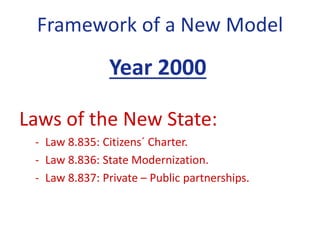

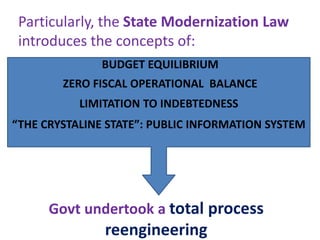

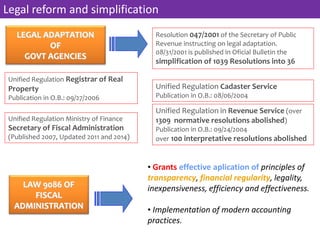

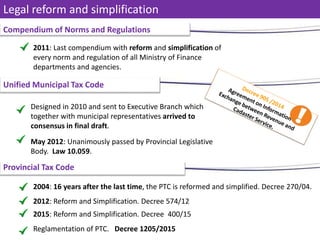

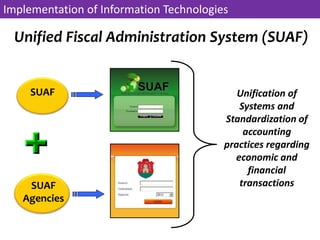

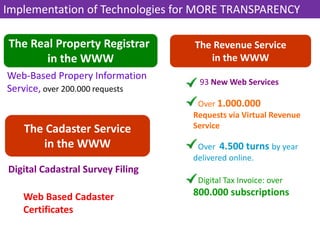

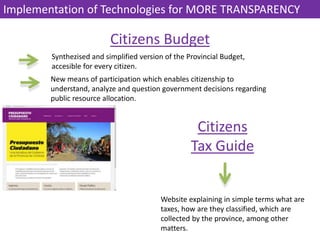

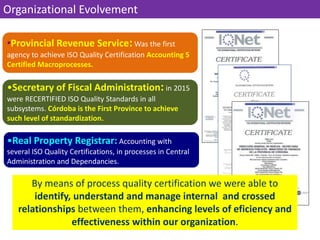

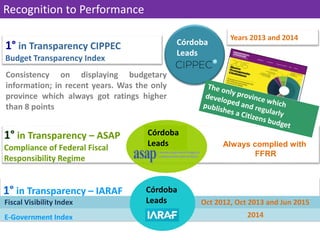

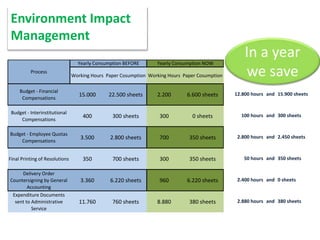

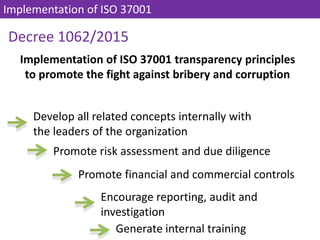

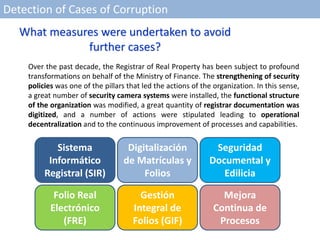

The document outlines the anti-corruption policies and reforms implemented in the province of Córdoba, Argentina, under the guidance of former Finance Minister Ángel M. Elettore from 2003 to 2015. Key highlights include the introduction of various laws aimed at state modernization, the establishment of a unified fiscal administration system, and the implementation of technologies for increased transparency and efficiency in public management. The document also addresses challenges in ensuring legal certainty and the effectiveness of tax collection due to regulatory complexity.