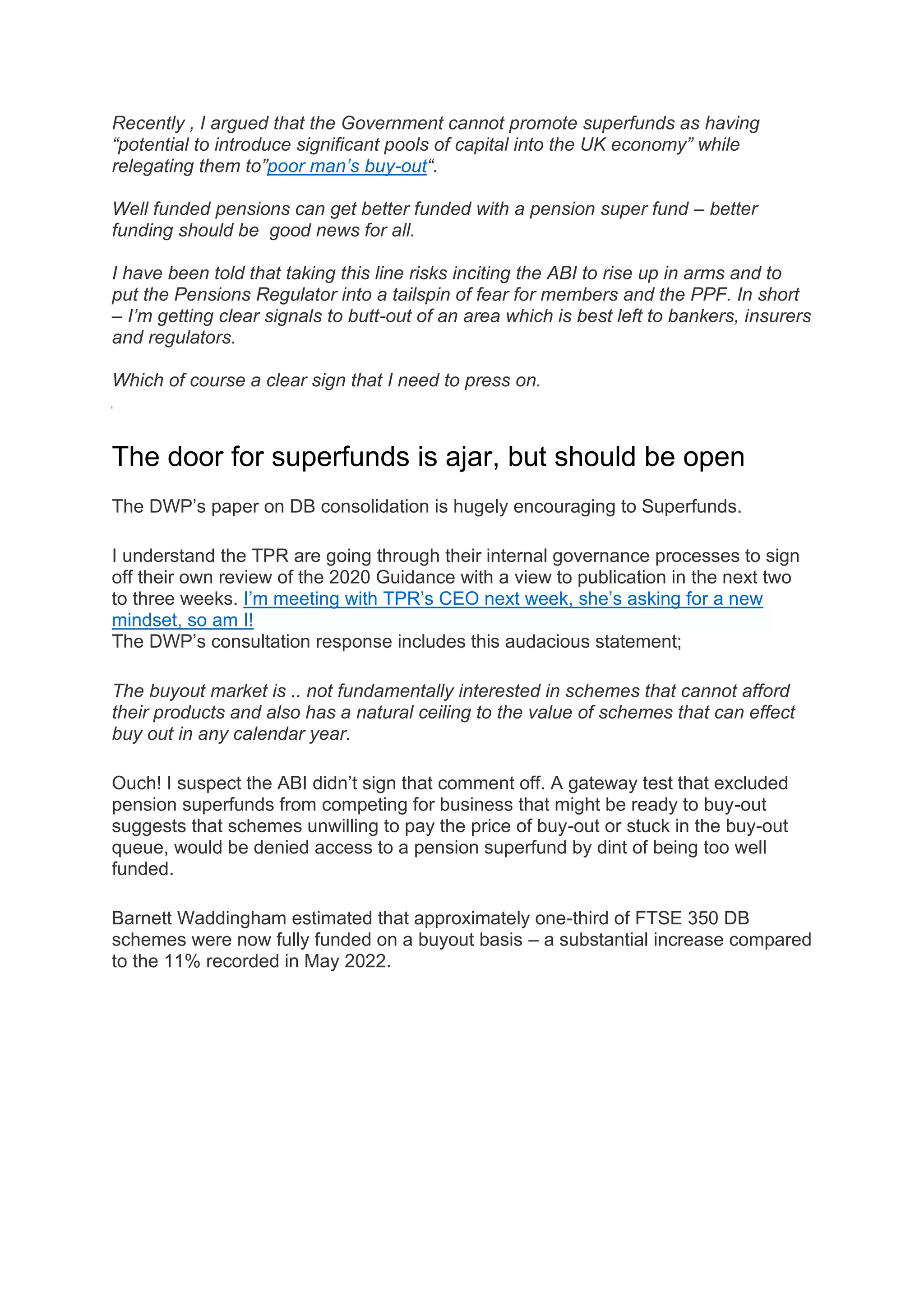

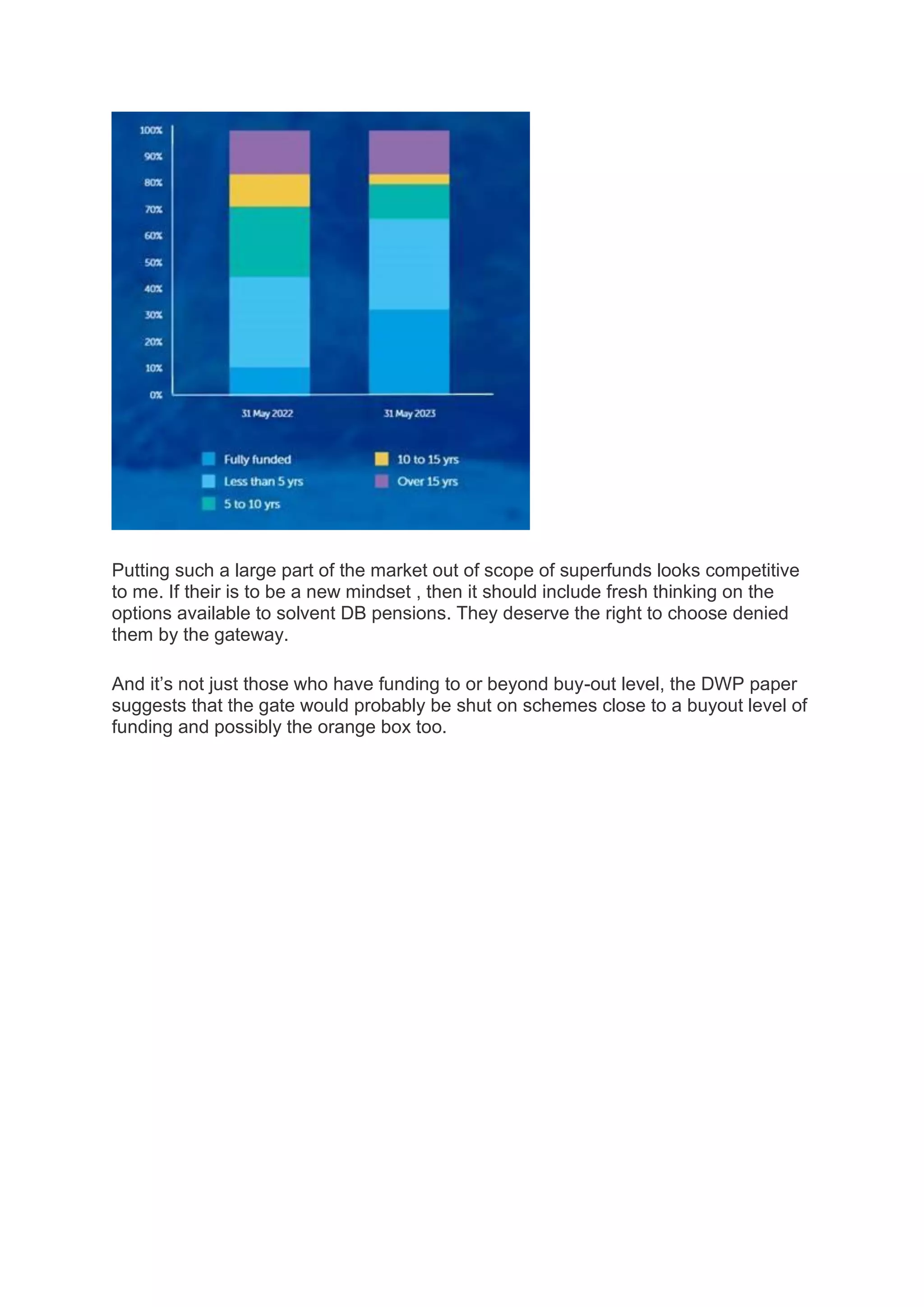

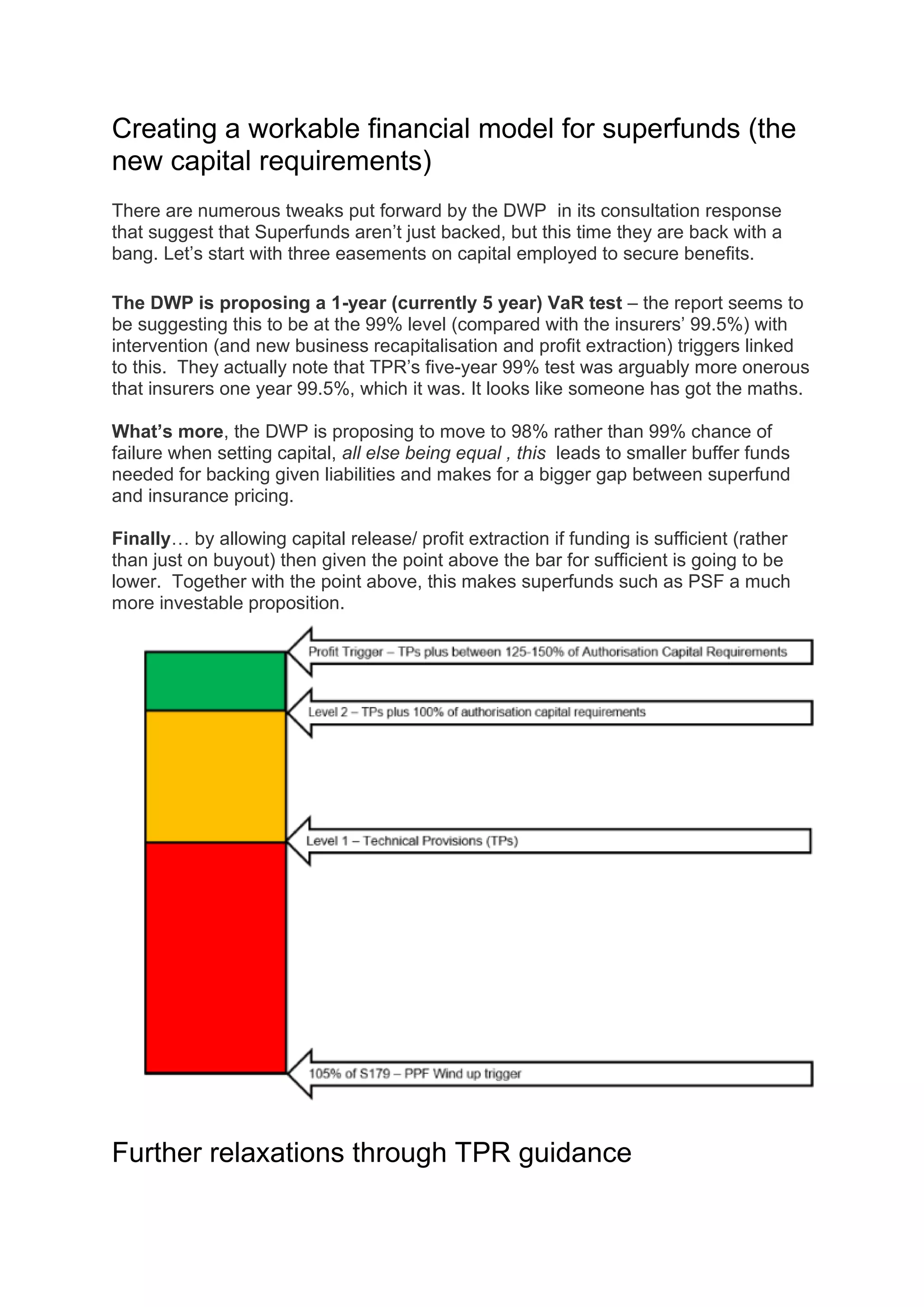

The document discusses options for how the UK government could encourage defined benefit pension schemes to invest more in productive assets while maintaining security of promised benefits. It gives four recommendations: 1) change the mindset that led to over-investment in LDI funds, 2) allow schemes to pay a super-levy to the Pension Protection Fund in exchange for higher investment in growth assets, 3) promote pension superfunds as an alternative to insurance buyouts, 4) promote collective defined contribution schemes. It argues the PPF could act as a consolidator for schemes but would need to demonstrate it is not unfair competition for private consolidators.