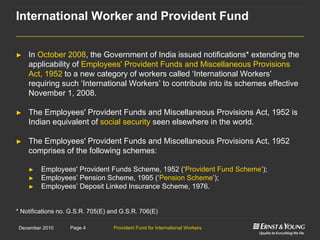

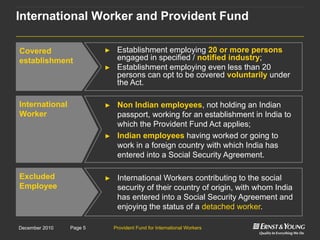

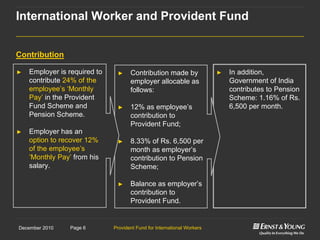

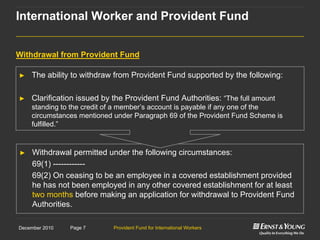

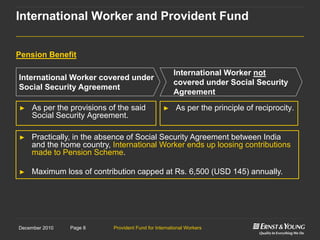

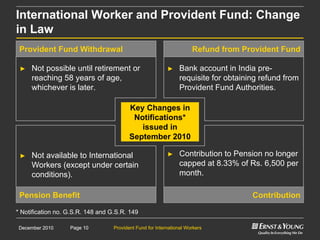

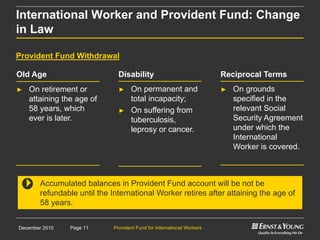

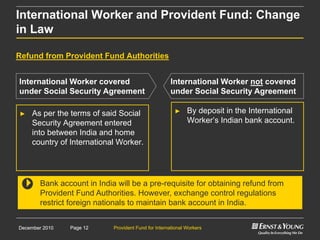

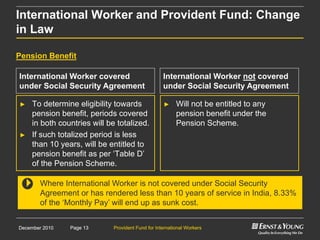

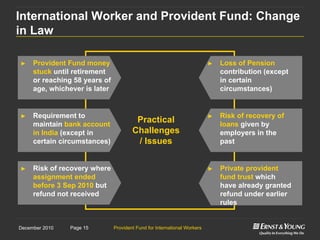

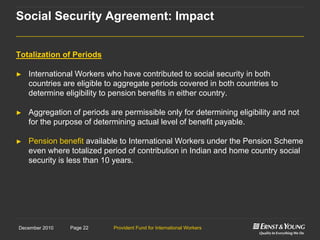

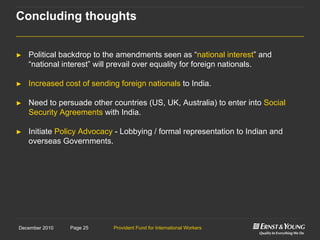

This document summarizes recent changes to India's provident fund rules for international workers. Key changes include: provident fund money is now locked until retirement at age 58; international workers risk losing pension contributions unless covered by a social security agreement between India and their home country; international workers now need an Indian bank account to receive provident fund refunds. The goal of the changes is to encourage other countries to sign social security agreements with India to protect the social security of Indian workers overseas.