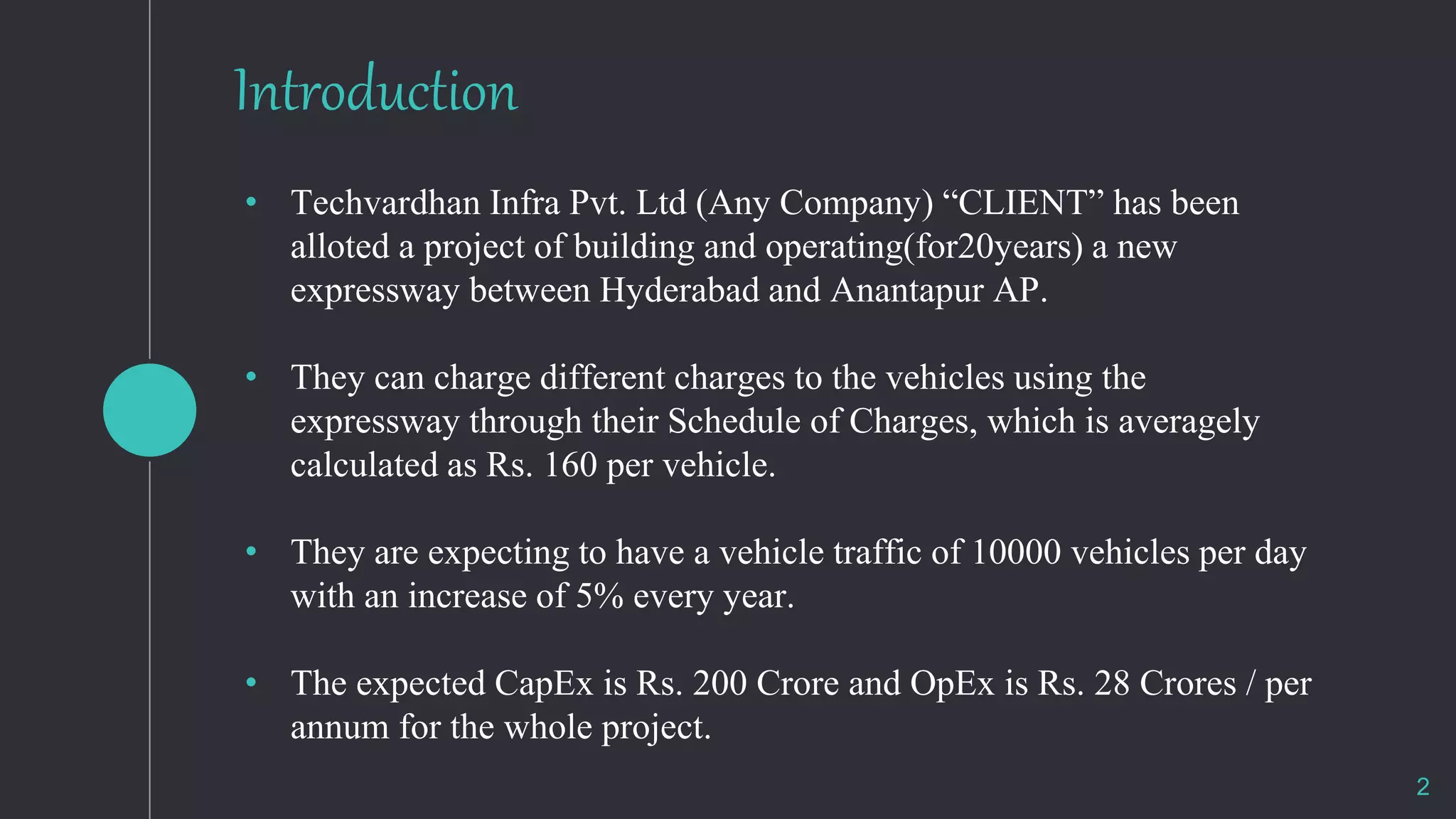

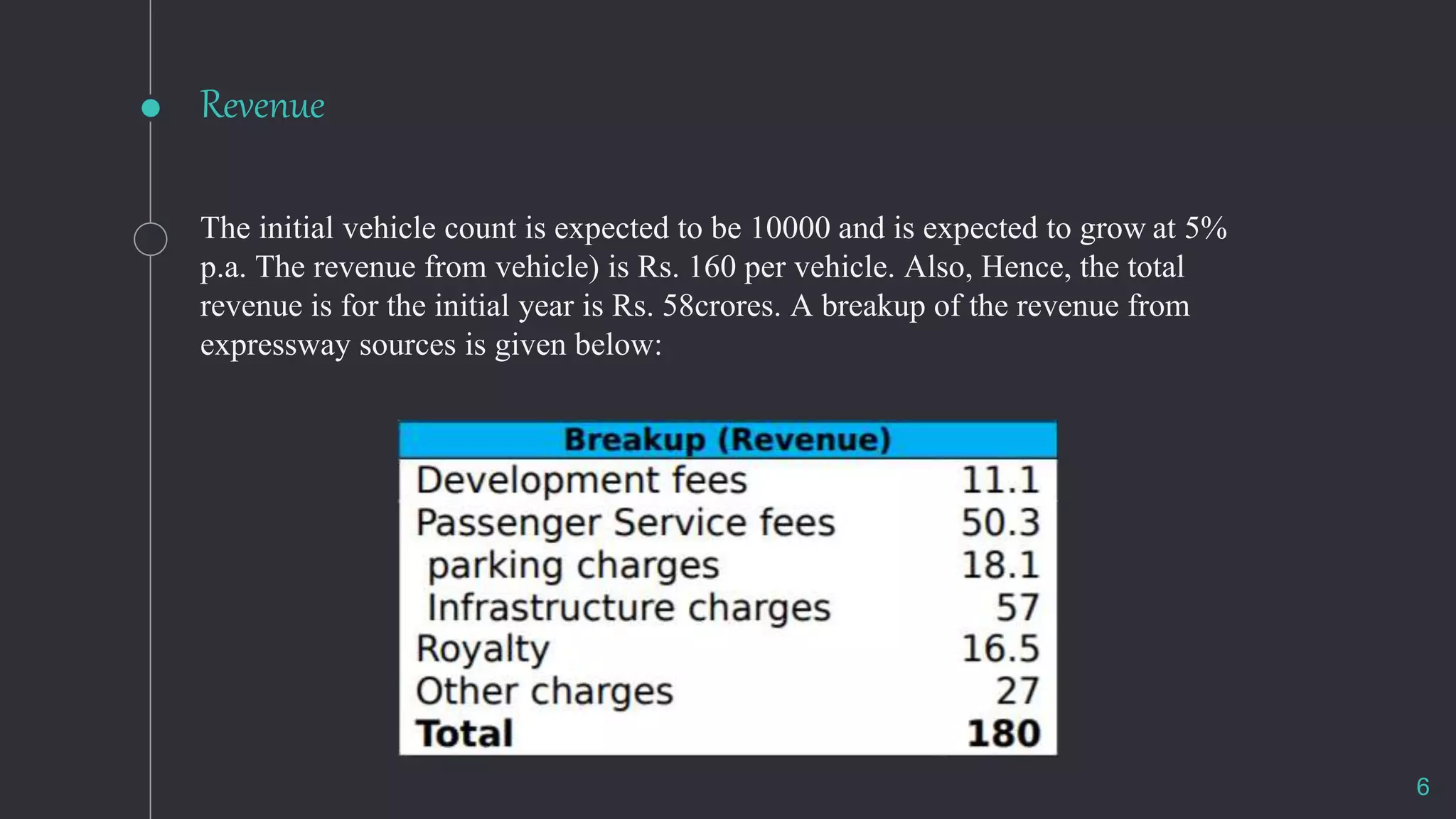

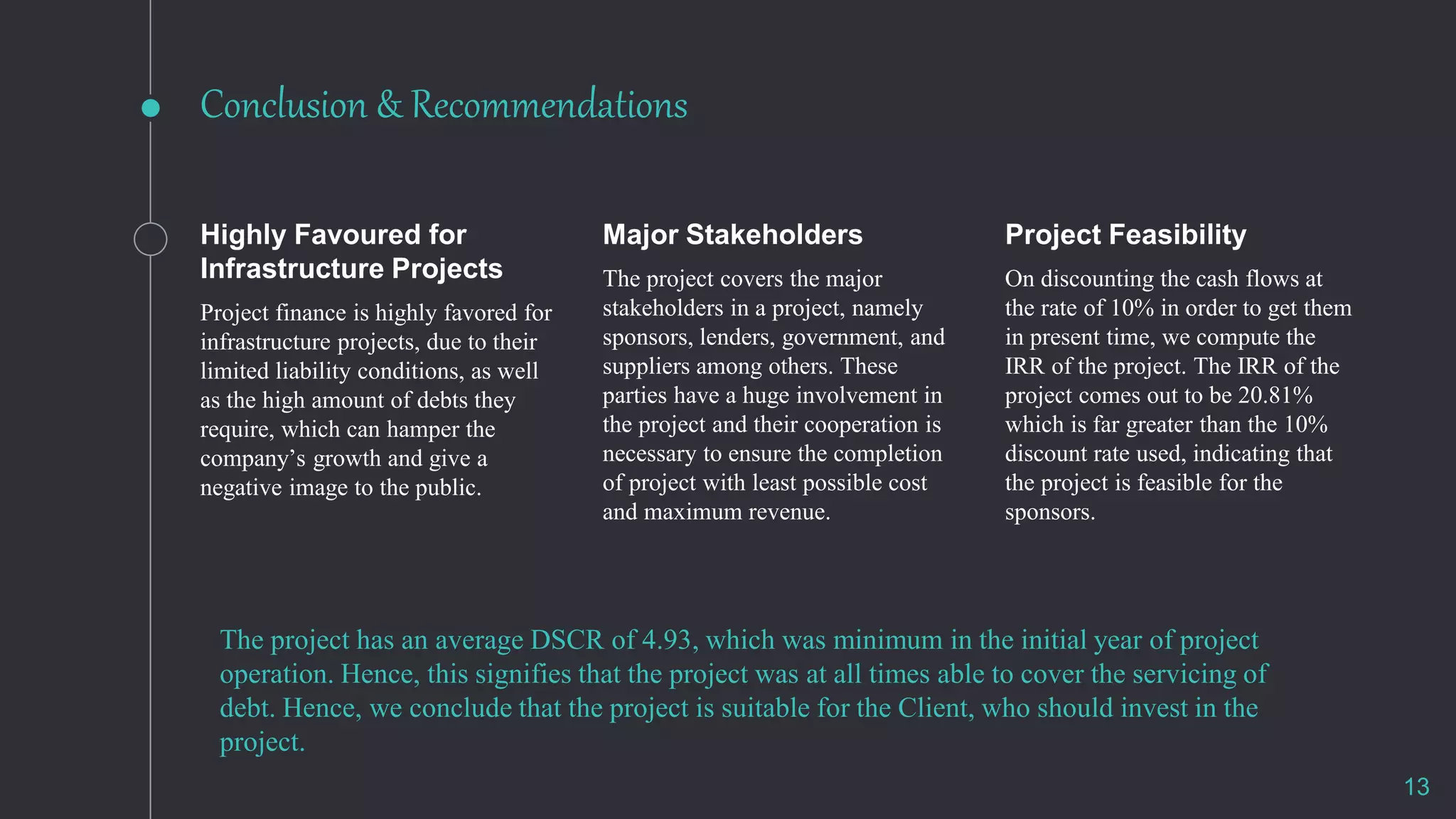

The document analyzes the feasibility of an expressway project in Hyderabad. The client has been allotted a project to build and operate a new expressway between Hyderabad and Anantapur for 20 years. They expect vehicle traffic of 10,000 per day growing at 5% annually. The capital expenditure is Rs. 200 crore and operating expenditure is Rs. 28 crore annually. The financial analysis shows the project has an equity IRR of 30.77% and project IRR of 20.81%, above the 10% discount rate, indicating the project is feasible. The average debt service coverage ratio is 1.48, showing the ability to repay loans over time. Therefore, the project appears financially viable for