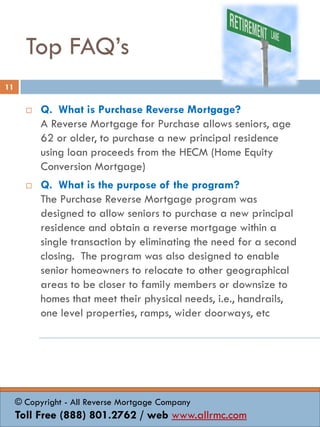

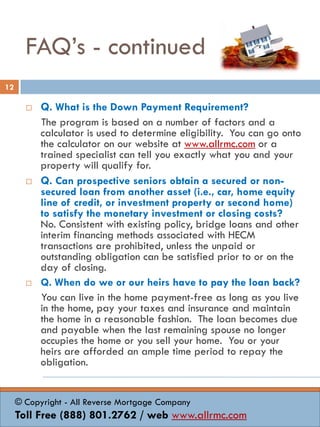

This document provides information about purchase reverse mortgages, which allow seniors to purchase a new home without monthly mortgage payments. It includes 4 case studies showing how purchase reverse mortgages enabled seniors to relocate to better homes, fund long-term care, or help grandchildren purchase homes. Common questions about purchase reverse mortgages are also addressed, such as down payment requirements, loan repayment, and whether the bank owns the home.