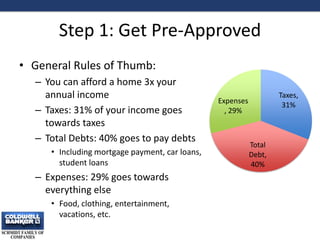

Brian Moran outlines the 5 key steps to home ownership: 1) Get pre-approved for a mortgage, 2) Hire a REALTOR® like himself to assist with the process, 3) Hire a home inspector to inspect the prospective home, 4) Make a formal mortgage application, and 5) Get ready for the closing. He provides details on each step, emphasizing the importance of getting pre-approved, hiring a knowledgeable REALTOR®, and being prepared for the closing.