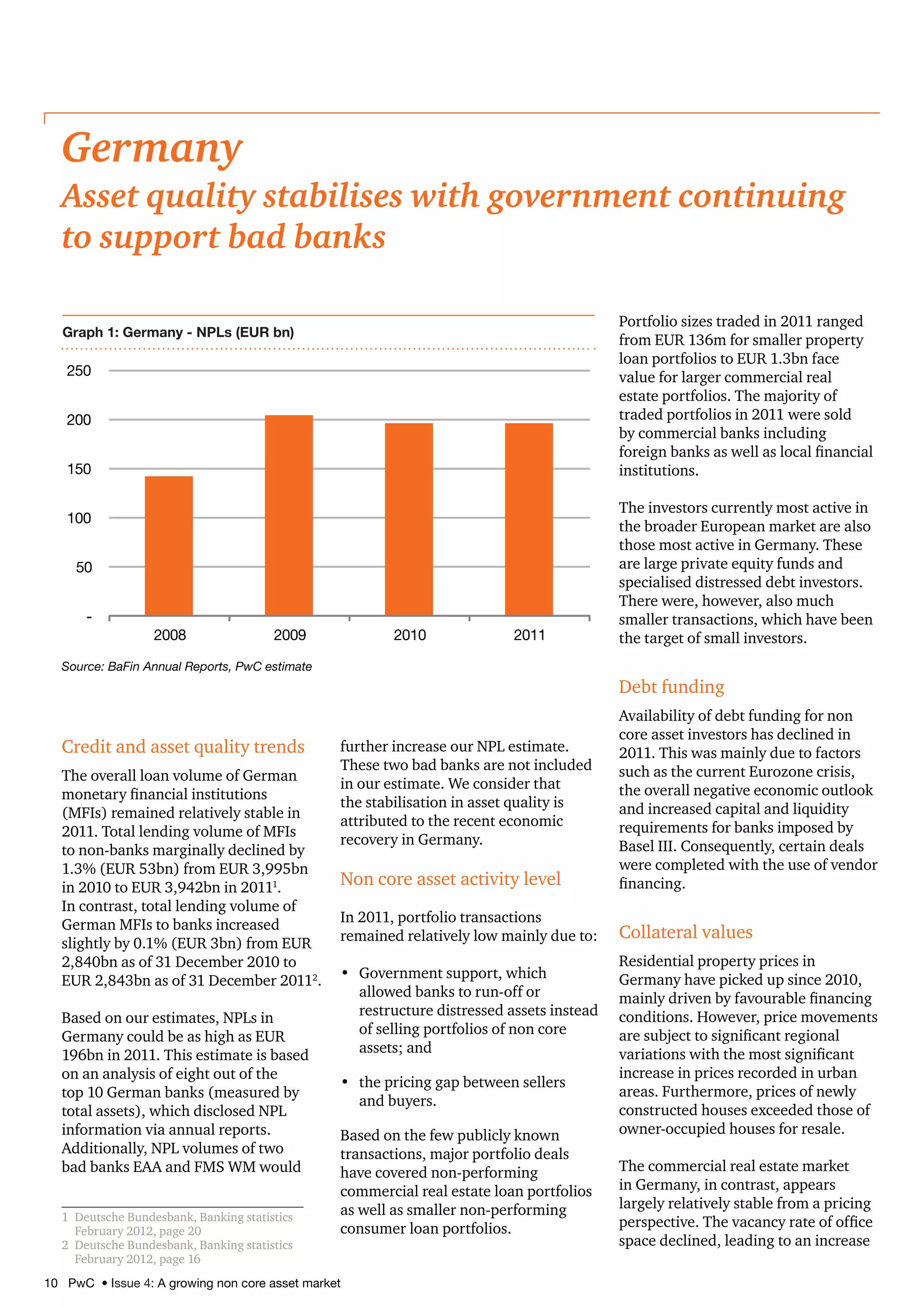

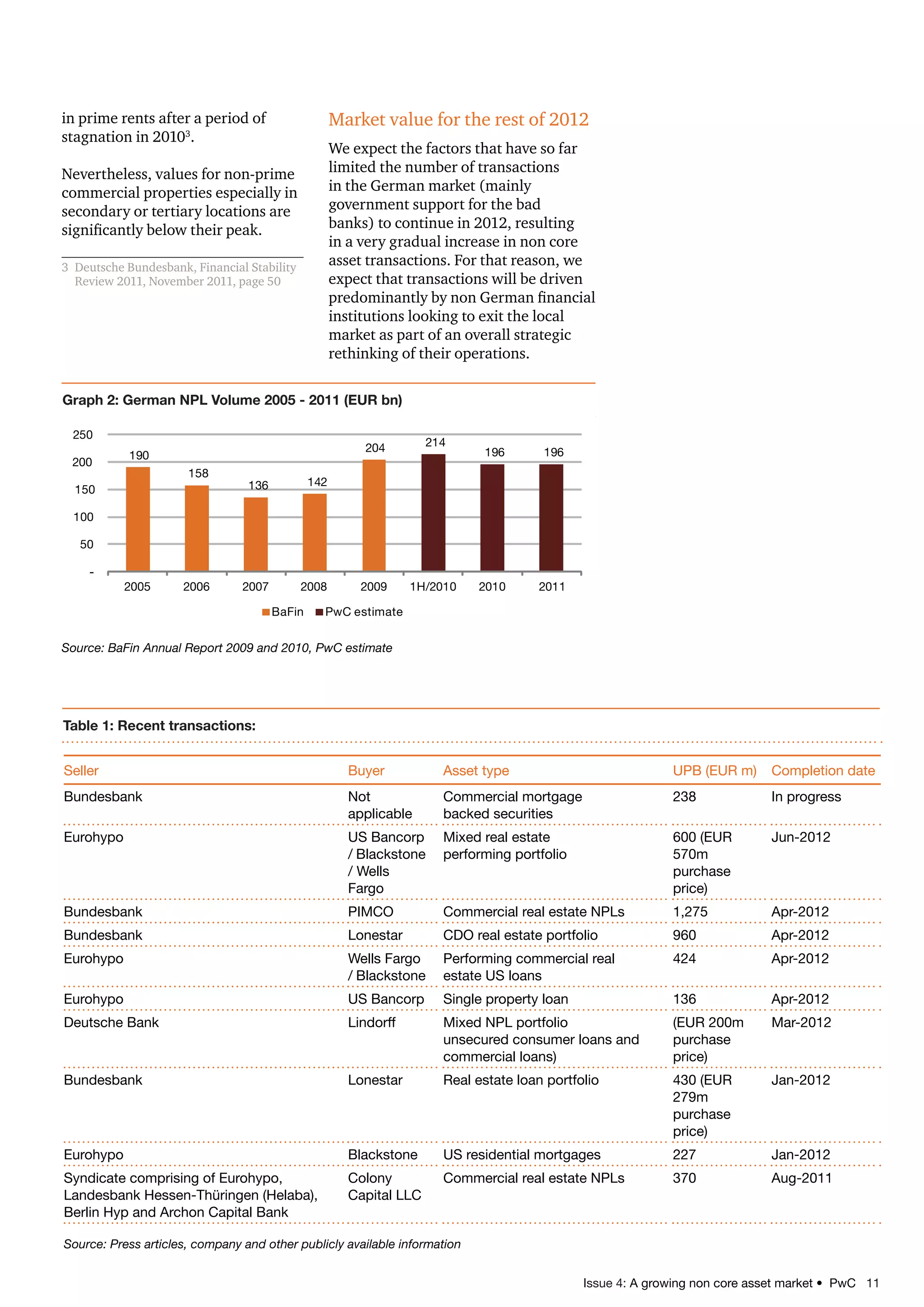

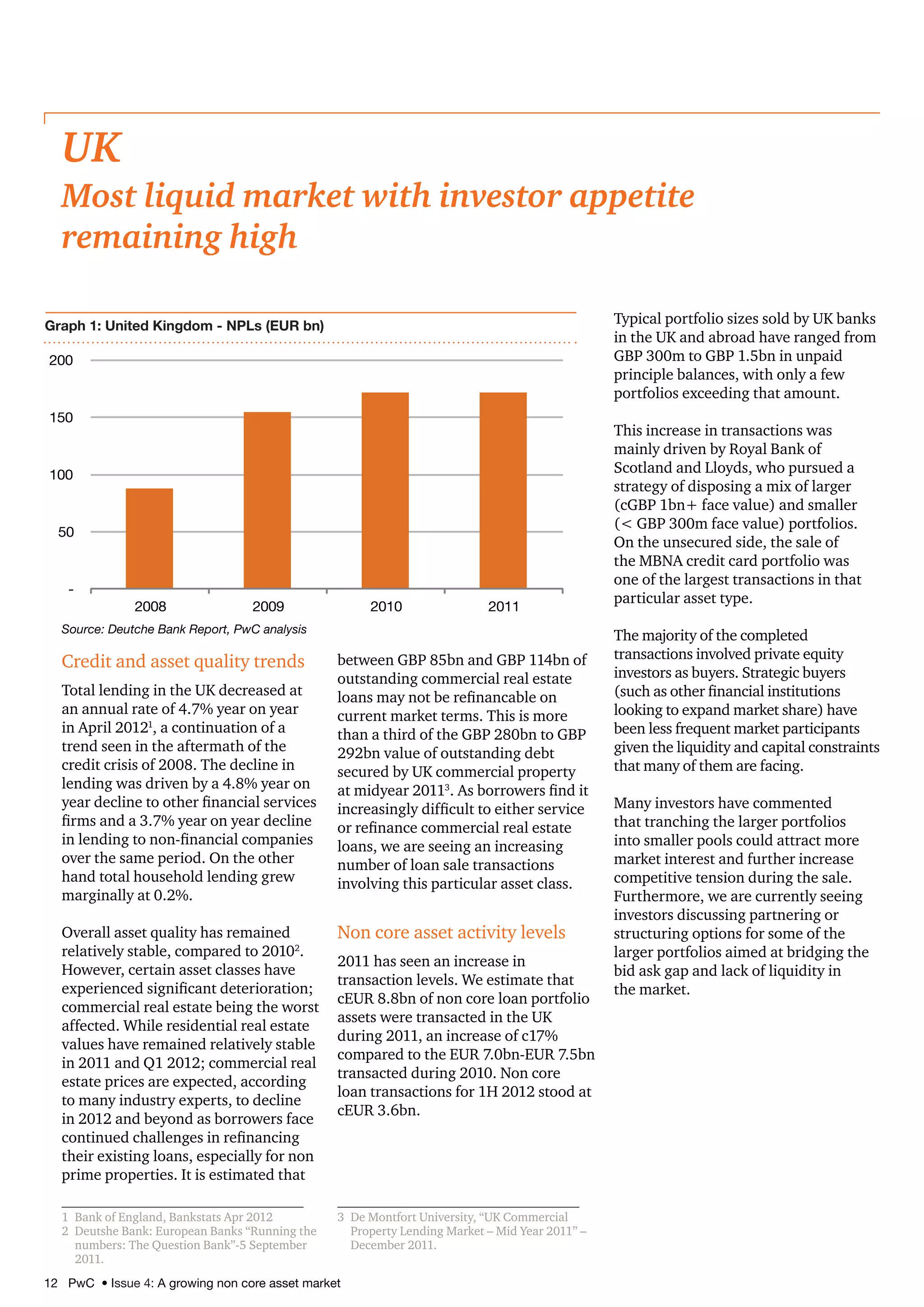

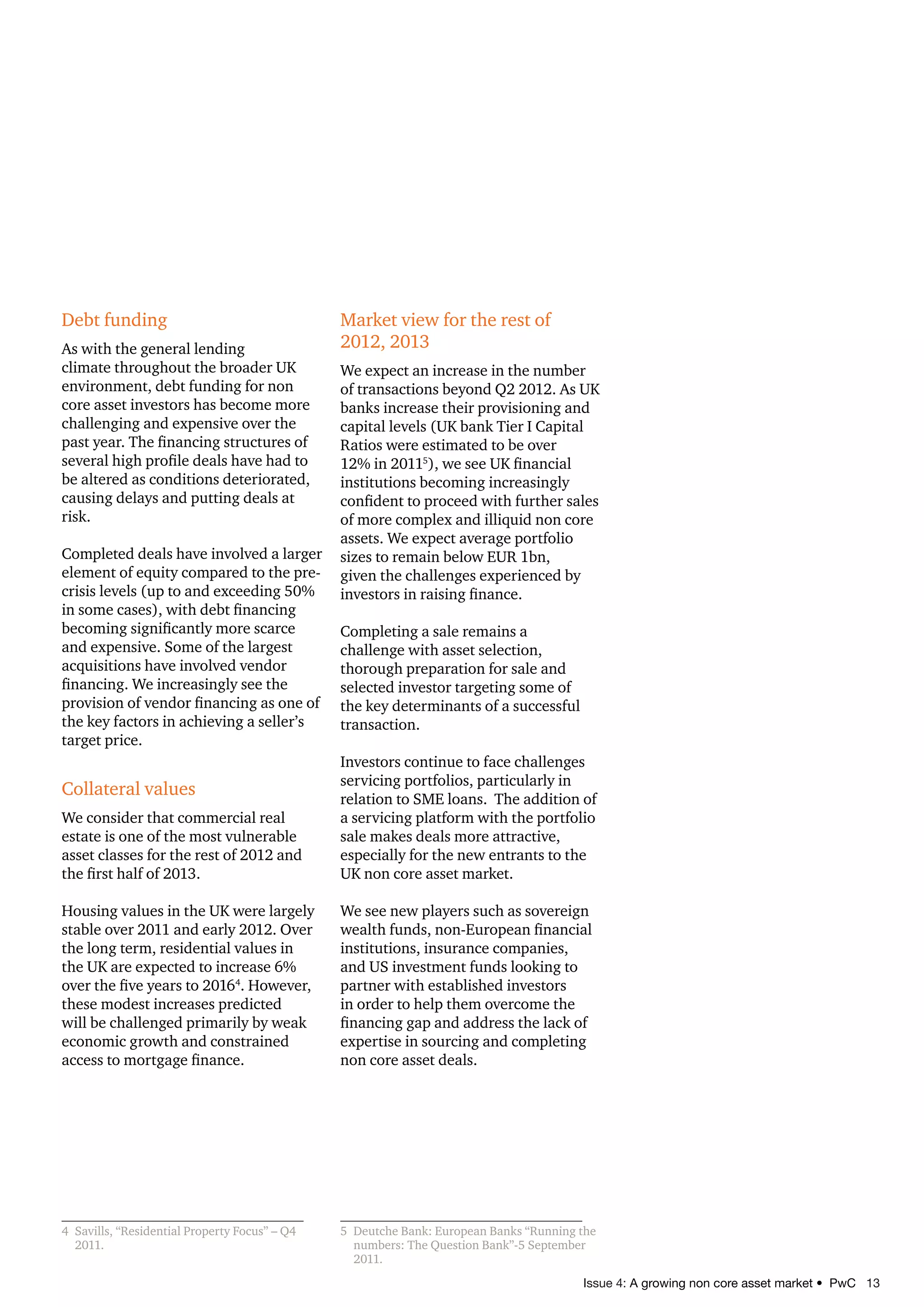

The document discusses trends in the German non-core asset market. It notes that asset quality has stabilized compared to 2010 due to an economic recovery. Non-core asset transactions have remained at relatively low levels but are expected to gradually increase, driven mainly by non-German institutions exiting the German market. Recent transactions have involved commercial real estate loan portfolios and smaller consumer loan portfolios, ranging from EUR 136 million to EUR 1.3 billion in size. Availability of debt funding has declined due to the Eurozone crisis and increased capital requirements.