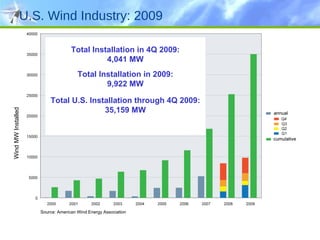

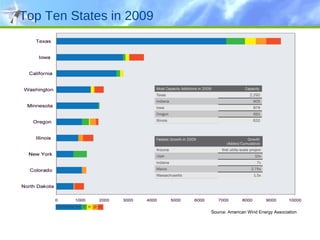

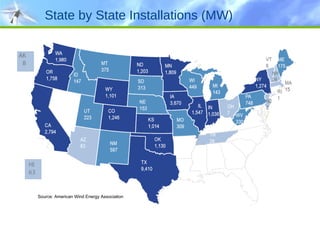

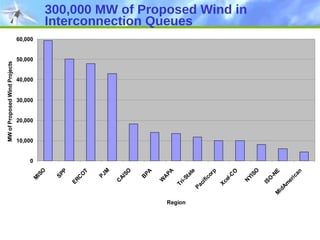

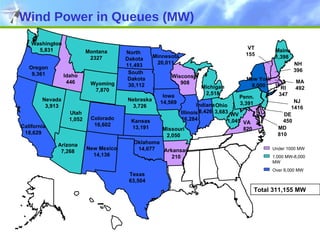

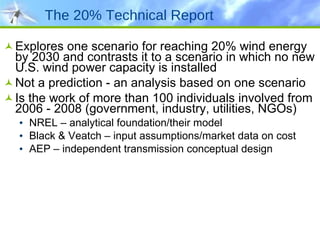

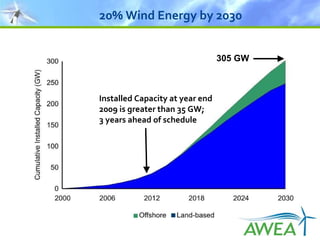

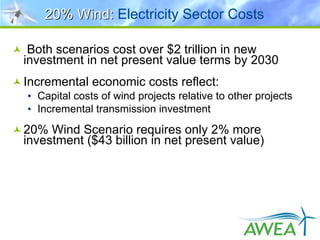

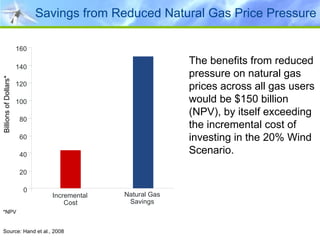

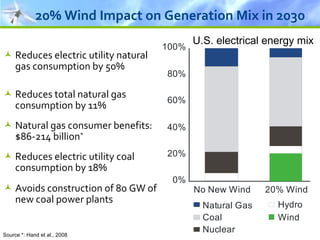

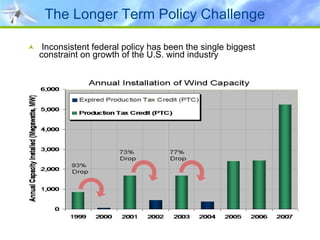

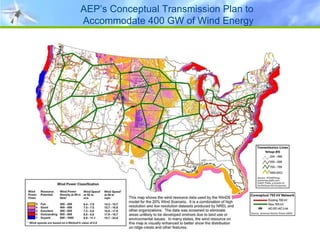

The document summarizes the history and future of the wind energy industry in the United States. It discusses how the industry began in the 1970s but struggled until policy support in the late 1970s. Europe then led wind development in the 1990s before the U.S. regained leadership in the 2000s. The industry has grown rapidly but faces challenges around transmission infrastructure and grid integration. Studies show 20% of U.S. electricity could come from wind by 2030 with the right policies around transmission and a production tax credit.

![Further Information American Wind Energy Association www.AWEA.org [email_address] 1501 M Street NW, Suite 1000 Washington, DC 20005](https://image.slidesharecdn.com/powertestconference-12710923318096-phpapp01/85/Power-Test-Conference-49-320.jpg)