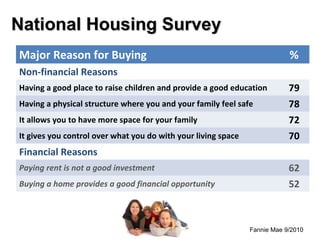

The document provides information for home buyers on the home buying process, including determining needs and budget, finding a home, making an offer, removing contingencies, leading up to settlement, the settlement process, and moving into the new home. It emphasizes working with a buyer's agent to represent the buyer's interests and make the strongest possible offer. The settlement process involves conducting a title search, clearing liens, issuing title insurance, preparing final documents, and completing the closing.