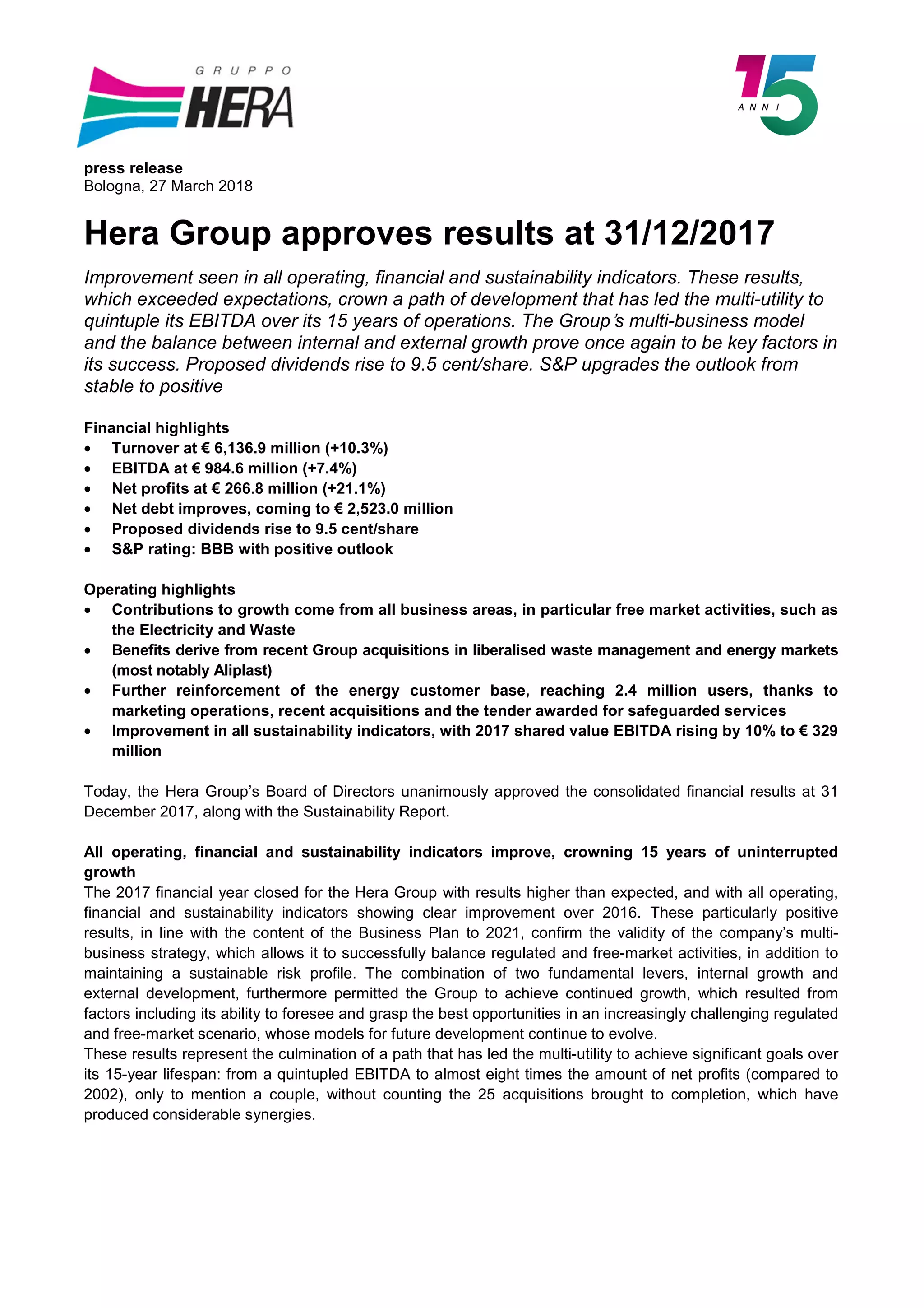

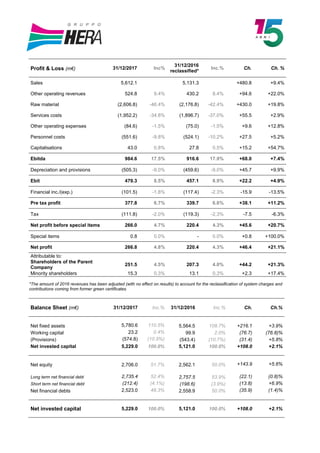

The Hera Group approved positive results for 2017, with improvements in all operating, financial, and sustainability indicators. Key highlights include:

- Turnover exceeded €6 billion, rising 10.3% due to factors like acquisitions and increased trading.

- EBITDA grew 7.4% to €984.6 million due to strong performances across all business areas, especially electricity.

- Net profits increased 21.1% to €266.8 million due to lower tax rates.

- Proposed dividends were raised to 9.5 cents per share.