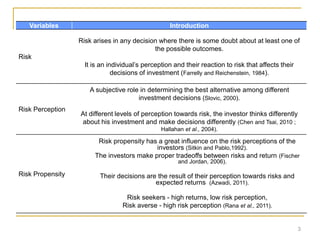

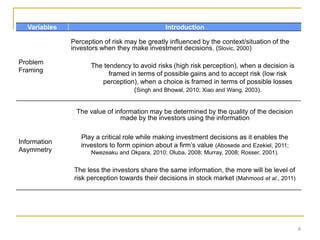

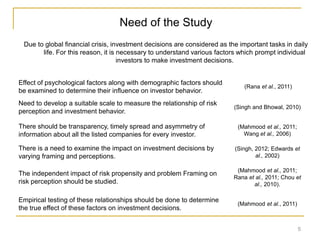

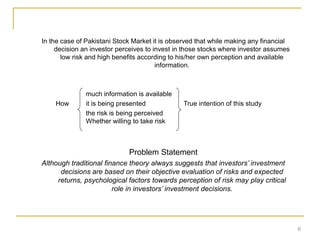

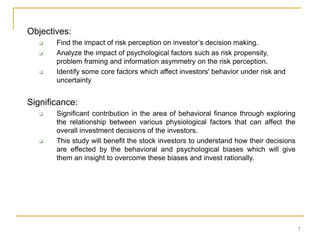

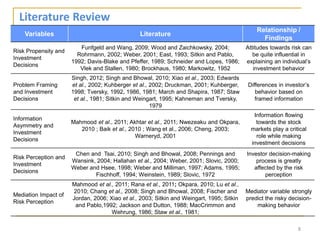

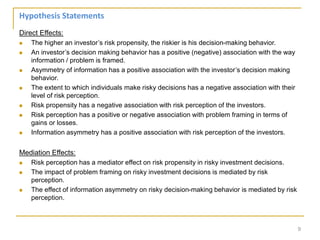

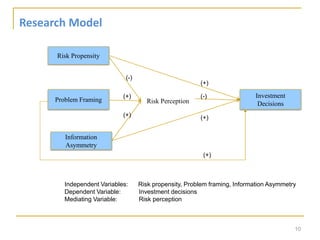

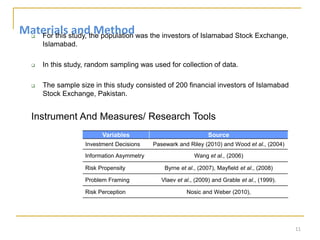

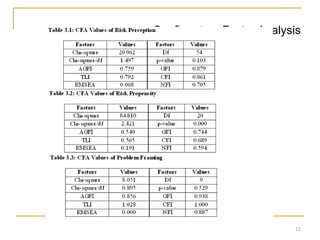

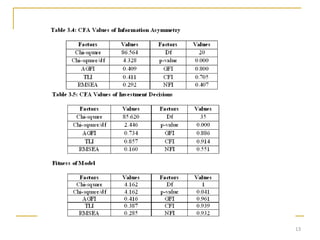

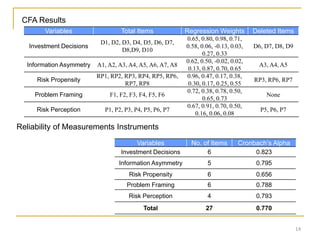

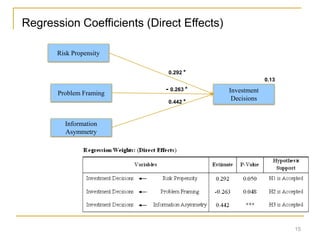

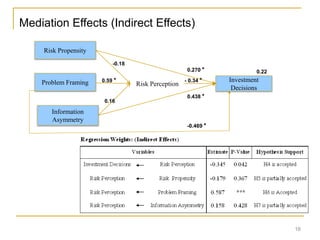

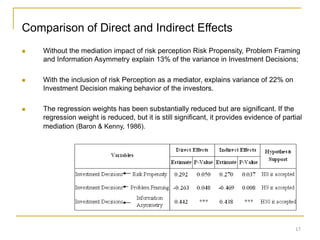

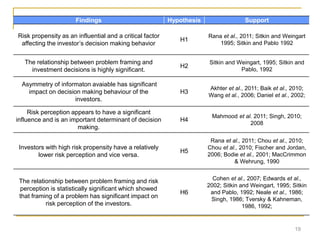

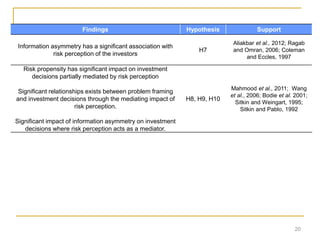

The document discusses a study on the impact of psychological factors on investment decision making. Specifically, it aims to analyze the impact of risk perception as a mediating factor between psychological variables (risk propensity, problem framing, information asymmetry) and investment decisions. The study uses a sample of 200 investors from the Islamabad Stock Exchange. Data is collected through a survey measuring the variables. Confirmatory factor analysis is conducted to validate the survey scales. The study aims to provide insights on how psychological biases influence investment decisions and help investors make more rational choices.