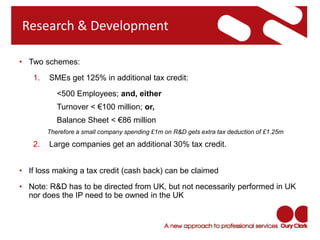

The document provides a comprehensive overview of the UK business environment, highlighting its large domestic market, competitive nature, and service-based economy. It discusses practical aspects for setting up in the UK, including VAT and payroll registration, as well as available tax incentives like R&D tax credits and the Patent Box scheme. Additionally, it emphasizes the importance of thorough market research and seeking advice to navigate the complexities of establishing a business in the UK.