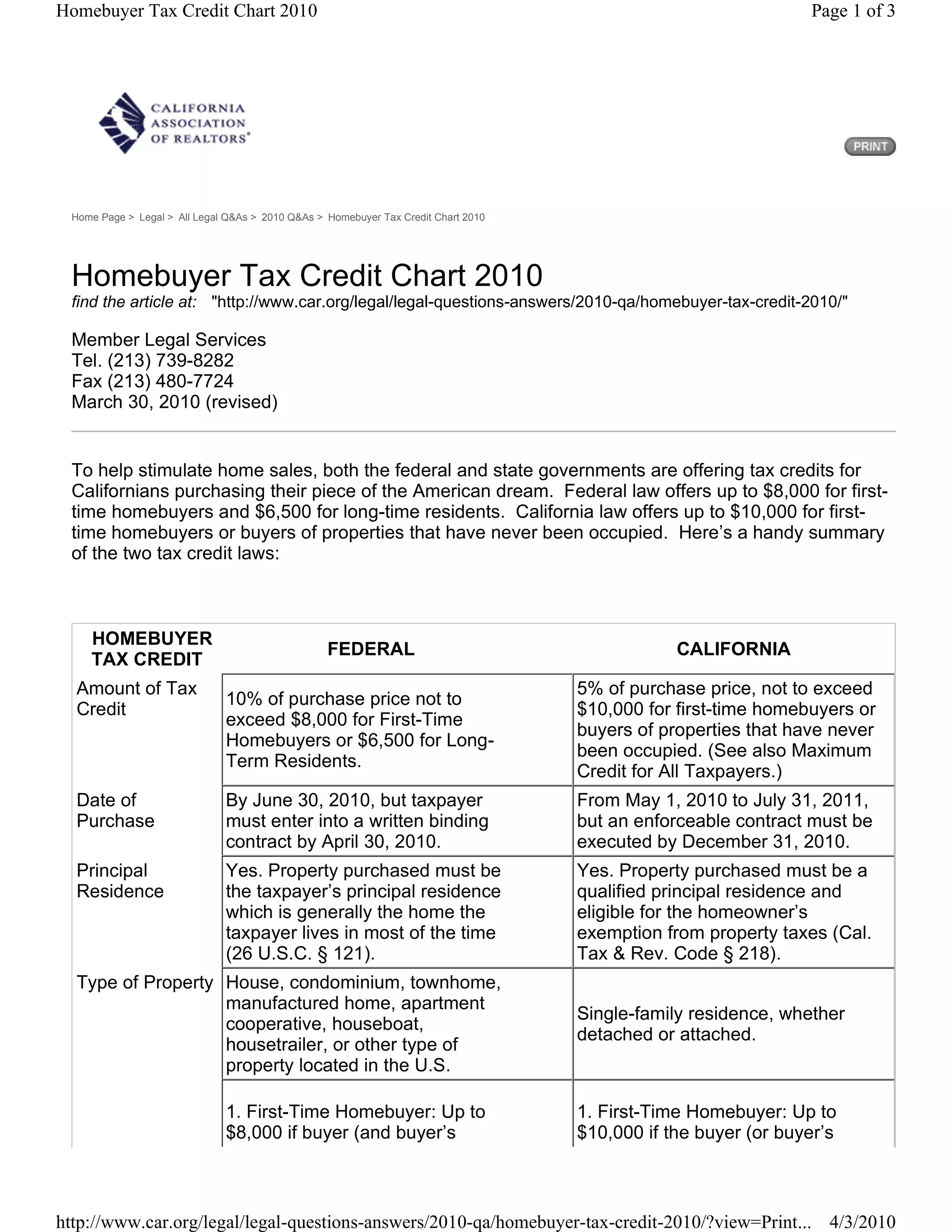

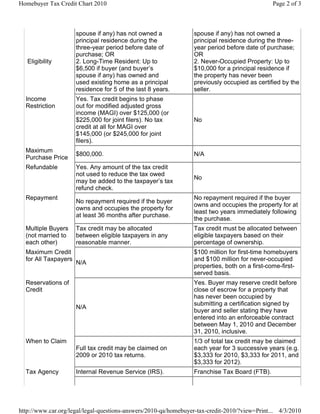

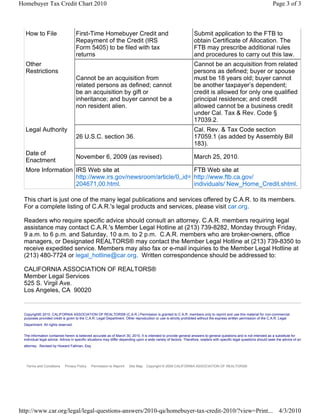

The document provides a summary of the federal and California homebuyer tax credits available in 2010. It outlines the key eligibility requirements, credit amounts, purchase price limits, occupancy requirements, income limits, and claim procedures for each tax credit. The federal credit offers up to $8,000 for first-time buyers and $6,500 for long-time residents, while California's credit offers up to $10,000 for eligible first-time buyers or buyers of never-occupied homes. Both credits required the purchased home to be the buyer's primary residence.