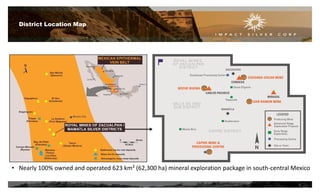

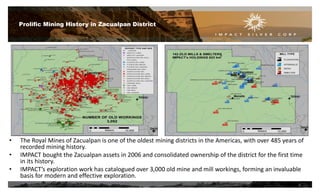

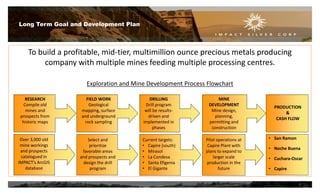

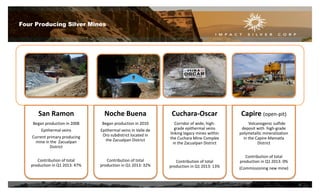

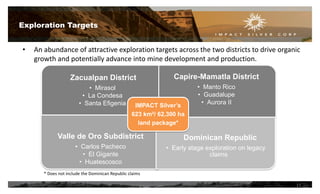

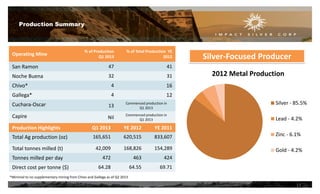

IMPACT Silver is a Canadian silver mining company with operations focused on exploration and development of silver projects in Mexico. The company operates two production centers, processing ore from four mines located in two districts. IMPACT aims to increase production through continued exploration, targeting new resources to expand mill throughput and generate cash flow. Key goals include advancing exploration prospects, increasing mill feed grades and throughput, and ultimately upgrading to the TSX to support future growth objectives of becoming a mid-tier silver producer.