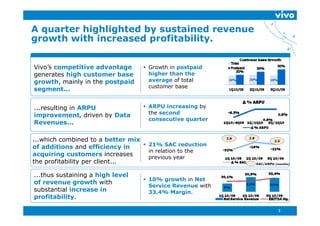

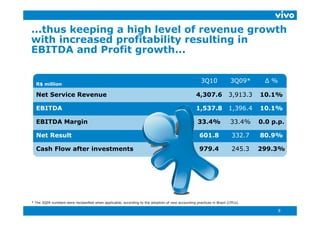

Vivo had a strong third quarter with sustained revenue growth and increased profitability:

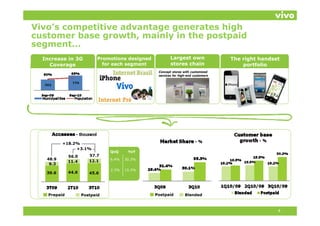

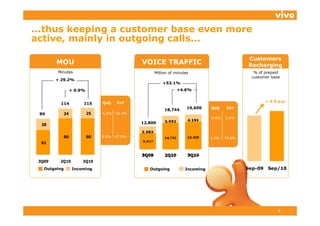

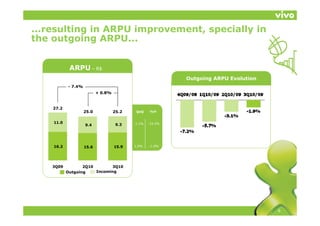

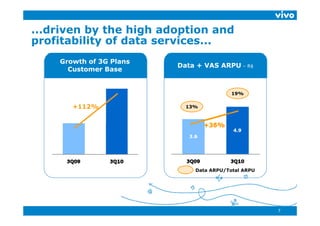

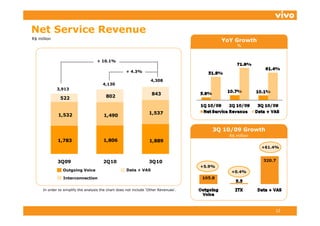

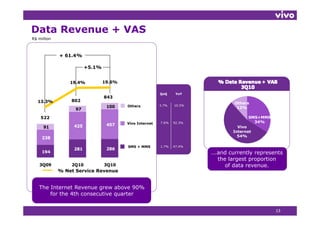

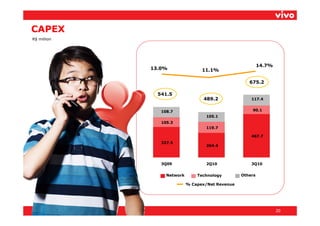

- Revenue grew 10.1% to R$4.3 billion due to increased customer base and higher postpaid subscriber growth.

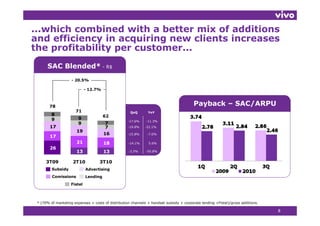

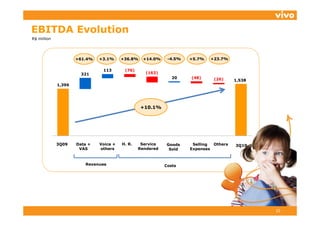

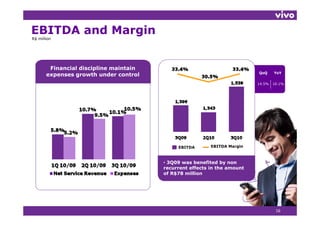

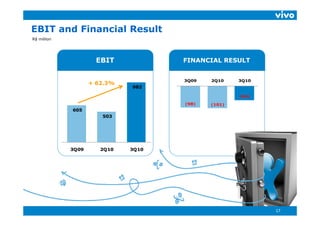

- EBITDA grew 10.1% to R$1.54 billion and margins remained steady at 33.4% due to efficiency gains in acquiring customers.

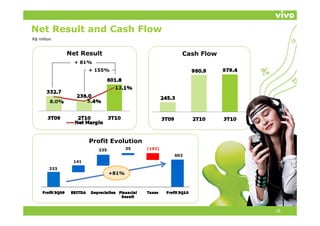

- Net income increased 80.9% to R$601.8 million as a result of the revenue growth and profitability gains.