Embed presentation

Download to read offline

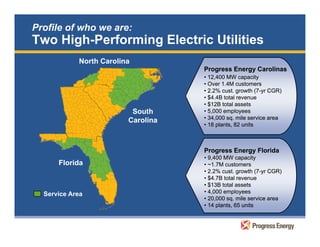

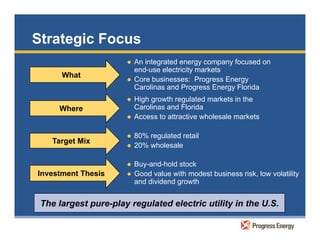

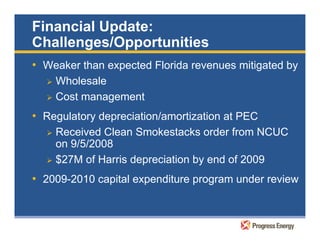

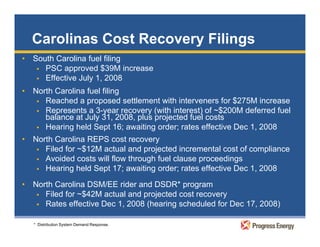

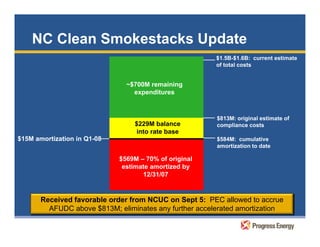

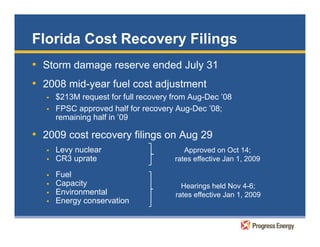

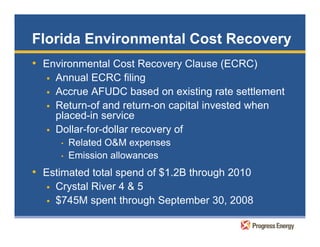

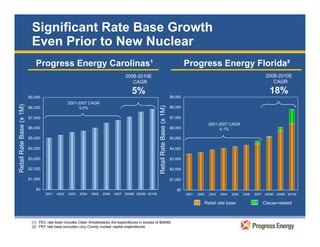

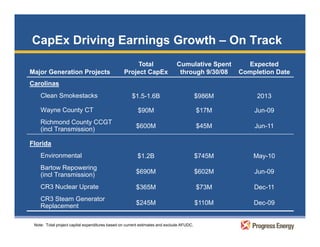

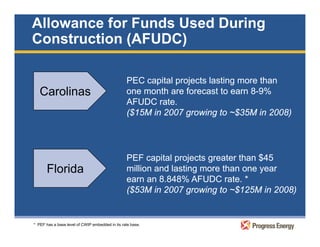

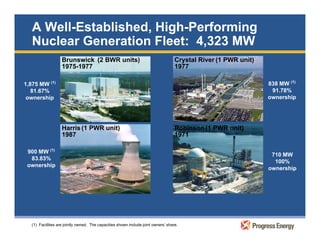

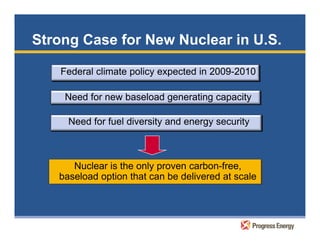

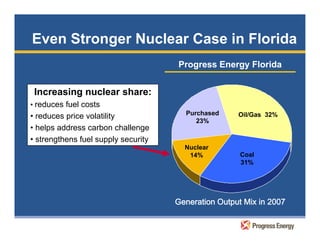

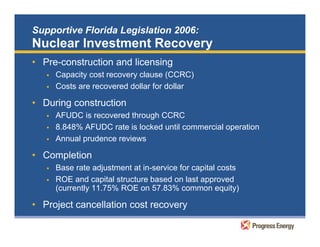

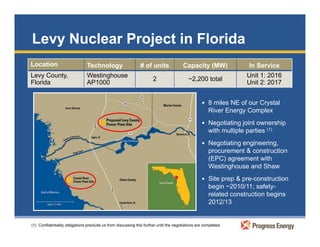

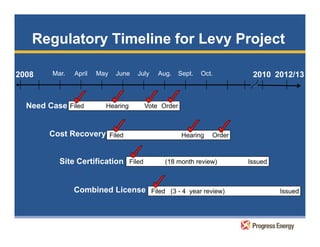

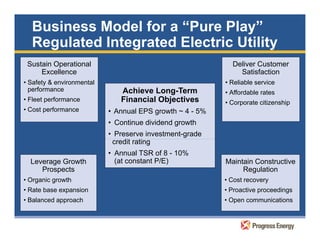

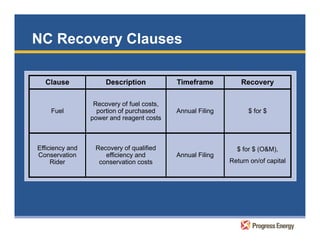

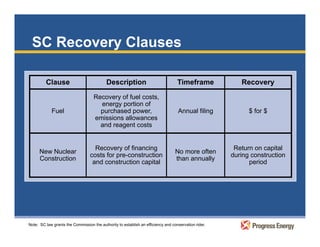

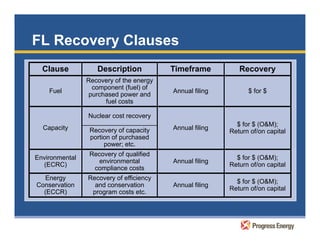

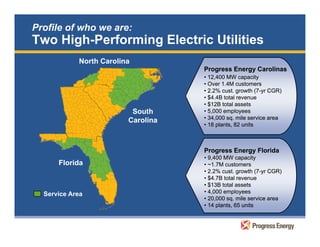

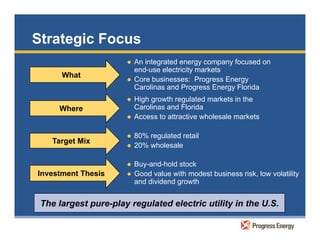

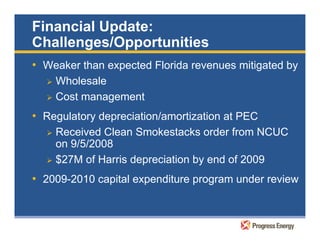

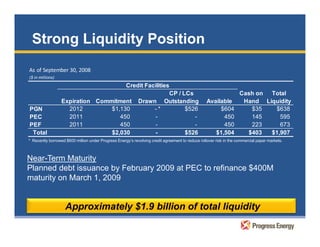

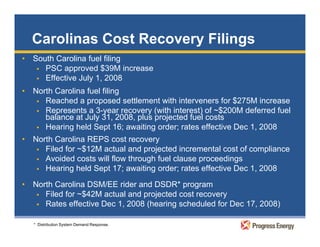

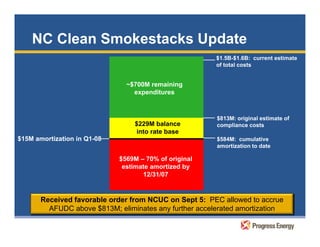

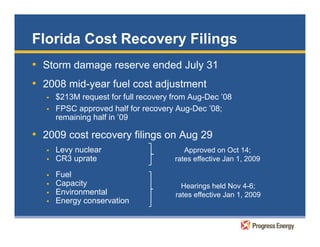

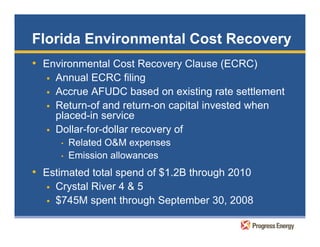

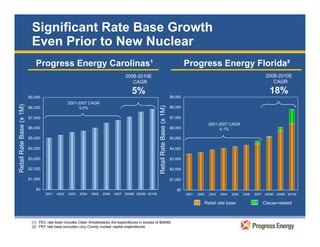

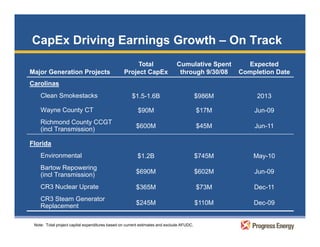

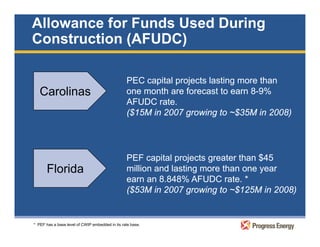

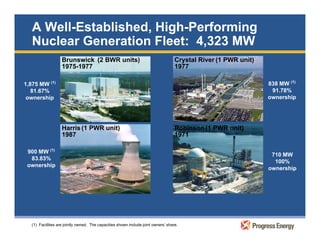

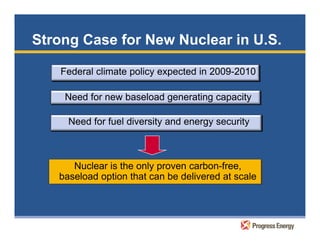

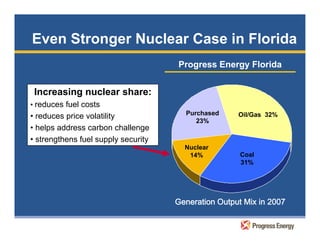

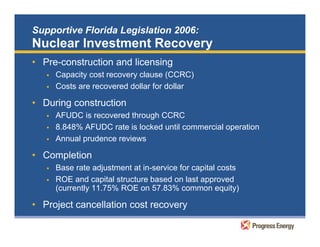

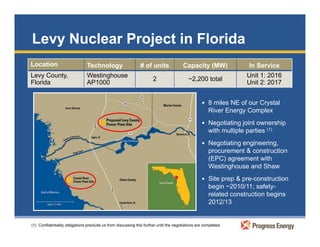

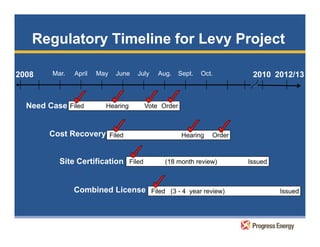

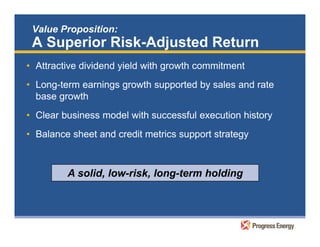

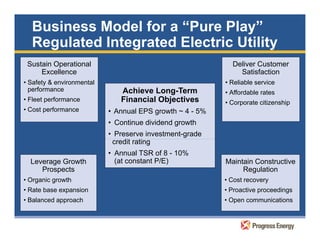

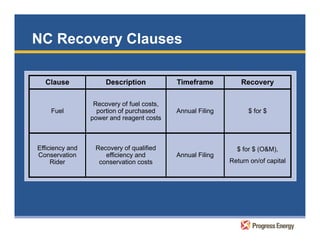

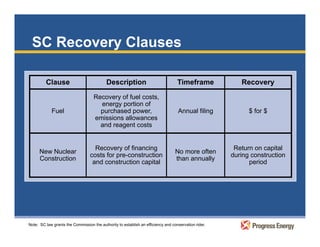

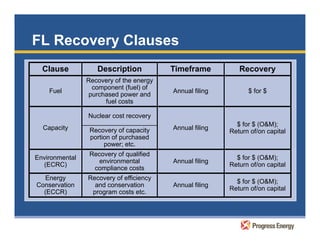

Progress Energy held a financial conference in Phoenix, Arizona on November 10-11, 2008. The conference focused on providing an overview of the company including its growth strategy and regulatory updates. Progress Energy is the largest regulated electric utility in the US with significant projected rate base growth through 2010 driven by investments in its regulated operations in North Carolina and Florida. Regulatory proceedings in both states approved various cost recovery filings which will support continued investment and earnings growth.