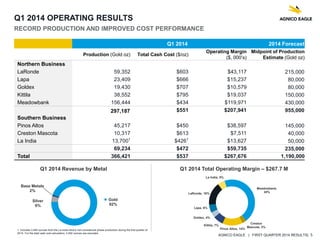

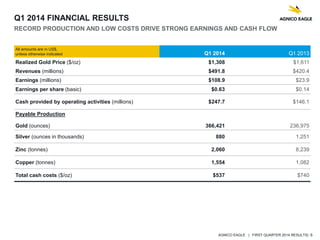

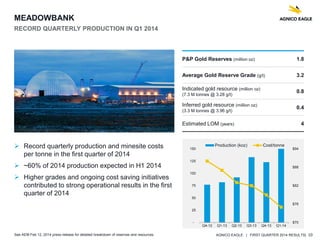

Agnico Eagle reported record quarterly gold production of 366,421 ounces with total cash costs of $537 per ounce in Q1 2014. Production was particularly strong at Meadowbank, with 156,444 ounces produced at a total cash cost of $434 per ounce. Agnico Eagle expects to exceed its 2014 production guidance of 1.205 million ounces and remain below the lower end of its cash cost forecast of $670 per ounce. The company also announced a joint acquisition with Yamana Gold of Osisko Mining Corporation on April 16, 2014.