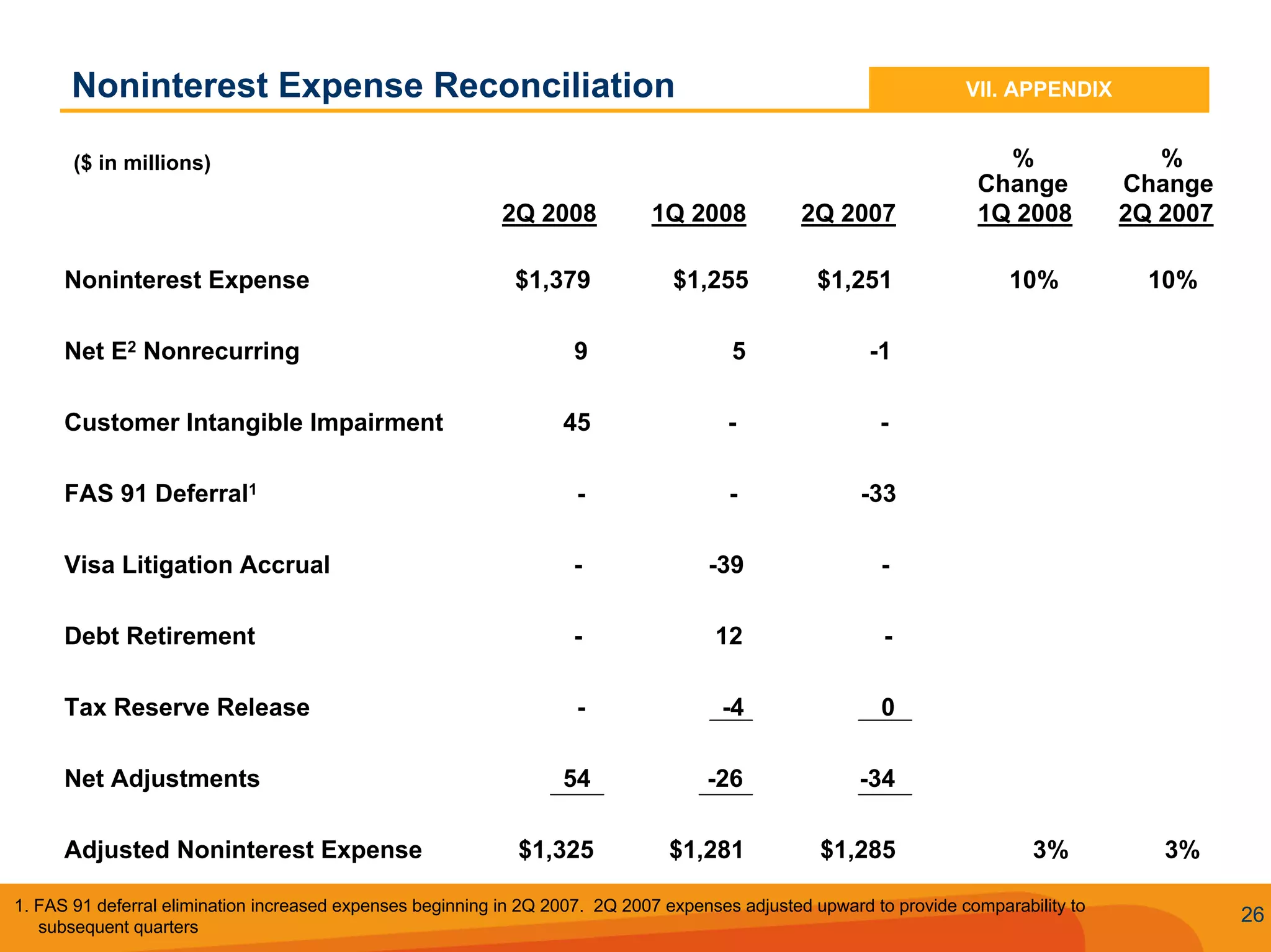

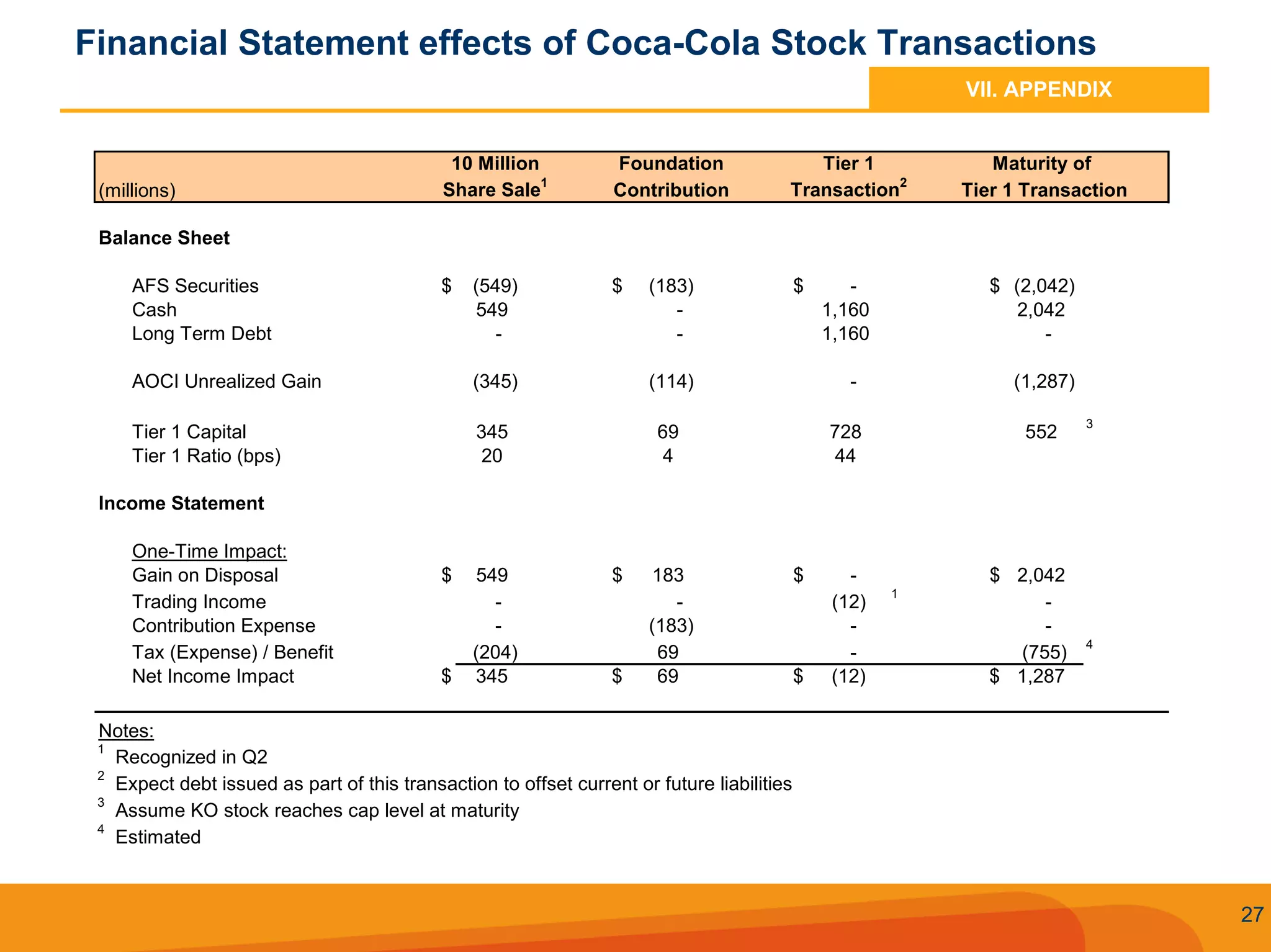

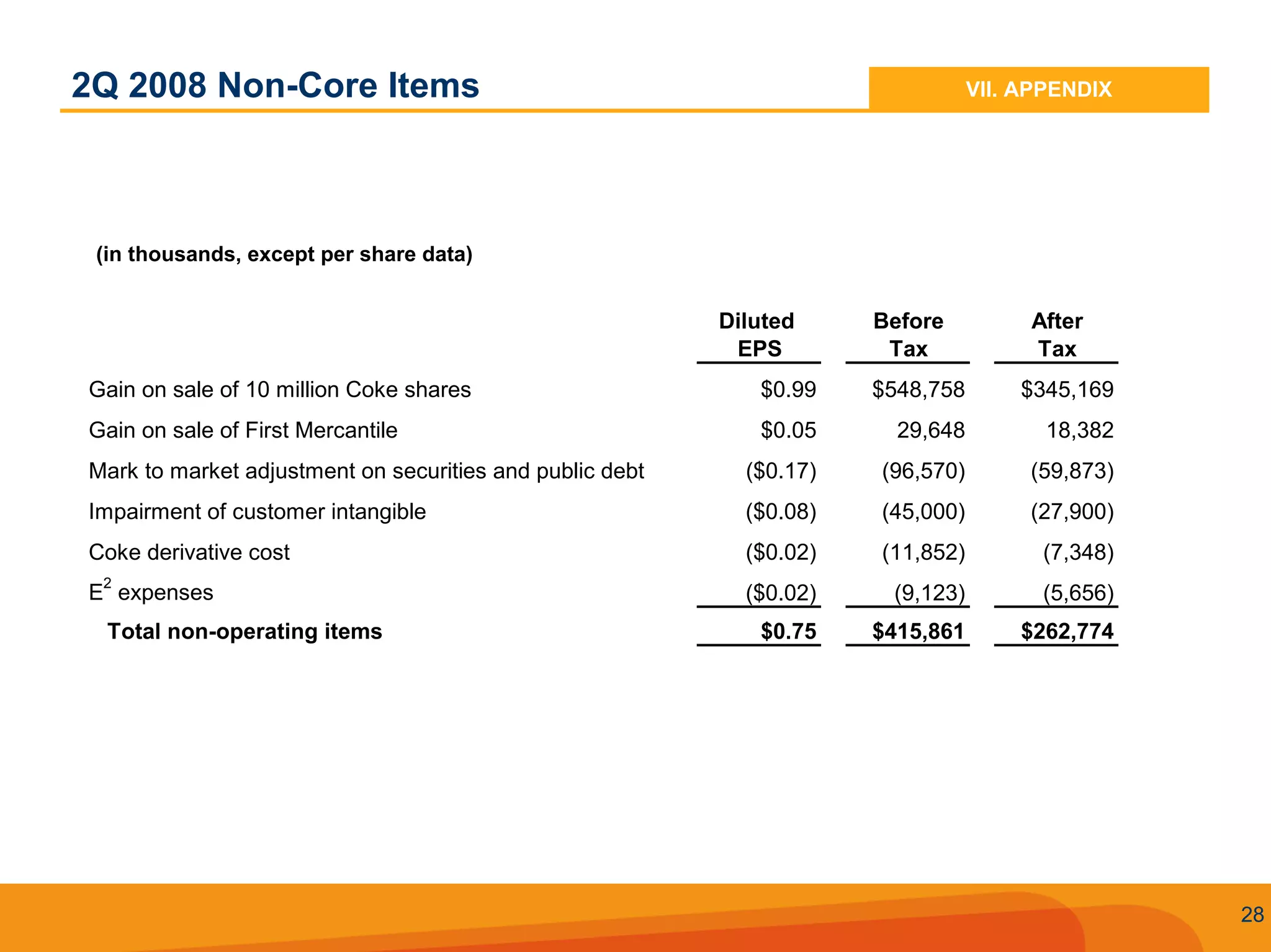

Download to read offline

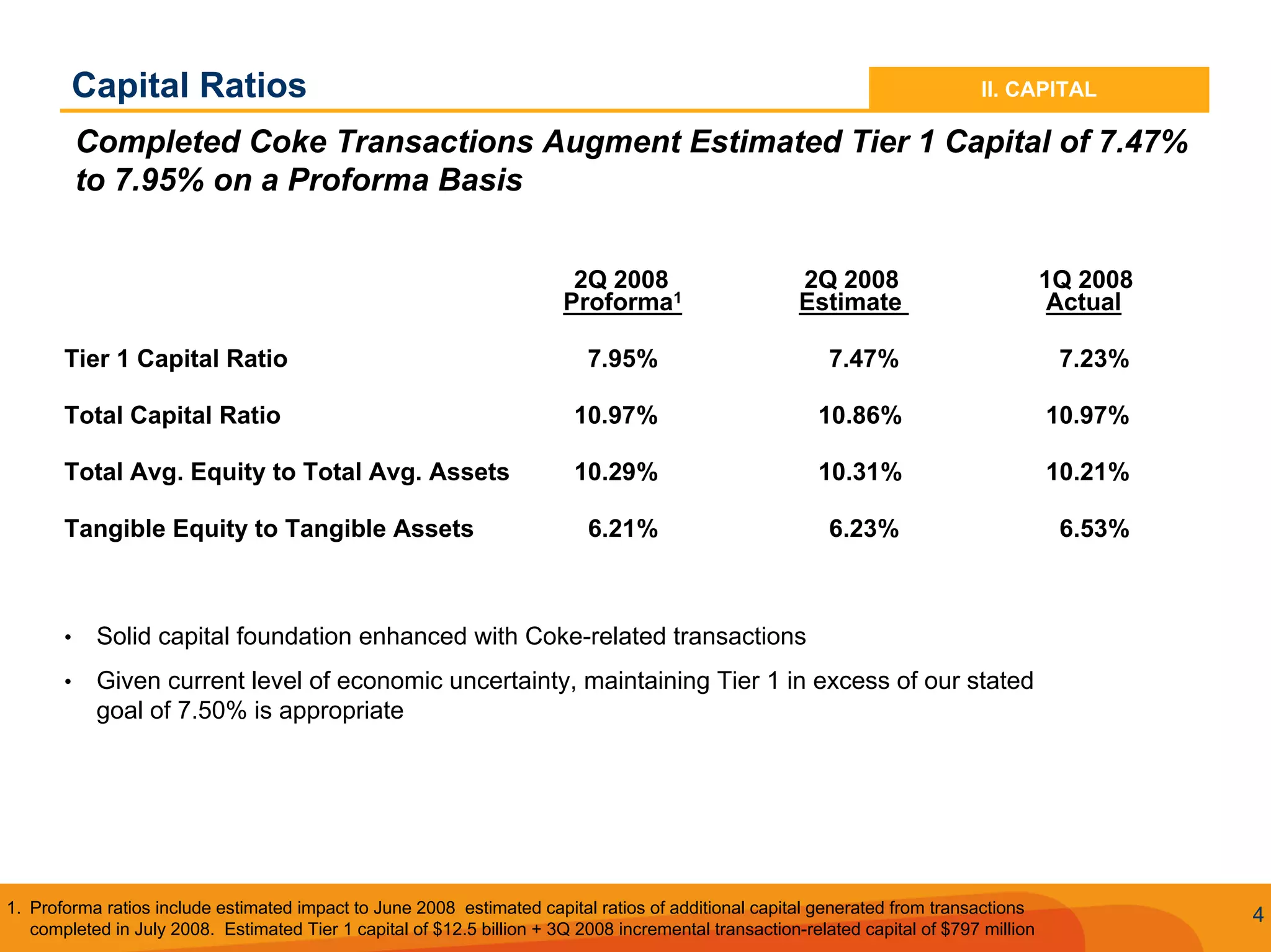

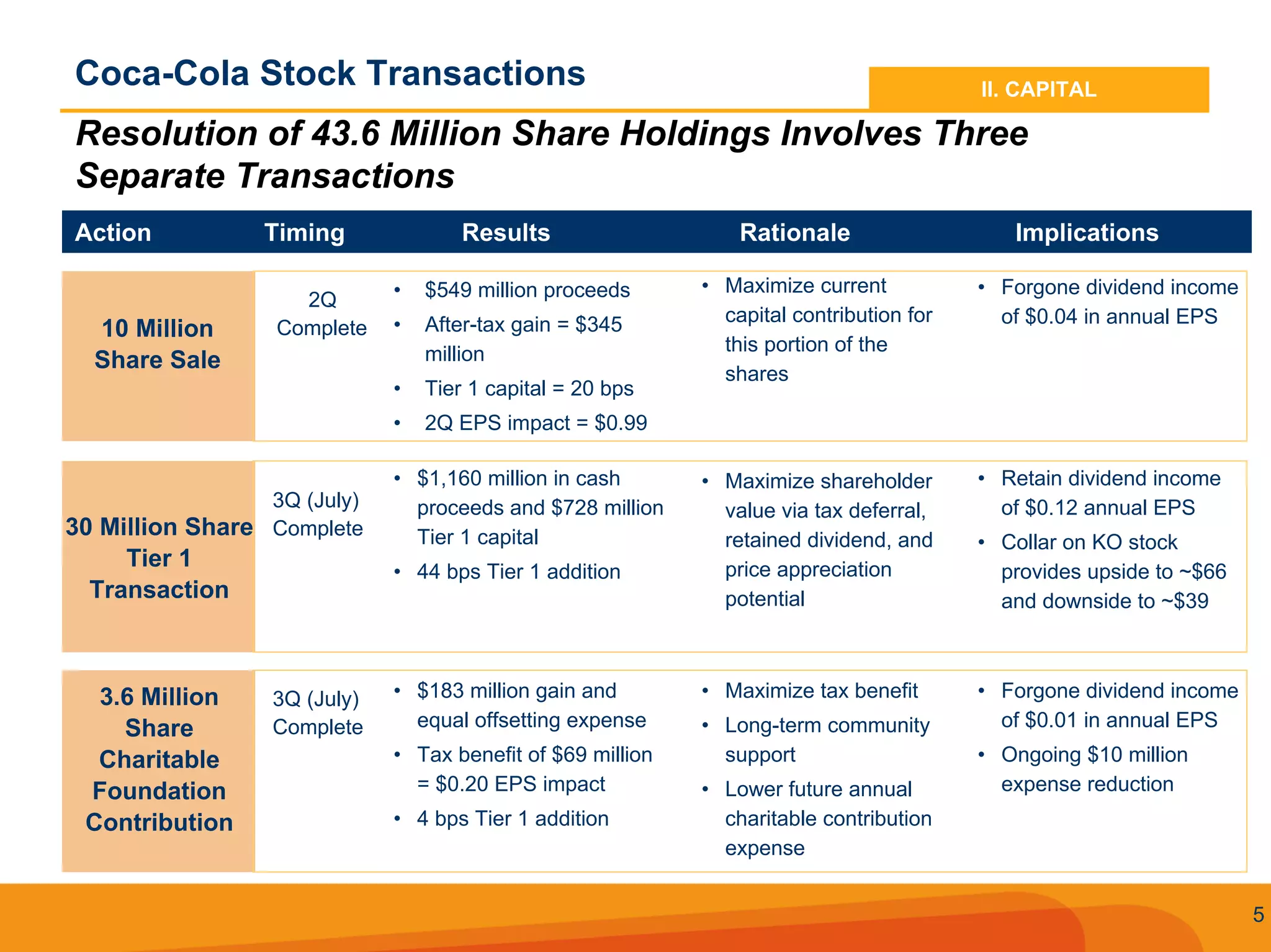

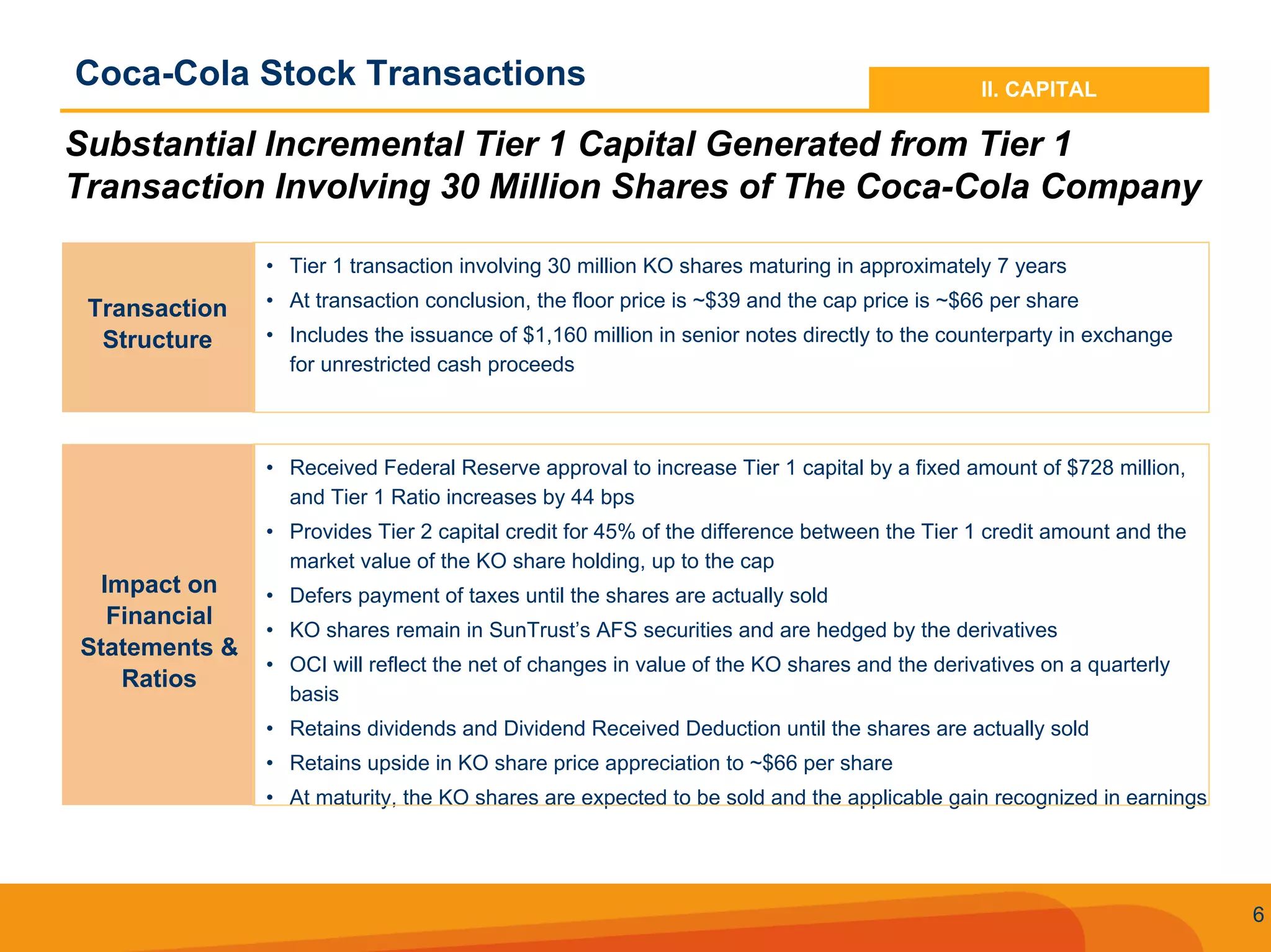

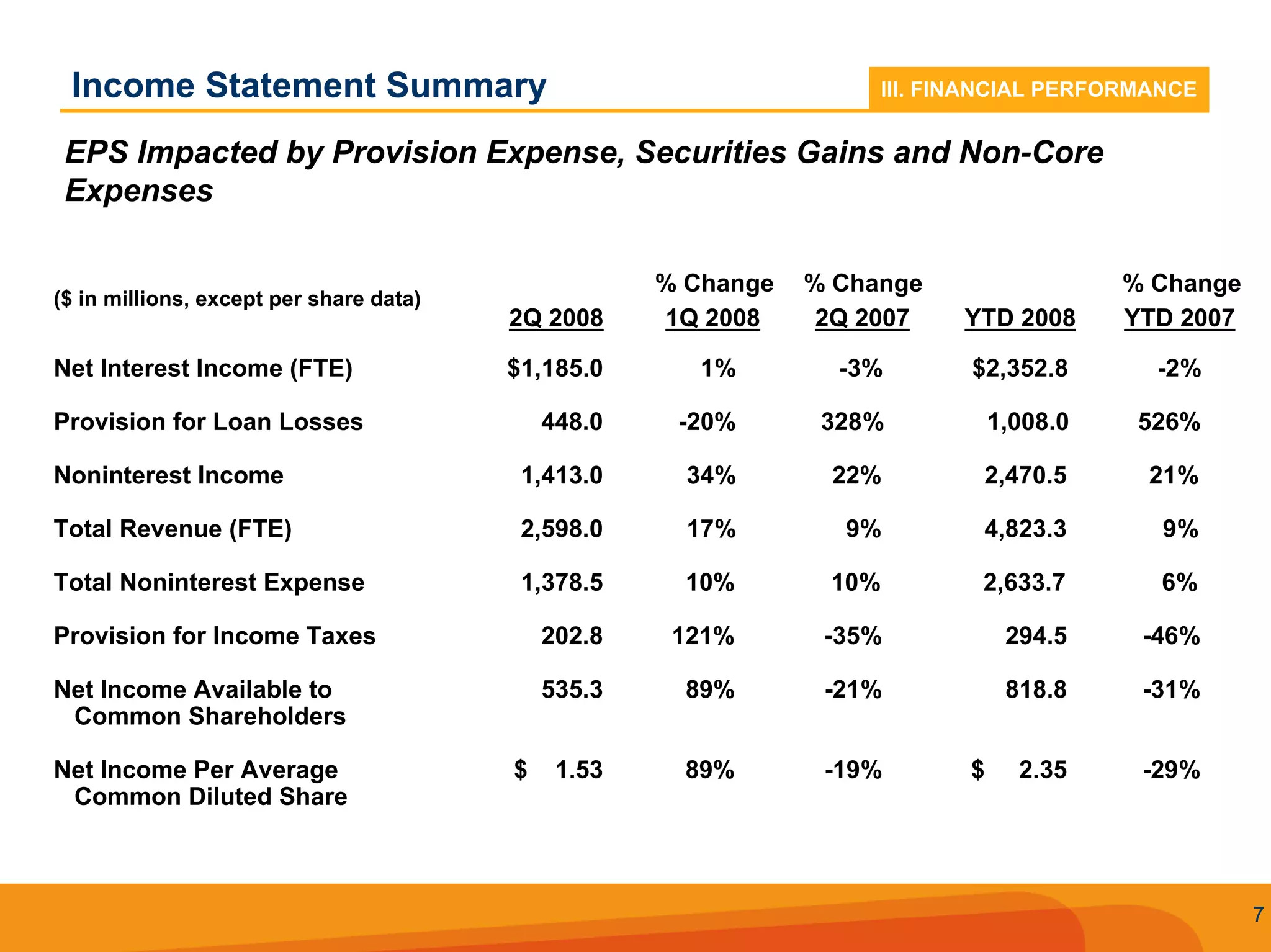

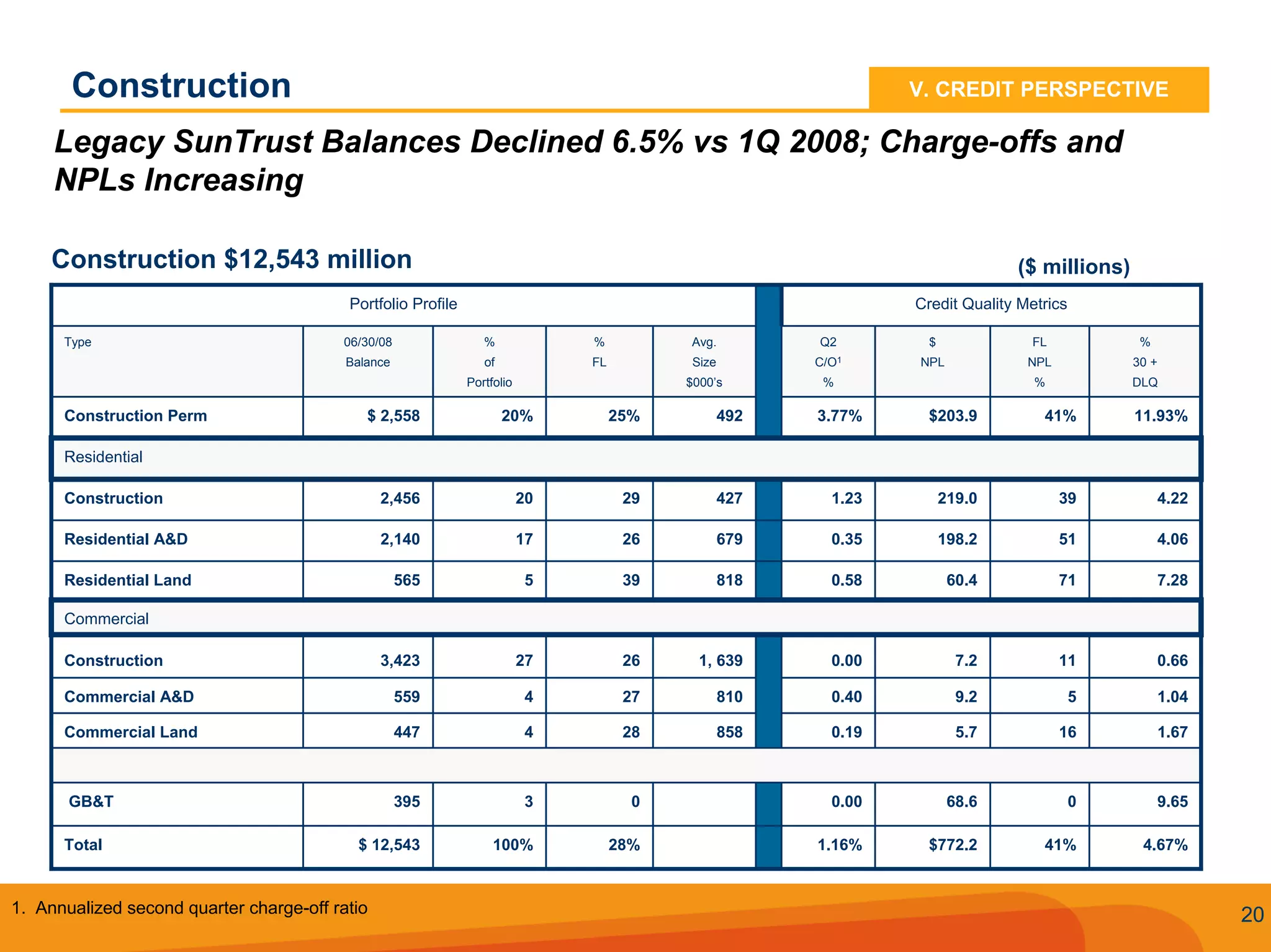

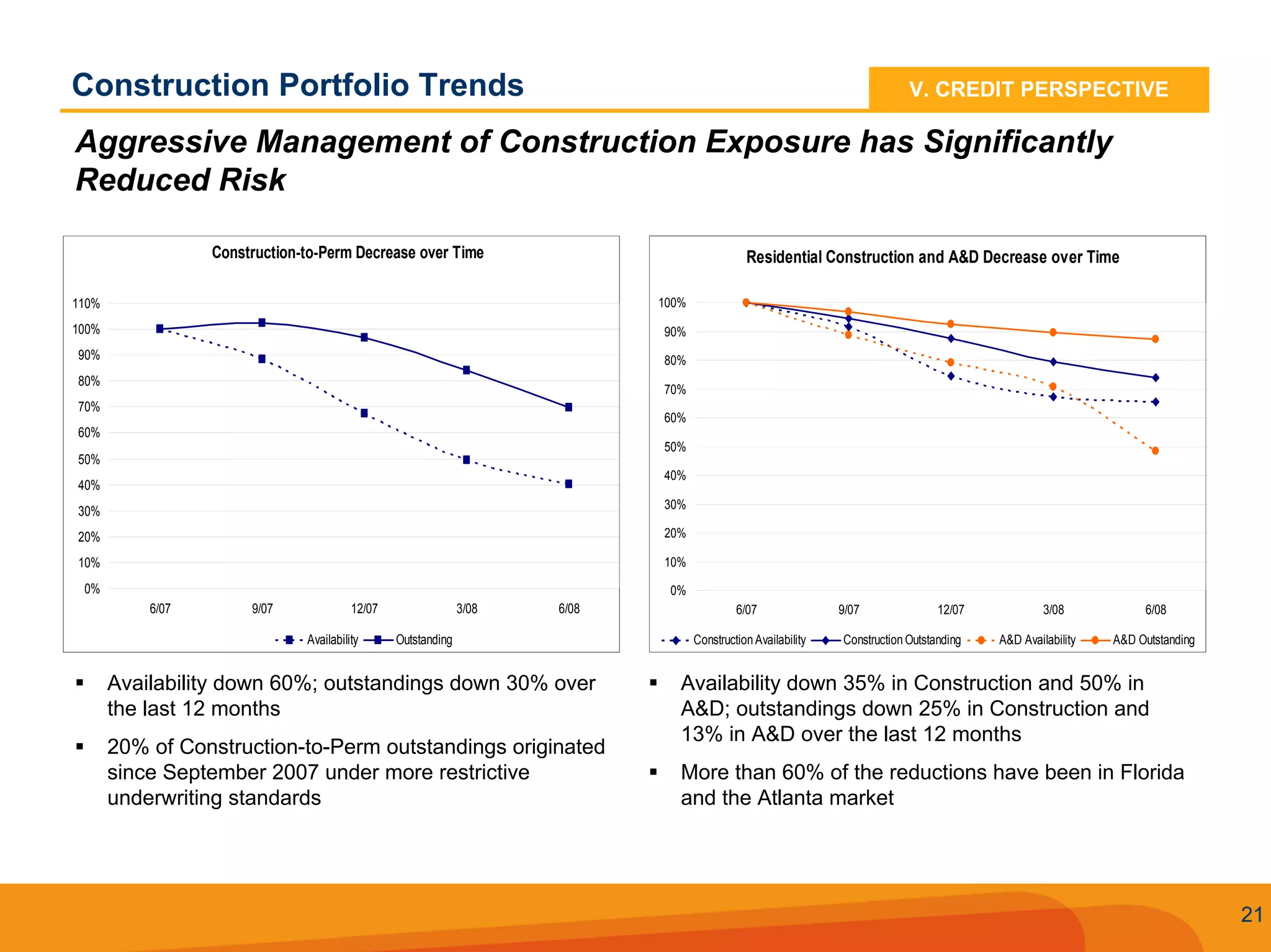

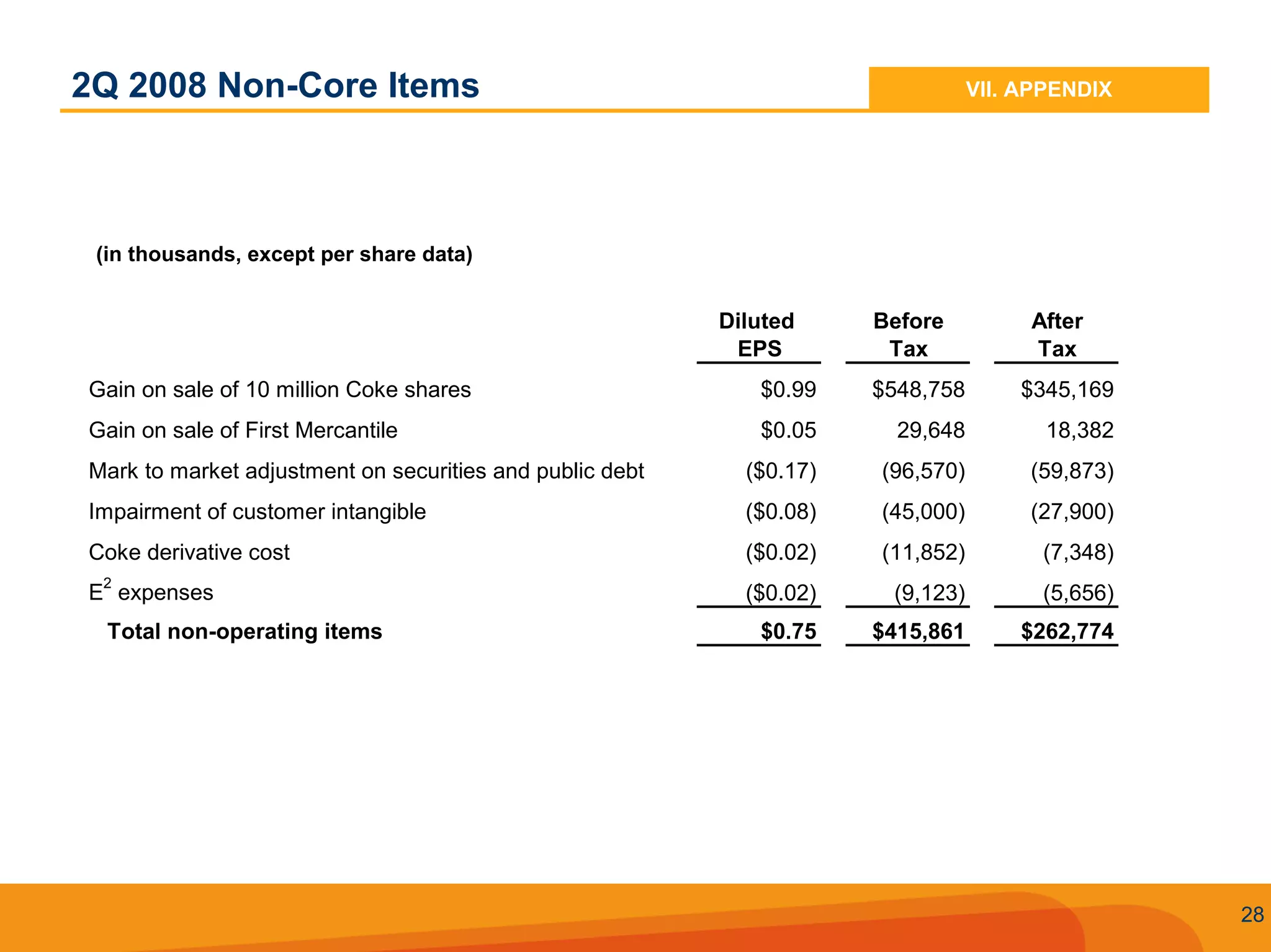

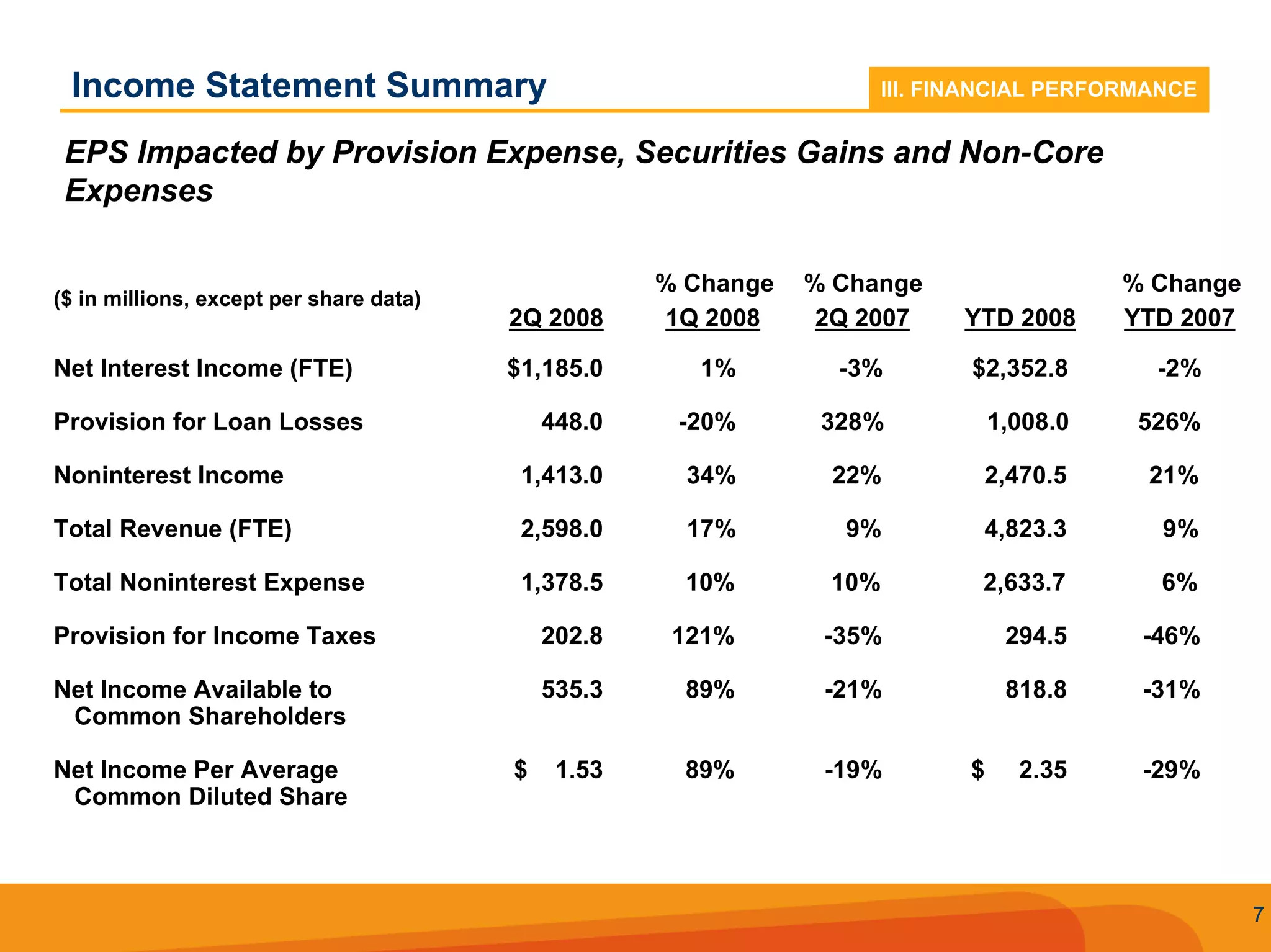

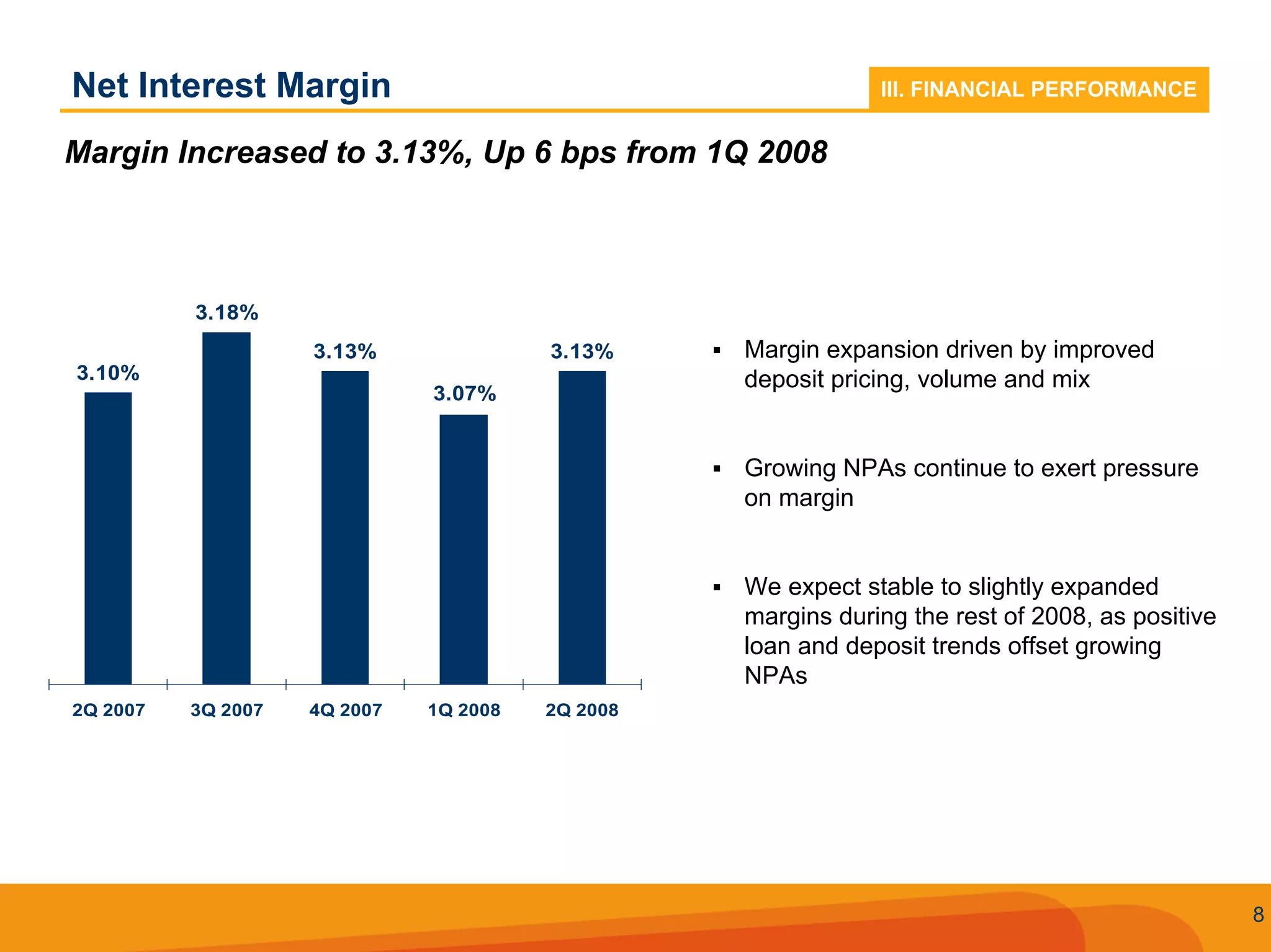

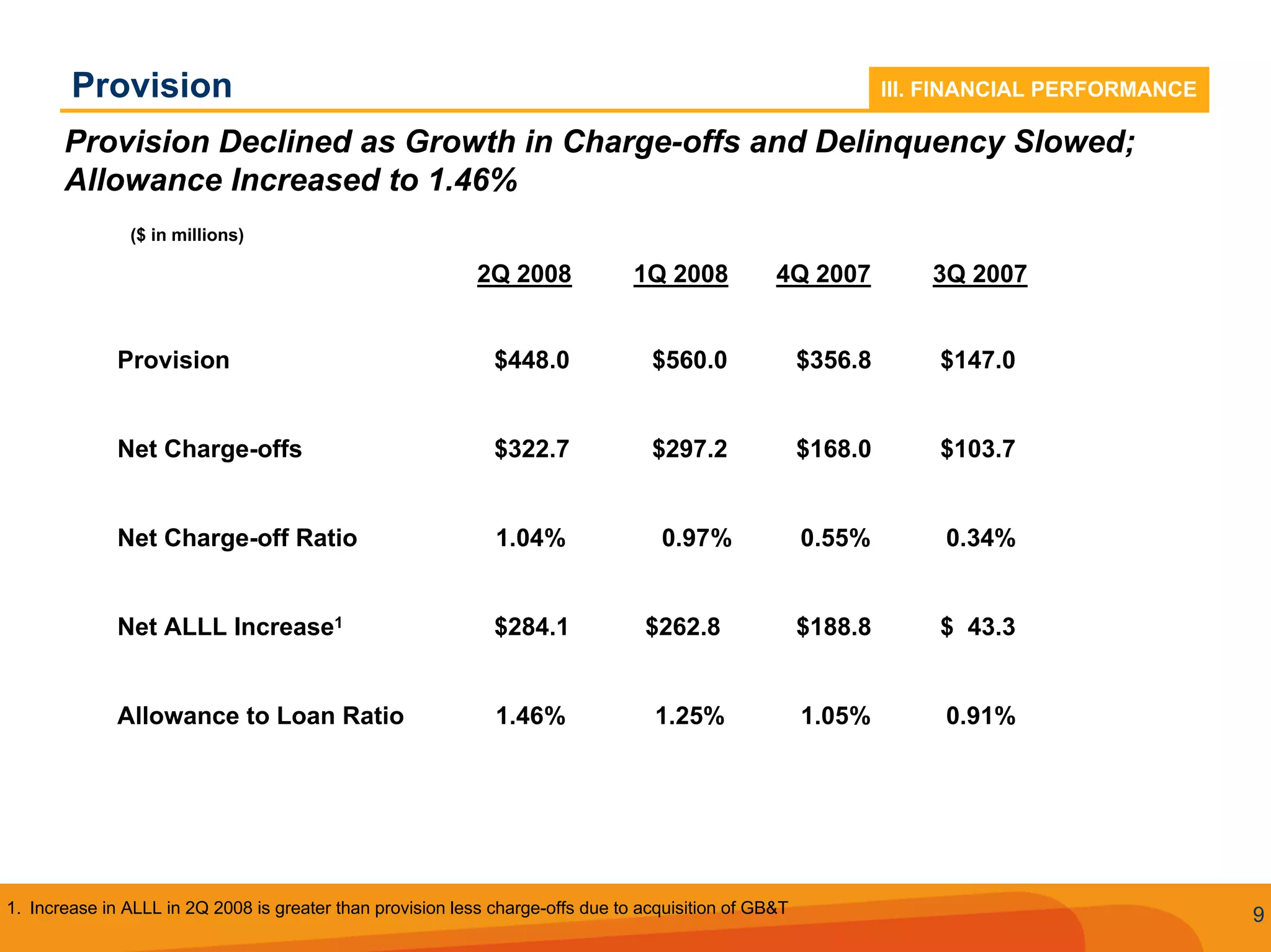

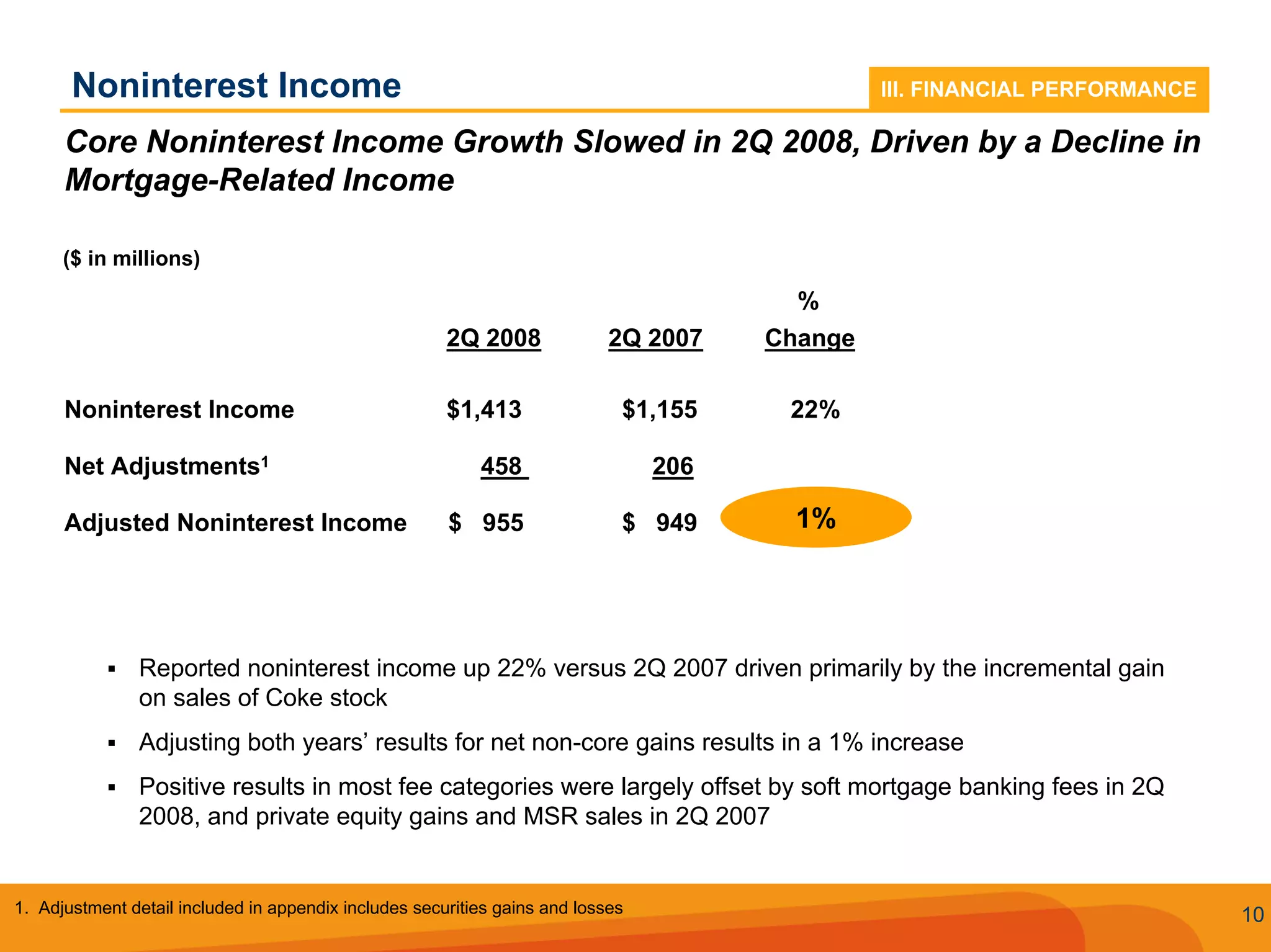

SunTrust Banks reported financial results for 2Q 2008. Net income increased 89% from the prior year due to securities gains, but core revenue growth was soft due to declining mortgage income. The provision for loan losses declined 20% from last quarter but credit quality continued to deteriorate. Capital levels improved substantially following transactions involving Coca-Cola stock, raising the estimated Tier 1 capital ratio to 7.47% from 7.23% last quarter. The net interest margin increased to 3.13% driven by improved deposit pricing and mix.