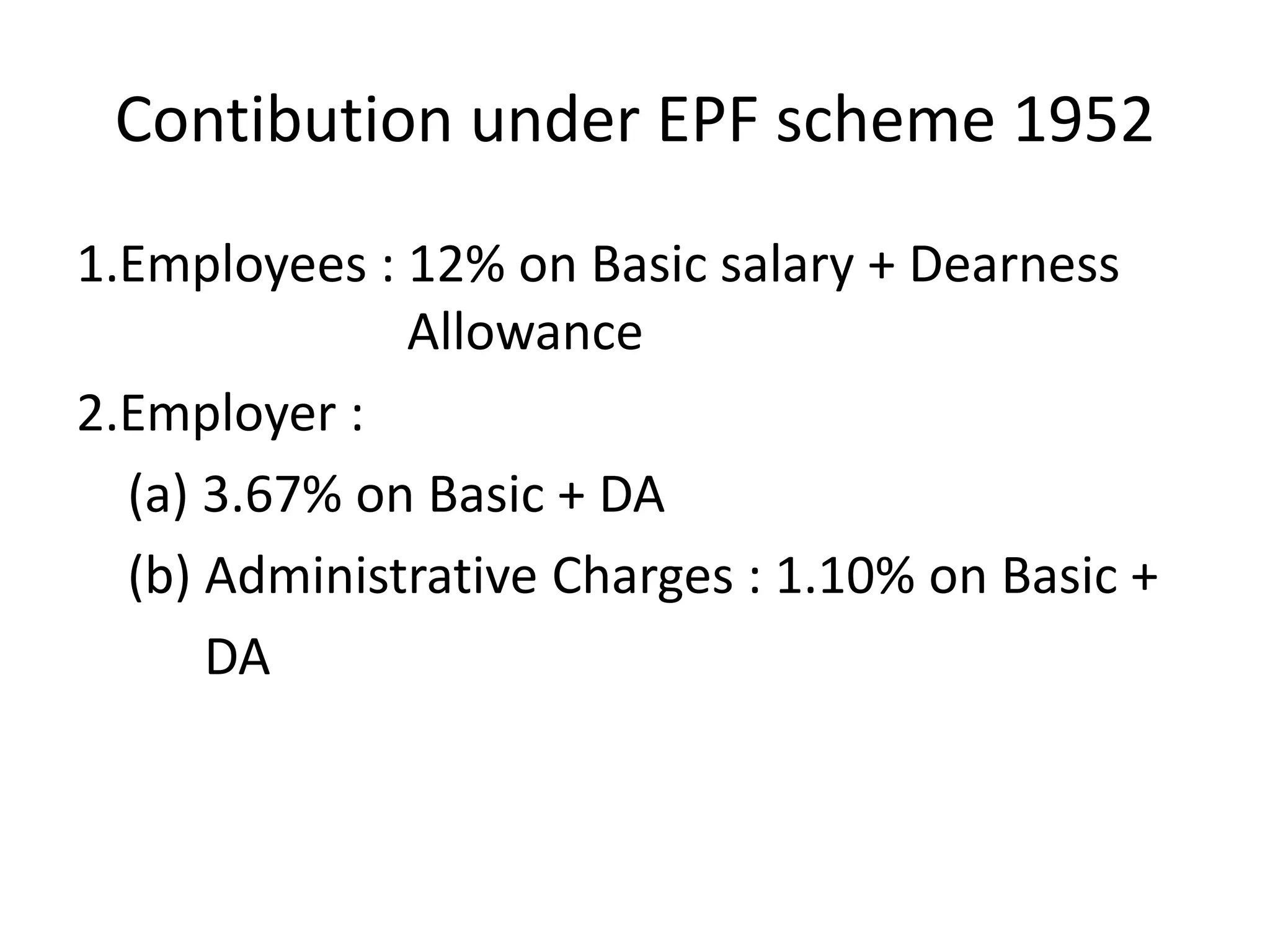

The document provides details about the Employees' Provident Funds Act of 1952 in India. It discusses the history and objectives of the act, including providing social security to industrial workers. It outlines the contribution rates under the EPF scheme and details who the act applies to. It also describes what types of withdrawals are allowed and the authorities responsible for handling claims. Two case studies related to the act are summarized, including issues around canteen allowance being included in wages for contribution calculation.