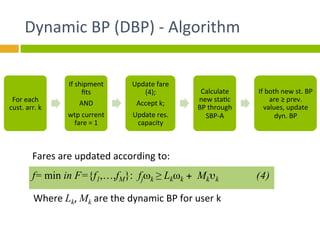

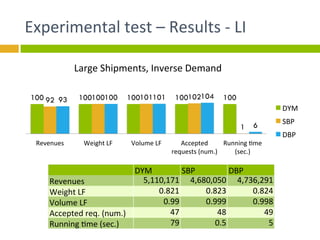

The document explores bid-price heuristics for cargo revenue management, emphasizing the shift from restriction/class-based to willingness-to-pay-based pricing strategies. The study tests various algorithms, including static and dynamic bid-price approaches, to optimize revenue under uncertain capacity conditions. Results indicate that the willingness-to-pay model enhances revenue effectiveness and suggests areas for future research and policy improvement.