Embed presentation

Download to read offline

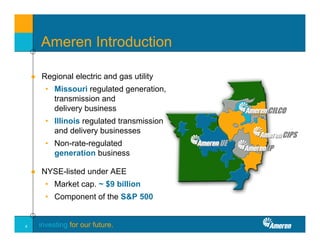

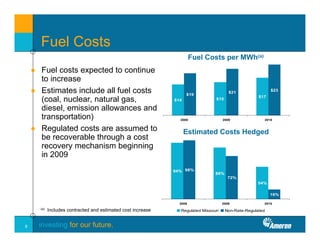

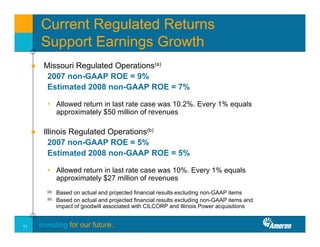

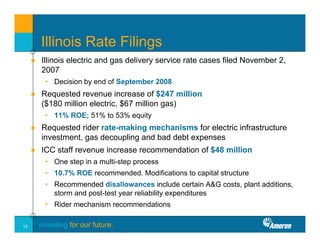

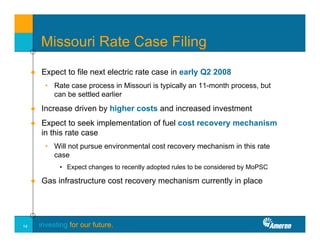

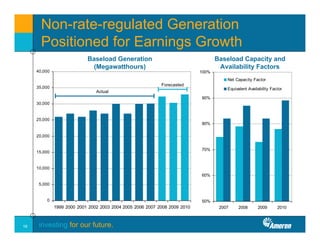

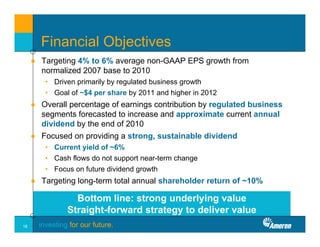

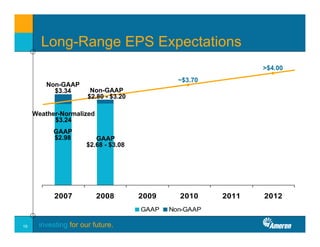

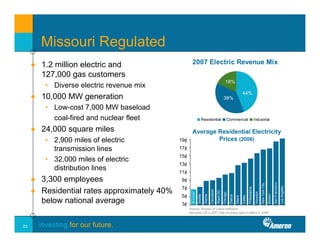

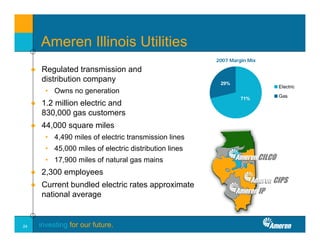

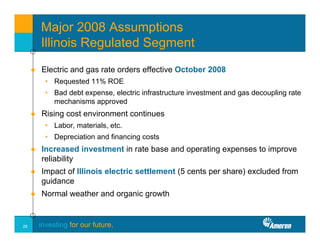

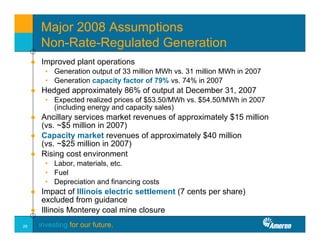

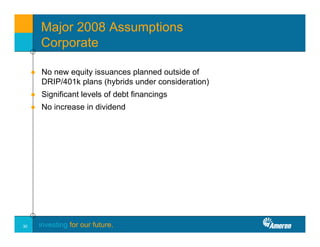

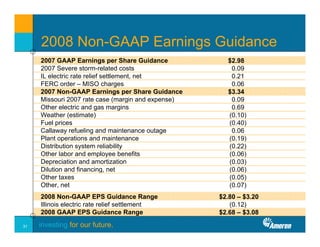

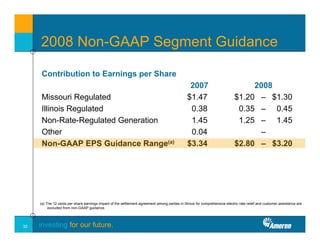

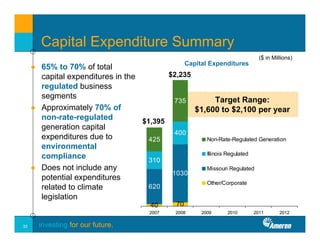

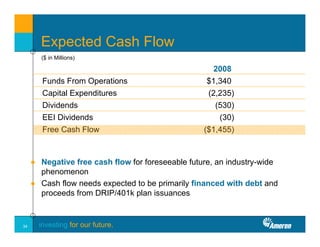

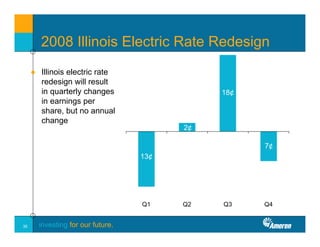

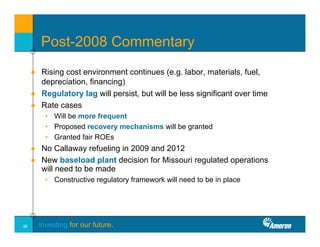

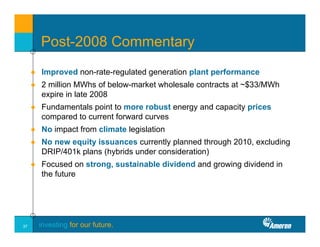

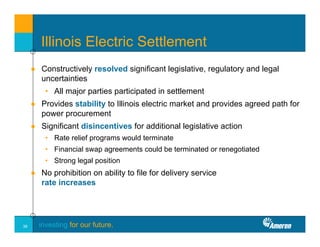

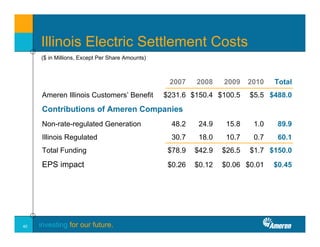

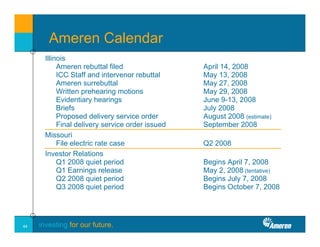

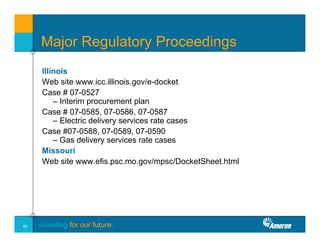

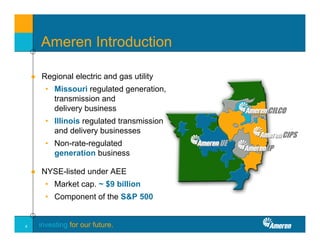

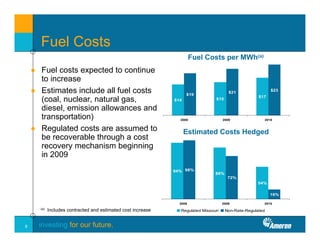

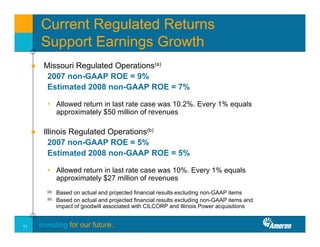

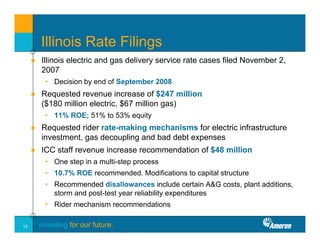

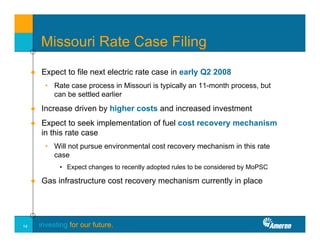

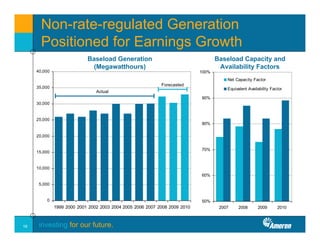

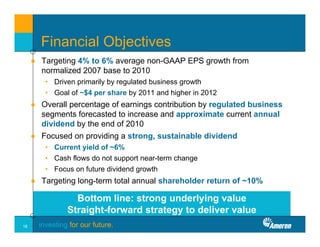

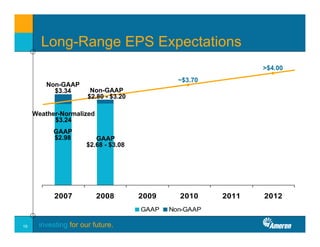

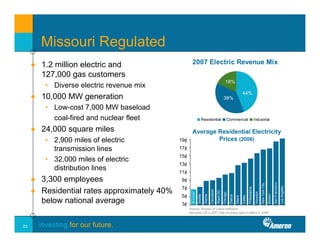

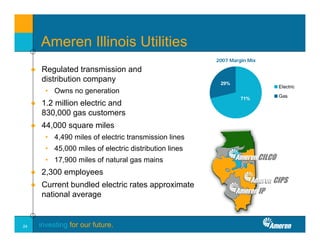

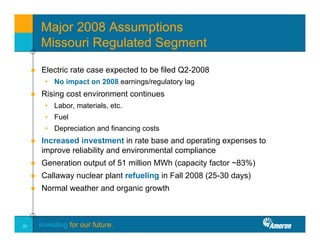

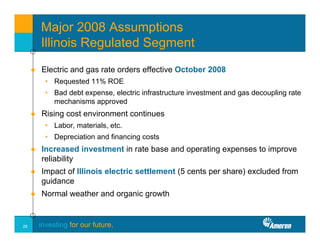

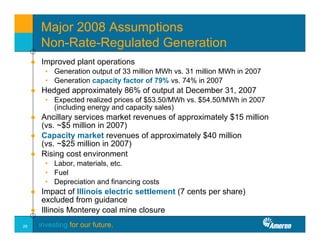

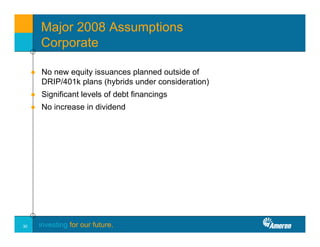

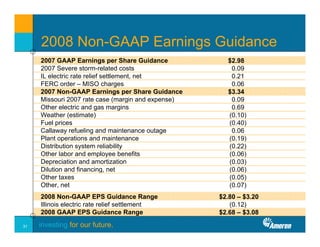

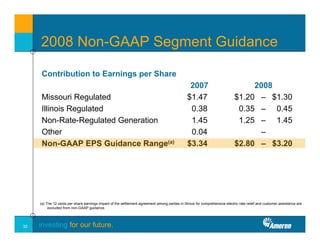

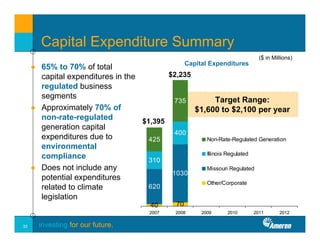

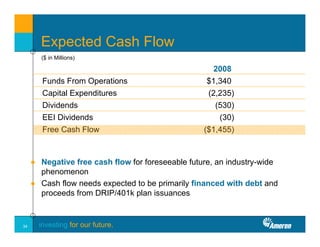

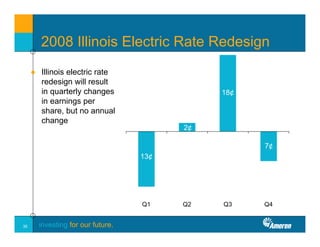

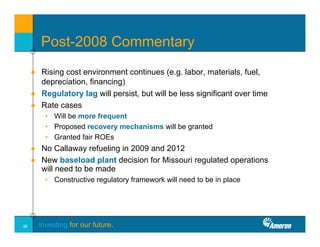

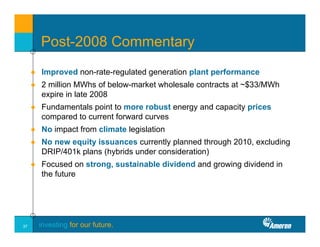

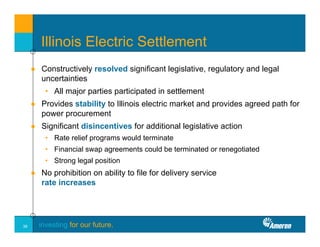

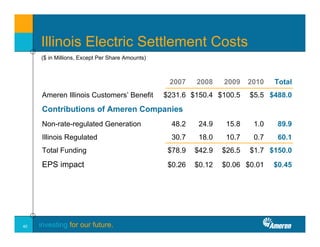

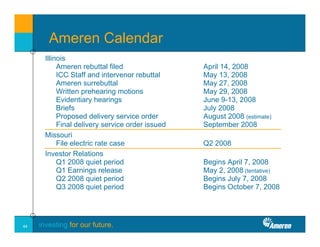

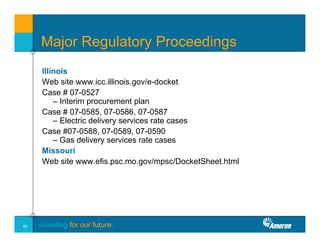

This document summarizes a presentation by Ameren, a regional electric and gas utility, at the Morgan Stanley Energy & Electricity Conference in April 2008. It discusses Ameren's business plan to achieve operational excellence, improve customer service, demonstrate environmental leadership, and maximize shareholder value. Financially, Ameren expects near-term regulatory lag due to rising costs but significant longer-term earnings growth from rate cases and increasing regulated investments. Regulated returns currently support earnings growth and regulated investment plans are expected to grow rate base and earnings.