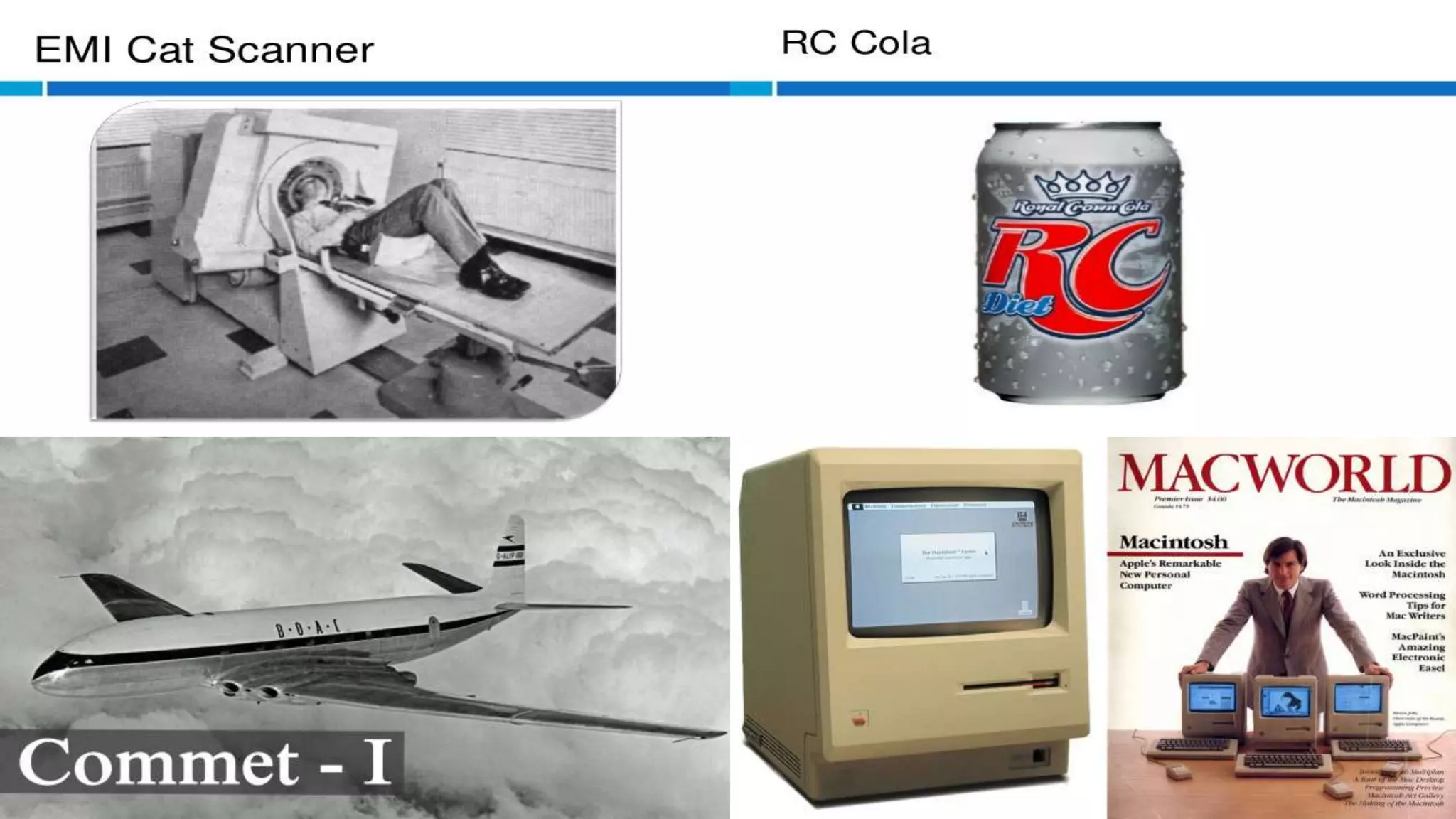

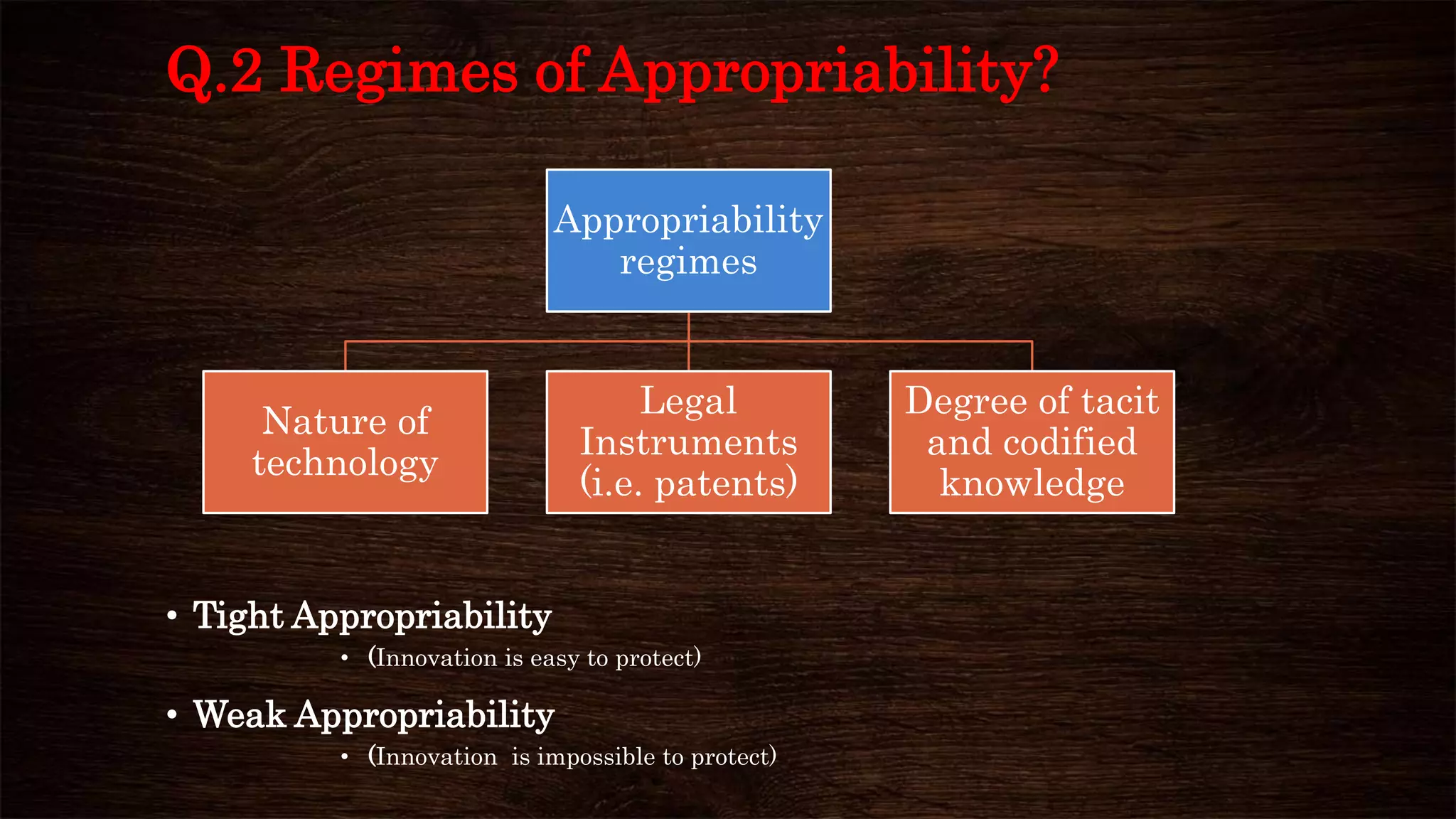

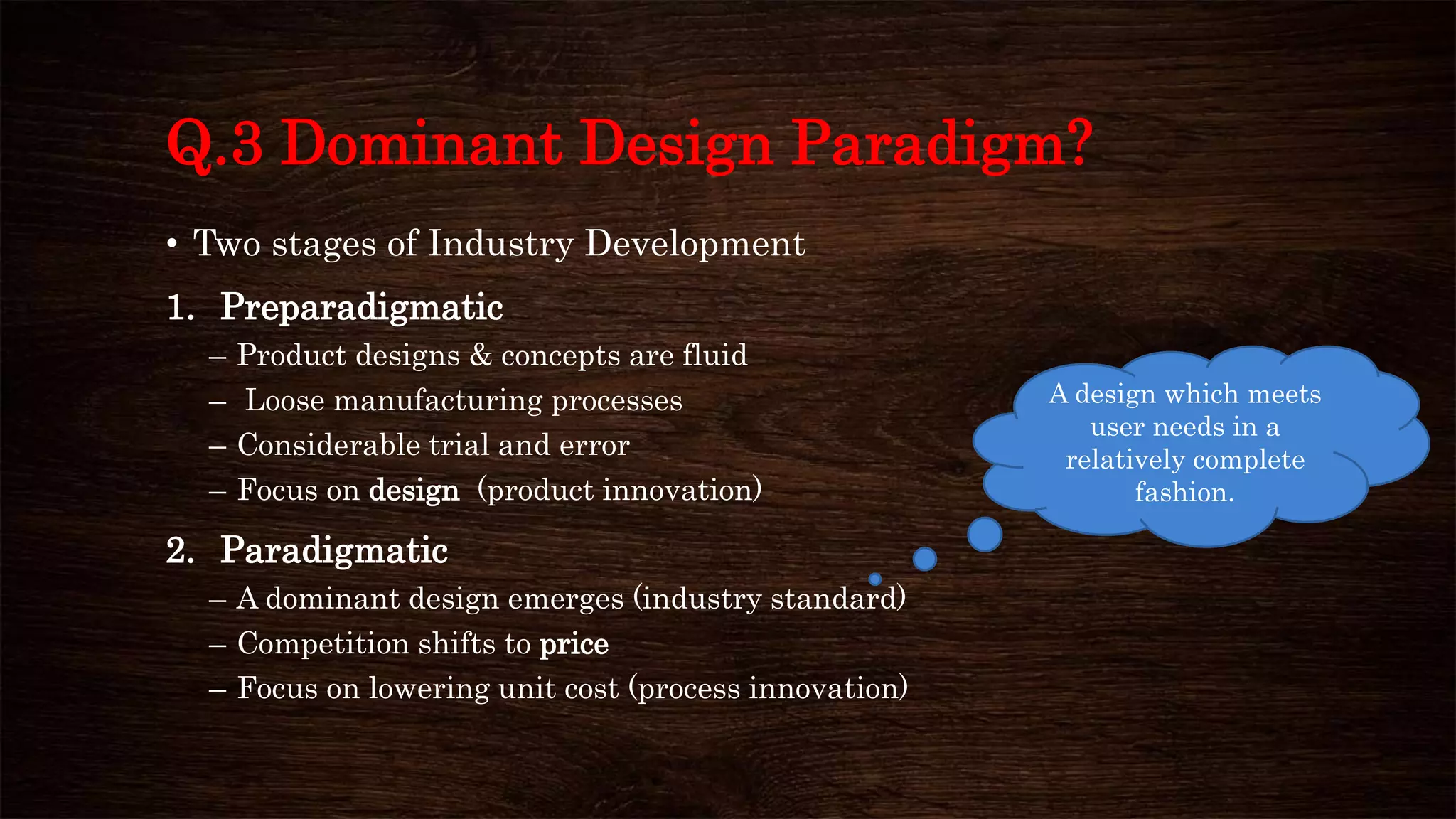

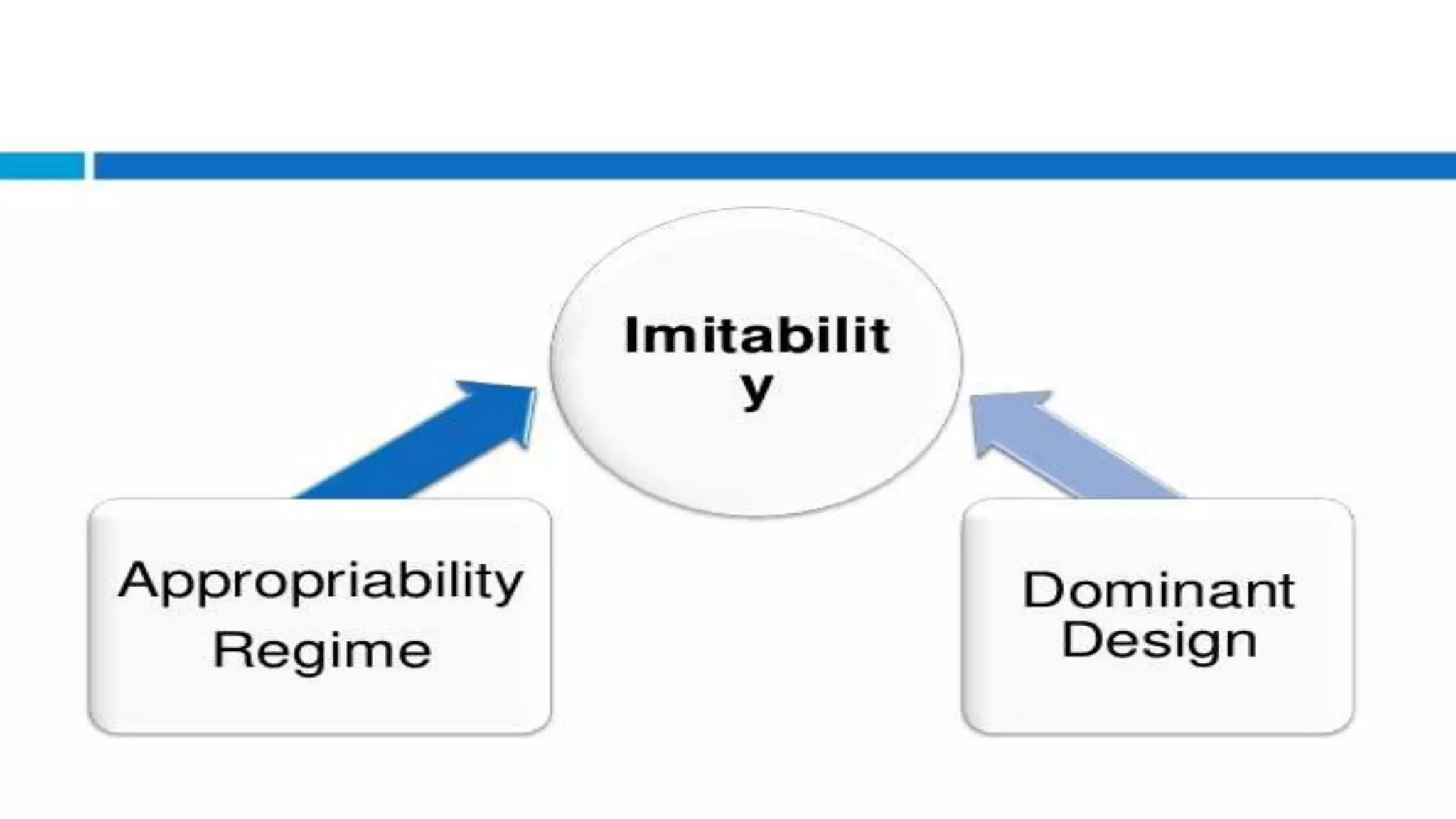

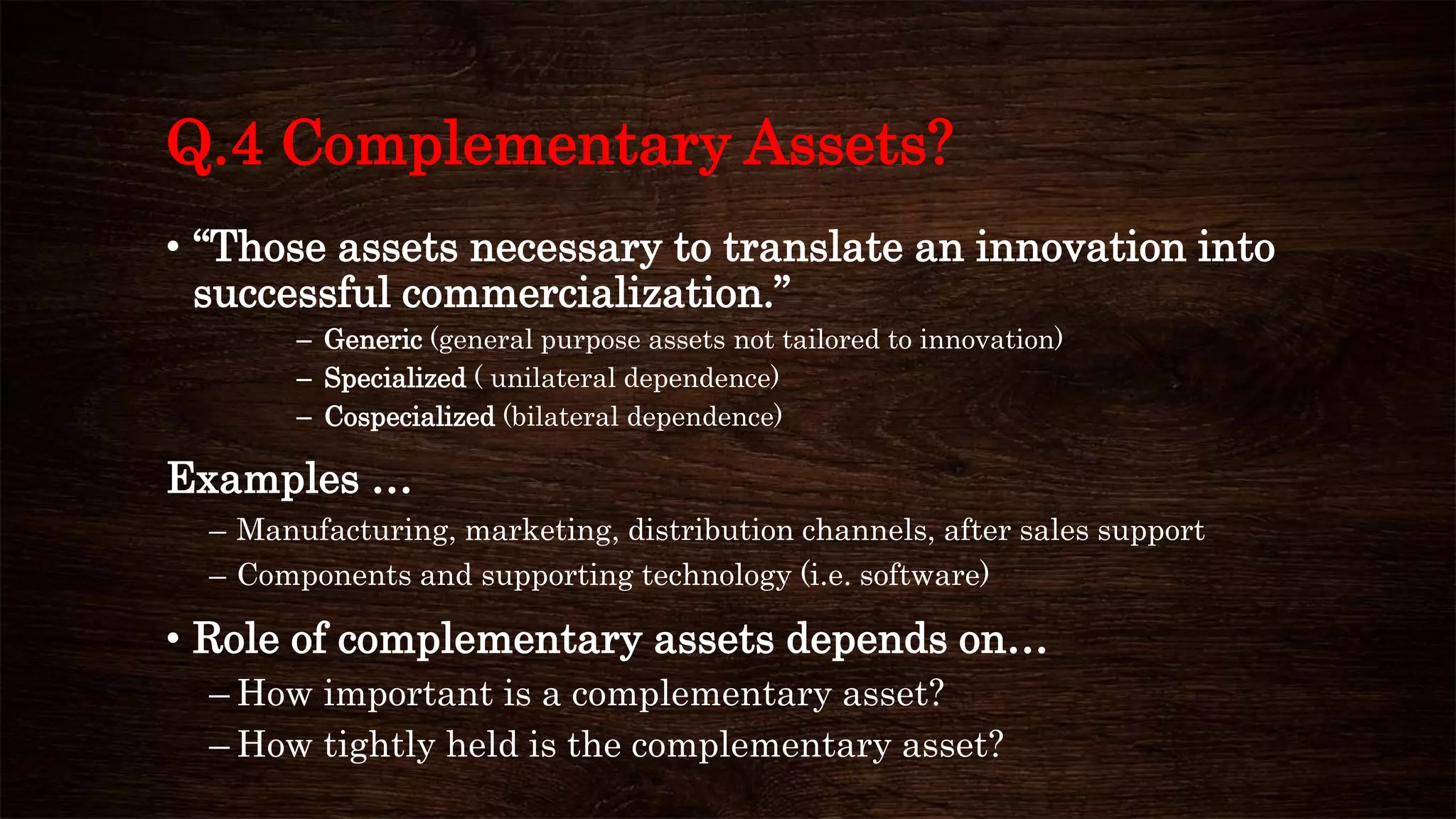

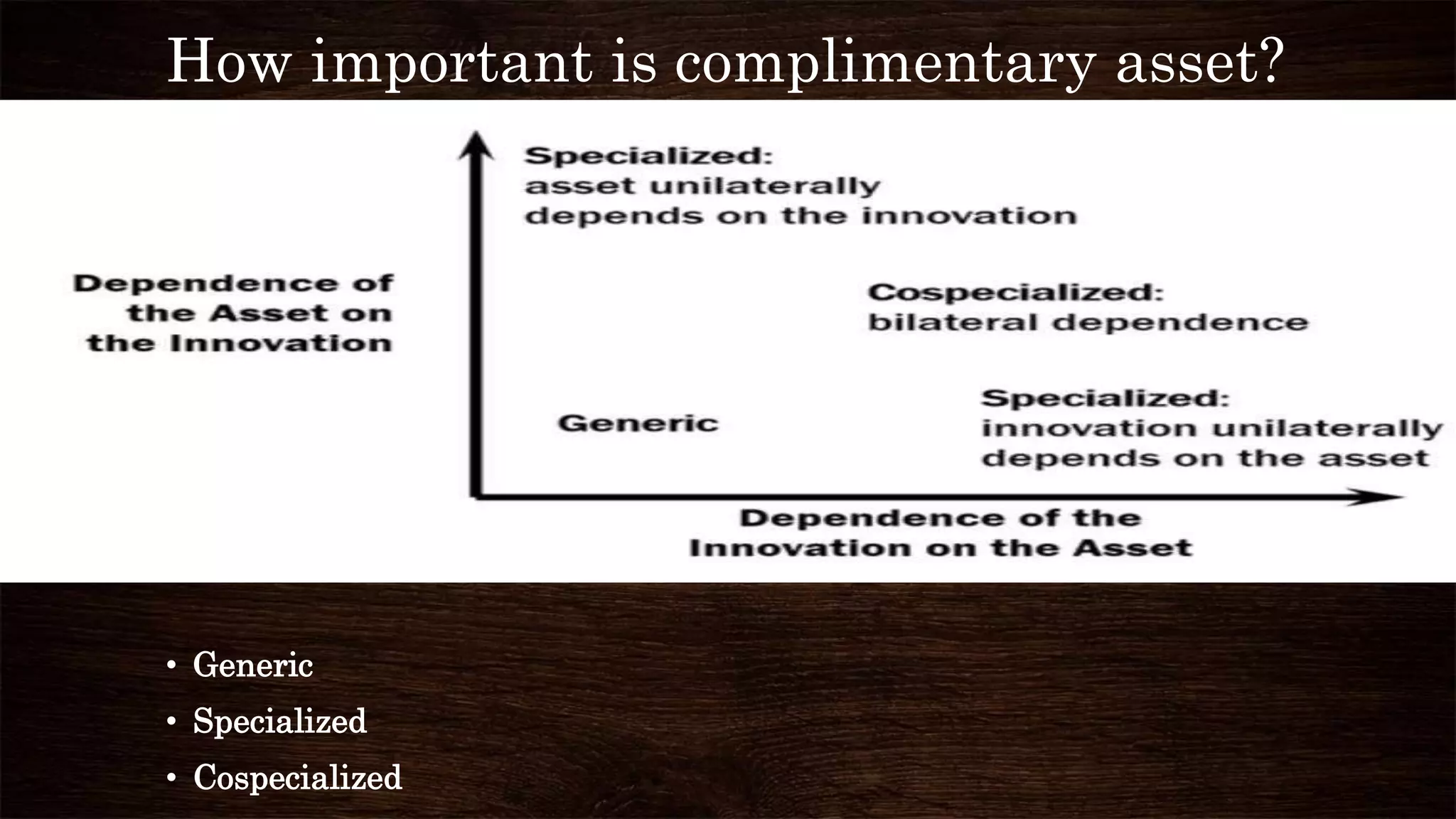

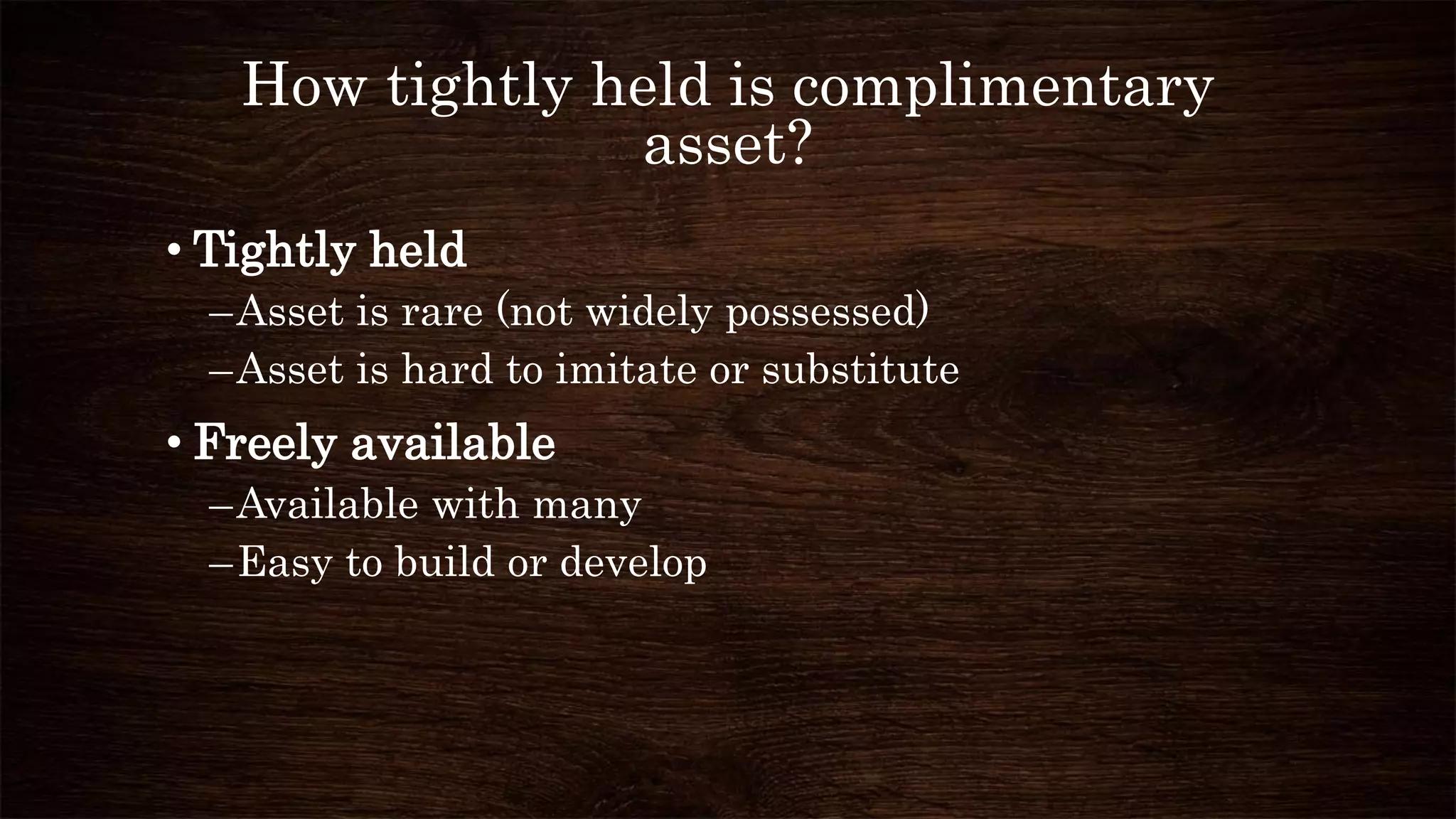

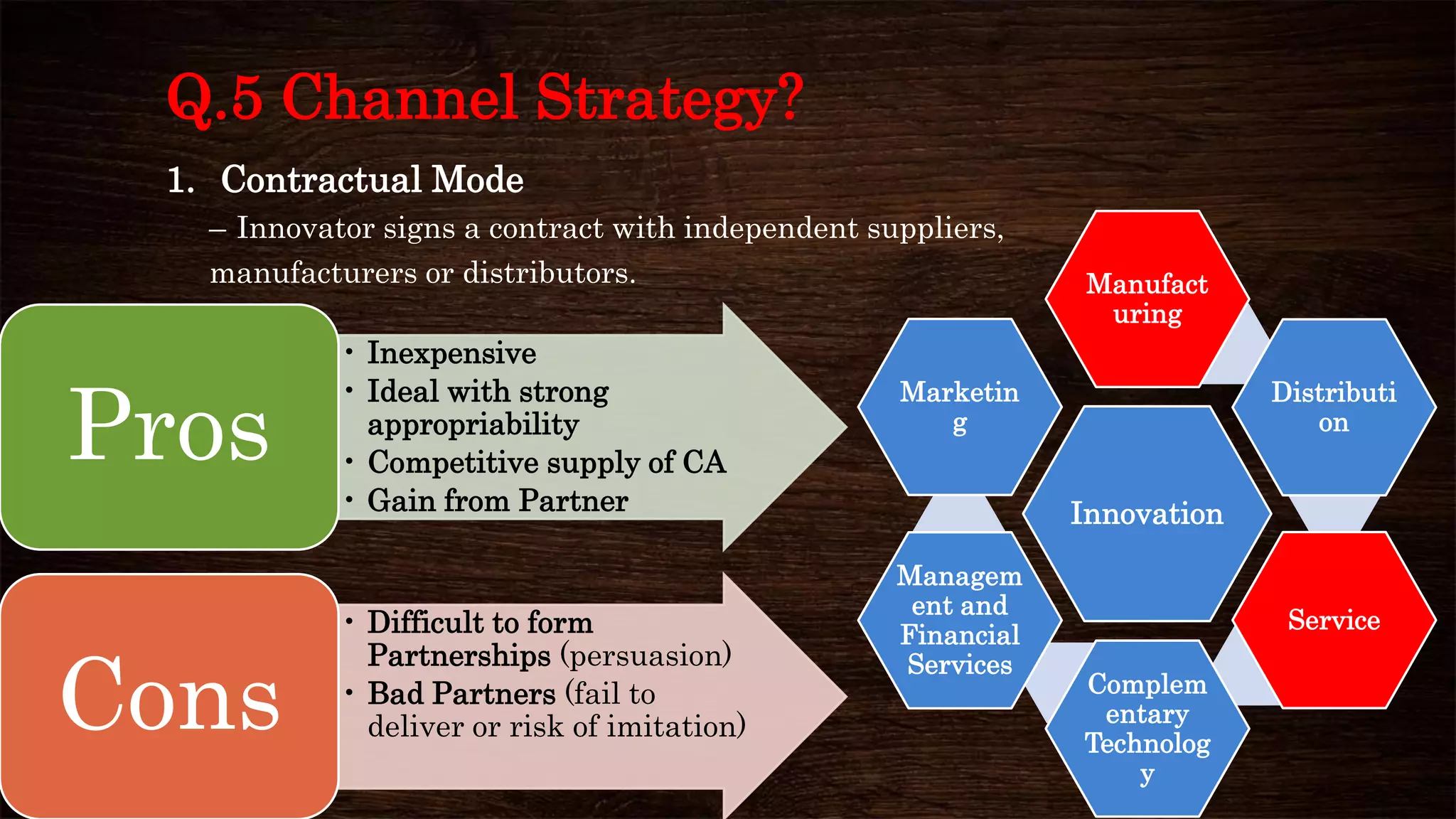

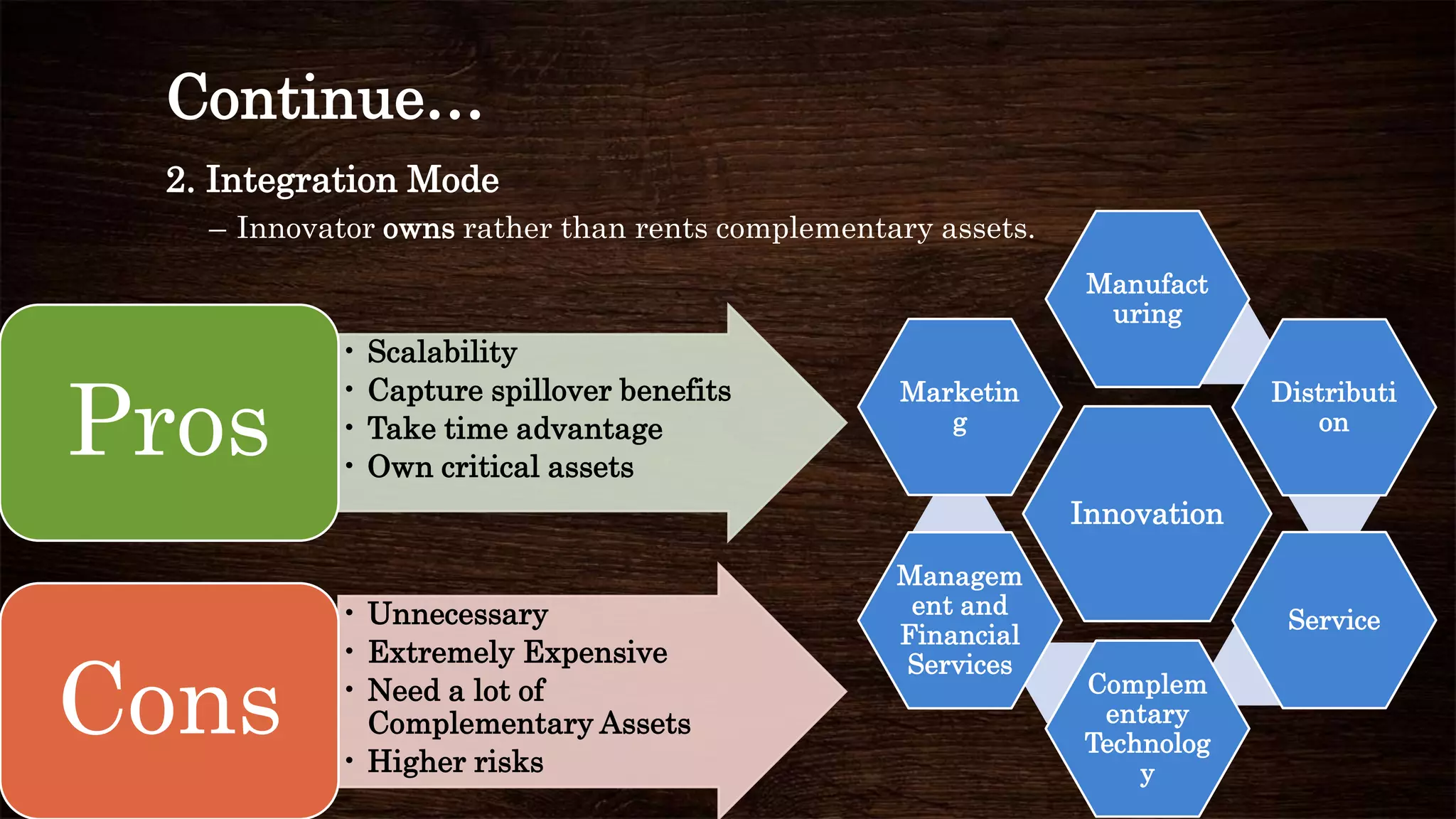

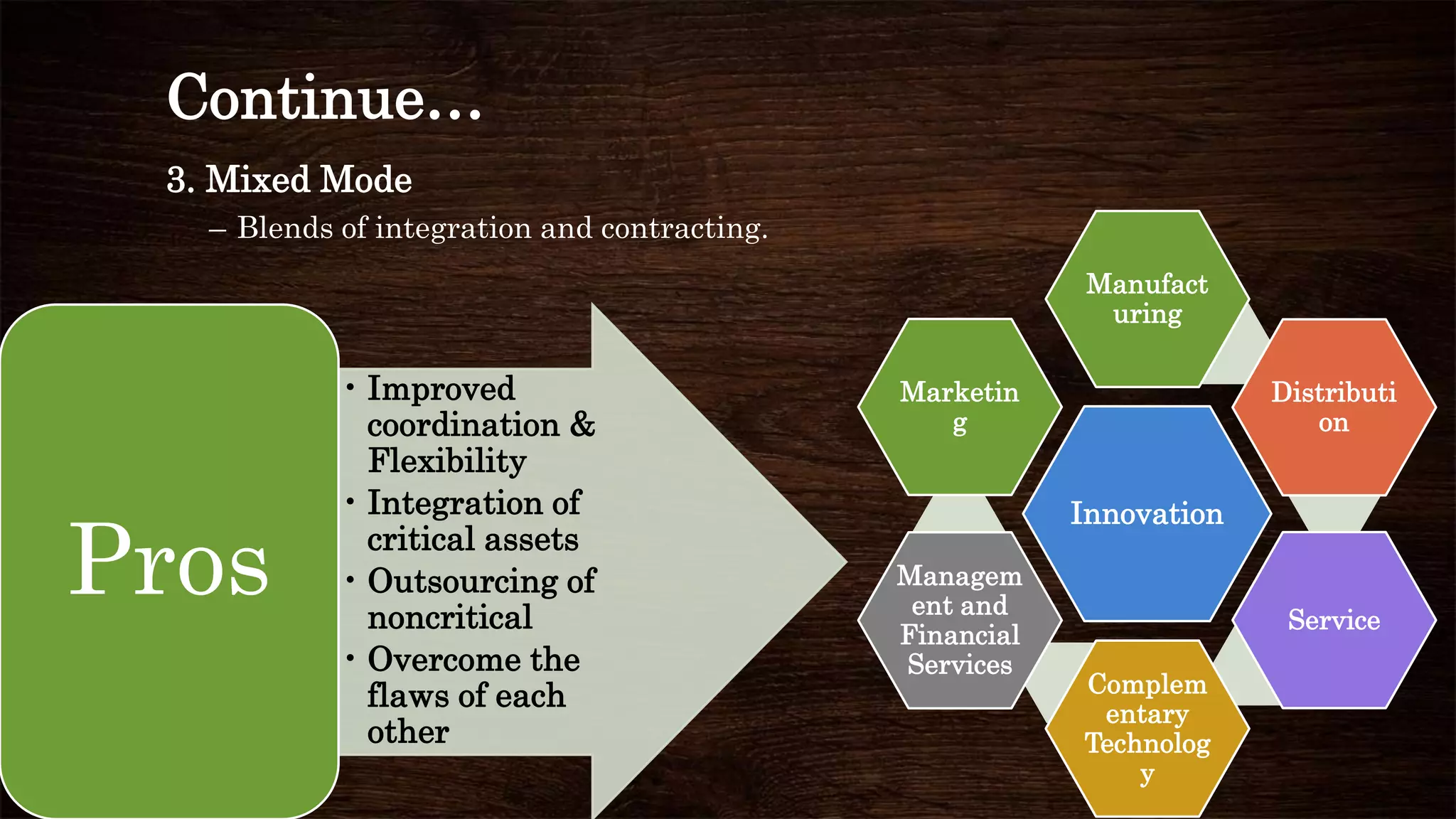

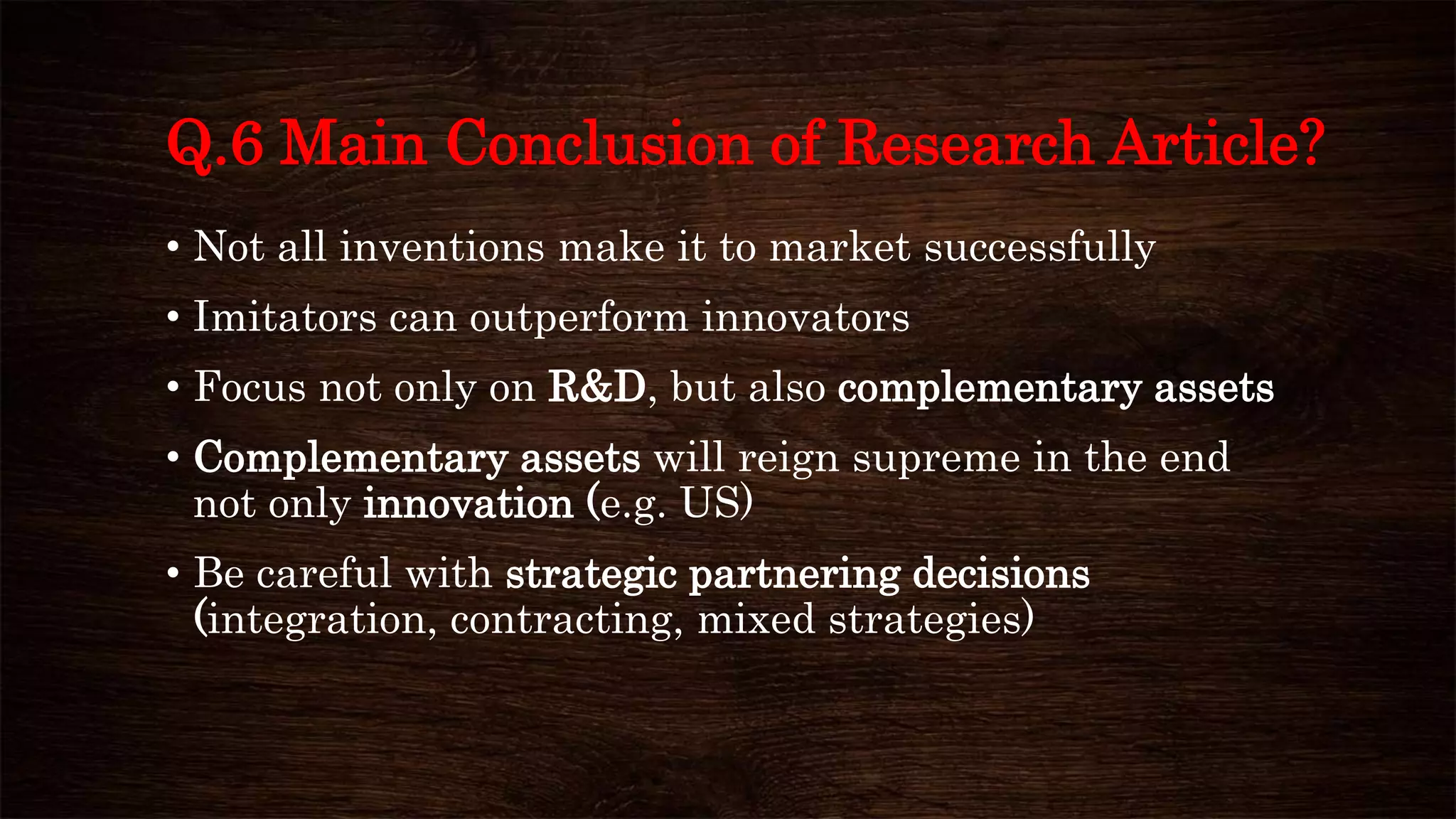

The research article by Jalal Khan and David J. Teece discusses the complexities of profiting from technological innovation, highlighting that not all innovative companies succeed in the market due to failures and the interplay of appropriability regimes, complementary assets, and dominant design paradigms. It outlines the importance of channel strategies, including contractual, integration, and mixed modes, for successful commercialization. The main conclusion emphasizes that while innovation is crucial, the role of complementary assets is paramount, and careful strategic partnerships are essential.